Texas Purchase Agreement by a Corporation of Assets of a Partnership

Description

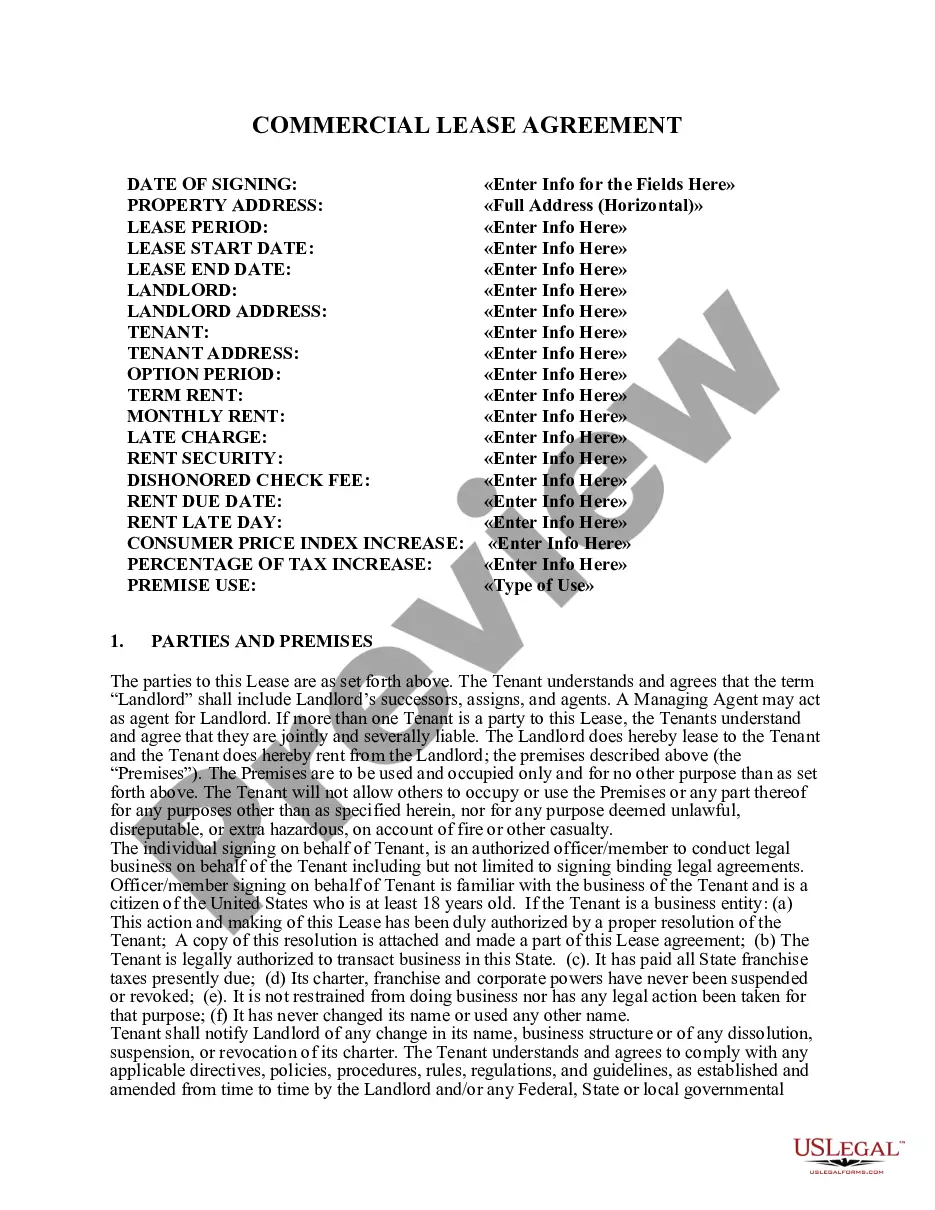

How to fill out Purchase Agreement By A Corporation Of Assets Of A Partnership?

Are you in a position where you need paperwork for potential organizational or personal activities each day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the Texas Purchase Agreement by a Corporation of Assets of a Partnership, designed to meet both federal and state requirements.

When you find the appropriate form, click Buy now.

Select the pricing plan you desire, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Texas Purchase Agreement by a Corporation of Assets of a Partnership template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form isn’t what you are looking for, use the Search area to find the form that suits your needs and preferences.

Form popularity

FAQ

What to include in a business sales contract.Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.) along with the rights and obligations of the parties.

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

Know How to Fill Out the Business Bill of SaleDate of Sale.Buyer's name and address.Seller's name and address.Business name and details, which include: State of incorporation. Address of the business's main headquarters. Assets, shares, personal property and other interests included with the company.

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.

What is included in your contract will differ based on your circumstances, but a starting agreement should include:Party information.Definitions.Purchased assets.Purchase price.Additional covenants.Warranties or disclaimers.Indemnification.Breach of contract provisions.More items...

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Asset Sale ChecklistList of Assumed Contracts.List of Liabilities Assumed.Promissory Note.Security Agreement.Escrow Agreement.Disclosure of Claims, Liens, and Security Interests.List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names.Disclosure of Licenses and Permits.More items...?