A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

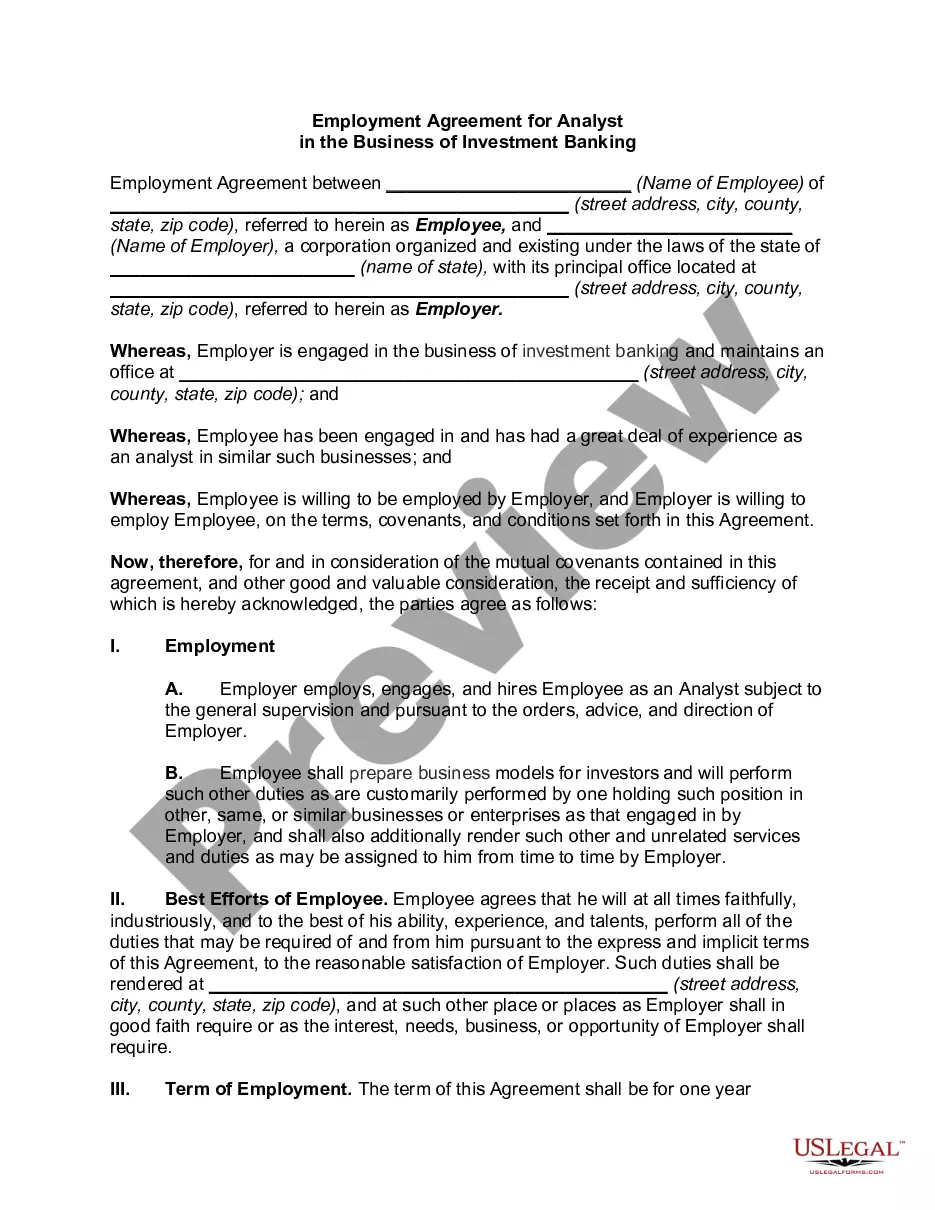

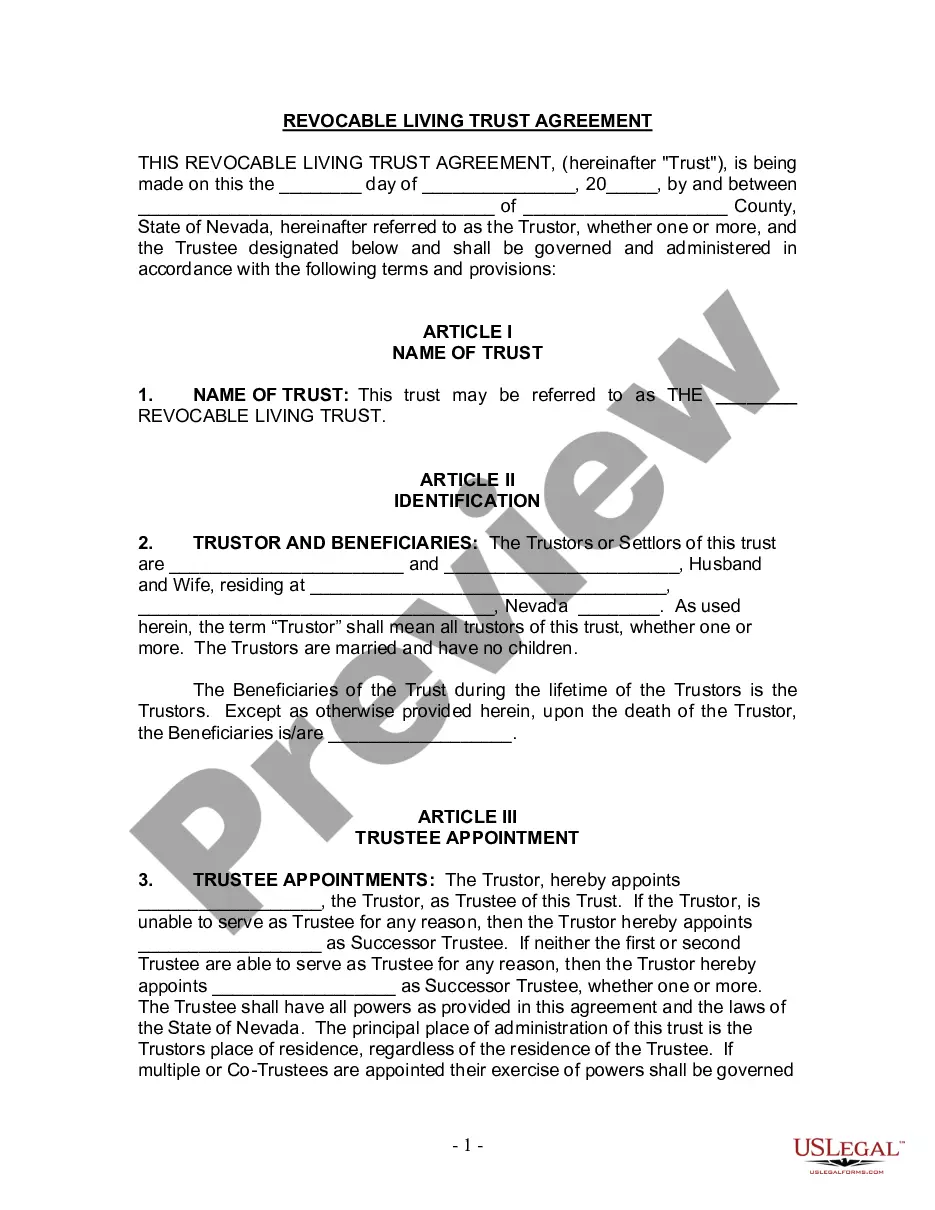

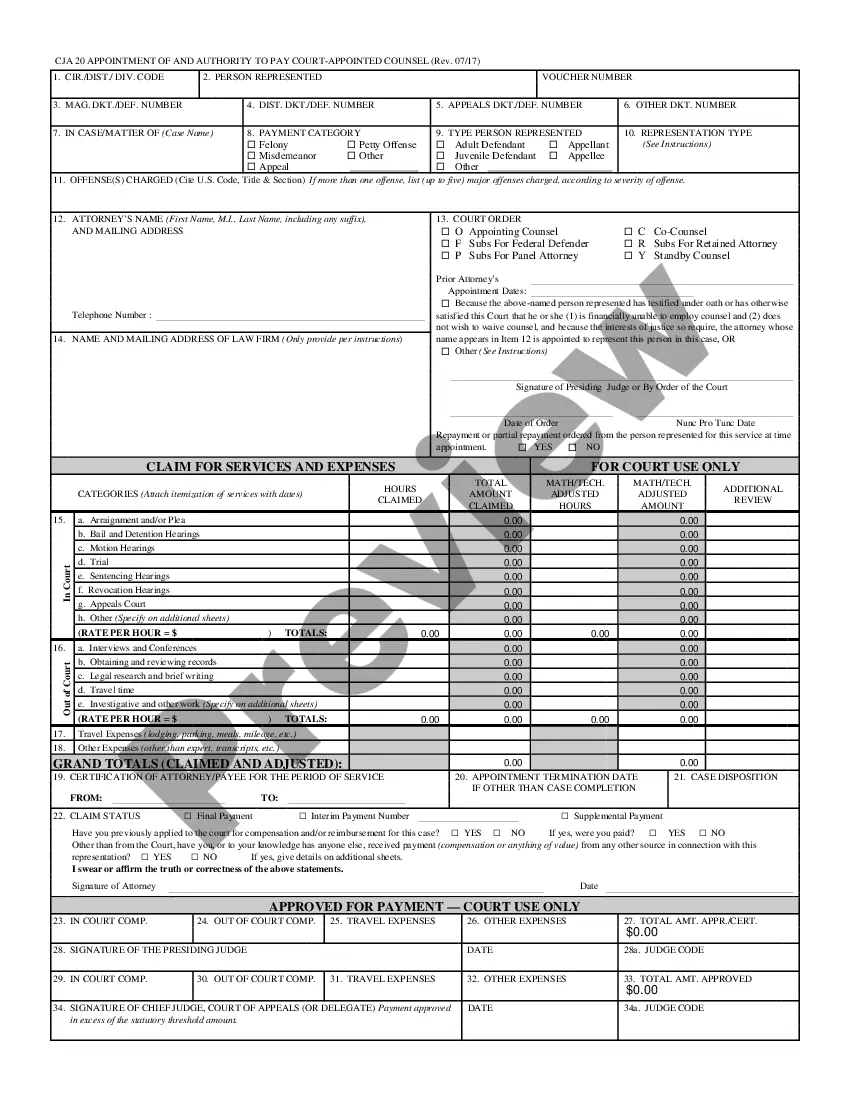

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legally binding document that allows individuals in Texas to protect and distribute their assets to their loved ones. This type of trust provides a secure way to ensure financial stability for future generations. The primary purpose of the Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is to allow the trust creator (also known as the settler) to transfer their assets into a trust for the benefit of their immediate family members. By doing so, the settler can ensure that their assets are managed and distributed according to their wishes, even after their passing. This type of trust comes with several key benefits. Firstly, it allows the settler to minimize estate taxes and avoid probate, ensuring a smooth transition of assets to the designated