A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

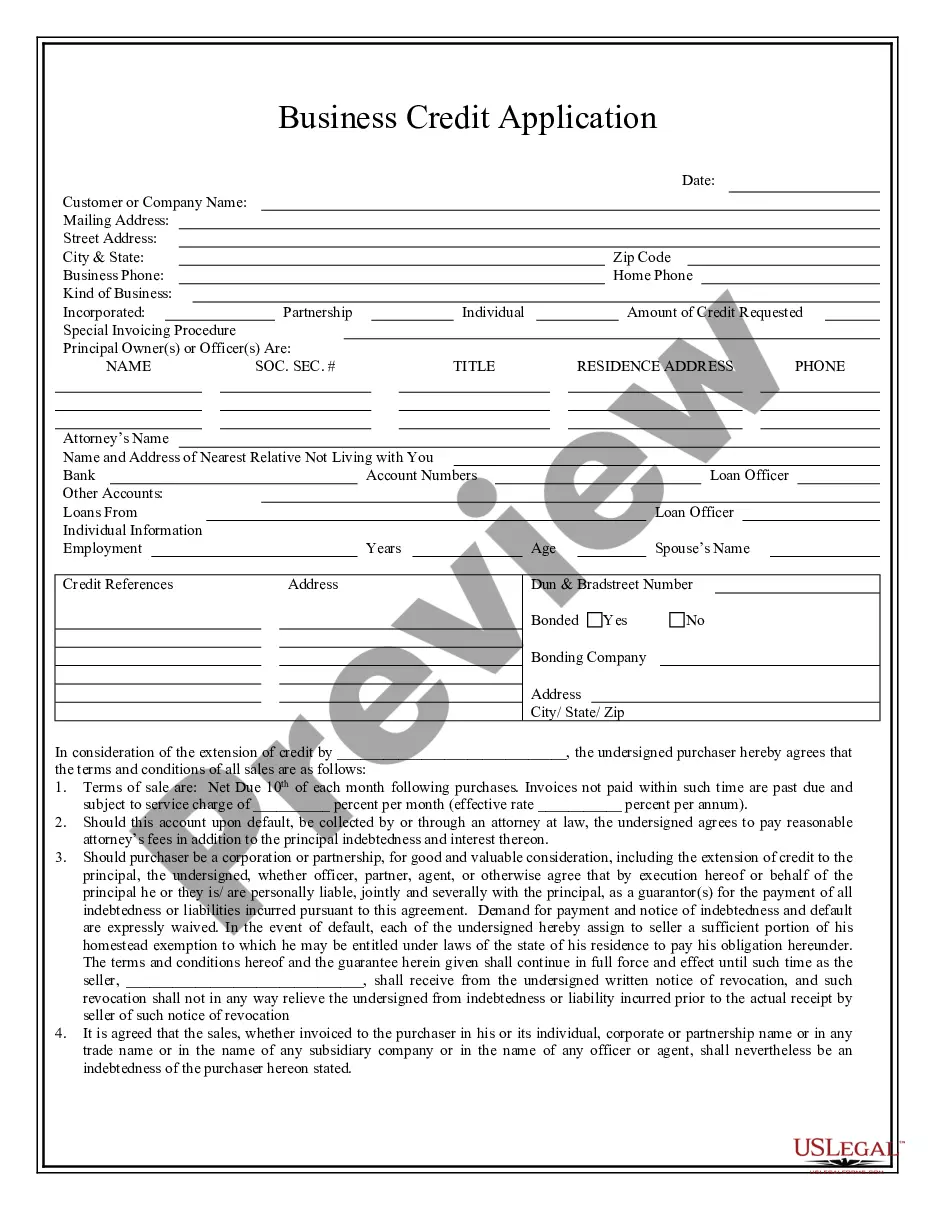

Texas Checklist for Limited Security Offering

Description

How to fill out Checklist For Limited Security Offering?

