Texas LLC Operating Agreement for Rental Property

Description

How to fill out LLC Operating Agreement For Rental Property?

If you need to finalize, secure, or create valid document templates, utilize US Legal Forms, the largest selection of valid forms available online.

Make the most of the site’s user-friendly and efficient search to find the documents you require.

Different templates for business and personal uses are organized by categories and states, or keywords.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of your valid document and download it to your device.

- Use US Legal Forms to access the Texas LLC Operating Agreement for Rental Property with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Texas LLC Operating Agreement for Rental Property.

- You can also view forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the appropriate city/state.

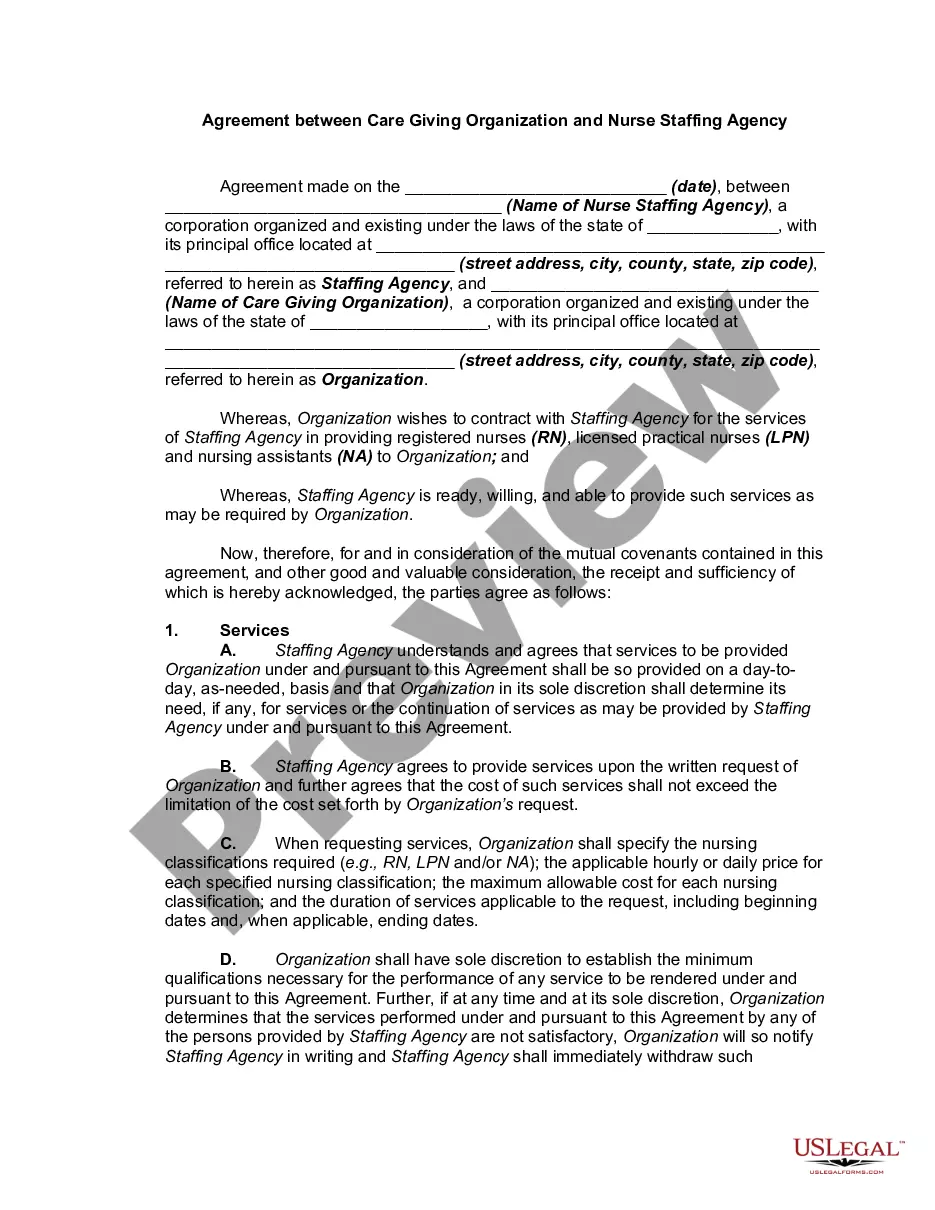

- Step 2. Use the Review option to check the contents of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the valid form template.

- Step 4. Once you find the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for the account.

Form popularity

FAQ

An LLC operating agreement is not required in Texas, but is highly recommended. This is an internal document that establishes how you will run your LLC. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

These forms can be filed online or mailed in duplicate along with a filing fee of $300 for domestic and $750 for foreign applications. Mailed applications should be sent to: PO Box 13697, Austin, TX 78711-3697. After your application is approved, you can file the optional Operating Agreement if you choose.

Your Texas LLC Operating Agreement doesn't need to be notarized. Once you (and the other LLC Members, if applicable) sign the Operating Agreement, then it becomes a legally binding document for all of you.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

No requirement exists under Texas law for a Texas LLC to create an operating agreement. However, it is recommended. Both sole owners and multi-members benefit from a Texas LLC operating agreement.

Your operating agreement can be written by your members, in which case it is free. On the other hand, you may also have an operating agreement written by a business lawyer, who will no doubt charge for this service. As noted above, our LLC formation service includes a free custom operating agreement for your company.

Operating agreements are not required for LLCs in Texas, and you do not need to file anything with the State regarding your operating agreement. A rock solid operating agreement is the foundation of every successful LLC. If you don't have one for your business, it is never too late.

A Texas LLC operating agreement can delineate the company's procedures, policies and other features. While this document is not required by law, without it in place, the members can be held personally liable in an event of a lawsuit.