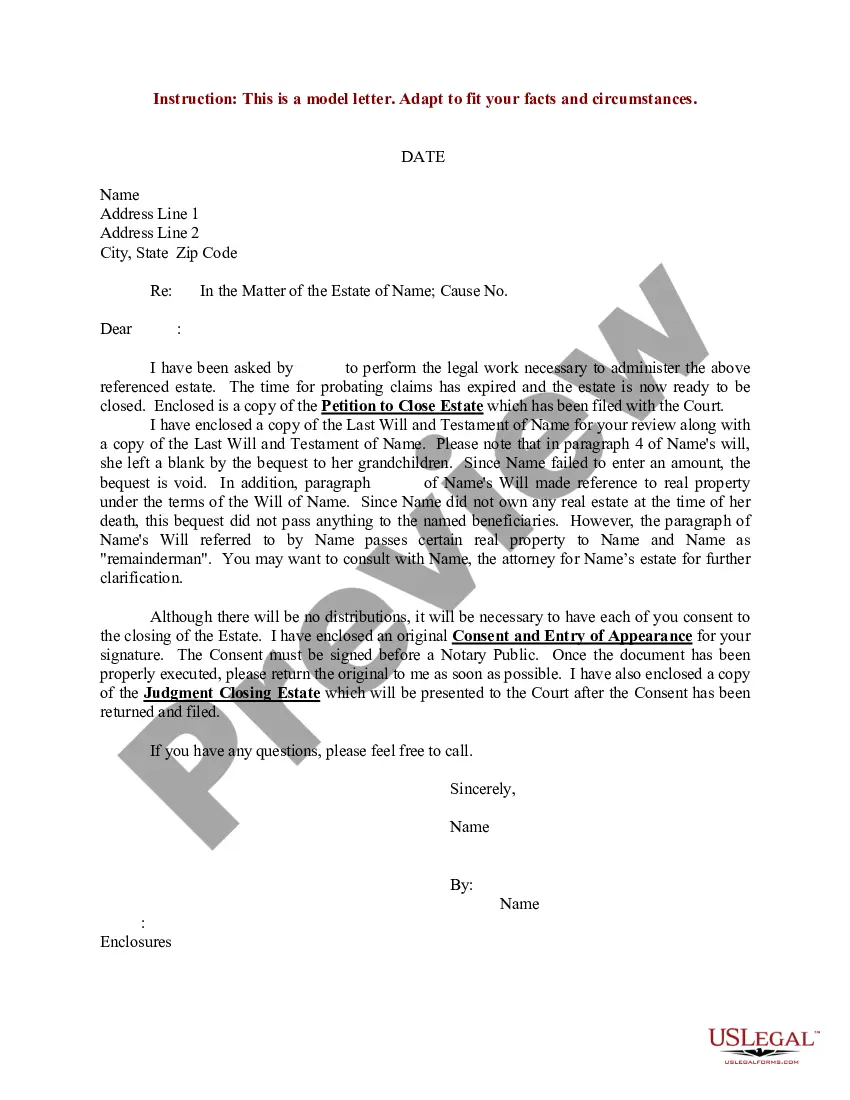

Texas Sample Letter for Closing of Estate with Breakdown of Assets and Expenses

Description

How to fill out Sample Letter For Closing Of Estate With Breakdown Of Assets And Expenses?

If you wish to comprehensive, acquire, or print legal record layouts, use US Legal Forms, the most important variety of legal types, that can be found online. Take advantage of the site`s basic and hassle-free lookup to obtain the files you need. Different layouts for enterprise and personal reasons are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to obtain the Texas Sample Letter for Closing of Estate with Breakdown of Assets and Expenses with a number of click throughs.

Should you be presently a US Legal Forms customer, log in to your accounts and click on the Acquire button to get the Texas Sample Letter for Closing of Estate with Breakdown of Assets and Expenses. You may also accessibility types you previously saved from the My Forms tab of your accounts.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have chosen the form to the correct city/region.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Do not overlook to read through the information.

- Step 3. Should you be unhappy using the type, use the Search industry at the top of the display screen to discover other models of the legal type format.

- Step 4. Once you have discovered the form you need, click the Get now button. Select the costs plan you like and add your qualifications to sign up on an accounts.

- Step 5. Method the financial transaction. You can use your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Pick the structure of the legal type and acquire it on your device.

- Step 7. Full, change and print or sign the Texas Sample Letter for Closing of Estate with Breakdown of Assets and Expenses.

Each and every legal record format you buy is the one you have for a long time. You possess acces to each and every type you saved with your acccount. Click the My Forms segment and decide on a type to print or acquire again.

Compete and acquire, and print the Texas Sample Letter for Closing of Estate with Breakdown of Assets and Expenses with US Legal Forms. There are many skilled and status-specific types you can use for your enterprise or personal requirements.

Form popularity

FAQ

An executor cannot change beneficiaries' inheritances or withhold their inheritances unless the will has expressly granted them the authority to do so. The executor also cannot stray from the terms of the will or their fiduciary duty.

In general, beneficiaries do have the proper to request data about the estate, inclusive of financial institution statements. However, the unique regulations and limitations on gaining access to bank statements may also range relying on the jurisdiction and the particular circumstances of the estate.

If the executor fails to provide beneficiaries with an accounting, they have a right to petition the court to try to compel the executor to provide one.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

As a beneficiary, you are entitled to review the trust's records including bank statements, the checking account ledger, receipts, invoices, etc. Before the trust administration is complete, it is recommended you request and review the trust's records which support the accounting.

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

Know your rights as a Beneficiary As an interested person, you are entitled to full disclosure of the trustee's handling of the estate. You have the right to seek accountings, file suit, complain and inquire about distributions. Texas Prop.

The most common way of closing an estate in Texas is to file a Notice of Closing Estate with the county court. This document acts as an affidavit and confirms that you have discharged your duties. It must state the following: All known debts have been paid or satisfied as much as the estate assets would allow.