A Texas Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife is a specific type of trust created under Texas law. This trust is designed to provide financial security for a wife after the death of her spouse, with the remaining assets continuing to benefit their children upon her passing. Here is a detailed description of this trust and its various types: 1. Texas Testamentary Trust of the Residue of an Estate: — This type of trust is established through a will and comes into effect only after the death of the spouse. — It is created to hold the remaining assets (residue) of the deceased spouse's estate, excluding specific bequests. — By placing the residue in the trust, it ensures that the assets are managed and distributed according to the testator's wishes, while protecting them from potential creditors, taxation, and mismanagement. 2. Trust for the Benefit of a Wife: — This trust is specifically aimed at providing financial support and security to the surviving wife. — It allows the wife to have access to income generated by the trust assets, such as investment earnings, dividends, or rental income. — The trustee, appointed by the deceased spouse, has the responsibility to manage the trust assets and make distributions to the wife as necessary for her support and maintenance. 3. Trust to Continue for Benefit of Children after the Death of the Wife: — This provision ensures that the trust remains intact even after the wife's passing, with the assets being distributed to the children. — The trustee continues to manage the trust and make necessary distributions for the benefit of the children, such as education expenses, healthcare needs, or general support until a specified age or event. — After reaching the designated age or milestone, the trust assets may be distributed outright to the children or continue to be held in further trusts, depending on the terms set forth in the trust. It is important to note that these terms and conditions can vary depending on the specific provisions outlined in the individual's will or trust document. Consulting with an experienced estate planning attorney is crucial to ensure that the trust is properly created, tailored to the individual's needs, and complies with Texas state laws.

