Title: Complete Guide: Texas Sample Letter for Assets and Liabilities of Decedent's Estate Introduction: Dealing with the estate of a deceased loved one can be a complex and challenging process. A crucial step involves assessing the assets and liabilities of the decedent's estate, which helps determine the distribution of assets and potential settlement of debts. To simplify this task, Texas provides various sample letters for assets and liabilities of the decedent's estate. In this article, we will delve into the essentials of these letters, their types, and their significance in the probate process. 1. Importance of Texas Sample Letter for Assets and Liabilities of Decedent's Estate: — Navigate the probate process: These sample letters serve as a framework for gathering and organizing information, enabling executors or administrators to effectively manage the decedent's estate. — Legal requirement: Providing comprehensive asset and liability information is necessary for the fair administration of estates, ensuring debts are appropriately settled, and assets distributed in accordance with the law. 2. Types of Texas Sample Letters: a. Texas Sample Letter for Assets of Decedent's Estate: — Purpose: This letter primarily focuses on compiling a detailed list of assets, encompassing personal property, real estate, financial accounts, investments, vehicles, and business interests. — Usage: Executors or administrators can use this letter to identify and document all assets owned by the decedent at the time of their passing. b. Texas Sample Letter for Liabilities of Decedent's Estate: — Purpose: This letter concentrates on capturing the outstanding debts and liabilities of the decedent, such as mortgages, loans, credit card debts, medical bills, taxes, and other financial obligations. — Usage: Executors or administrators can employ this letter to create an accurate overview of all financial obligations, allowing them to determine the prioritization and settlement of debts. 3. Essential Components and Structure of Texas Sample Letters: Regardless of the type, Texas sample letters for assets and liabilities should generally include the following components: — Executor/Administrator Information: Full name, contact details (address, phone number, email). — Decedent Information: Full name, date of death, date of birth, social security number. — Comprehensive Asset/Liability Information: Categorization of assets/liabilities, detailed descriptions, estimated value, associated account numbers, and any pertinent supporting documentation. — Verification Statement: A declaration stating that all information disclosed is to the best of the executor's knowledge, accurate, and complete. 4. Additional Considerations: — Professional guidance: Seek assistance from an attorney or estate planning professional to ensure the accuracy and legality of the information provided within the letters. — Tailoring to specific circumstances: Depending on the complexity and unique aspects of the estate, additional detailed information may be necessary to ensure a comprehensive assessment. In conclusion, utilizing the provided Texas sample letters for assets and liabilities of the decedent's estate streamlines the probate process and facilitates an efficient asset distribution and debt settlement. By following a standardized structure and including relevant information, executors or administrators can ensure compliance with legal requirements and effectively manage the decedent's estate.

Texas Sample Letter for Assets and Liabilities of Decedent's Estate

Description

How to fill out Texas Sample Letter For Assets And Liabilities Of Decedent's Estate?

