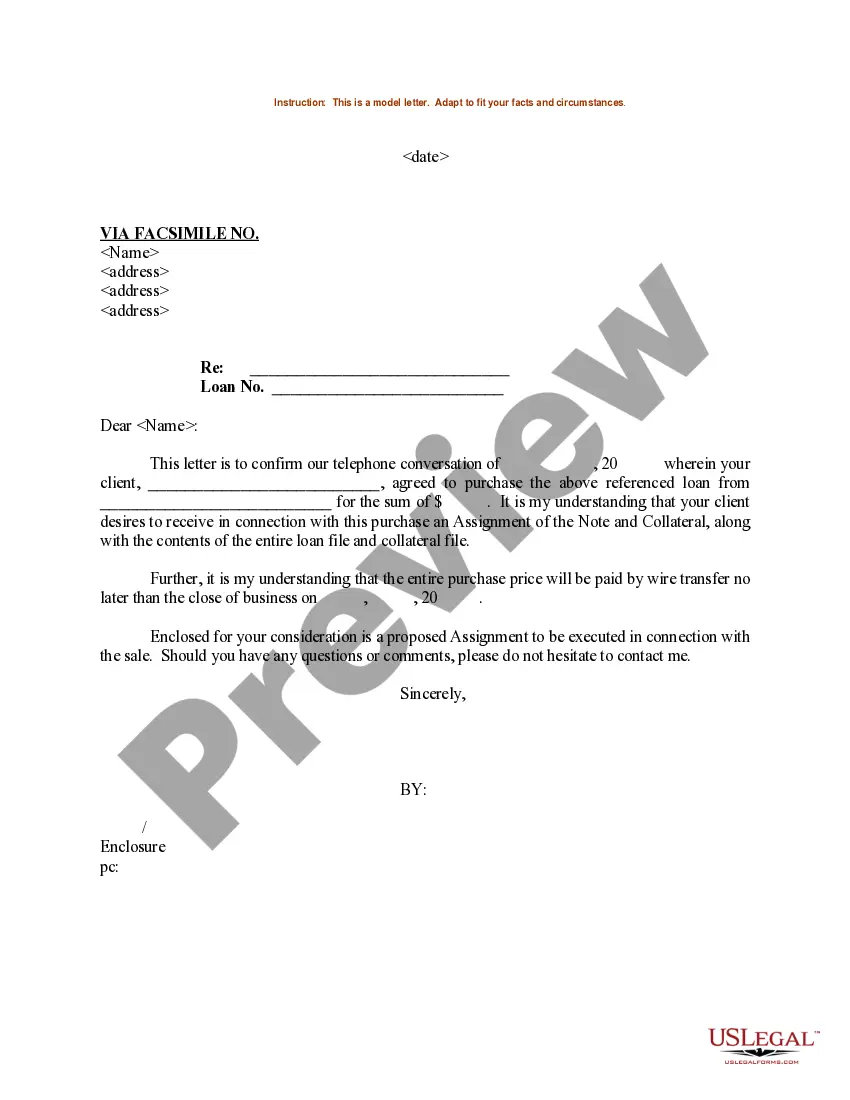

Texas Sample Letter for Refinancing of Loan

Description

How to fill out Sample Letter For Refinancing Of Loan?

You might spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast selection of legal forms that are reviewed by experts.

It's easy to obtain or print the Texas Sample Letter for Loan Refinancing from the service.