Locating the appropriate lawful document template can be quite a challenge.

Clearly, there are numerous templates available online, but how do you acquire the correct document you need.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the Texas Checklist for Limited Security Offering, which you can utilize for both business and personal purposes.

If the form does not meet your requirements, use the Search box to find the appropriate form. Once you are certain the form is correct, click the Buy Now button to acquire the form. Select the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Texas Checklist for Limited Security Offering. US Legal Forms is the premier repository of legal forms where you can find various document templates. Take advantage of the service to obtain properly crafted documents that comply with state requirements.

- All of the templates are reviewed by professionals and meet state and federal requirements.

- If you are already a member, Log In to your account and click on the Download button to obtain the Texas Checklist for Limited Security Offering.

- Use your account to search for the legal forms you have previously ordered.

- Navigate to the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/county. You can preview the form using the Preview button and read the form description to confirm it is the right one for you.

Form popularity

FAQ

Yes, blue sky laws are still active in Texas to protect investors from fraud in securities transactions. The ongoing enforcement of these laws underscores their importance in maintaining transparency and trust in the investment marketplace. Staying updated with the Texas Checklist for Limited Security Offering ensures that your activities remain compliant with current laws and regulations.

Certain entities and individuals are exempt from blue sky laws, including government-issued securities, private placements, and specific types of non-profit organizations. These exemptions provide flexibility for investors and issuers alike, allowing for quicker funding solutions. By leveraging the Texas Checklist for Limited Security Offering, you can identify if your situation qualifies for any available exemptions.

To obtain a securities license in Texas, you must complete specific educational requirements, pass an examination, and submit an application to the state’s securities regulator. Applicants typically must demonstrate their understanding of securities markets and regulations. Utilizing the Texas Checklist for Limited Security Offering can guide you through the licensing process and highlight mandatory steps.

The blue sky law in Texas refers to the Texas Securities Act, which regulates the offer and sale of securities to protect investors from deceitful practices. This law requires securities to be registered unless they qualify for an exemption and mandates full disclosure of information to potential buyers. Familiarizing yourself with the Texas Checklist for Limited Security Offering will help you comply with these blue sky regulations.

The limited offering exemption in Texas allows businesses to offer and sell securities without the need for full registration, provided that certain conditions are met. This exemption is beneficial for small businesses and startups looking to raise capital while minimizing regulatory burdens. By following the Texas Checklist for Limited Security Offering, you can ensure your offering qualifies under this exemption.

Blue sky laws are designed to protect investors from fraudulent sales of securities by requiring sellers to register their offerings and provide disclosure. In Texas, these laws help ensure that potential investors receive important information about the risks involved in limited security offerings. Using the Texas Checklist for Limited Security Offering can help you understand these regulations and navigate compliance effectively.

Section 33 of the Texas Securities Act outlines the requirements for limited security offerings in the state. It specifies exemptions that allow businesses to raise funds without registering the security with the Texas State Securities Board. Understanding this section is crucial for anyone looking to navigate the Texas checklist for limited security offerings effectively. This section can help businesses streamline their fundraising process while remaining compliant with state laws.

The most common securities licenses include the Series 7, which allows buying and selling all types of securities, and the Series 63, needed for state compliance. These licenses are crucial for anyone looking to operate within the Texas financial market. By adhering to the Texas Checklist for Limited Security Offering, you can ensure you meet all necessary qualifications and regulations.

To obtain a securities license in Texas, candidates must pass specific examinations and demonstrate proficiency in investment knowledge. You will also need to complete a background check and meet residency requirements. The Texas Checklist for Limited Security Offering outlines these steps, making it easier for you to track your progress.

To become a financial advisor in Texas, you typically need a bachelor's degree and relevant certifications, such as passing the Series 7 and Series 66 exams. Additionally, you must adhere to state regulations, which the Texas Checklist for Limited Security Offering can help you with. Utilizing a trusted platform like USLegalForms can guide you through the required documentation.