Texas Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

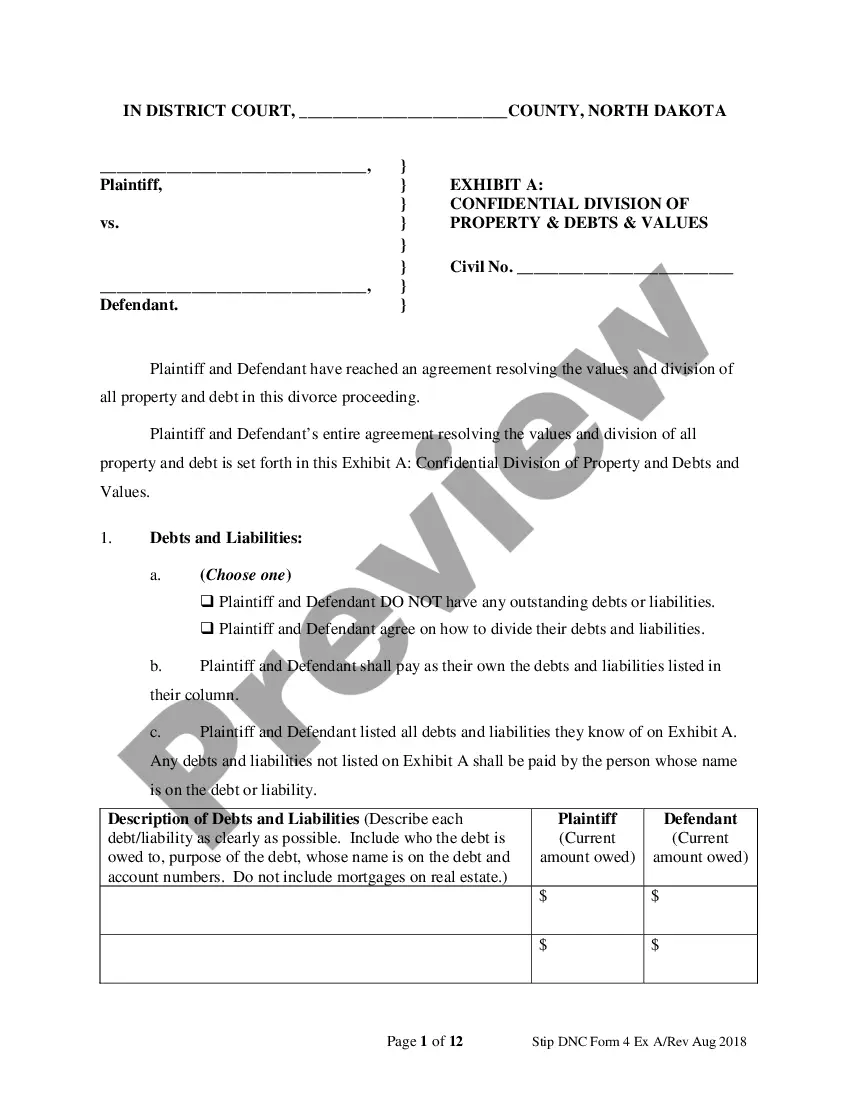

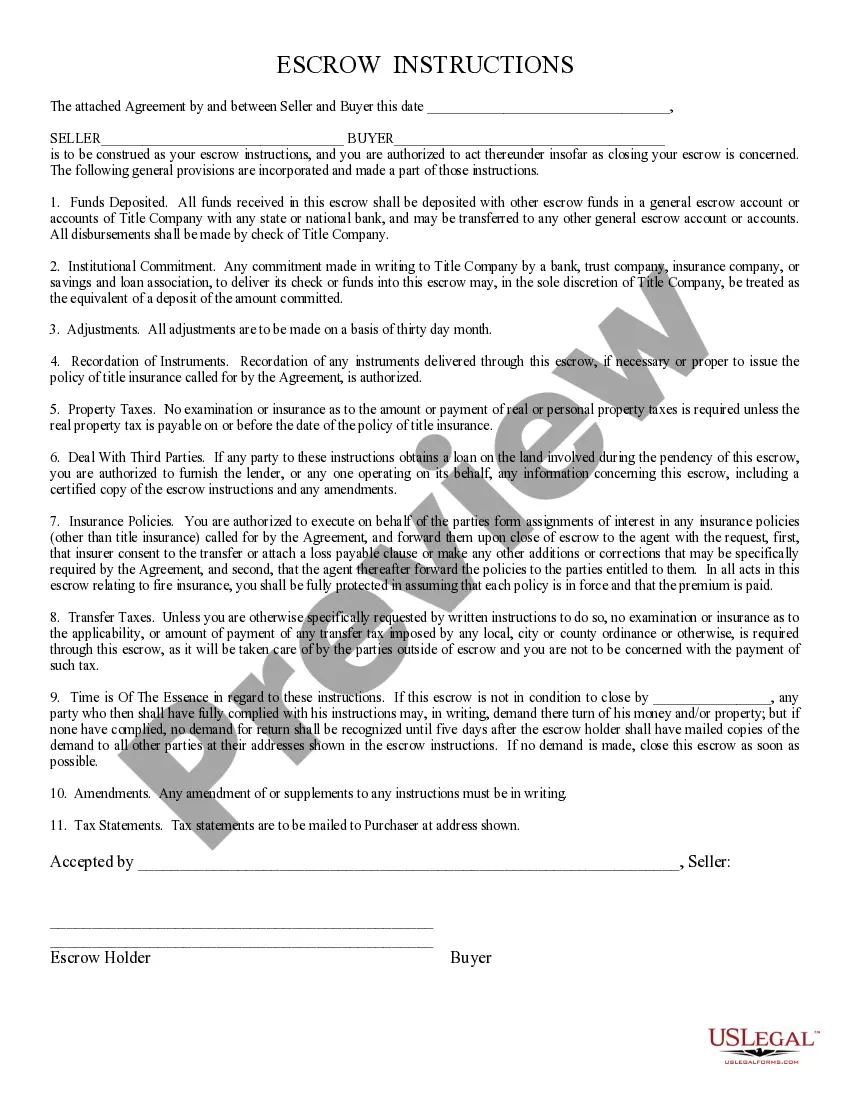

How to fill out Texas Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

US Legal Forms - one of the greatest libraries of legal kinds in America - delivers an array of legal record web templates it is possible to obtain or print. Using the website, you will get a large number of kinds for enterprise and specific uses, categorized by groups, suggests, or search phrases.You can find the latest versions of kinds like the Texas Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife within minutes.

If you have a monthly subscription, log in and obtain Texas Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife through the US Legal Forms collection. The Download option can look on each type you perspective. You gain access to all formerly acquired kinds from the My Forms tab of your bank account.

In order to use US Legal Forms initially, listed below are basic recommendations to help you started out:

- Make sure you have picked out the best type to your city/region. Click the Preview option to check the form`s content material. Look at the type information to ensure that you have chosen the appropriate type.

- In the event the type does not fit your specifications, make use of the Lookup area on top of the display screen to get the one that does.

- If you are satisfied with the shape, verify your decision by clicking the Acquire now option. Then, choose the pricing plan you like and give your credentials to sign up for the bank account.

- Procedure the financial transaction. Make use of your charge card or PayPal bank account to complete the financial transaction.

- Find the format and obtain the shape on the system.

- Make modifications. Complete, change and print and signal the acquired Texas Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

Each and every format you added to your money does not have an expiry date and is also yours eternally. So, if you would like obtain or print an additional version, just go to the My Forms segment and click on about the type you want.

Get access to the Texas Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife with US Legal Forms, the most considerable collection of legal record web templates. Use a large number of expert and state-certain web templates that fulfill your company or specific requires and specifications.

Form popularity

FAQ

You can establish a marital trust with the help of an attorney who specializes in estate planning. The trust document must specify all assets and property held in the trust. This can include nearly anything of value. That includes stocks, bonds, mutual funds, cash and physical property.

Most A Trusts are actually also QTIP Trusts. However, for it to be a QTIP Trust, only the surviving spouse can be the beneficiary of the trust during his or her lifetime, and the trust is required to pay all income generated by the trust (e.g. dividends and interest) to the surviving spouse at least annually.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

The marital deduction is unlimited. The correct answer is a. An outright specific bequest of property from a U.S. citizen to his resident alien spouse does not qualify for the marital deduction.

One of the drawbacks of a testamentary trust is the considerable responsibility it puts on the trustee. He must meet regularly with the probate court to demonstrate his safe handling of the trust, and depending on your wishes, his tasks may go on for many years.

This technique is novel because normally, gifts between spouses qualify for the federal estate and gift tax marital deduction and must be included in the spouse's estate at death. Gifts made to an Irrevocable Spousal Trust are not taxed in the survivor's estate.

A Testamentary Trust is a trust established under the provisions of a person's Last Will and Testament. Unlike trusts created during the lifetime of the Grantor, a testamentary trust does not become effective until the Grantor has died and his Will has been through probate.

A marital deduction trust can take one of two forms, either a life estate coupled with a general power of appointment given to the spouse or a Qualified Terminable Interest Property (QTIP) trust.

There are three types of marital trusts: a general power of appointment, a qualified terminable interest property (QTIP) trust, and an estate trust. A martial trust protects the assets and benefits of a surviving spouse and children.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.