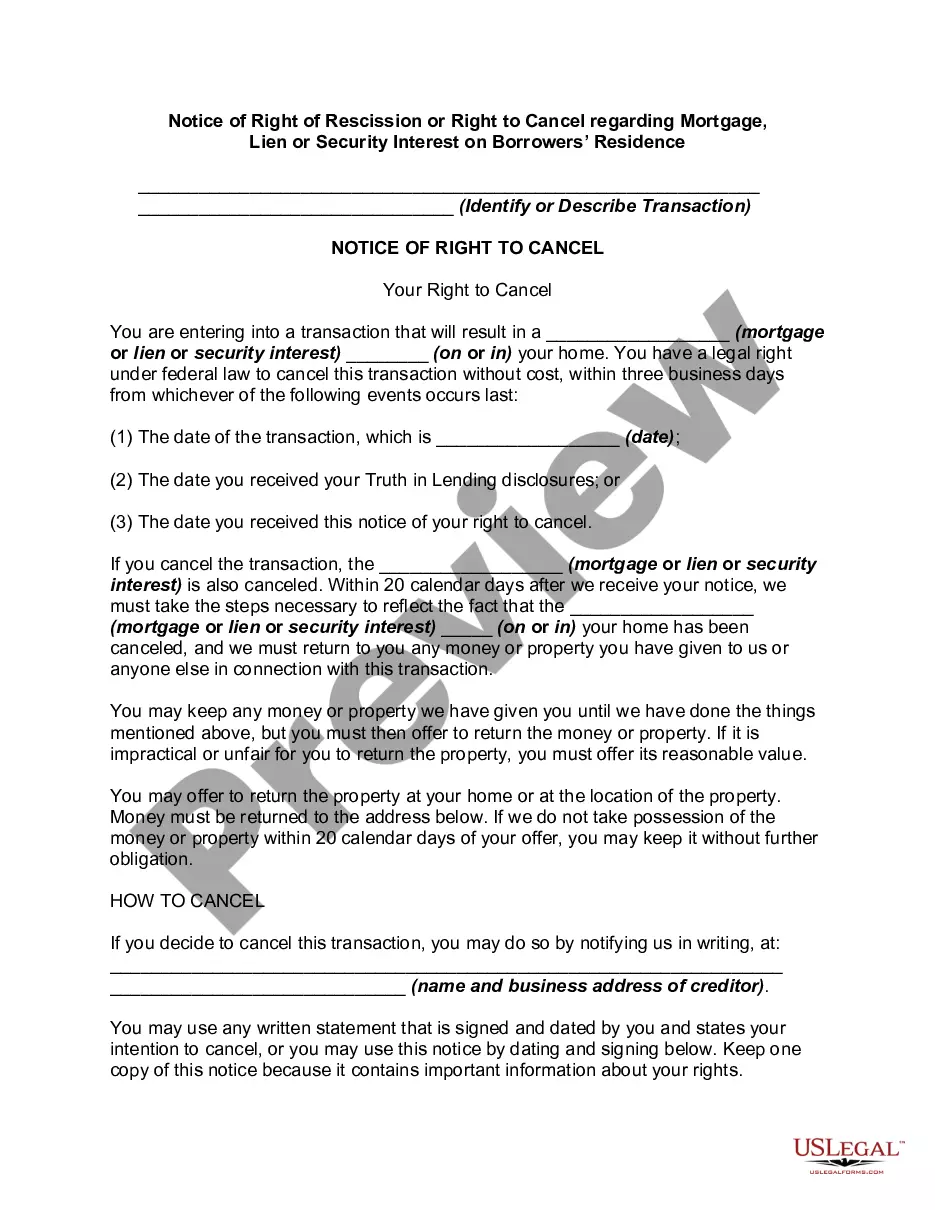

According to 12 CFR 226.23, in a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction, with some exceptions. To exercise the right to rescind, the consumer shall notify the creditor of the rescission by mail, telegram or other means of written communication. Notice is considered given when mailed, when filed for telegraphic transmission or, if sent by other means, when delivered to the creditor's designated place of business. The consumer may exercise the right to rescind until midnight of the third business day following consummation, delivery of the notice

required by paragraph (b) of this section, or delivery of all material disclosures, whichever occurs last.

Texas Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence

Description

How to fill out Notice Of Right Of Rescission Or Right To Cancel Regarding Mortgage, Lien Or Security Interest On Borrowers' Residence?

US Legal Forms - among the most significant libraries of authorized forms in the United States - provides a wide range of authorized record templates you are able to obtain or print. Utilizing the internet site, you will get a huge number of forms for business and person purposes, categorized by types, says, or search phrases.You will discover the latest models of forms just like the Texas Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence within minutes.

If you currently have a membership, log in and obtain Texas Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence from the US Legal Forms collection. The Obtain key can look on each form you see. You have access to all previously delivered electronically forms in the My Forms tab of your profile.

If you would like use US Legal Forms initially, allow me to share simple recommendations to get you started off:

- Be sure you have chosen the best form for your personal metropolis/region. Click on the Review key to check the form`s content. See the form explanation to actually have selected the correct form.

- In the event the form doesn`t match your needs, take advantage of the Look for industry near the top of the display to get the the one that does.

- In case you are content with the form, confirm your option by visiting the Buy now key. Then, choose the prices plan you like and supply your credentials to register to have an profile.

- Approach the transaction. Make use of your charge card or PayPal profile to complete the transaction.

- Find the structure and obtain the form in your gadget.

- Make adjustments. Complete, edit and print and indication the delivered electronically Texas Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence.

Each template you put into your bank account lacks an expiration time and is your own for a long time. So, if you want to obtain or print yet another backup, just proceed to the My Forms area and then click about the form you want.

Get access to the Texas Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien or Security Interest on Borrowers' Residence with US Legal Forms, probably the most extensive collection of authorized record templates. Use a huge number of skilled and express-distinct templates that meet your small business or person demands and needs.

Form popularity

FAQ

What is the purpose of a Notice of Right to Cancel form? Under federal law, some ? but not all ? mortgages include a right of rescission, which gives the borrower 3 business days following the signing of a loan document package to review the terms of the transaction and cancel the transaction.

Established by the Truth in Lending Act (TILA) under U.S. federal law, the right of rescission allows a borrower to cancel a home equity loan, home equity line of credit (HELOC), or refinance with a new lender, other than with the current mortgagee, within three days of closing.

(1) When a consumer rescinds a transaction, the security interest giving rise to the right of rescission becomes void, and the consumer shall not be liable for any amount, including any finance charge.

If you are refinancing a mortgage, you have until midnight of the third business day after the transaction to rescind (cancel) the mortgage contract. The right of rescission refers to the right of a consumer to cancel certain types of loans.

If you are buying a home with a mortgage, you do not have a right to cancel the loan once the closing documents are signed. If you are refinancing a mortgage, you have until midnight of the third business day after the transaction to rescind (cancel) the mortgage contract.

Established by the Truth in Lending Act (TILA) under U.S. federal law, the right of rescission allows a borrower to cancel a home equity loan, home equity line of credit (HELOC), or refinance with a new lender, other than with the current mortgagee, within three days of closing.

Each consumer entitled to rescind must be given two copies of the rescission notice and the material disclosures.

The right of rescission doesn't apply when you're buying a home, and it only applies to a loan against your primary residence. So, for instance, you won't be able to rescind your mortgage if you're buying or refinancing a second home, vacation home, or investment property.