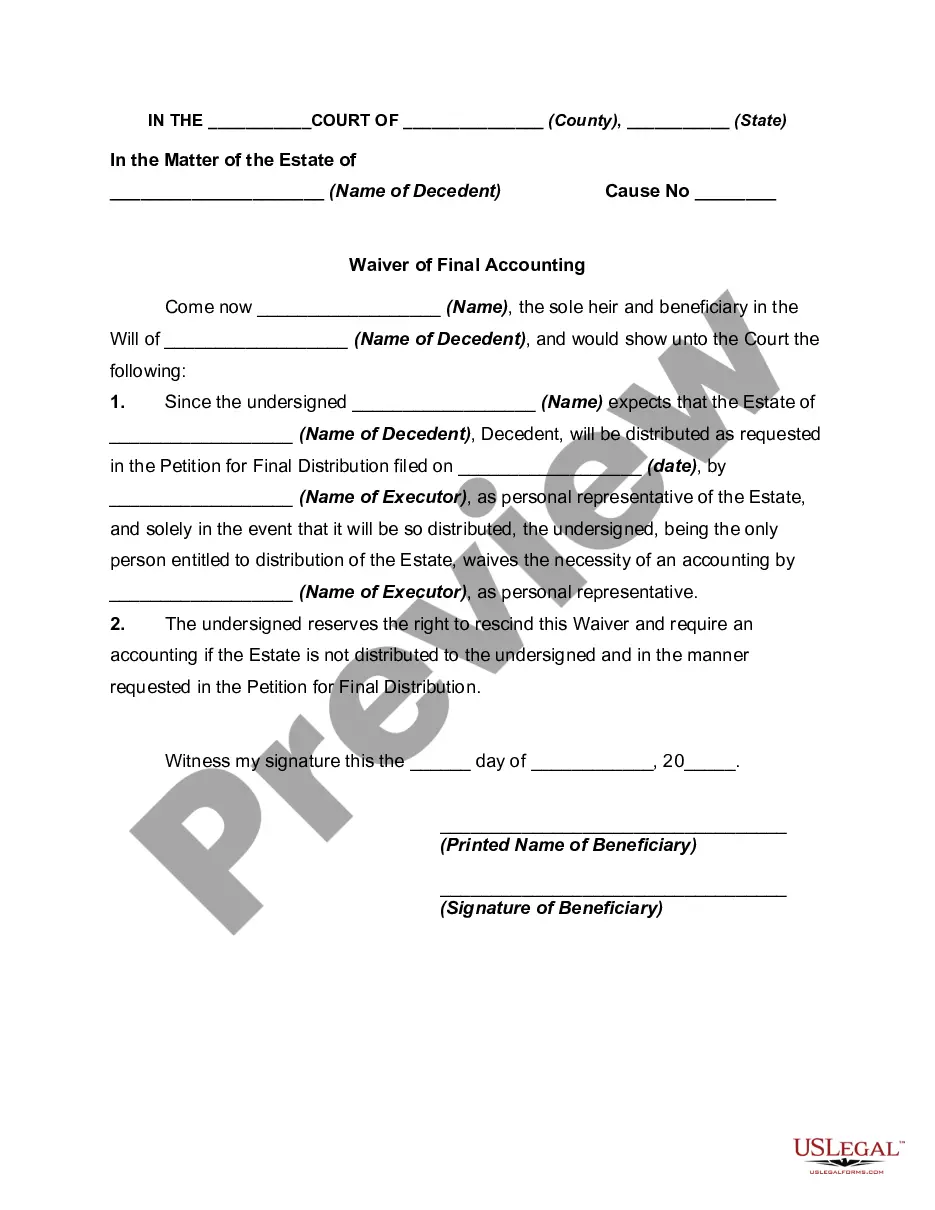

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

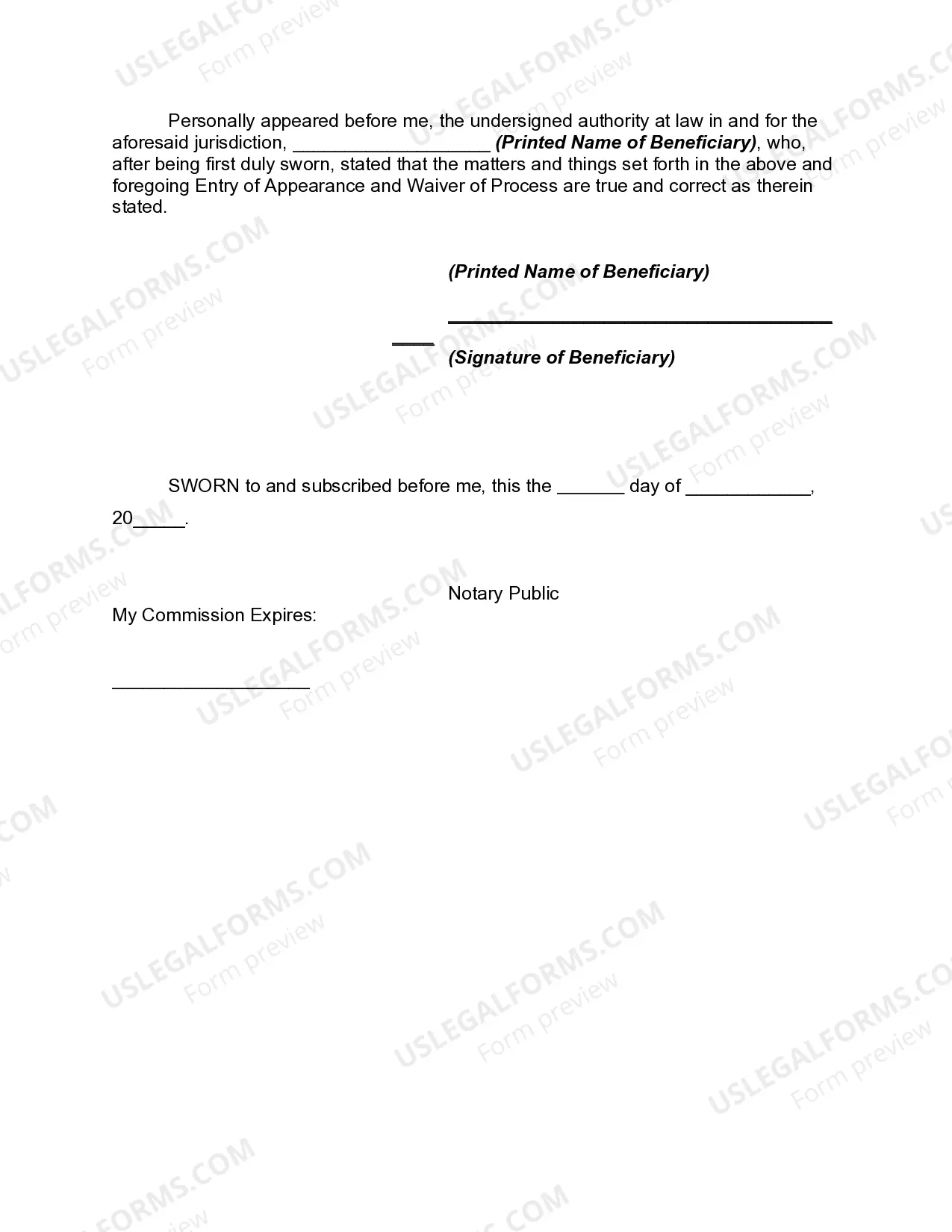

A Texas Waiver of Final Accounting by Sole Beneficiary is a legal document used in the state of Texas to waive the requirement of a final accounting by the executor or administrator of an estate. This waiver allows the sole beneficiary of the estate to forego the formal accounting process, providing convenience and simplification. The Texas Probate Code provides provisions that allow beneficiaries to waive the final accounting requirement. By signing this waiver, the sole beneficiary acknowledges that they have received full and complete information regarding the estate's assets, debts, and distributions. They also consent to the distribution of assets without the need for a detailed final accounting. There are various types of Texas Waiver of Final Accounting by Sole Beneficiary, depending on the specific circumstances and preferences of the parties involved. Some common variations include: 1. Full Waiver: This type of waiver completely eliminates the need for any final accounting by the executor or administrator. The sole beneficiary acknowledges that they have received all required information and releases the executor from any further obligations. 2. Limited Waiver: In certain cases, the sole beneficiary may choose to waive only a portion of the final accounting requirement. For example, they may waive the need for an itemized list of assets but still require some information about the estate's debts. 3. Conditional Waiver: This type of waiver is contingent upon certain conditions being met. The sole beneficiary may specify criteria, such as receiving a certain percentage of the estate before the waiver becomes effective. 