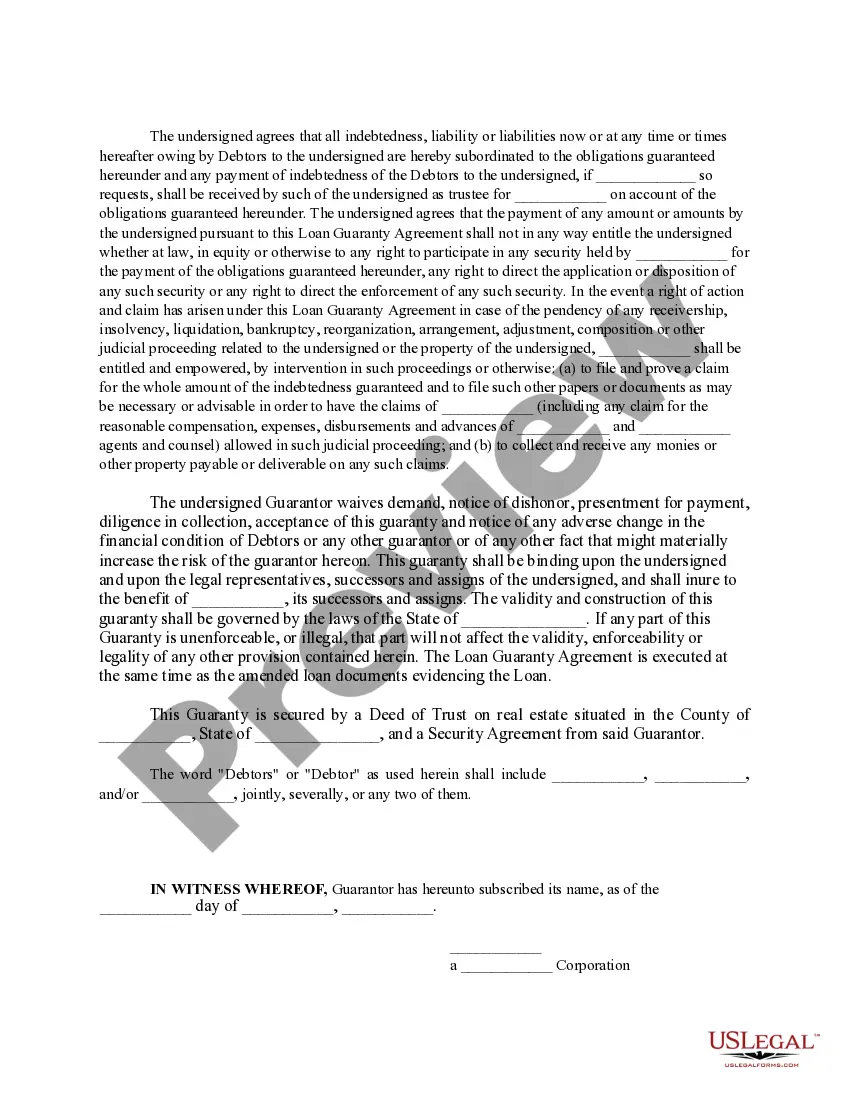

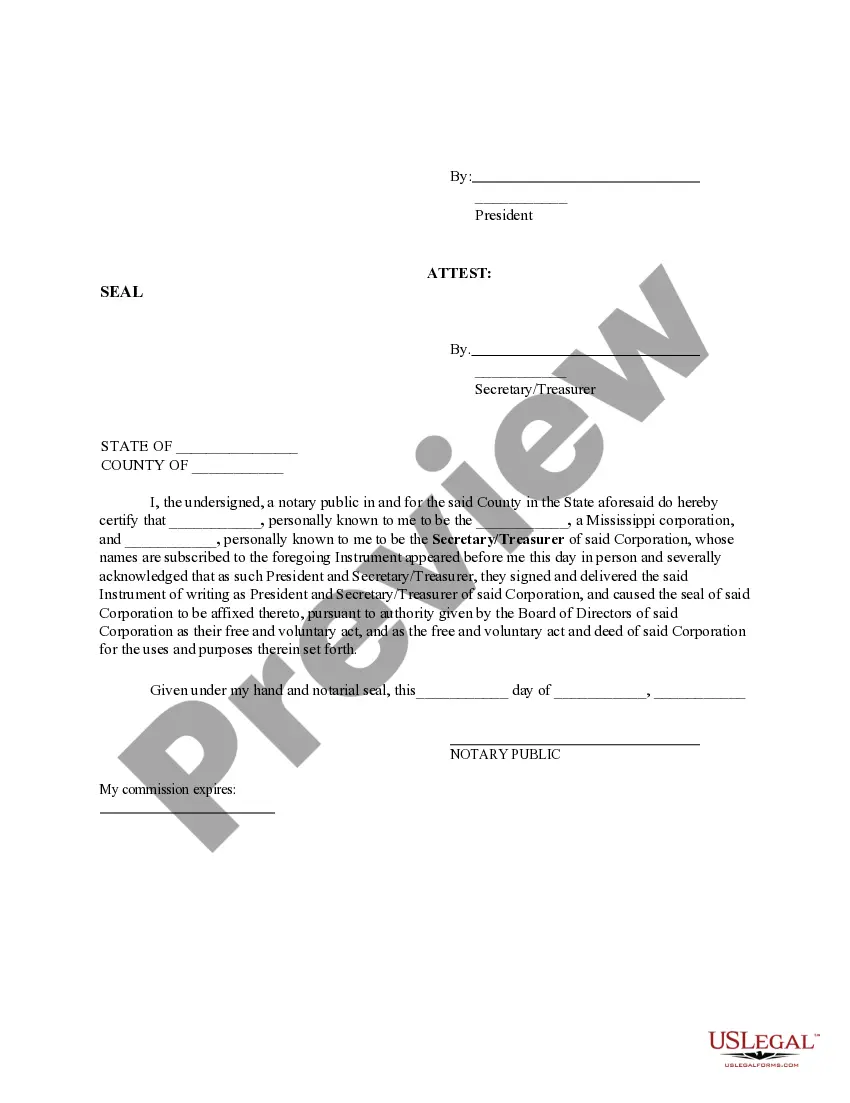

Texas Loan Guaranty Agreement

Description

How to fill out Loan Guaranty Agreement?

You can spend several hours on the web trying to find the authorized papers web template which fits the federal and state requirements you need. US Legal Forms gives 1000s of authorized forms which can be examined by professionals. You can actually obtain or print out the Texas Loan Guaranty Agreement from your services.

If you already have a US Legal Forms accounts, you can log in and click the Download button. Following that, you can full, change, print out, or sign the Texas Loan Guaranty Agreement. Each authorized papers web template you get is your own property forever. To acquire an additional copy of any bought develop, go to the My Forms tab and click the related button.

If you work with the US Legal Forms site the very first time, follow the simple directions below:

- Very first, ensure that you have selected the best papers web template for that state/town of your liking. Read the develop information to ensure you have picked out the right develop. If accessible, make use of the Preview button to appear through the papers web template also.

- If you would like discover an additional edition of your develop, make use of the Research discipline to find the web template that meets your needs and requirements.

- After you have discovered the web template you desire, click on Acquire now to carry on.

- Choose the pricing plan you desire, type your accreditations, and register for a free account on US Legal Forms.

- Total the deal. You can use your Visa or Mastercard or PayPal accounts to fund the authorized develop.

- Choose the format of your papers and obtain it in your system.

- Make alterations in your papers if required. You can full, change and sign and print out Texas Loan Guaranty Agreement.

Download and print out 1000s of papers web templates using the US Legal Forms website, that provides the most important variety of authorized forms. Use expert and condition-specific web templates to deal with your organization or specific demands.

