A Texas Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a monetary loan between a lender and a borrower in the state of Texas. This type of promissory note establishes the borrower's obligation to repay a specific amount of money, referred to as the principal amount, to the lender on a predetermined date specified in the note. The key elements of a Texas Promissory Note Payable on a Specific Date include: 1. Principal Amount: This denotes the total sum of money borrowed by the borrower, which is to be repaid to the lender. 2. Interest Rate: This indicates the cost of borrowing, expressed as a percentage, that the borrower must pay to the lender. The interest rate may be fixed or variable, depending on the terms agreed upon. 3. Repayment Date: This refers to the specific date on which the borrower is obligated to repay the principal amount and any accrued interest to the lender. The date is clearly mentioned in the promissory note, ensuring clarity and certainty for both parties involved. 4. Late Payment Penalties: The promissory note may outline the consequences of late or missed payments by the borrower. This can include additional interest charges, late fees, or other penalties as agreed upon by both parties. 5. Collateral: In some cases, the lender may require the borrower to provide collateral to secure the loan. Collateral can include real estate, automobiles, or other valuable assets. If the borrower defaults on the loan, the lender may seize the collateral as a form of repayment. Types of Texas Promissory Note Payable on a Specific Date: 1. Simple Promissory Note: This type of promissory note includes the basic elements mentioned above, outlining the borrower's obligation to repay the loan on a predetermined date. It does not involve complex terms or collateral. 2. Secured Promissory Note: A secured promissory note uses collateral to secure the loan. The borrower provides a valuable asset as collateral, reducing the risk for the lender. If the borrower fails to repay the loan, the lender can seize the collateral. 3. Balloon Promissory Note: This type of promissory note involves regular payments of interest and a portion of the principal amount, similar to a traditional installment loan. However, a balloon payment, typically a larger sum, becomes due on the specified date. This option may be suitable for borrowers expecting a significant inflow of funds at a future date. A properly executed Texas Promissory Note Payable on a Specific Date is crucial for both the lender and the borrower, as it ensures that the terms of the loan are clearly defined and legally enforceable. It provides protection and clarity to all parties involved and serves as evidence of the loan agreement. It is always recommended consulting with a legal professional to ensure compliance with Texas state laws and to address any specific circumstances related to the loan.

