Texas Sample Letter for Request for Estimate of Appraisal Costs

Description

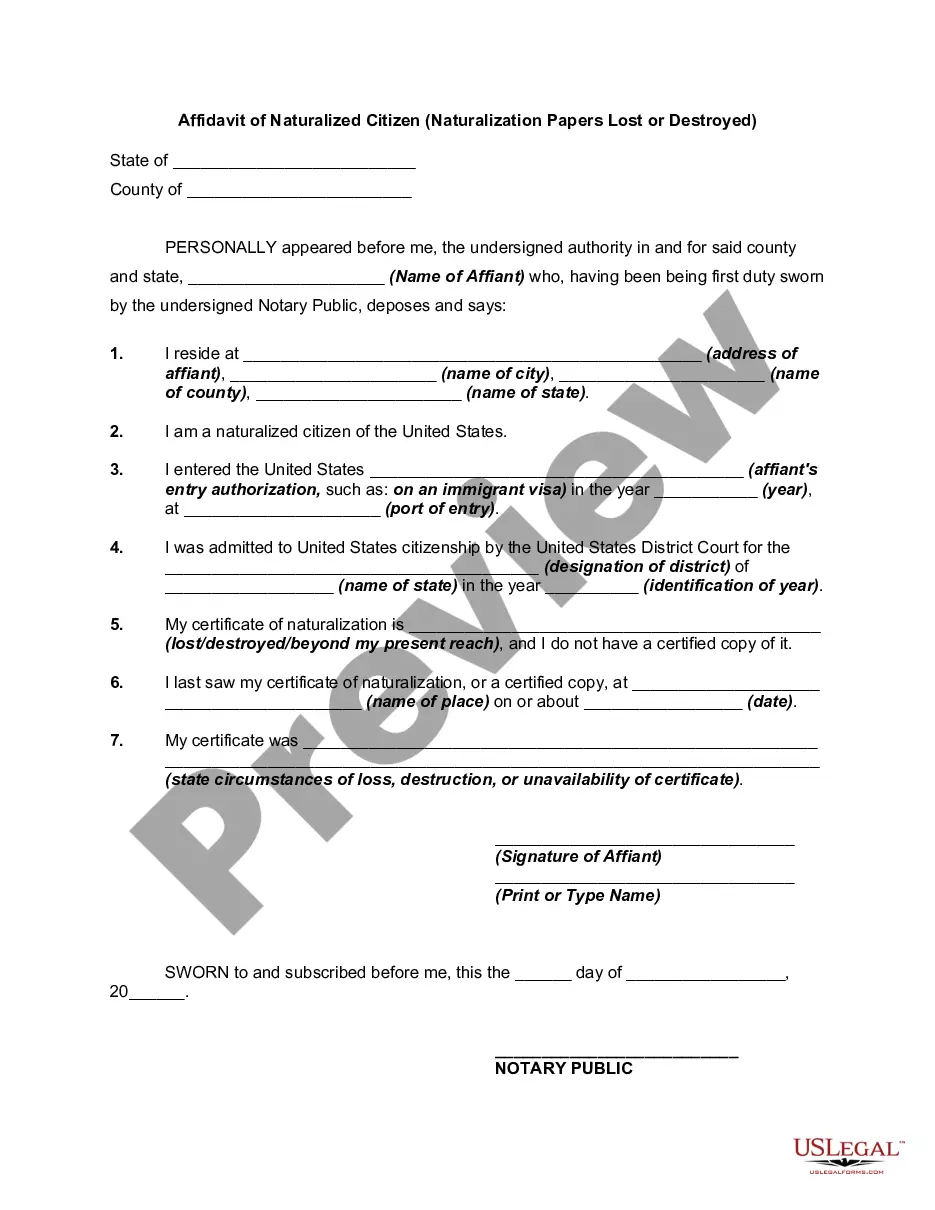

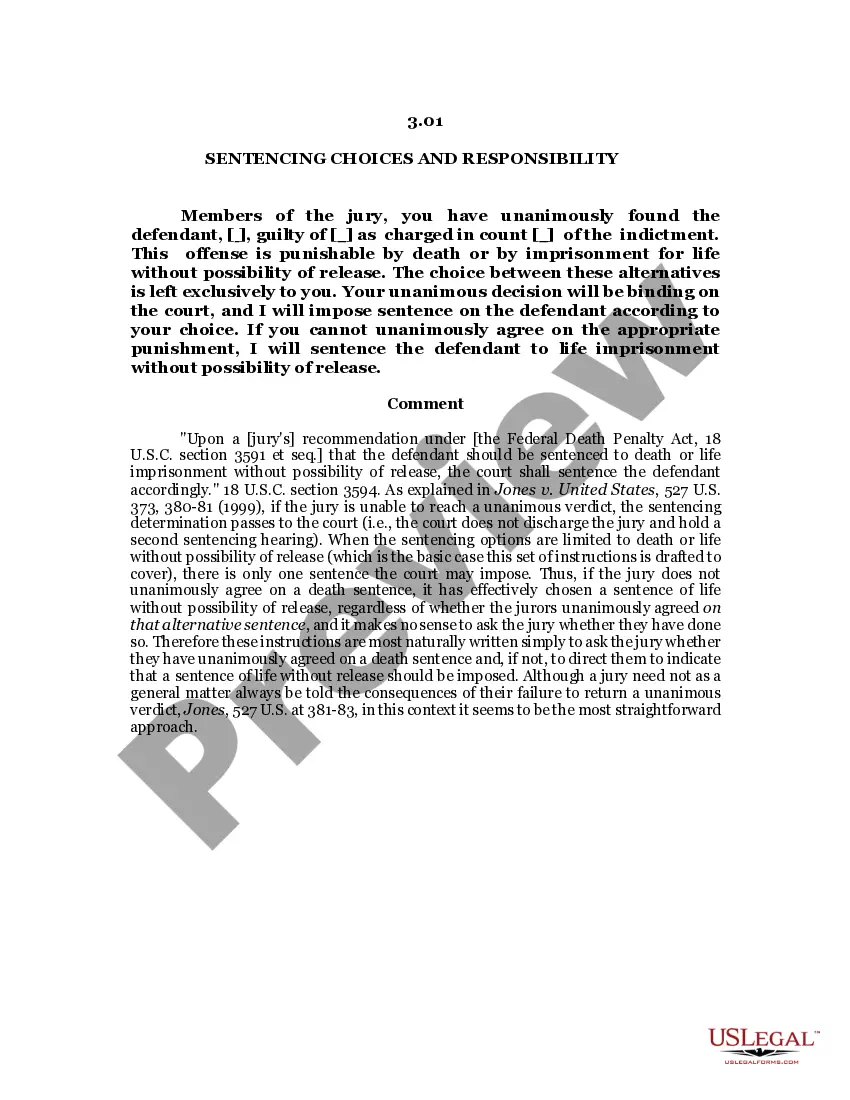

How to fill out Sample Letter For Request For Estimate Of Appraisal Costs?

If you require to complete, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. Once you have found the form you want, select the Buy now option. Choose the pricing plan you prefer and input your information to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Texas Sample Letter for Request for Estimate of Appraisal Costs in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire option to obtain the Texas Sample Letter for Request for Estimate of Appraisal Costs.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you select the form for the correct city/state.