beneficiaries. Additionally, it provides asset protection, shielding the trust assets from creditors and potential lawsuits. There are different types of Texas Irrevocable Trust Agreements for the Benefit of Spouse, Children, and Grandchildren that individuals can consider based on their unique circumstances: 1. Spousal Support Trust: This trust type is designed to ensure the well-being of the surviving spouse by providing income and financial support throughout their lifetime. It secures the spouse's future financial stability while protecting the trust assets for the benefit of the children and grandchildren. 2. Education Trust: This trust aims to provide financial support for the education expenses of children and grandchildren. It can cover tuition fees, books, living expenses, and other educational needs. The settler can specify the terms and conditions for disbursements to ensure the funds are used solely for educational purposes. 3. Medical Trust: The primary focus of this trust is to cover medical expenses for the spouse and descendants. It can provide resources for healthcare treatments, long-term care, medications, and other medical-related costs. The trust ensures that the family's healthcare needs are met, even in the absence of the settler. 4. Inheritance Protection Trust: This trust type is designed to protect the inheritance of children and grandchildren from various risks such as divorce, lawsuits, or irresponsible spending. It allows the settler to designate a trustee who has the authority to manage and distribute the assets on behalf of the beneficiaries. The trust can have specific provisions to shield the assets and prevent them from being depleted irresponsibly. When creating a Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren, it is crucial to consult with an experienced attorney specializing in trust and estate planning. They can help tailor the trust to meet the individual's goals and ensure compliance with Texas state laws and regulations.