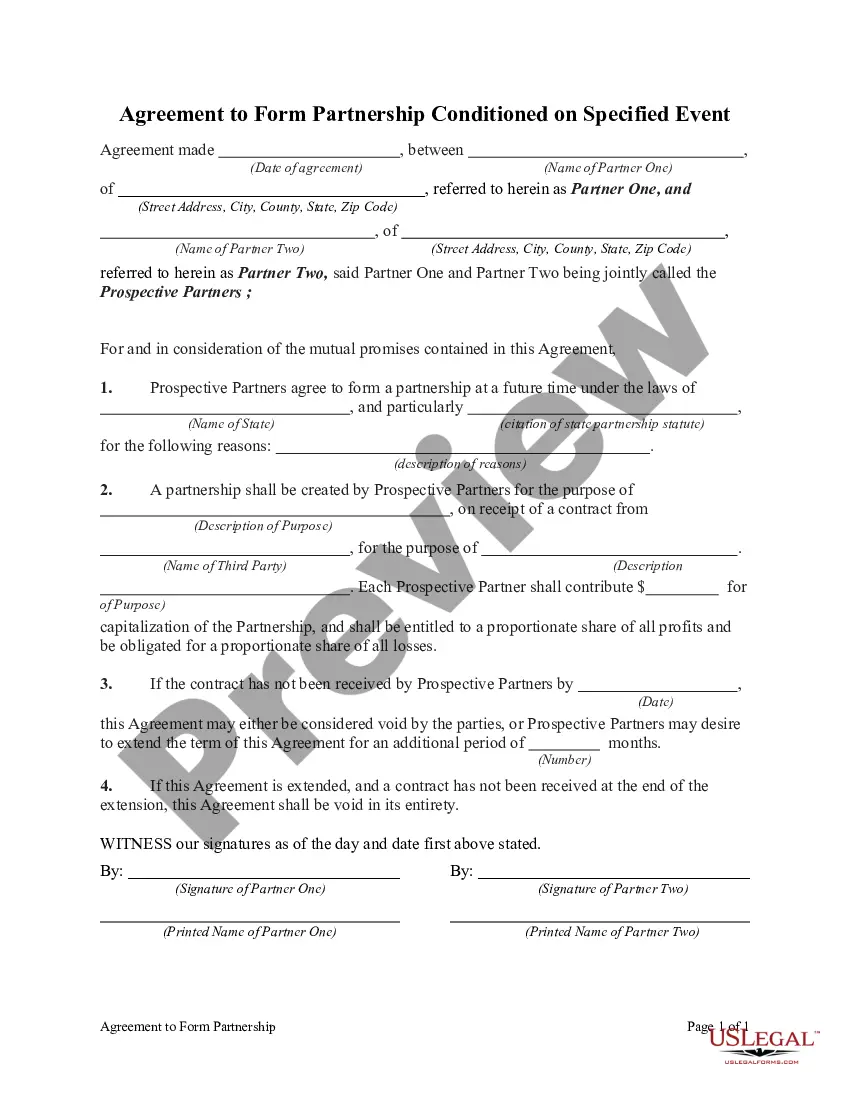

Texas Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Agreement To Form Partnership In Future To Conduct Business?

Selecting the appropriate authorized document template can be quite challenging.

Certainly, there are numerous templates accessible online, but how will you locate the legal form you require? Utilize the US Legal Forms website.

The service offers a vast array of templates, including the Texas Agreement to Form Partnership in Future to Conduct Business, suitable for both business and personal purposes.

If the form does not meet your requirements, use the Search section to find the appropriate form. Once you are sure the form is right, select the Purchase now button to acquire it. Choose the pricing plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the format and download the legal document template to your device. Complete, edit, print, and sign the received Texas Agreement to Form Partnership in Future to Conduct Business. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to download professionally crafted papers that adhere to state regulations.

- All the forms are reviewed by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Texas Agreement to Form Partnership in Future to Conduct Business.

- Use your account to look for the legal forms you have previously purchased.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/county. You can preview the form using the Review button and read the form description to confirm it’s suitable for you.

Form popularity

FAQ

To set up a business partnership agreement, begin by discussing your partnership's structure, goals, and financial arrangements with your partners. Draft the agreement using clear language to reflect your discussions, covering essential aspects such as duties, profit-sharing, and dispute resolution. A Texas Agreement to Form Partnership in Future to Conduct Business can provide a solid foundation and help ensure all parties are on the same page.

To file a partnership agreement in Texas, you generally do not need to file the agreement itself with the state, but you should register your business name if it differs from your own. Ensure that each partner retains a signed copy of the Texas Agreement to Form Partnership in Future to Conduct Business for their records. Additionally, check local regulations as they may require specific filings depending on your business type.

Writing a simple business partnership agreement involves specifying the names of the partners, the business purpose, and each partner's financial contributions. It is also beneficial to define decision-making procedures and how profits will be distributed. Use a Texas Agreement to Form Partnership in Future to Conduct Business as a guide, ensuring that all critical elements are included to avoid disputes.

Creating a business partnership starts with identifying potential partners who share your vision. Next, you need to discuss roles, responsibilities, and contributions to the partnership. To formalize this relationship, consider drafting a Texas Agreement to Form Partnership in Future to Conduct Business. This agreement outlines the terms and can help prevent misunderstandings down the road.

The four types of partnerships include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type serves different needs and has distinct legal implications. Understanding these differences is essential when considering a Texas Agreement to Form Partnership in Future to Conduct Business. A well-defined partnership type can protect your interests and facilitate collaboration.

In the context of a Texas Agreement to Form Partnership in Future to Conduct Business, it is important to understand the four primary types of partnerships. These include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has distinct characteristics and legal implications, so identifying the right fit for your business plan is crucial. If you're unsure, consider using a reliable platform like US Legal Forms to guide you through the process of forming a suitable partnership structure.

To form a General Partnership in Texas, partners need to agree on their contributions, responsibilities, and how profits will be shared. There are no formal registration requirements, but creating a Texas Agreement to Form Partnership in Future to Conduct Business is advisable for legal protection and clarity. It helps partners outline their individual roles, business goals, and conflict resolution methods, setting a solid foundation for their enterprise.

While verbal agreements can establish a partnership, a written agreement is highly recommended to avoid misunderstandings. A Texas Agreement to Form Partnership in Future to Conduct Business provides a concrete framework that defines each partner's rights, responsibilities, and expectations. This written document serves as a reference point for partners, ensuring transparency and clarity in their business relationship.

Partnerships in Texas must comply with state regulations, which include registering the business if necessary and adhering to partnership laws outlined in the Texas Business Organizations Code. It is essential to have a Texas Agreement to Form Partnership in Future to Conduct Business that details the operational procedures and decision-making processes. This helps partners avoid disputes and misunderstandings while maintaining a clear structure.

In Texas, a partnership involves two or more individuals or entities collaborating to run a business for profit. Each partner contributes to the business, sharing both profits and responsibilities. Establishing a Texas Agreement to Form Partnership in Future to Conduct Business can outline each partner's roles, contributions, and profit-sharing methods to ensure clarity and mutual understanding.