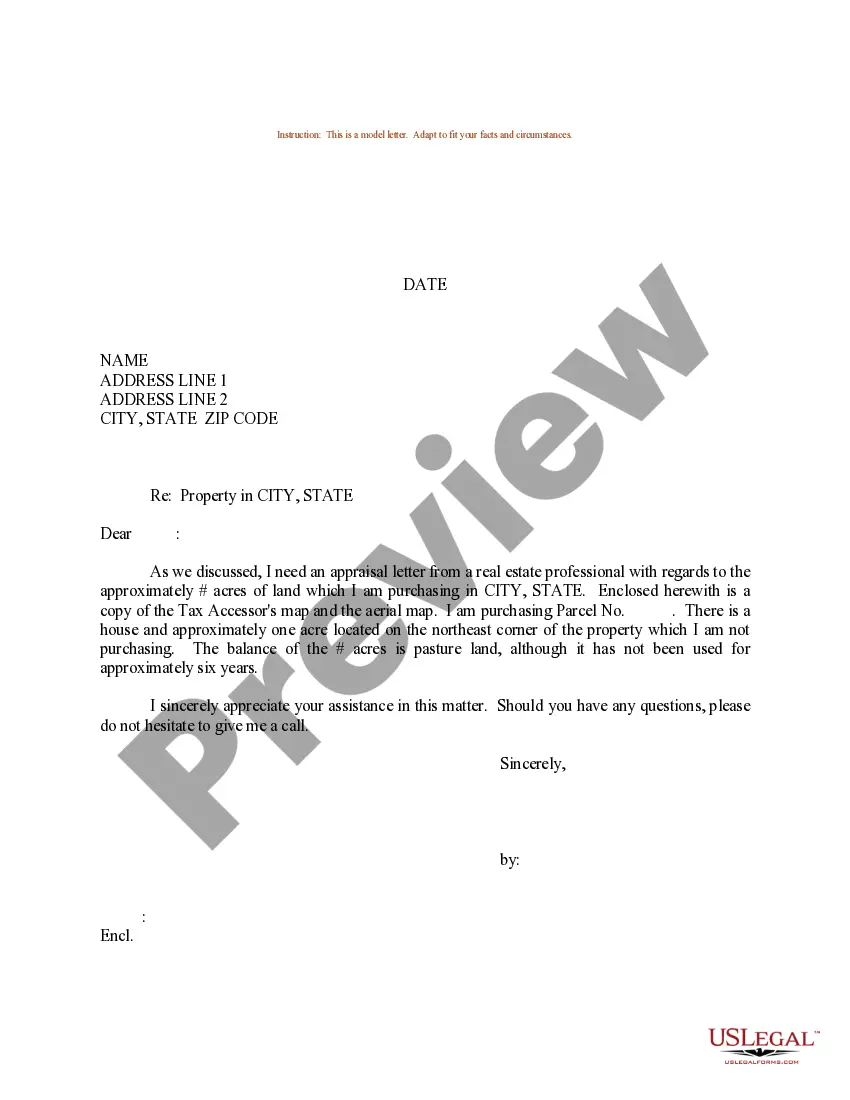

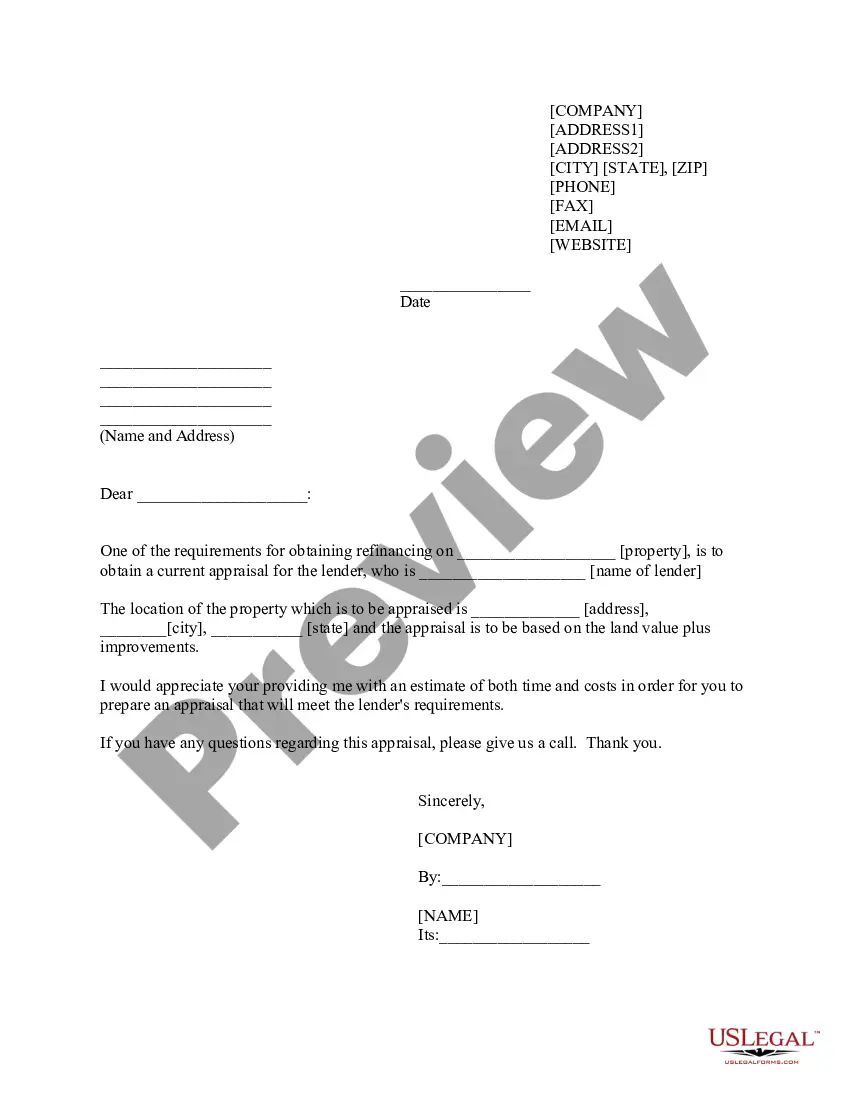

- Step 2. Utilize the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative models of the legal form template.

Form popularity

FAQ

Yes, an appraisal can return a higher value based on various factors such as improving market conditions or renovations made to the property. It's essential to keep track of your property's value, as this can directly influence your taxes and future financial decisions. A Texas Sample Letter for Request for Estimate of Appraisal Costs can help you investigate potential reasons behind an increased appraisal.

In Texas, there is no strict cap on how much an appraisal can increase annually. However, certain limitations apply for properties that are homesteaded, which may limit increases to about 10% each year. Understanding these nuances is crucial, and utilizing a Texas Sample Letter for Request for Estimate of Appraisal Costs can help you navigate these complexities effectively.

Yes, a higher appraisal typically results in increased property taxes. When the appraised value of your property goes up, local taxing authorities may adjust your tax bill accordingly. To take control of this situation, consider drafting a Texas Sample Letter for Request for Estimate of Appraisal Costs, which can allow you to understand potential tax ramifications better.

A notice of appraised value is a document that informs property owners of the appraised value set by local authorities for taxation purposes. This notice is usually sent out annually and gives you the opportunity to dispute the valuation if you find it unjust. Using a Texas Sample Letter for Request for Estimate of Appraisal Costs can help you prepare a formal response if you believe your appraisal needs further evaluation.

The maximum property tax rate in Texas is determined by local governments and various taxing authorities. While there is no fixed maximum, the average rate tends to hover around 1.5% to 2.5% of the appraised value. Keeping this in mind will help you understand the importance of obtaining a Texas Sample Letter for Request for Estimate of Appraisal Costs for your financial planning.

