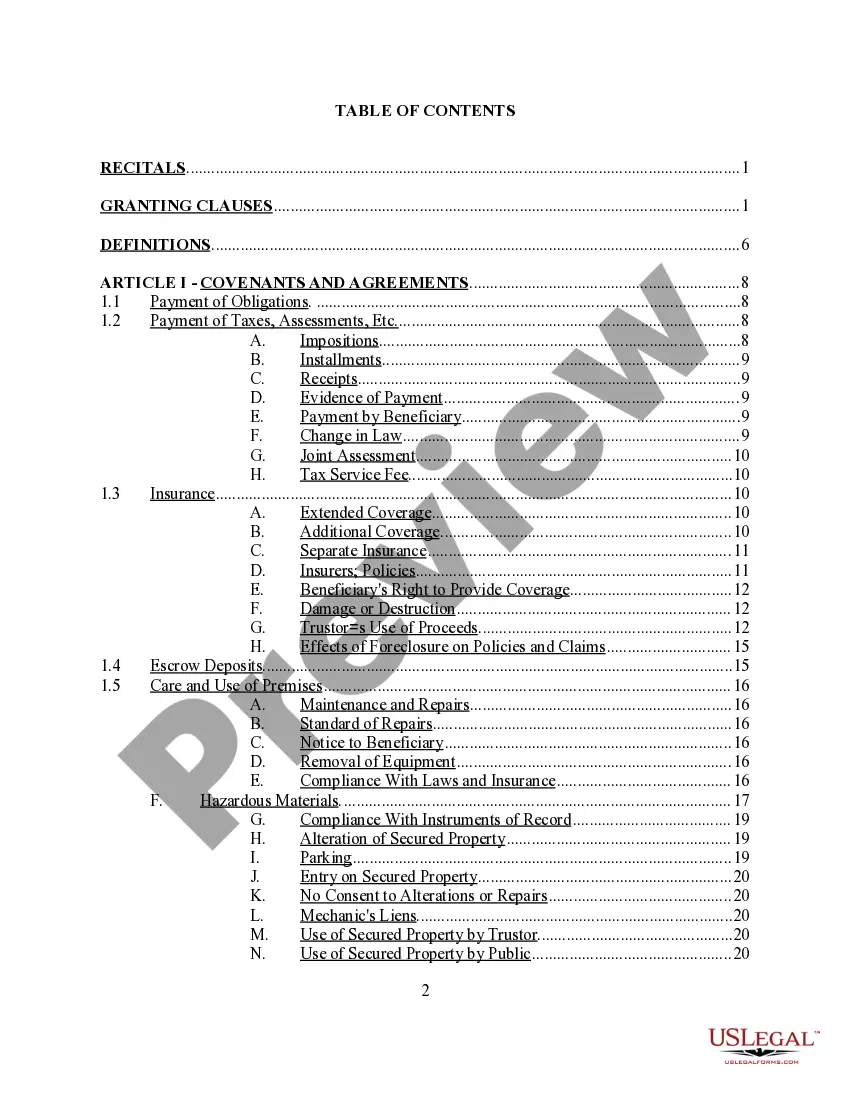

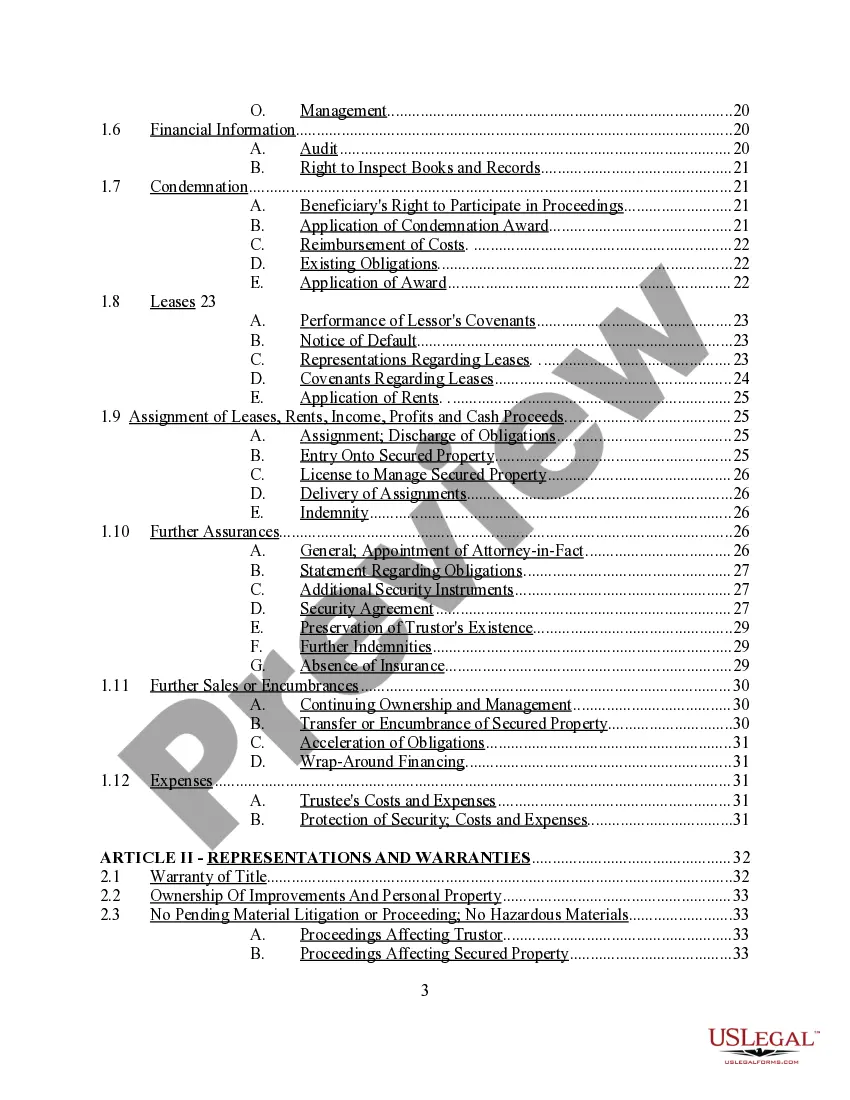

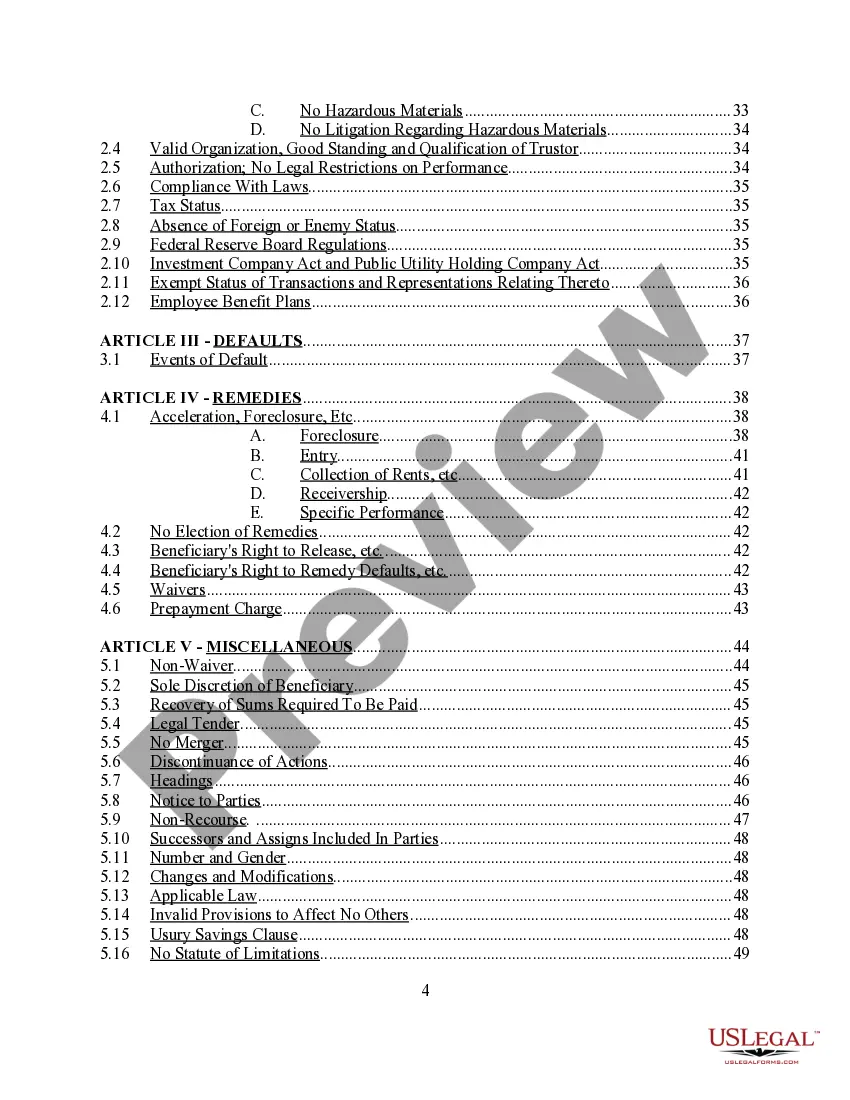

Title: Understanding the Texas Complex Deed of Trust and Security Agreement Introduction: The Texas Complex Deed of Trust and Security Agreement is a legal document that serves as an essential component of real estate financing transactions in Texas. This article provides a comprehensive overview of this agreement, exploring its purpose, key components, and different types. Keywords: Texas Complex Deed of Trust, Security Agreement, real estate financing, legal document, property collateral 1. Purpose of the Texas Complex Deed of Trust and Security Agreement: The main purpose of the Texas Complex Deed of Trust and Security Agreement is to secure a loan against a property. This agreement serves as a mechanism to provide the lender with a legal right to seize and sell the property in case the borrower defaults on the loan payment. It ensures the protection of the lender's investment and provides a means of recourse. Keywords: loan security, default, property seizure, borrower, lender, investment protection, recourse 2. Key Components of the Texas Complex Deed of Trust and Security Agreement: a) Parties Involved: The agreement involves three main parties — the borrower (property owner), the lender (financial institution), and the trustee (neutral third party). b) Description of the Property: The agreement clearly describes the property being used as collateral for the loan. It includes the legal description, address, and any restrictions or encumbrances. c) Loan Terms and Obligations: This section outlines the specific terms of the loan, including interest rate, repayment schedule, prepayment penalties, and any other conditions. d) Lien and Mortgage: The agreement establishes a lien on the property, giving the lender the right to foreclose if the borrower defaults. e) Insurance and Taxes: The agreement typically requires the borrower to