Texas Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you'll gain access to thousands of forms for business and personal purposes, organized by categories, suggestions, or keywords. You can obtain the latest versions of documents such as the Texas Promissory Note with Payments Amortized for a Set Number of Years in just a few seconds.

If you already have a membership, Log In and download the Texas Promissory Note with Payments Amortized for a Set Number of Years from the US Legal Forms library. The Acquire button will appear on every form you view. You can access all previously downloaded documents in the My documents section of your account.

If you are satisfied with the form, confirm your selection by clicking the Acquire now button. Then, choose your payment plan and provide your information to register for an account.

Proceed with the purchase. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Texas Promissory Note with Payments Amortized for a Set Number of Years.

Each template you added to your account does not expire and is yours permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Access the Texas Promissory Note with Payments Amortized for a Set Number of Years via US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you're using US Legal Forms for the first time, here are some straightforward instructions to get you started.

- Ensure you have selected the correct form for your area/region.

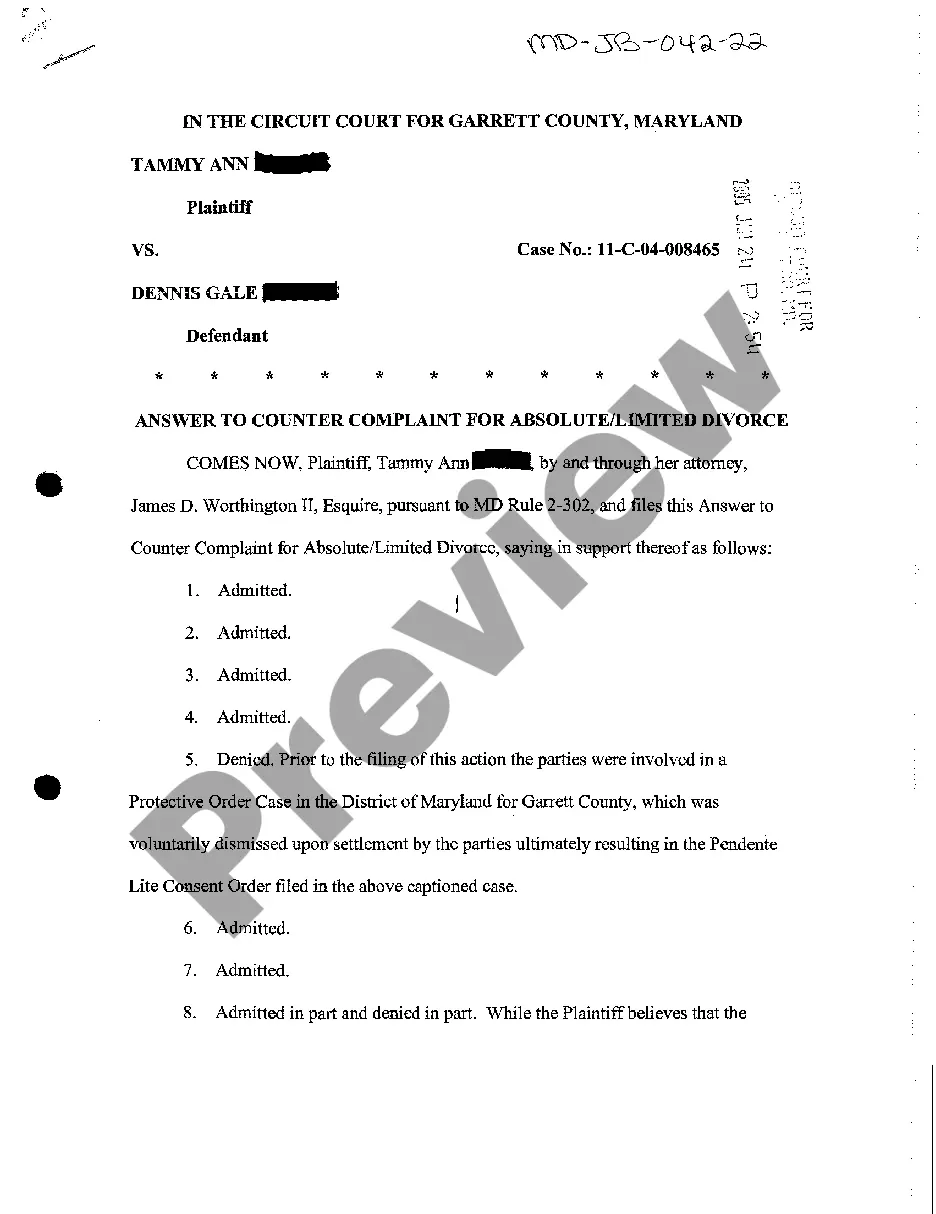

- Click on the Preview button to review the content of the form.