In Texas, the increase in appraisal values can vary significantly based on market conditions and local policies. Generally, appraisals can rise anywhere from 5% to 10% in a given year. To better manage potential changes in your appraisal, you might consider using a Texas Sample Letter for Request for Estimate of Appraisal Costs, which can provide insights into expected costs.

When requesting an estimate, use a friendly and professional tone in your communication. Express appreciation for their time and invite them to review your project specifications. Utilizing a Texas Sample Letter for Request for Estimate of Appraisal Costs can help you structure your request appropriately and make a positive impression. This approach not only fosters good relations but also clarifies your needs effectively.

To ask a contractor for an estimate, start by clearly stating your project details and requirements. Share information about the scope of work, timelines, and any specific materials you prefer. You can use a Texas Sample Letter for Request for Estimate of Appraisal Costs to ensure you cover all essential aspects. This letter helps in getting more accurate and timely responses from contractors.

To figure out your property tax, first, identify your property’s appraised value. Then, find the applicable tax rate for your area. By multiplying the appraised value by the tax rate, you will arrive at your estimated property tax. If needed, use a Texas Sample Letter for Request for Estimate of Appraisal Costs to gather accurate figures from your local appraisal office.

Calculating property taxes in Texas begins with determining your property's appraised value. Then, multiply this value by the tax rate, which is set by local taxing authorities. For greater clarity and to assist in your calculations, consider requesting a Texas Sample Letter for Request for Estimate of Appraisal Costs from your appraiser desk.