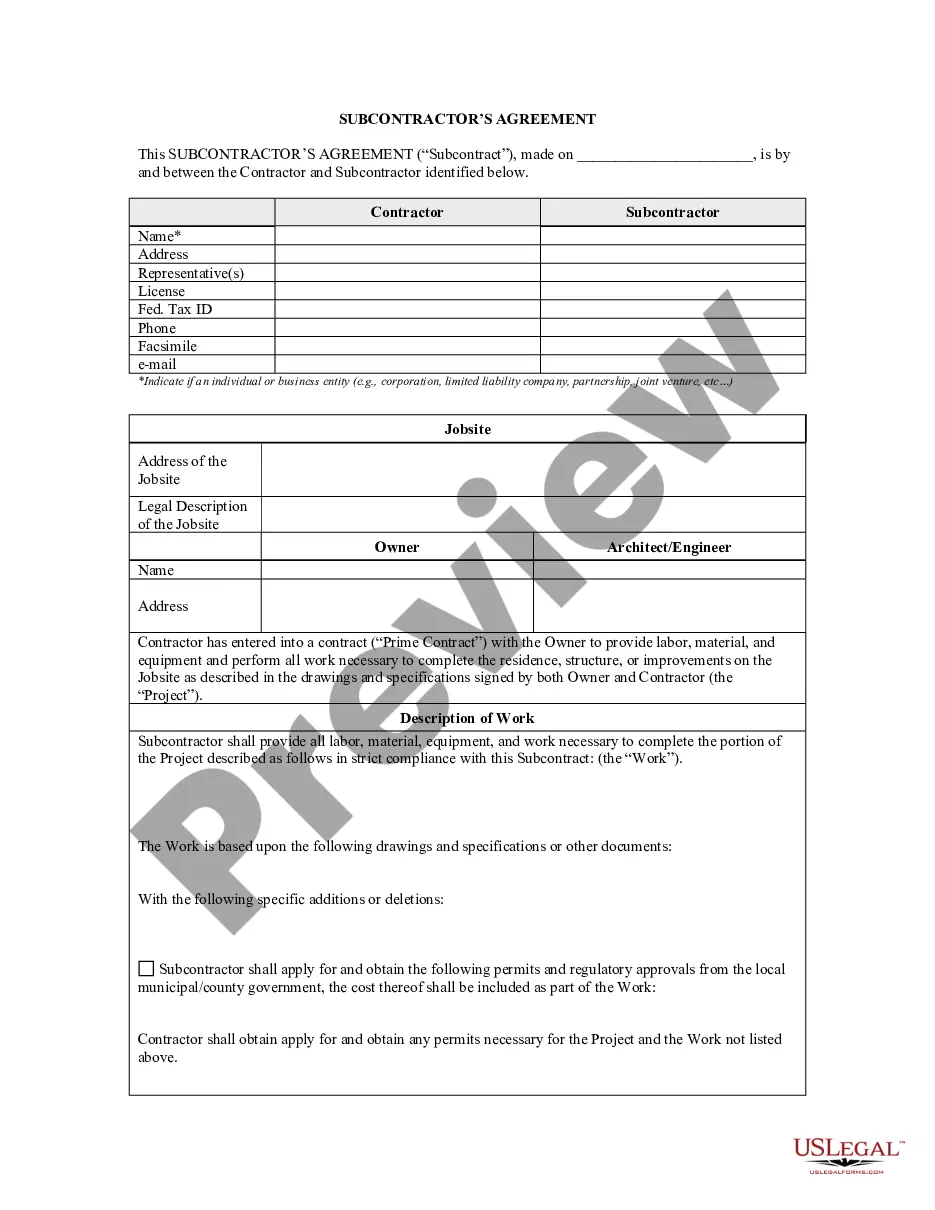

Texas Worksheet — Contingent Worker is a comprehensive document designed to gather detailed information about workers who fall under the category of contingent workers in the state of Texas. These workers are typically employed on a temporary or contract basis and include freelancers, consultants, part-time workers, and independent contractors. This worksheet serves as a crucial tool for both employers and workers to ensure compliance with relevant state regulations and accurately report their employment status. The Texas Worksheet — Contingent Worker consists of various sections that require the collection of specific information. Some key categories covered in this worksheet include: 1. Worker Information: This section collects basic details about the contingent worker, such as their full name, contact information, and Social Security number. It also entails gathering information about their employment classification, such as whether they are an independent contractor or a temporary employee. 2. Employment Details: This portion of the worksheet focuses on the worker's job-related information, such as the start date of their assignment, the anticipated duration of the job, and the hourly rate or fixed compensation they receive. Employers need to provide accurate details to ensure proper classification and compensation for these contingent workers. 3. Scope of Work: Here, employers must outline the specific duties and responsibilities of the worker. This section helps in defining the nature of the work performed, ensuring clarity for both parties involved in the employment arrangement. 4. Tax Information: As employment tax regulations differ for contingent workers, this section gathers pertinent tax details. It includes information regarding tax withholding preferences, filing status, and allowances claimed by the contingent worker. 5. Worker Classification: The Texas Worksheet — Contingent Worker aims to determine the correct classification of the worker, whether as an employee or an independent contractor. This classification is vital for legal and financial purposes, including taxation and eligibility for employee benefits. It's important to note that while the main purpose of the Texas Worksheet — Contingent Worker remains consistent, there might be variations based on specific industries, sectors, or organizations. These variations could lead to different types of worksheets, each customized to address the unique requirements of various contingent workers in Texas. Some potential variants of the worksheet may include Texas Worksheet — Contingent Worker for IT Professionals, Texas Worksheet — Contingent Worker for Healthcare Workers, and Texas Worksheet — Contingent Worker for Construction Industry, among others. These specialized worksheets would take into account the specific needs and regulations governing different sectors while covering the core sections mentioned above.

Texas Worksheet - Contingent Worker

Description

How to fill out Texas Worksheet - Contingent Worker?

Choosing the right legitimate record web template could be a battle. Needless to say, there are tons of templates available on the net, but how will you discover the legitimate form you will need? Utilize the US Legal Forms site. The assistance offers thousands of templates, such as the Texas Worksheet - Contingent Worker, which can be used for business and personal demands. Each of the kinds are examined by professionals and meet up with state and federal demands.

