Title: Texas Living Trust with Provisions for Disability: A Comprehensive Guide Introduction: When planning for the future, individuals often opt for a living trust to protect their assets and ensure their wishes are followed during times of incapacitation. In the state of Texas, a living trust with provisions for disability serves as a powerful tool to safeguard one's estate and provide for their needs in case of temporary or permanent disability. This article aims to provide a detailed understanding of the Texas living trust, its benefits, and the different types available. Types of Texas Living Trusts with Provisions for Disability: 1. Revocable Living Trust: A revocable living trust is the most common type of trust in Texas. This trust allows the settler (the individual creating the trust) to maintain full control over their assets during their lifetime. In the event of a disability, a successor trustee can take over management seamlessly, ensuring the well-being and financial security of the incapacitated individual. 2. Irrevocable Living Trust: Contrary to a revocable trust, an irrevocable living trust is more rigid, meaning changes cannot be made after it is established. While typically not utilized for disability planning, an irrevocable living trust can include provisions for disability, securing assets and providing for the disabled individual's care. Key Provisions for Disability within a Texas Living Trust: 1. Appointment of a Successor Trustee: One of the essential provisions is the appointment of a successor trustee who will manage the trust assets in case of incapacity. The successor trustee should be someone trusted by the settler and possess the necessary financial acumen to handle the responsibilities effectively. 2. Disability Criteria: Clearly defining the criteria that determine disability is vital to empower the successor trustee to step in and manage the trust. This may involve incorporating provisions from the Texas Estates Code, which outline the legal requirements for determining incapacity. 3. Powers of the Successor Trustee: To ensure a smooth transition, the Texas living trust should specify the powers granted to the successor trustee in managing the trust during the settler's incapacitation. These powers may include accessing and distributing income, paying bills, managing investments, and making healthcare and personal care decisions. 4. Allocating Funds for Disability Expenses: Including provisions for funding disability-related expenses is crucial to provide for the disabled individual's needs. Clearly outlining how funds will be allocated for medical care, therapy, living costs, and other essential requirements helps safeguard the individual's quality of life. Benefits of a Texas Living Trust with Provisions for Disability: 1. Avoidance of Probate: Establishing a living trust in Texas with provisions for disability can help individuals and their families bypass the probate process. This ensures a smoother asset transition during incapacity and after the settler's passing, saving valuable time and money. 2. Privacy and Confidentiality: Unlike a will, which is a public record, a living trust offers privacy by keeping the trust terms and asset distribution confidential. This prevents potential disputes and maintains the settler's privacy during difficult times. 3. Flexibility and Customization: A Texas living trust can be entirely tailored to the settler's specific requirements, adjusting provisions as circumstances change. This allows for greater flexibility in accommodating the needs of a disabled individual. Conclusion: A Texas living trust with provisions for disability is a wise estate planning option that ensures seamless asset management and protection of an individual's well-being during times of incapacity. Whether opting for a revocable or irrevocable trust, carefully considering the key provisions and benefits mentioned above will help establish a robust living trust that caters to one's specific needs and ensures long-term security.