4. Partial Waiver: In situations where multiple beneficiaries are involved, the sole beneficiary may only waive the final accounting as it pertains to their share of the estate. This allows them to expedite the distribution process while still ensuring accountability for other beneficiaries. It is important to note that a Texas Waiver of Final Accounting by Sole Beneficiary should be prepared and executed in accordance with the applicable state laws. It is recommended to consult with an attorney experienced in estate planning and probate matters to ensure the waiver accurately reflects the intentions and interests of the sole beneficiary. In conclusion, a Texas Waiver of Final Accounting by Sole Beneficiary is a legal document that allows the sole beneficiary of an estate to waive the requirement of a formal final accounting. This waiver provides convenience and streamlines the distribution process, offering flexibility in tailoring the extent of the waiver to the needs of the parties involved.A Texas Waiver of Final Accounting by Sole Beneficiary is a legal document used in the state of Texas to waive the requirement of a final accounting by the executor or administrator of an estate. This waiver allows the sole beneficiary of the estate to forego the formal accounting process, providing convenience and simplification. The Texas Probate Code provides provisions that allow beneficiaries to waive the final accounting requirement. By signing this waiver, the sole beneficiary acknowledges that they have received full and complete information regarding the estate's assets, debts, and distributions. They also consent to the distribution of assets without the need for a detailed final accounting. There are various types of Texas Waiver of Final Accounting by Sole Beneficiary, depending on the specific circumstances and