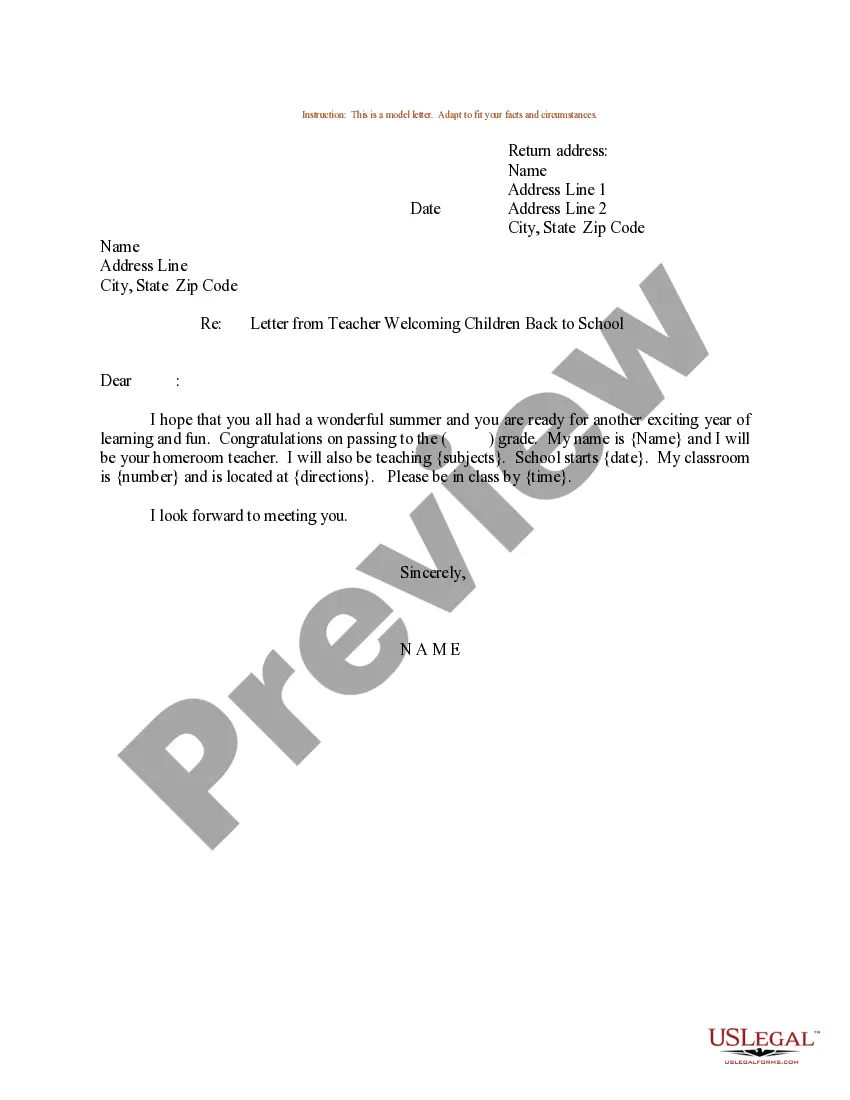

If available, utilize the Preview button to view the document template as well. To find another version of the form, use the Search section to locate the template that suits your needs.

- If you have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can fill out, edit, print, or sign the Texas Sample Letter for Loan Refinancing.

- Every legal document template you download is your personal property indefinitely.

- To get another copy of any downloaded form, navigate to the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions outlined below.

- First, ensure that you have chosen the right document template for your selected county/area.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

A Texas 50(a)(6) loan (home equity/ cash out refinance) is a loan originated in accordance with and. secured by a lien permitted under the provisions of Article XVI, Section 50(a)(6) of the Texas Constitution, which allows a borrower to take equity out of a homestead property under certain conditions.

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...?

A Texas Section 50(a)(6) mortgage is a loan originated in accordance with and secured by a lien permitted under the provisions of Article XVI, Section 50(a)(6), of the Texas Constitution, which allow a borrower to take equity out of a homestead property under certain conditions.

The Texas A6 12-Day Letter is a loan disclosure that is part of the initial Loan Disclosure Package that is sent by the lender. The letter states that all people on the note (and their spouses even if they're not on the loan) must sign and date the letter in order to start the 12-day clock.

The refinance disclosure must be delivered to the owner at least 12 days before the refinance is closed. If a lender mails the refinance disclosure to the owner, the lender must allow a reasonable period of time for delivery.

Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation. An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

In Texas, a cash-out refinance loan pays off all other liens on your property, including your primary mortgage and any second mortgage loans or lines of credit you may have. The loan can be large enough to generate cash back, along with paying off all existing liens, if you have enough equity to back the loan.

A Texas 50(a)(6) loan (home equity/ cash out refinance) is a loan originated in accordance with and. secured by a lien permitted under the provisions of Article XVI, Section 50(a)(6) of the Texas Constitution, which allows a borrower to take equity out of a homestead property under certain conditions.

This would indicate that the Texas 50(f)(2), 12-Day Notice must be mailed in sufficient time for the owner to have received it no later than three business days after application, with a rebuttable presumption that the owner has received this notice three business days after it is placed in the mail.

A Texas A6 designation is given to any cash out home equity loan on a primary residence in Texas where cash is provided to the borrower. (Note: paying off non-mortgage debts such as credit cards is considered getting cash out).