Stock Certificate Legend refers to wording found on the front or back of a stock certificate which serves as notice of and a brief explanation of certain restrictions affecting the stock shares represented by that stock certificate.

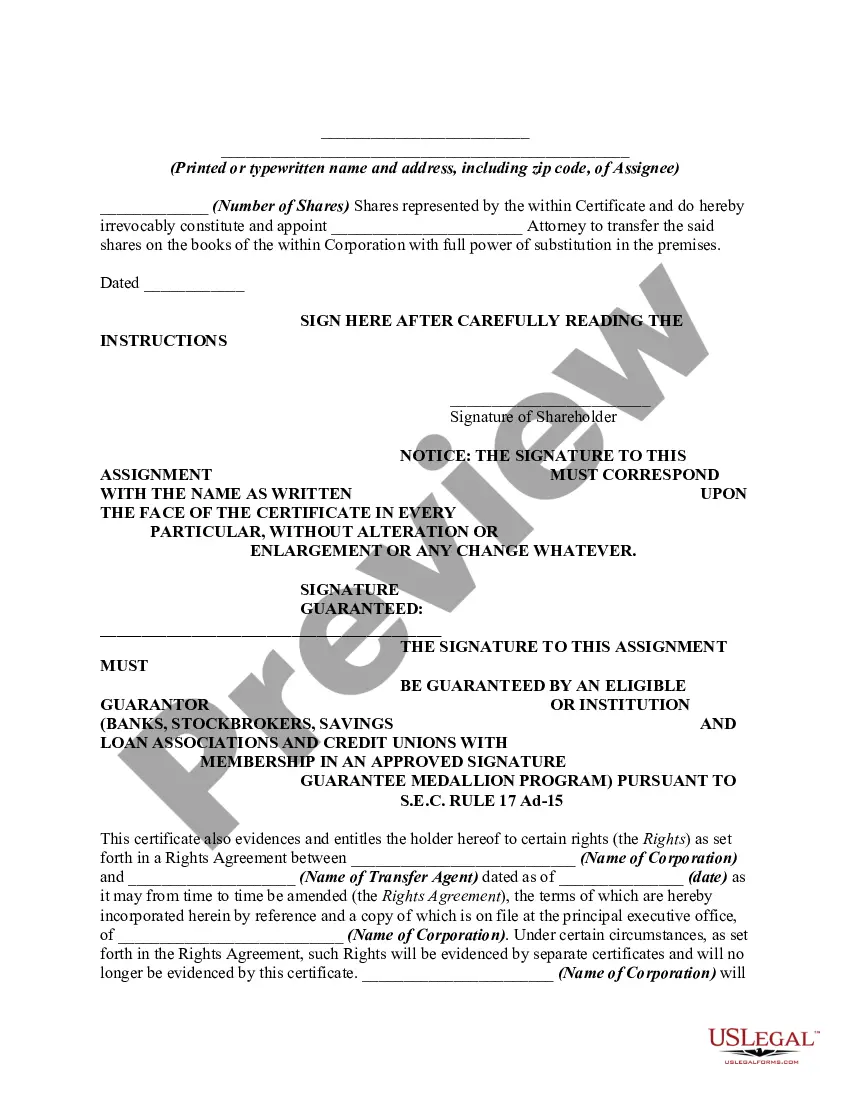

The reverse side of a stock certificate generally bears a form of assignment, which, when properly executed, transfers title to the stock represented by the certificate.