preferences of the parties involved. Some common variations include: 1. Full Waiver: This type of waiver completely eliminates the need for any final accounting by the executor or administrator. The sole beneficiary acknowledges that they have received all required information and releases the executor from any further obligations. 2. Limited Waiver: In certain cases, the sole beneficiary may choose to waive only a portion of the final accounting requirement. For example, they may waive the need for an itemized list of assets but still require some information about the estate's debts. 3. Conditional Waiver: This type of waiver is contingent upon certain conditions being met. The sole beneficiary may specify criteria, such as receiving a certain percentage of the estate before the waiver becomes effective. 4. Partial Waiver: In situations where multiple beneficiaries are involved, the sole beneficiary may only waive the final accounting as it pertains to their share of the estate. This allows them to expedite the distribution process while still ensuring accountability for other beneficiaries. It is important to note that a Texas Waiver of Final Accounting by Sole Beneficiary should be prepared and executed in accordance with the applicable state laws. It is recommended to consult with an attorney experienced in estate planning and probate matters to ensure the waiver accurately reflects the intentions and interests of the sole beneficiary. In conclusion, a Texas Waiver of Final Accounting by Sole Beneficiary is a legal document that allows the sole beneficiary of an estate to waive the requirement of a formal final accounting. This waiver provides convenience and streamlines the distribution process, offering flexibility in tailoring the extent of the waiver to the needs of the parties involved.