The Texas LLC Operating Agreement for Real Estate is a legal document that outlines the rules, regulations, and structure of a limited liability company (LLC) specifically formed for real estate investments in the state of Texas. It sets out the rights, responsibilities, and obligations of the members (owners) of the LLC, as well as the procedures for managing the company and its real estate assets. One type of Texas LLC Operating Agreement for Real Estate is the Single-Member LLC Operating Agreement. This agreement is designed for a real estate investment company with a single owner or member. It specifies the member's authority, capital contributions, profit/loss distribution, and decision-making powers regarding the company's real estate assets. Another type is the Multi-Member LLC Operating Agreement for Real Estate. This agreement is suitable for real estate investment companies with multiple members or owners. It establishes the terms regarding member contributions, capital accounts, profit/loss sharing, decision-making processes, admission of new members, and member withdrawal or dissolution procedures. The Texas LLC Operating Agreement for Real Estate typically includes various important provisions tailored to real estate investments, such as: 1. Purpose: Clearly defines the primary objectives and activities the LLC will undertake in the real estate sector. 2. Capital Contributions: Outlines the initial capital investments made by each member to acquire real estate properties or fund property management costs. 3. Management: Specifies whether the LLC will be member-managed or manager-managed. Member-managed means all members have equal say in decision-making, while manager-managed grants authority to a designated manager. 4. Voting Rights: Specifies how voting rights are allocated among members, such as based on capital contributions or ownership percentages. 5. Profit/Loss Distribution: States how profits and losses from real estate investments will be divided among members. This can be based on capital contributions, ownership percentages, or another predetermined formula. 6. Transfer of Membership Interest: Outlines the conditions and procedures for transferring ownership or membership interest in the LLC, such as obtaining the approval of existing members. 7. Dissolution: Establishes the circumstances under which the LLC may be dissolved, such as by unanimous member consent or specified events like bankruptcy or death. 8. Dispute Resolution: Determines the process for resolving disputes between members, potentially through mediation or arbitration. It is crucial to consult with a qualified attorney specializing in real estate law to draft or review the Texas LLC Operating Agreement for Real Estate, ensuring it conforms to state laws and protects the interests of all members involved.

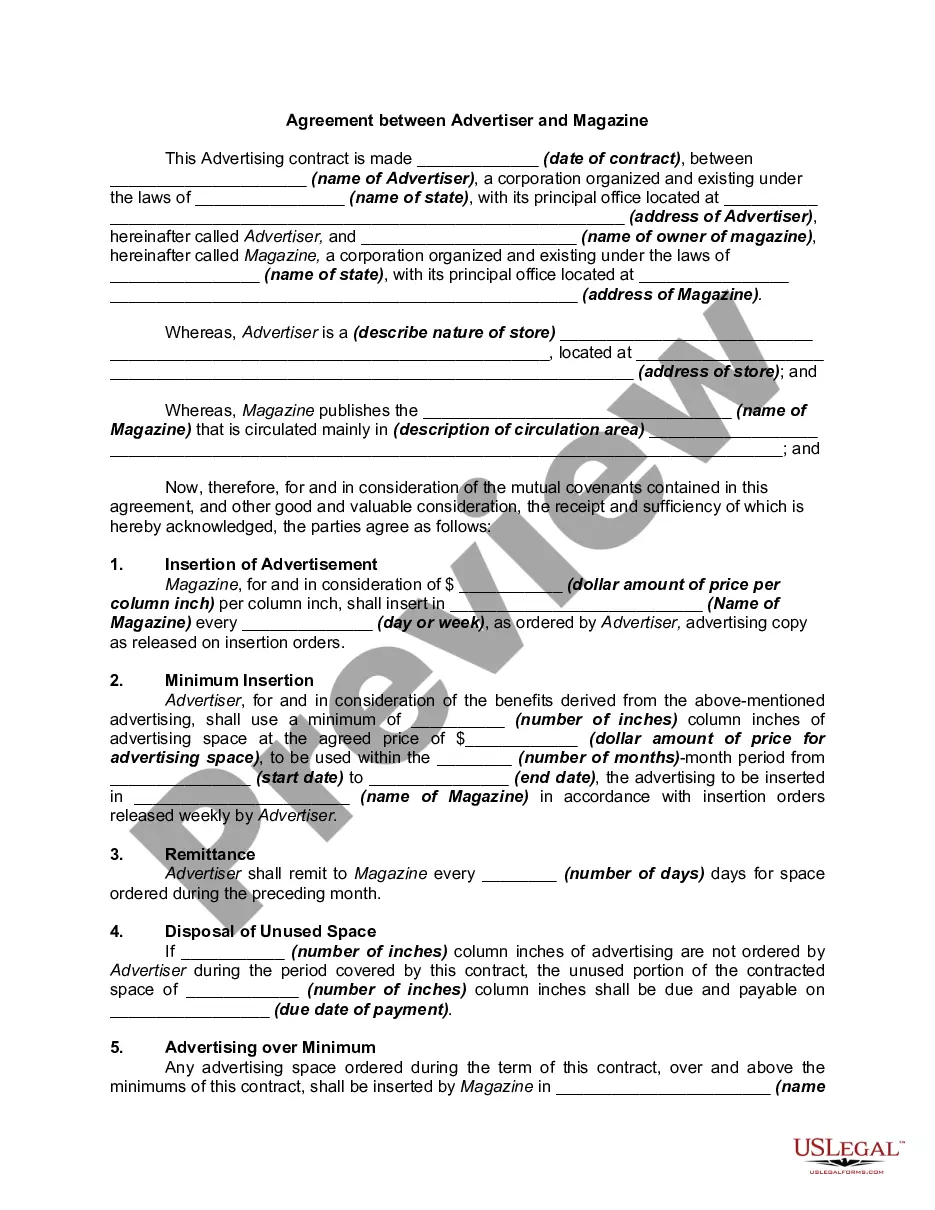

Texas LLC Operating Agreement for Real Estate

Description

How to fill out Texas LLC Operating Agreement For Real Estate?

You may commit time on the web searching for the authorized papers template that meets the state and federal specifications you require. US Legal Forms supplies thousands of authorized forms that are examined by professionals. It is possible to obtain or printing the Texas LLC Operating Agreement for Real Estate from our assistance.

If you already have a US Legal Forms profile, you may log in and click the Down load switch. Next, you may total, change, printing, or sign the Texas LLC Operating Agreement for Real Estate. Each authorized papers template you purchase is the one you have for a long time. To have one more duplicate of the purchased kind, visit the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms internet site the first time, stick to the easy guidelines listed below:

- Very first, ensure that you have selected the proper papers template for the state/metropolis that you pick. See the kind explanation to ensure you have picked the appropriate kind. If readily available, make use of the Review switch to search through the papers template too.

- If you would like get one more version of the kind, make use of the Lookup industry to obtain the template that fits your needs and specifications.

- Once you have located the template you would like, just click Get now to carry on.

- Find the pricing plan you would like, enter your references, and register for a free account on US Legal Forms.

- Complete the transaction. You should use your credit card or PayPal profile to fund the authorized kind.

- Find the file format of the papers and obtain it to your gadget.

- Make adjustments to your papers if needed. You may total, change and sign and printing Texas LLC Operating Agreement for Real Estate.

Down load and printing thousands of papers layouts using the US Legal Forms site, that provides the largest variety of authorized forms. Use skilled and condition-specific layouts to take on your business or individual demands.