Texas Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares

Description

How to fill out Legend On Stock Certificate With Reference To Separate Document Restricting Transfer Of Shares?

Choosing the right lawful document format can be quite a have a problem. Obviously, there are tons of web templates available on the net, but how would you discover the lawful form you want? Make use of the US Legal Forms website. The assistance delivers thousands of web templates, including the Texas Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares, which can be used for enterprise and personal requirements. All of the forms are inspected by experts and meet up with state and federal demands.

If you are currently authorized, log in for your account and then click the Obtain switch to find the Texas Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares. Utilize your account to appear from the lawful forms you have acquired previously. Go to the My Forms tab of your respective account and acquire yet another backup from the document you want.

If you are a whole new user of US Legal Forms, listed below are easy instructions for you to follow:

- Initial, be sure you have chosen the correct form to your city/county. You may check out the shape using the Preview switch and browse the shape explanation to make certain this is the best for you.

- When the form fails to meet up with your needs, use the Seach discipline to discover the correct form.

- Once you are certain that the shape would work, click on the Acquire now switch to find the form.

- Pick the rates plan you would like and type in the necessary information. Make your account and purchase an order making use of your PayPal account or credit card.

- Select the data file format and down load the lawful document format for your system.

- Comprehensive, edit and produce and signal the received Texas Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares.

US Legal Forms is definitely the most significant collection of lawful forms in which you can see numerous document web templates. Make use of the company to down load appropriately-manufactured papers that follow condition demands.

Form popularity

FAQ

The transfer agent will require an opinion letter from the issuer's counsel or from his or her own lawyer plus 144 papers completed by a broker?stating that the restricted legend can be removed.

The purpose of the restrictive legend or notation is to protect the issuing company from loosing its private placement exemption for the initial sale of the securities and to notify the investor that the restricted securities cannot be resold into the public securities market without satisfying certain requirements.

Rule 144 is a set of regulations that outline the conditions in which the sale of unregistered or restricted stock shares can be sold. Typically, criteria must be met before a sale is allowed, including a minimum period in which the stock should be held, which can be up to one year.

A restricted security must bear a legend giving notice of the restrictions. That legend which must be removed after the restrictions are lifted. A security with a legend cannot be transferred or sold and must be removed before any transaction.

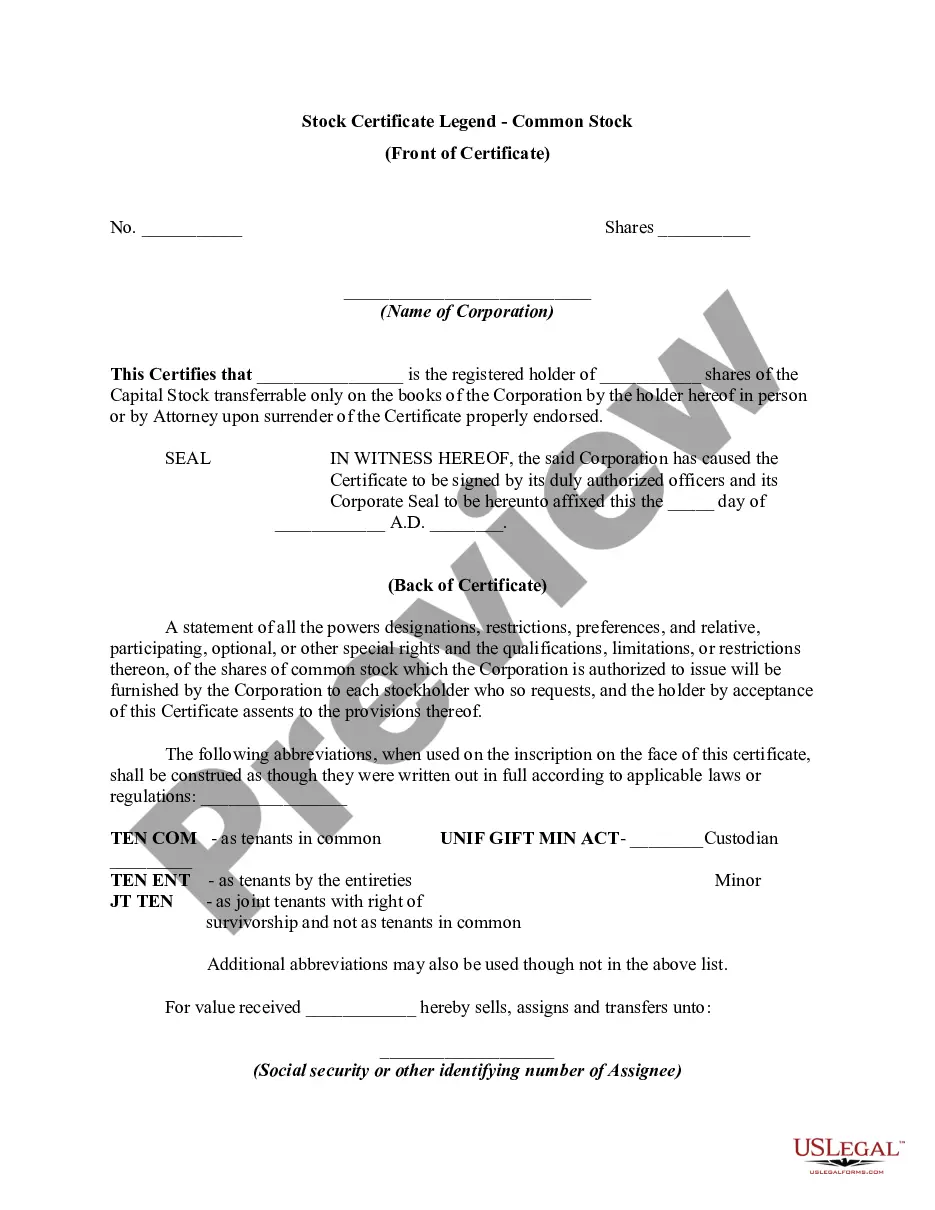

A legend is a statement on a stock certificate noting restrictions on the transfer or sale of a company's stock.

Restricted Securities Securities include common and preferred stock, debt securities (but not all debt is a security), options and warrants.

Removing a restricted stock legend is a matter solely in the discretion of the issuer of the securities. State law, not federal law, covers disputes about the removal of legends. Thus, the SEC will not take action in any decision or dispute about removing a restrictive legend.