maintain adequate insurance coverage and stay current on property taxes. f) Default and Remedies: This section defines the borrower's default conditions, such as missed loan payments, breach of other obligations, or a decline in property value. It details the lender's rights and remedies in case of default. Keywords: parties, property description, loan terms, lien, foreclosure, insurance, taxes, default conditions, borrower's obligations, lender's remedies 3. Types of Texas Complex Deed of Trust and Security Agreement: a) First Lien Deeds of Trust: These agreements establish the lender's priority lien on the property and are typically used in primary financing transactions. b) Second Lien Deeds of Trust: In cases where there is already an existing first lien deed of trust, a second lien deed of trust is used to secure additional financing. It has a subordinate position to the first lien deed. c) Construction Loan Deeds of Trust: This type of agreement secures the loan used for the construction of a property. It may include disbursement provisions and provisions related to inspections and completion. d) Wraparound Deeds of Trust: These agreements consolidate multiple loans into a single deed of trust, often allowing the borrower to obtain additional financing without disturbing the existing deed. Keywords: first lien, second lien, construction loan, wraparound, financing, priority, subordinate, consolidation Conclusion: The Texas Complex Deed of Trust and Security Agreement is a vital legal document that offers protection to both lenders and borrowers in real estate financing transactions. Understanding its purpose, key components, and different types is crucial for anyone involved in property financing or investment in the state of Texas. Keywords: legal document, property financing, investment, protection, lenders, borrowers, real estate, Texas

Texas Complex Deed of Trust and Security Agreement

Description

How to fill out Texas Complex Deed Of Trust And Security Agreement?