Should you be currently listed, log in to the profile and then click the Down load button to obtain the Texas Worksheet - Contingent Worker. Make use of profile to check with the legitimate kinds you possess ordered in the past. Go to the My Forms tab of your respective profile and have one more backup from the record you will need.

Should you be a brand new customer of US Legal Forms, here are straightforward recommendations so that you can adhere to:

- Initially, ensure you have chosen the correct form for the town/region. You can look through the shape while using Preview button and browse the shape information to guarantee it will be the best for you.

- When the form fails to meet up with your preferences, utilize the Seach field to obtain the appropriate form.

- Once you are positive that the shape is acceptable, go through the Acquire now button to obtain the form.

- Opt for the costs prepare you need and enter in the necessary details. Make your profile and buy the order using your PayPal profile or Visa or Mastercard.

- Choose the document file format and download the legitimate record web template to the gadget.

- Full, change and print and signal the attained Texas Worksheet - Contingent Worker.

US Legal Forms is definitely the most significant collection of legitimate kinds for which you can discover various record templates. Utilize the service to download skillfully-manufactured files that adhere to status demands.

Form popularity

FAQ

In order to hire a Contingent Worker, first Create Job Requisition using the (JM) Supervisory Org. Once the Job Req is approved by the Office of Human Resources, you will need to create a contract by completing the Contract Contingent Worker-Task.

Contingent employment means a worker's position with a company is temporary. The individual is not an employee of the business, and therefore isn't hired on a permanent basis. Typically, contingent workers are hired to complete a project.

Contingent workers include independent contractors, freelancers, consultants, advisors or other outsourced workers hired on a per-job and non-permanent basis.

Contingent workers are not employees. A person cannot be an active contingent worker and an active employee at the same time. Contingent workers can never be paid in Workday, can never be benefits eligible, and cannot hold more than one job in Workday.

The US Labor Department defines this in terms of who is responsible for the taxes. When a company hires a worker, temporary or permanent, they must take care of their taxes. However, when independent contingent workers are hired, they do not become employees and thus, have to take care of their own taxes.

In order to hire a Contingent Worker, first Create Job Requisition using the (JM) Supervisory Org. Once the Job Req is approved by the Office of Human Resources, you will need to create a contract by completing the Contract Contingent Worker-Task.

A contingent worker is someone who works for an organization without being hired as their employee. Contingent workers may provide their services under a contract, temporarily, or on an as-needed basis.

Contingent workers are not employees. A person cannot be an active contingent worker and an active employee at the same time. Contingent workers can never be paid in Workday, can never be benefits eligible, and cannot hold more than one job in Workday.

The FTE report shows your employees' full-time equivalent based on their weekly working hours.

Contingent work provides that income stream while your search for the right job continues. At the same time, staying active as a contingent worker also helps keep gaps from forming on your employment history on your resume. Temporary jobs often have fixed time limits too which helps you plan your next move.