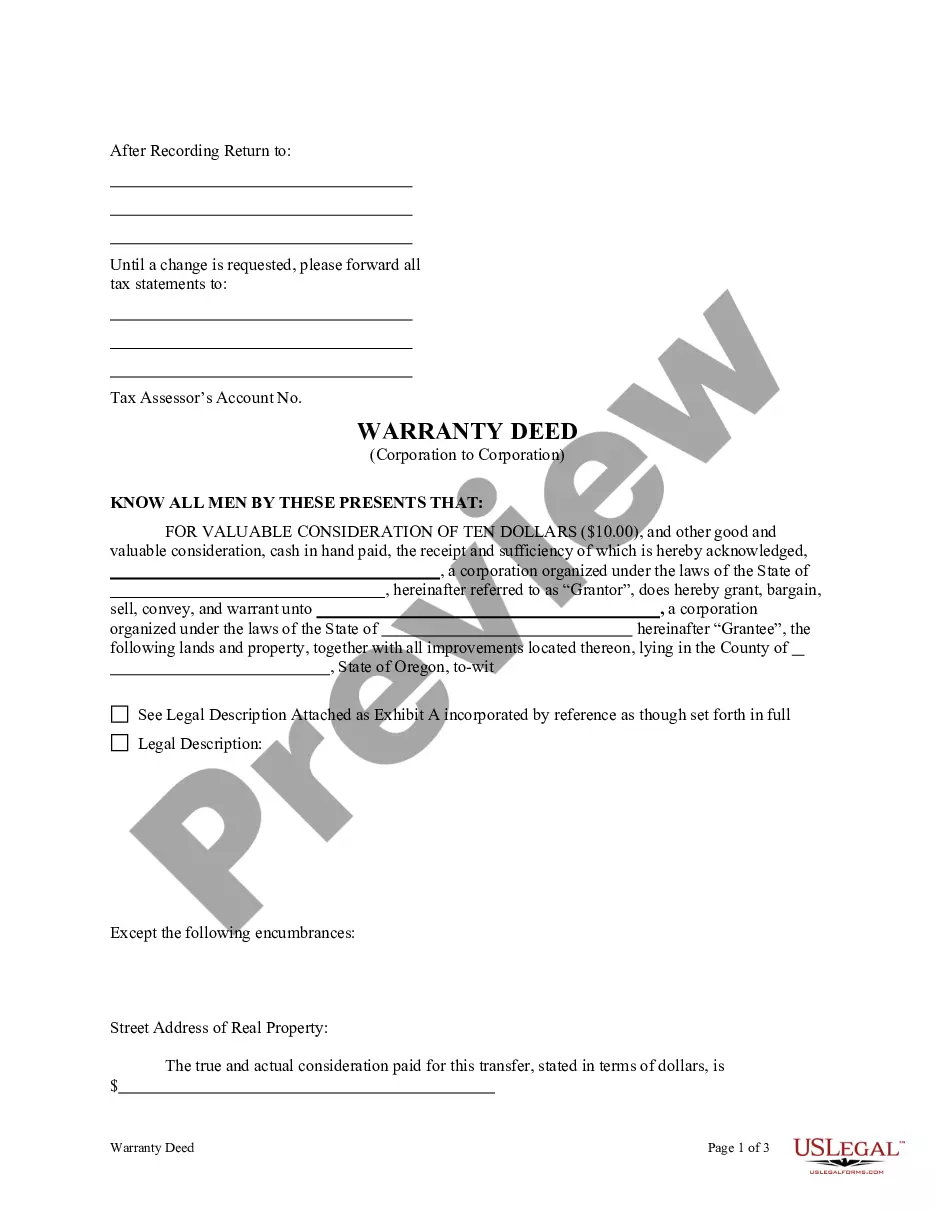

Have you been within a situation in which you need files for either enterprise or individual reasons virtually every working day? There are plenty of legitimate document web templates available online, but finding ones you can depend on isn`t effortless. US Legal Forms delivers a large number of form web templates, like the Texas Sample Letter for Assets and Liabilities of Decedent's Estate, that happen to be created to meet state and federal demands.

In case you are already acquainted with US Legal Forms web site and get a free account, merely log in. After that, you may download the Texas Sample Letter for Assets and Liabilities of Decedent's Estate web template.

Should you not offer an account and wish to begin to use US Legal Forms, follow these steps:

- Discover the form you require and ensure it is to the correct area/county.

- Use the Preview switch to check the shape.

- Browse the information to ensure that you have chosen the correct form.

- In the event the form isn`t what you`re trying to find, use the Search field to get the form that meets your requirements and demands.

- If you get the correct form, click Purchase now.

- Opt for the rates plan you desire, fill in the required details to make your bank account, and pay for the transaction utilizing your PayPal or credit card.

- Select a handy data file format and download your backup.

Discover all of the document web templates you have purchased in the My Forms food selection. You can aquire a more backup of Texas Sample Letter for Assets and Liabilities of Decedent's Estate at any time, if needed. Just click on the necessary form to download or print the document web template.

Use US Legal Forms, the most comprehensive variety of legitimate forms, to save time and steer clear of mistakes. The service delivers appropriately produced legitimate document web templates which can be used for a variety of reasons. Make a free account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

7 elements to include in your letter of last instruction Contact information. ... Legal form, document, and property locations. ... Personal and financial passwords. ... Beneficiary information. ... Guidance for pets. ... Funeral or memorial service wishes. ... Legal and financial information and wishes.

A letter of instruction has no legal authority, but it can provide an easy-to-understand explanation of a person's overall estate plan to their executor. A good letter of instruction should contain the following information: A complete list of all assets.

In Texas, however, a small estate affidavit is offered only where there is no will (also referred to as dying intestate) and for estates with a value of $75,000 or less. With some simple paperwork, your loved one's estate can be distributed without a costly court proceeding.

The SEA must be signed and sworn to by each heir before a notary. and can be determined by reviewing Chapter 201, Texas Estates Code. Filing fee is $263, but no additional fees are required to file amended SEAs.

Estate Plan Letter of Instruction. Dear ______________ (Executor, Agent, Trustee, Loved One, Etc.) I am writing this letter to provide you with important information you will need to know in the event of my incapacity or death. Please refer to this letter for assistance as you deal with my affairs.

This document gives the Executor the authority he or she will need to formally act on behalf of the decedent. It gives the right to handle financial and other affairs related to closing out the estate.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

If there is no will, an heir to the estate can submit an application to the court to act as administrator of the estate. The probate court will schedule a hearing to review any application and select an administrator of the estate based on Texas intestate laws.