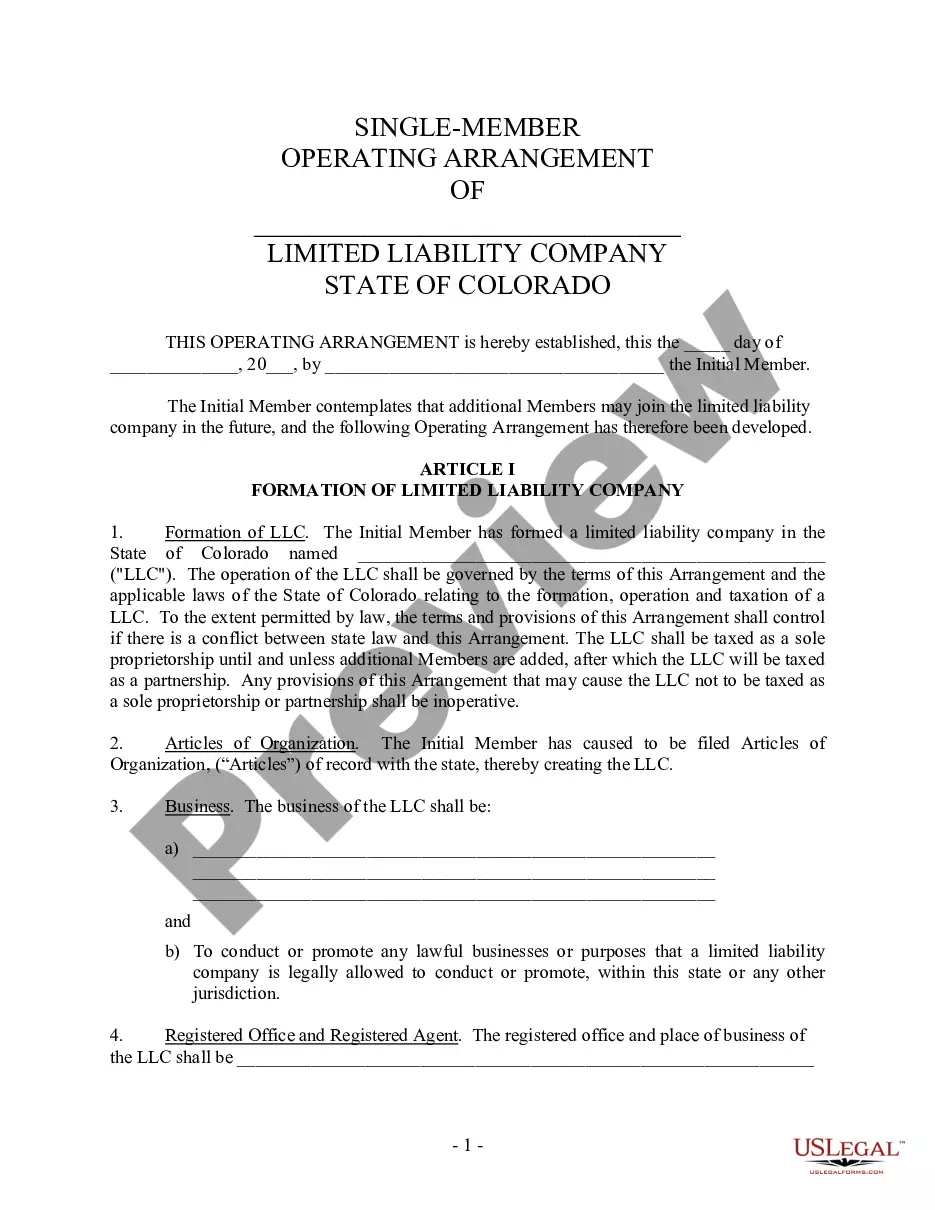

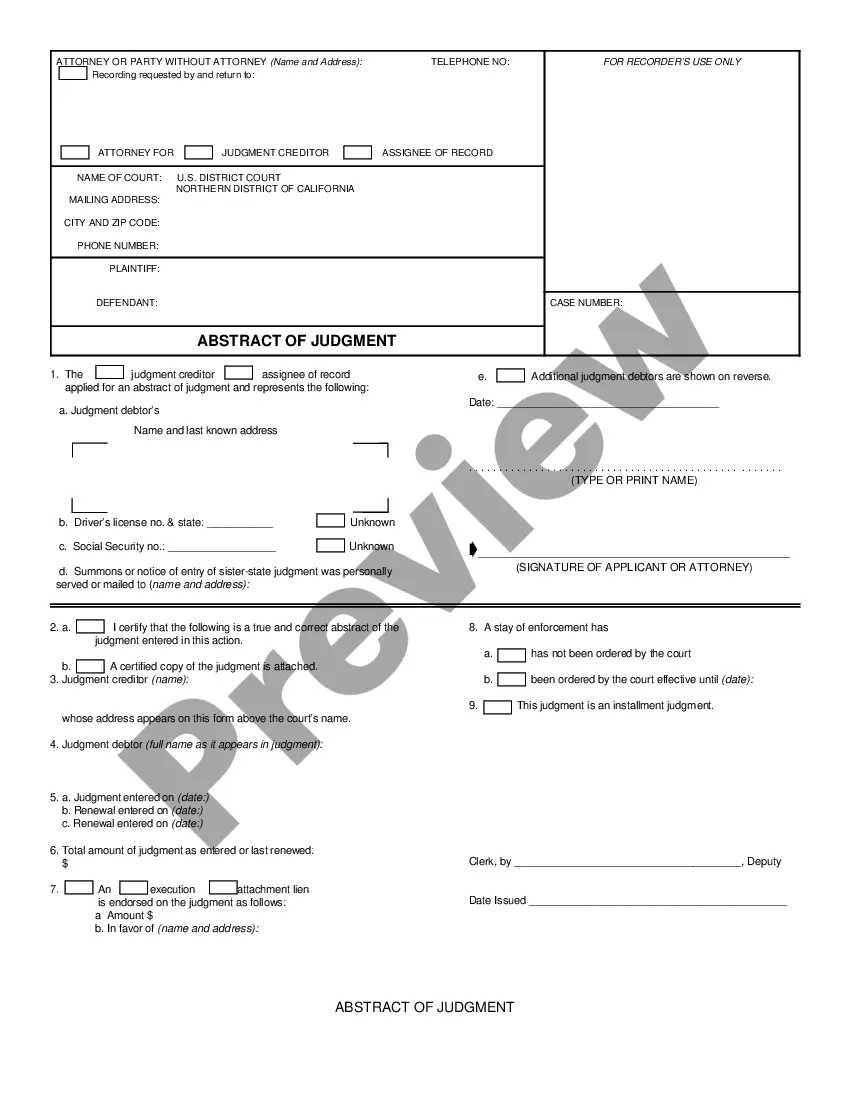

Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions is a legal document that outlines the terms and conditions for the buy and sell of stock in a close corporation in the state of Texas. This agreement is aimed at protecting the interests of shareholders in a close corporation and ensuring a smooth and fair process for buying and selling stock. The agreement includes provisions that detail the circumstances under which a shareholder can sell their stock and the process that needs to be followed for such transactions to take place. These provisions often include a right of first refusal, which grants existing shareholders the option to purchase the stock before it is offered to external parties. By including an agreement of the spouse, the document ensures that both spouses are aware and in agreement with the stock transactions. Stock transfer restrictions are an important component of this agreement. These restrictions put limitations on the transfer of shares, preventing them from being sold or transferred without the consent of the other shareholders or the corporation itself. These restrictions are put in place to maintain the stability and control within the close corporation and to safeguard the interests of the shareholders. There can be different types of Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions, depending on the specific needs and goals of the corporation and its shareholders. Some common types include: 1. Cross-Purchase Agreement: In this type of agreement, individual shareholders have the option to purchase the stock from selling shareholders. Each shareholder has the opportunity to buy a proportional share of the stock being sold. 2. Redemption Agreement: In a redemption agreement, the corporation itself has the option to repurchase the stock from selling shareholders. This type of agreement is often used when the corporation has sufficient cash reserves or the means to finance the stock repurchase. 3. Hybrid Agreement: This type of agreement combines elements of both cross-purchase and redemption agreements. In a hybrid agreement, both individual shareholders and the corporation have the option to purchase the stock. In conclusion, a Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions is a crucial legal document that governs the buying and selling of stock in a close corporation in Texas. It ensures a fair and regulated process, protects the interests of the shareholders, and maintains the stability and control of the corporation. Different types of agreements, such as cross-purchase, redemption, or hybrid agreements, can be tailored to the specific needs of the corporation and its shareholders.

Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions

Description

How to fill out Texas Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

It is possible to spend hrs online trying to find the authorized document template which fits the state and federal specifications you want. US Legal Forms provides thousands of authorized kinds which are examined by experts. You can actually download or printing the Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions from my services.

If you currently have a US Legal Forms account, you can log in and click on the Download switch. Next, you can total, modify, printing, or sign the Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions. Every authorized document template you buy is yours eternally. To get another backup for any bought type, visit the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms website the first time, keep to the straightforward directions below:

- Very first, be sure that you have selected the best document template to the county/city of your choice. Read the type description to ensure you have picked out the appropriate type. If accessible, take advantage of the Preview switch to search from the document template as well.

- If you would like discover another model from the type, take advantage of the Research discipline to find the template that suits you and specifications.

- When you have discovered the template you want, click on Purchase now to carry on.

- Choose the costs program you want, enter your qualifications, and register for your account on US Legal Forms.

- Comprehensive the transaction. You should use your credit card or PayPal account to pay for the authorized type.

- Choose the formatting from the document and download it to the system.

- Make modifications to the document if possible. It is possible to total, modify and sign and printing Texas Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions.

Download and printing thousands of document themes utilizing the US Legal Forms site, which offers the biggest collection of authorized kinds. Use expert and status-particular themes to handle your business or specific requires.