Texas Promissory Note Payable on a Specific Date

Description

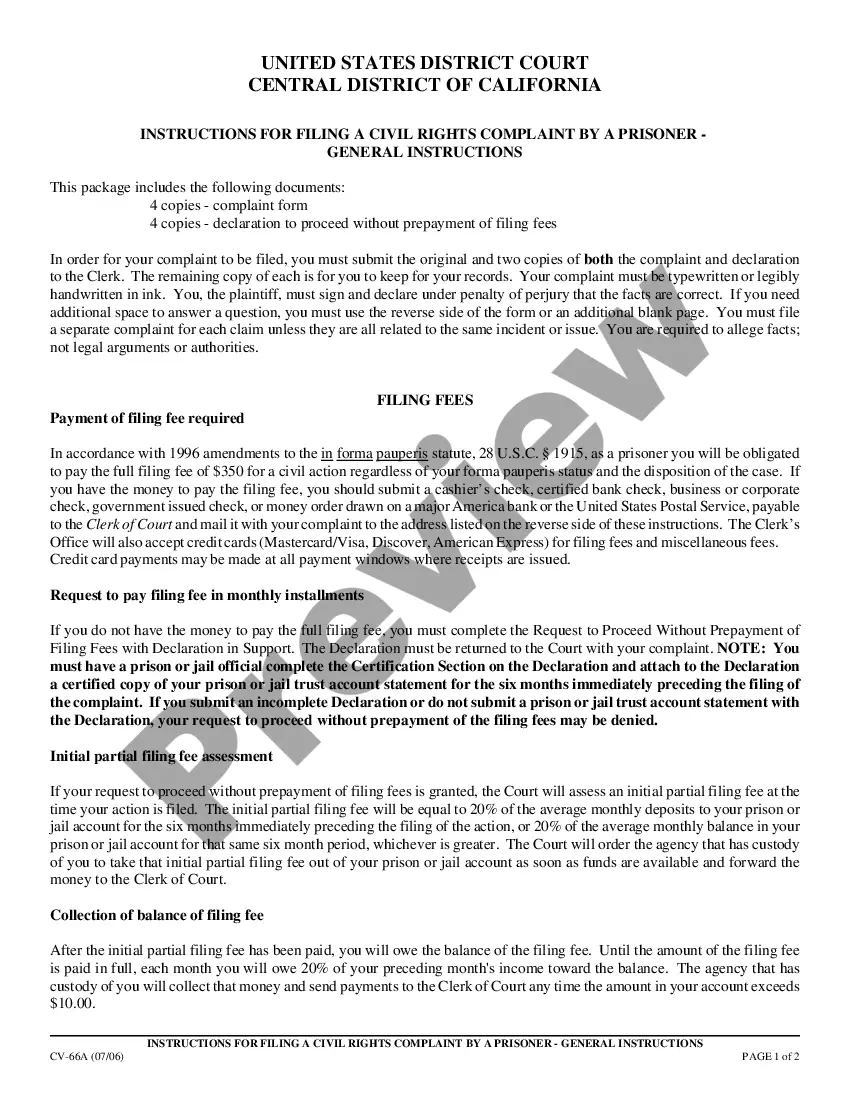

How to fill out Texas Promissory Note Payable On A Specific Date?

US Legal Forms - one of the biggest libraries of legitimate varieties in America - delivers an array of legitimate file web templates you are able to download or print out. While using site, you will get 1000s of varieties for company and specific purposes, sorted by categories, claims, or key phrases.You will find the most up-to-date versions of varieties much like the Texas Promissory Note Payable on a Specific Date within minutes.

If you currently have a membership, log in and download Texas Promissory Note Payable on a Specific Date from the US Legal Forms catalogue. The Down load switch will appear on each type you look at. You get access to all earlier delivered electronically varieties within the My Forms tab of your respective bank account.

If you want to use US Legal Forms for the first time, listed below are straightforward directions to help you started off:

- Make sure you have picked out the right type for your personal town/state. Click the Preview switch to examine the form`s content. See the type information to ensure that you have selected the appropriate type.

- In the event the type does not satisfy your requirements, make use of the Search industry at the top of the screen to get the one that does.

- In case you are satisfied with the shape, confirm your option by simply clicking the Acquire now switch. Then, pick the costs strategy you favor and provide your references to sign up to have an bank account.

- Method the financial transaction. Make use of your charge card or PayPal bank account to accomplish the financial transaction.

- Pick the structure and download the shape in your product.

- Make alterations. Complete, modify and print out and signal the delivered electronically Texas Promissory Note Payable on a Specific Date.

Each template you put into your bank account does not have an expiration time and is your own property permanently. So, if you want to download or print out one more duplicate, just go to the My Forms segment and click about the type you need.

Gain access to the Texas Promissory Note Payable on a Specific Date with US Legal Forms, probably the most considerable catalogue of legitimate file web templates. Use 1000s of specialist and status-certain web templates that meet up with your business or specific requires and requirements.

Form popularity

FAQ

It depends on the wording of the promissory note as to how the maturity date is calculated. If it states that the term of the note is in months, then the maturity date is simply counted on months. If the term of the note is in days, then each day beginning with the first day after the note is signed is counted.

Many differences among promissory notes relate to when and how the borrowed amount will be repaid. Although you are free to negotiate terms that work for your arrangement, your note must either have an end date or be payable when the lender demands it. Unconditional .

Generally, a note cannot be prepaid before the date established in the note for payment. A state statute that establishes a ceiling or maximum rate of interest to be charged on the loan is called a usury statute.

Definition: The maturity date of a note is the time and date when the interest and principal is due in full and must be repaid. A note or promissory note is a written promise to a pay specific amount of money at a future date. The future date is called the maturity date.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

Demand Promissory Note: A note that needs to be repaid immediately when the lender asks. There is no specific term or due date for the money under these notes. Due Date: The date on which a loan must be paid in full. This is sometimes called the maturity date.

A prepayment may be allowed by a promissory note. A prepayment provision would allow you, as a borrower, to pay a debt early without paying an extra premium payment or penalty. It can consist of the unpaid accrued interest and the unpaid principal sum as of the date of prepayment.

The maturity date of a note indicates the date when the note is due to be repaid to the investor along with any accrued interest, if it has not yet converted to equity.

The Note Date is the date of the Note.

Short answer: A promissory note must be signed by the borrower. However, an undated but signed promissory note is valid and effective because the signature date is not an essential element of a promissory note.