Form popularity

FAQ

In a finance or lending context, a guarantor would be forced to answer for the debt or default of the debtor to the creditor, if a debtor does not fulfill an obligation on their part to repay their debt.

Yes, a personal guarantee is signed in Texas. The sign indicates that the guarantor has fully decided to repay the loan when the business defaults to pay within a given period. Still, the financial company may acquire the guarantor's property in compensation for the loan when the business fails to cover the credits.

This unsecured written promise is not tied to a specific asset, such as a house, so any part of the borrower's assets can be used to repay the debt. If the investor defaults on the loan, a personal guarantee allows the lender to seek compensation for damages by going after the owner's home, cash, and any other assets.

In writing ? The guarantee must be evidenced in writing to be enforceable. Signed ? The document must be signed by the guarantor or their authorised agent. Their name can be written or printed.

It is a legally binding personal promise to step into the shoes of the original party to the contract. For example, an individual may personally agree to pay off the debts of a company they are acquiring as part of the acquisition.

A loan guarantee is a legally binding commitment to pay a debt in the event the borrower defaults. This most often occurs between family members, where the borrower can't obtain a loan because of a lack of income or down payment, or due to a poor credit rating.

When a company goes under, it's common for someone who has signed a personal guarantee to wonder if there's a way to get out of it. However, unless the lender agrees to waive it (which would be unlikely), or some fundamental flaw exists in the agreement, the personal guarantee will remain binding.

A personal guaranty for a residential lease agreement in Texas where the guarantor unconditionally guarantees the performance of the tenant's monetary and non-monetary obligations under the lease agreement.