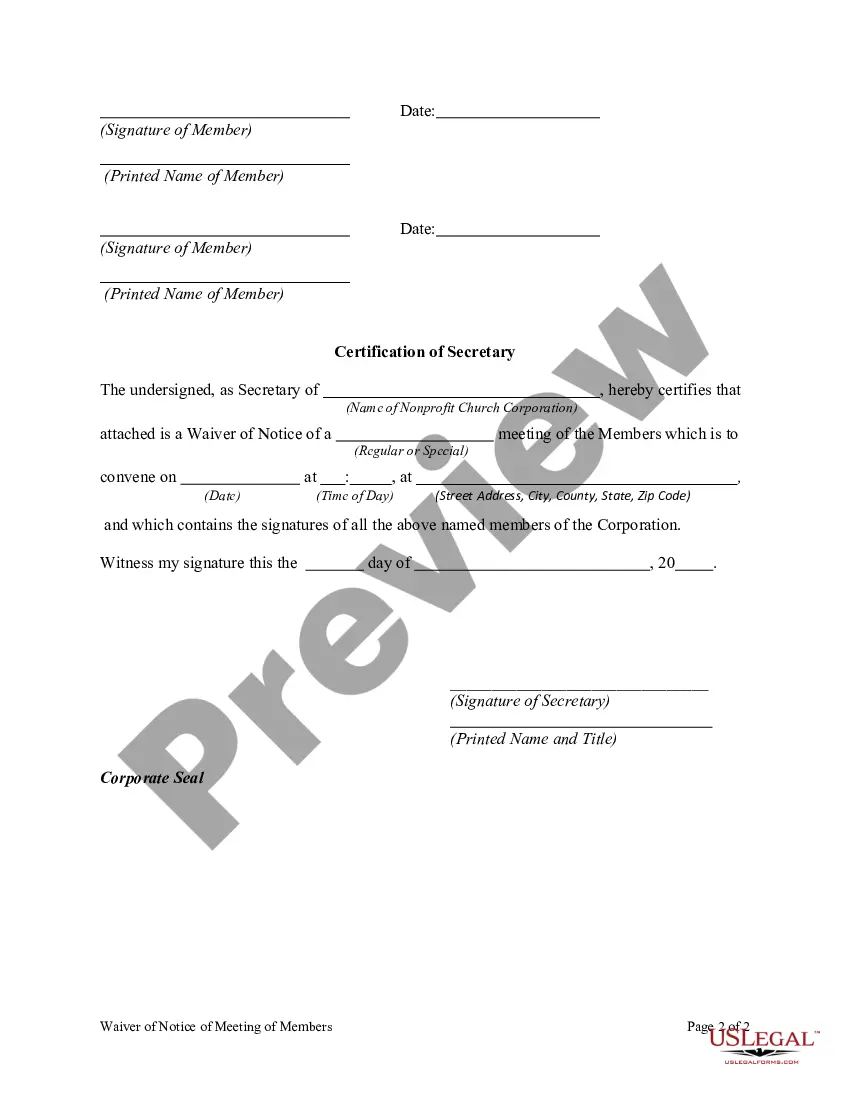

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation is a legal document that allows members of the church corporation to waive their right to receive notice of upcoming meetings. This waiver is commonly used in situations where the members are aware of the meeting or have already discussed the matter at hand. When a nonprofit church corporation needs to hold a meeting, it is usually required by law to provide notice to its members. However, in certain circumstances, it may be more practical to proceed with a meeting without providing prior notice. This is where the Texas Waiver of Notice of Meeting comes into play. By signing the waiver, the members of the nonprofit church corporation agree to waive their right to receive formal notice of the meeting. This means that they willingly give up their entitlement to know about the details of the meeting, such as the time, place, and agenda. It is crucial for all members to fully understand the implications of signing this waiver and make an informed decision. The Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation can be categorized into two types: 1. General Waiver: This type of waiver is used when the members want to waive their notice of all future meetings of the church corporation. By signing this waiver, members are essentially agreeing that they will not receive any notice for any upcoming meetings. 2. Specific Waiver: On the other hand, a specific waiver is used when the members only want to waive their notice for a particular meeting. This type of waiver is commonly used when the members are already aware of the meeting, or when the agenda is urgent and time-sensitive. It is important to note that a Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation is a legally binding document. As such, it should be prepared and signed in accordance with the laws and regulations applicable to nonprofit corporations in Texas. It is recommended to seek legal advice or consult an attorney to ensure compliance with all legal requirements and to address any specific concerns related to the church corporation.Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation is a legal document that allows members of the church corporation to waive their right to receive notice of upcoming meetings. This waiver is commonly used in situations where the members are aware of the meeting or have already discussed the matter at hand. When a nonprofit church corporation needs to hold a meeting, it is usually required by law to provide notice to its members. However, in certain circumstances, it may be more practical to proceed with a meeting without providing prior notice. This is where the Texas Waiver of Notice of Meeting comes into play. By signing the waiver, the members of the nonprofit church corporation agree to waive their right to receive formal notice of the meeting. This means that they willingly give up their entitlement to know about the details of the meeting, such as the time, place, and agenda. It is crucial for all members to fully understand the implications of signing this waiver and make an informed decision. The Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation can be categorized into two types: 1. General Waiver: This type of waiver is used when the members want to waive their notice of all future meetings of the church corporation. By signing this waiver, members are essentially agreeing that they will not receive any notice for any upcoming meetings. 2. Specific Waiver: On the other hand, a specific waiver is used when the members only want to waive their notice for a particular meeting. This type of waiver is commonly used when the members are already aware of the meeting, or when the agenda is urgent and time-sensitive. It is important to note that a Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation is a legally binding document. As such, it should be prepared and signed in accordance with the laws and regulations applicable to nonprofit corporations in Texas. It is recommended to seek legal advice or consult an attorney to ensure compliance with all legal requirements and to address any specific concerns related to the church corporation.