You are able to devote time on the web trying to find the lawful record design that fits the federal and state requirements you need. US Legal Forms offers 1000s of lawful varieties which are evaluated by pros. You can easily acquire or produce the Texas Complex Deed of Trust and Security Agreement from your assistance.

If you already have a US Legal Forms bank account, you can log in and click on the Down load option. Next, you can total, edit, produce, or signal the Texas Complex Deed of Trust and Security Agreement. Every lawful record design you buy is yours permanently. To get an additional version associated with a purchased kind, visit the My Forms tab and click on the related option.

If you use the US Legal Forms site for the first time, keep to the easy instructions under:

- Very first, make sure that you have selected the proper record design for your county/city of your choosing. Look at the kind description to ensure you have picked the appropriate kind. If readily available, take advantage of the Review option to look through the record design as well.

- If you want to locate an additional variation of your kind, take advantage of the Lookup area to discover the design that meets your needs and requirements.

- Upon having discovered the design you want, click on Buy now to continue.

- Choose the rates strategy you want, key in your references, and register for a free account on US Legal Forms.

- Total the transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the lawful kind.

- Choose the format of your record and acquire it to your system.

- Make modifications to your record if necessary. You are able to total, edit and signal and produce Texas Complex Deed of Trust and Security Agreement.

Down load and produce 1000s of record themes utilizing the US Legal Forms website, which provides the largest selection of lawful varieties. Use specialist and state-certain themes to handle your company or specific needs.