An apartment cooperative will typically involved a corporation renting apartments to people who are also owners of stock in the corporation. The apartment complex is owned by the corporation.

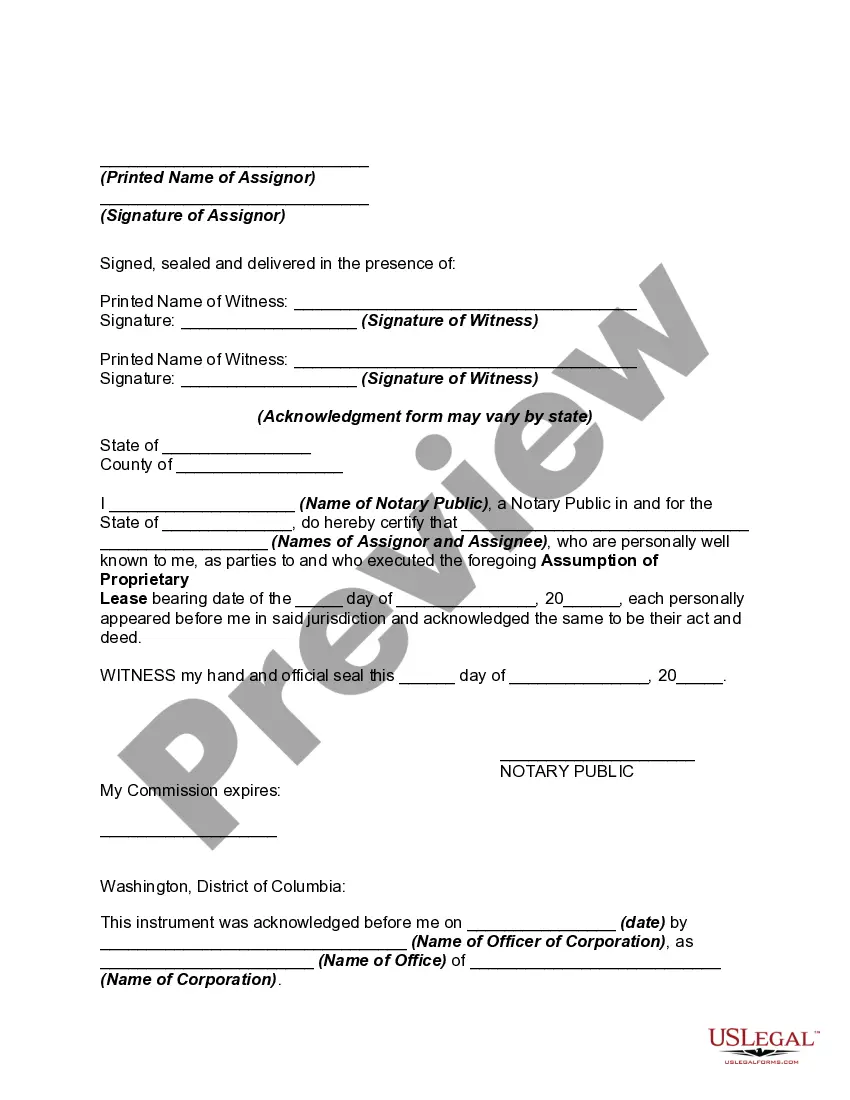

Two basic documents are ordinarily involved in the transfer of a member's or stockholder's interest in a cooperative apartment corporation: (1) an agreement for the purchase and sale of the proprietary lease and the appurtenant membership or stock; and (2) the instrument of assignment. Also, it is common to have an assumption by the Assignee of the liabilities under the Lease.

The agreement of purchase and sale is similar in format to an agreement for the sale of real property. The seller agrees to assign all rights under the proprietary lease covering the unit, and to sell the membership or stock in the corporation. The seller also agrees to procure the consent of the corporation to the transfer if this is required in the proprietary lease. The purchaser agrees to pay the purchase price and to submit references to the corporation and otherwise cooperate in procuring its consent to the transfer, and also promises to execute an agreement in a form approved by the corporation by which the purchaser assumes and agrees to be bound by all covenants and conditions of the proprietary lease.