- Read the form description to confirm that you've chosen the appropriate document.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

Form popularity

FAQ

Yes, promissory notes are legally binding in Texas as long as they meet certain requirements. A Texas Promissory Note with Payments Amortized for a Certain Number of Years is valid when executed properly and when all involved parties agree to the terms. This legal binding status implies that the parties must uphold their commitments, and failure to do so can lead to legal repercussions. Utilizing platforms like US Legal Forms can simplify the creation of legally sound promissory notes.

In Texas, the statute of limitations for enforcing a promissory note is typically four years. This means that if you have a Texas Promissory Note with Payments Amortized for a Certain Number of Years, you must act within this time frame to claim your rights under the note. After this period, you lose the legal ability to enforce the terms of the note. Staying informed about this timeline is essential for both lenders and borrowers.

Several factors can contribute to the invalidity of a promissory note. For example, if a Texas Promissory Note with Payments Amortized for a Certain Number of Years contains inaccurate or misleading information, it may not hold legal weight. Additionally, if it is not properly executed, such as lacking signatures or proper witnessing, it can be challenged in court. Seeking professional assistance can help ensure the note remains valid.

The time period of a promissory note typically refers to the duration given for repayment. In the context of a Texas Promissory Note with Payments Amortized for a Certain Number of Years, this period will be specified in the note. It may range from a few months to several years, depending on the terms agreed upon by both parties. Borrowers should always review these periods carefully to ensure they can meet their obligations.

A promissory note can be deemed void if it lacks key elements that establish its validity. For instance, if a Texas Promissory Note with Payments Amortized for a Certain Number of Years is not signed by the borrower or lacks clear repayment terms, it may not hold up in court. Furthermore, notes signed under duress or fraud can also be declared void. It is essential to ensure all parties understand their obligations to avoid such issues.

Valuing a promissory note, such as a Texas Promissory Note with Payments Amortized for a Certain Number of Years, requires assessing the net present value of future payments based on the agreed-upon interest rate. Additional factors like market conditions and the creditworthiness of the borrower can influence the value. Therefore, it's crucial to employ the right valuation methods. Explore uslegalforms if you seek further assistance in understanding the valuation process.

Calculating the value of a promissory note, such as a Texas Promissory Note with Payments Amortized for a Certain Number of Years, involves finding the present value of its future payments. This takes into account the interest rate and the time until each payment is received. For precise calculations, utilizing financial models or calculators can simplify the process. If you need a straightforward solution, check out uslegalforms for tools that assist in valuation.

To create a valid promissory note in Texas, certain requirements must be met. A Texas Promissory Note with Payments Amortized for a Certain Number of Years requires a clear statement of the borrowed amount, specified repayment terms, and signatures from both parties involved. Furthermore, the note should include the interest rate if applicable. Utilizing a trusted platform like US Legal Forms can streamline creating a legally sound document that meets state requirements.

Yes, a promissory note can expire if the terms are not fulfilled within a specific time frame. For a Texas Promissory Note with Payments Amortized for a Certain Number of Years, if payments do not occur and the statute of limitations passes, collection efforts can cease. To avoid expiration, keep accurate records and ensure timely payments. Regularly review the terms to stay informed about expiration conditions.

The validity of a promissory note in Texas hinges on various factors such as compliance with the law and adherence to the specific terms outlined. A Texas Promissory Note with Payments Amortized for a Certain Number of Years remains valid as long as its conditions are met and upheld. Regular communication and records of payments can help ensure that all parties remain within the bounds of the agreement. Consider consulting with professionals if needed.