Texas Living Trust with Provisions for Disability

Description

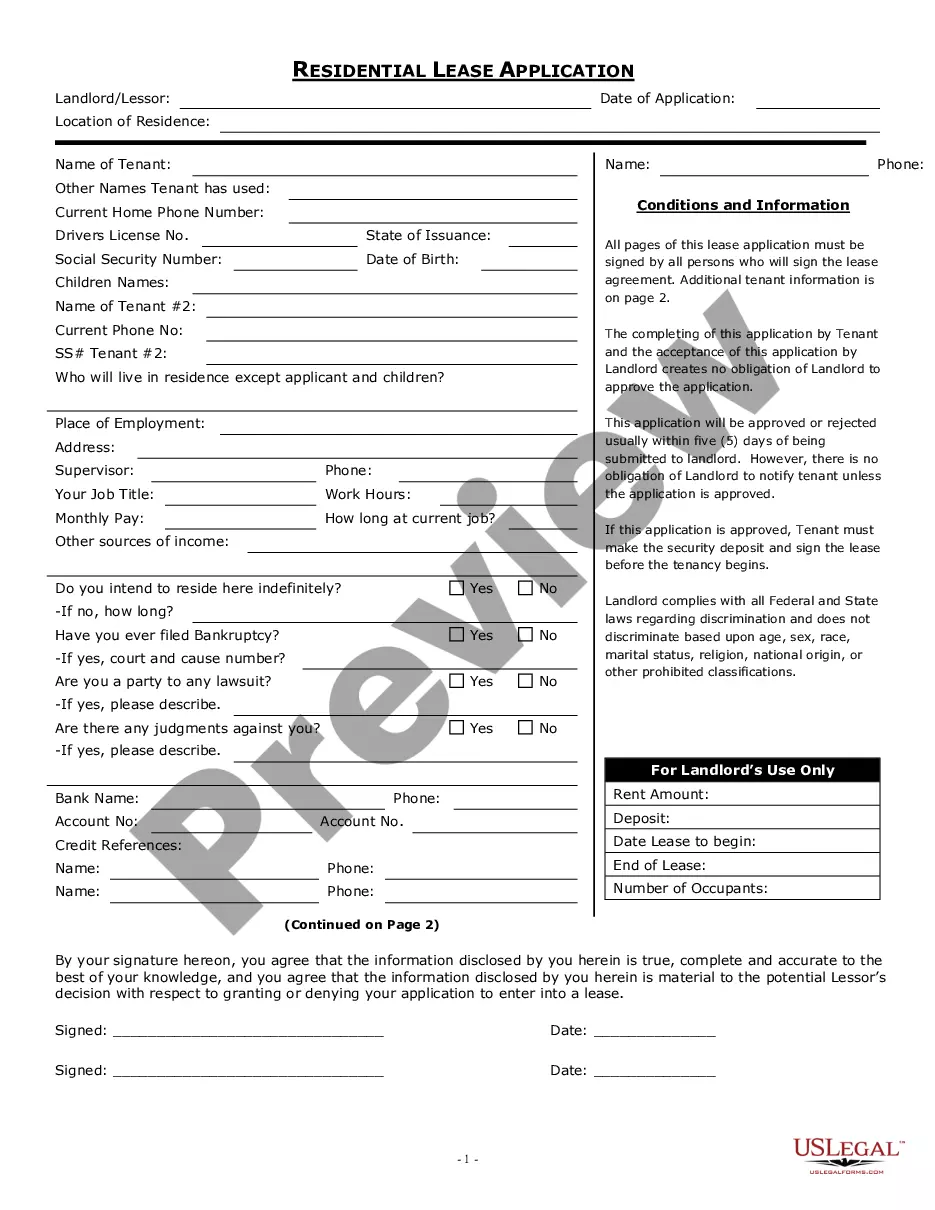

How to fill out Texas Living Trust With Provisions For Disability?

Are you presently in the place that you will need files for possibly organization or individual reasons almost every working day? There are plenty of legitimate file layouts available on the Internet, but finding versions you can rely isn`t simple. US Legal Forms gives 1000s of develop layouts, just like the Texas Living Trust with Provisions for Disability, which are composed to satisfy federal and state needs.

In case you are currently familiar with US Legal Forms web site and have an account, basically log in. After that, you are able to acquire the Texas Living Trust with Provisions for Disability web template.

Unless you come with an profile and want to begin using US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is for that correct town/area.

- Make use of the Preview option to examine the form.

- Look at the information to ensure that you have chosen the appropriate develop.

- In the event the develop isn`t what you are seeking, use the Lookup field to discover the develop that suits you and needs.

- If you discover the correct develop, click Purchase now.

- Select the rates strategy you want, complete the necessary details to make your bank account, and buy an order using your PayPal or bank card.

- Select a hassle-free paper structure and acquire your copy.

Find all of the file layouts you may have purchased in the My Forms menu. You can obtain a additional copy of Texas Living Trust with Provisions for Disability anytime, if required. Just select the necessary develop to acquire or printing the file web template.

Use US Legal Forms, by far the most substantial selection of legitimate varieties, to save some time and avoid mistakes. The assistance gives expertly created legitimate file layouts that can be used for a variety of reasons. Generate an account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

A Special Disability Trust (SDT) is a special type of trust that allows parents and immediate family members to plan for current and future needs of a person with severe disability. The trust can pay for reasonable care, accommodation and other discretionary needs of the beneficiary during their lifetime.

HOW DOES MONEY FROM A TRUST THAT IS NOT MY RESOURCE AFFECT MY SSI BENEFITS? Money paid directly to you from the trust reduces your SSI benefit. Money paid directly to someone to provide you with food or shelter reduces your SSI benefit but only up to a certain limit.

Trusts considered to be qualified disability trusts are entitled to the same personal exemption allowed to all individual taxpayers when filing a tax return. The personal exemption in 2012 is $3,800.

SSDI is not a needs-based benefit. If you are on that program for two years, you will also qualify for Medicare. Because SSDI is not needs-based, a special needs trust is not necessary to qualify for it.

The first $20 of income received each month is not counted. In addition, with respect to earned income, the first $65 each month is not counted, and one-half of the earnings over $65 in any given month is not counted.

The SSDI program does not limit the amount of cash, assets, or resources an applicant owns. An SSDI applicant can own two houses, five cars, and have $1,000,000 in the bank. And the SSDI program doesn't have a limit to the amount of unearned income someone can bring in; for instance, dividends from investments.

The first $20 of income received each month is not counted. In addition, with respect to earned income, the first $65 each month is not counted, and one-half of the earnings over $65 in any given month is not counted.

Unlike SSI, there are no income or asset limits for SSDI eligibility. Instead, to qualify for SSDI, enrollees must have a sufficient work history (generally, 40 quarters) and meet the strict federal disability rules. SSA uses the same rules to determine disability for both the SSI and the SSDI programs.