The Texas Stock Certificate Legend, specifically pertaining to Common Stock, is an important aspect of corporate and business law in the state of Texas. It serves as a legal document to certify the ownership of shares in a company and outlines certain restrictions or special provisions that govern the transfer of these shares. Here is a detailed description of the Texas Stock Certificate Legend — Common Stock, along with relevant keywords: 1. Definition: The Texas Stock Certificate Legend — Common Stock is an inscription or statement typically found on the face or back of stock certificates issued by corporations in Texas. It contains legally required language notifying the holder of specific conditions, limitations, or restrictions associated with the transfer, sale, or ownership of common stock. 2. Purpose: The purpose of including a stock certificate legend is to protect the rights and interests of both the issuing company and the shareholders. By clearly outlining any restrictions or obligations related to the common stock, the legend discourages unauthorized transfers, clarifies rights and obligations, and ensures transparency in stock ownership. 3. Content: The Texas Stock Certificate Legend — Common Stock may include the following details or provisions (keywords): a. Restrictive Transfer: The legend may specify that the common stock is subject to certain restrictions on its transferability, limiting the ability of shareholders to sell or pledge their shares without complying with certain conditions. b. Securities Act Compliance: The legend may state that the offer, sale, or transfer of the common stock has not been registered under the Securities Act of 1933, thus warning potential purchasers that they may be subject to certain restrictions and regulations. c. Accredited Investors: If applicable, the legend might indicate that the common stock is only offered or sold to accredited investors, as defined by federal securities laws. d. Buy-Sell Agreements: In cases where the common stock is subject to a buy-sell agreement or shareholder agreement, the legend may refer to such agreements and outline the restrictions imposed by them. e. Right of First Refusal: The legend might mention a company's right of first refusal, giving the corporation the option to purchase any shares of common stock before they can be sold or transferred to third parties. f. Other Provisions: The legend may include additional provisions such as lock-up periods (restricting the sale or transfer of shares for a specific period), co-sale rights, voting rights, or any other legally significant clauses relevant to the common stock. 4. Types of Texas Stock Certificate Legend — Common Stock: a. Standard Legend: This type of legend encompasses the basic provisions and restrictions associated with common stock transfers, complying with state and federal securities laws. b. Customized Legend: Depending on the specific needs or requirements of a company, the legend can be customized to include additional provisions or restrictions that are unique to the organization. In conclusion, the Texas Stock Certificate Legend — Common Stock is a vital element in corporate law, ensuring transparency, compliance with securities regulations, and protecting the interests of both shareholders and issuing companies. By detailing specific provisions and restrictions on the transfer of common stock, the legend contributes to the overall governance and smooth functioning of Texas corporations.The Texas Stock Certificate Legend, specifically pertaining to Common Stock, is an important aspect of corporate and business law in the state of Texas. It serves as a legal document to certify the ownership of shares in a company and outlines certain restrictions or special provisions that govern the transfer of these shares. Here is a detailed description of the Texas Stock Certificate Legend — Common Stock, along with relevant keywords: 1. Definition: The Texas Stock Certificate Legend — Common Stock is an inscription or statement typically found on the face or back of stock certificates issued by corporations in Texas. It contains legally required language notifying the holder of specific conditions, limitations, or restrictions associated with the transfer, sale, or ownership of common stock. 2. Purpose: The purpose of including a stock certificate legend is to protect the rights and interests of both the issuing company and the shareholders. By clearly outlining any restrictions or obligations related to the common stock, the legend discourages unauthorized transfers, clarifies rights and obligations, and ensures transparency in stock ownership. 3. Content: The Texas Stock Certificate Legend — Common Stock may include the following details or provisions (keywords): a. Restrictive Transfer: The legend may specify that the common stock is subject to certain restrictions on its transferability, limiting the ability of shareholders to sell or pledge their shares without complying with certain conditions. b. Securities Act Compliance: The legend may state that the offer, sale, or transfer of the common stock has not been registered under the Securities Act of 1933, thus warning potential purchasers that they may be subject to certain restrictions and regulations. c. Accredited Investors: If applicable, the legend might indicate that the common stock is only offered or sold to accredited investors, as defined by federal securities laws. d. Buy-Sell Agreements: In cases where the common stock is subject to a buy-sell agreement or shareholder agreement, the legend may refer to such agreements and outline the restrictions imposed by them. e. Right of First Refusal: The legend might mention a company's right of first refusal, giving the corporation the option to purchase any shares of common stock before they can be sold or transferred to third parties. f. Other Provisions: The legend may include additional provisions such as lock-up periods (restricting the sale or transfer of shares for a specific period), co-sale rights, voting rights, or any other legally significant clauses relevant to the common stock. 4. Types of Texas Stock Certificate Legend — Common Stock: a. Standard Legend: This type of legend encompasses the basic provisions and restrictions associated with common stock transfers, complying with state and federal securities laws. b. Customized Legend: Depending on the specific needs or requirements of a company, the legend can be customized to include additional provisions or restrictions that are unique to the organization. In conclusion, the Texas Stock Certificate Legend — Common Stock is a vital element in corporate law, ensuring transparency, compliance with securities regulations, and protecting the interests of both shareholders and issuing companies. By detailing specific provisions and restrictions on the transfer of common stock, the legend contributes to the overall governance and smooth functioning of Texas corporations.