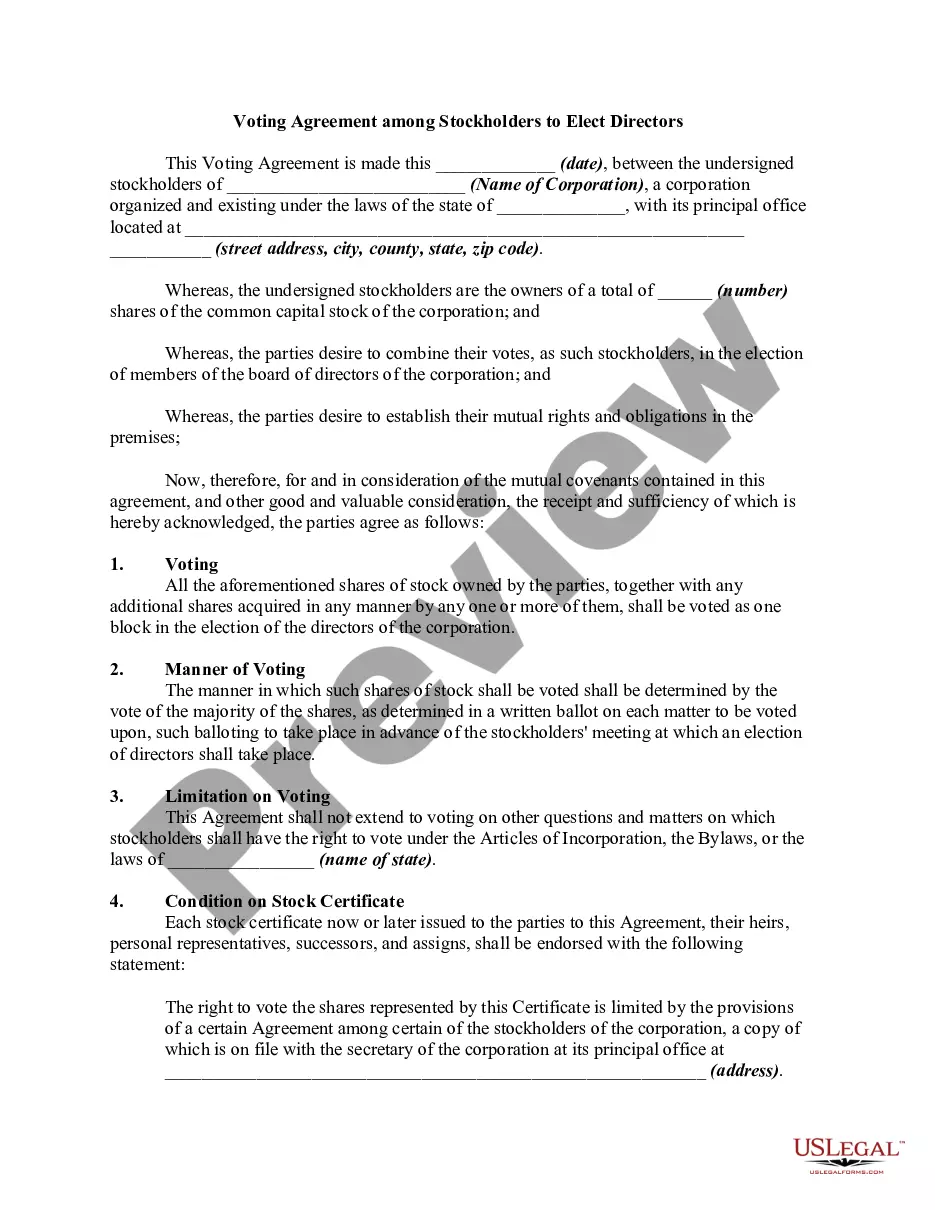

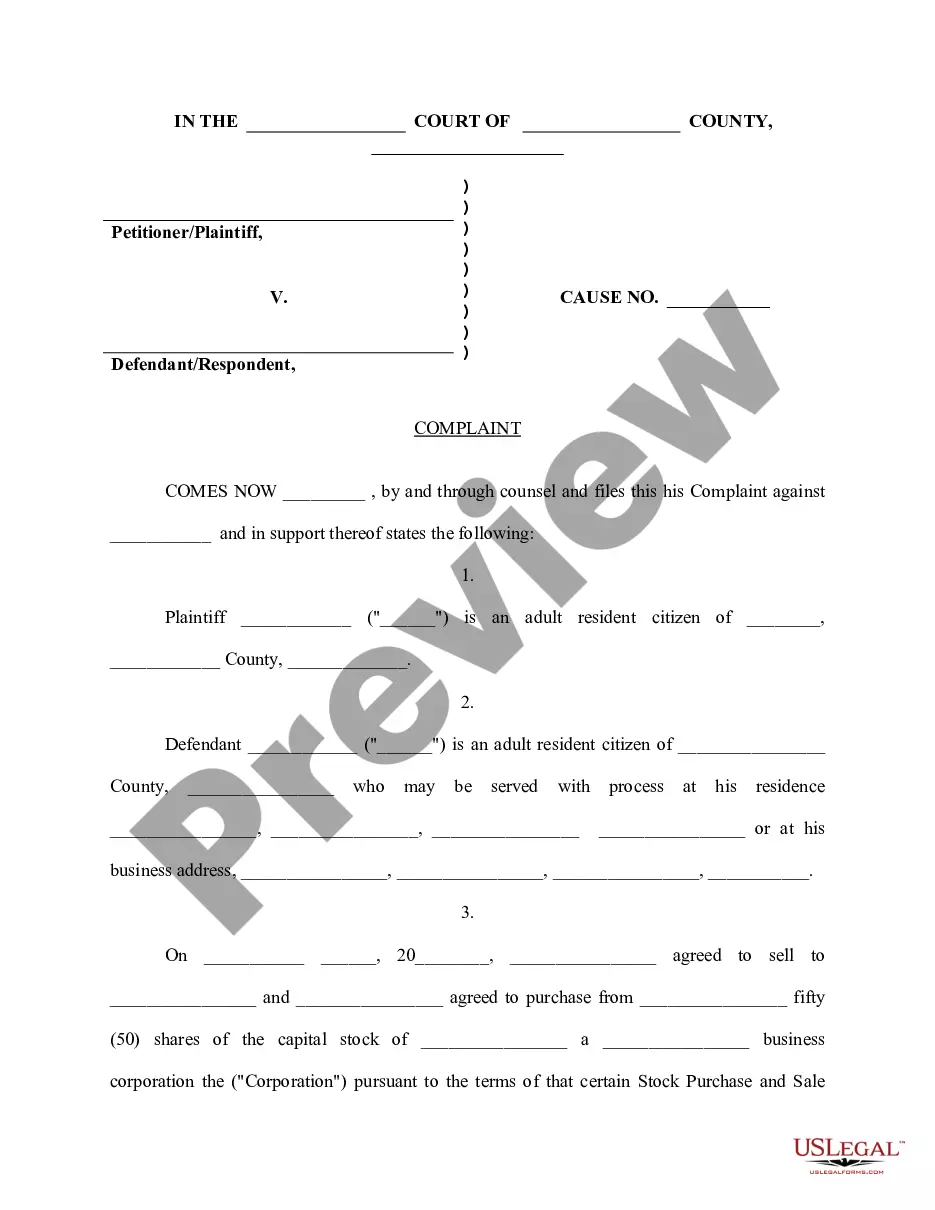

A Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legally binding document that outlines the distribution of profits in a close corporation based on certain predetermined allocations. It is essential for shareholders in Texas close corporations to understand and establish an agreement to mitigate potential disputes and ensure fair treatment. This type of agreement recognizes the unique nature of close corporations, where shareholders are usually actively involved in the company's management. By having a clear understanding of how dividends will be allocated among shareholders, parties can avoid disagreements and protect their interests. There are two primary types of Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation: 1. Fixed Allocation Agreement: This agreement specifies a fixed percentage or share of dividends that each shareholder will receive. For example, if there are three shareholders and the agreement states a fixed allocation of 40%, 30%, and 30%, the dividends will be distributed accordingly. This type of agreement provides a straightforward and predictable distribution of profits. 2. Formula Allocation Agreement: This agreement allocates dividends based on a predetermined formula that may take into account various factors such as ownership stake, capital contributions, or preferred stock status. The formula can be customized to reflect the unique circumstances of the close corporation and the specific needs of the shareholders. By using a formula, this type of agreement allows for more flexibility and adaptability to changing circumstances. Other relevant keywords for a Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation could include: — Dividendistributionio— - Dividend allocation — Shareholder right— - Close corporation agreement — Profidistributionio— - Close corporation management — Shareholder dispute— - Shareholder equality — Shareholder equit— - Corporate governance It is worth noting that while this content provides an overview of the topic, it is always advisable to seek legal counsel to ensure compliance with the specific laws and regulations governing close corporations in Texas.

Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Texas Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

If you have to full, download, or print out legitimate record themes, use US Legal Forms, the greatest variety of legitimate types, which can be found on the web. Utilize the site`s basic and practical search to get the files you need. Different themes for company and person purposes are categorized by classes and suggests, or key phrases. Use US Legal Forms to get the Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation in just a handful of click throughs.

If you are already a US Legal Forms consumer, log in for your accounts and click on the Acquire key to find the Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation. You can even accessibility types you formerly downloaded within the My Forms tab of your own accounts.

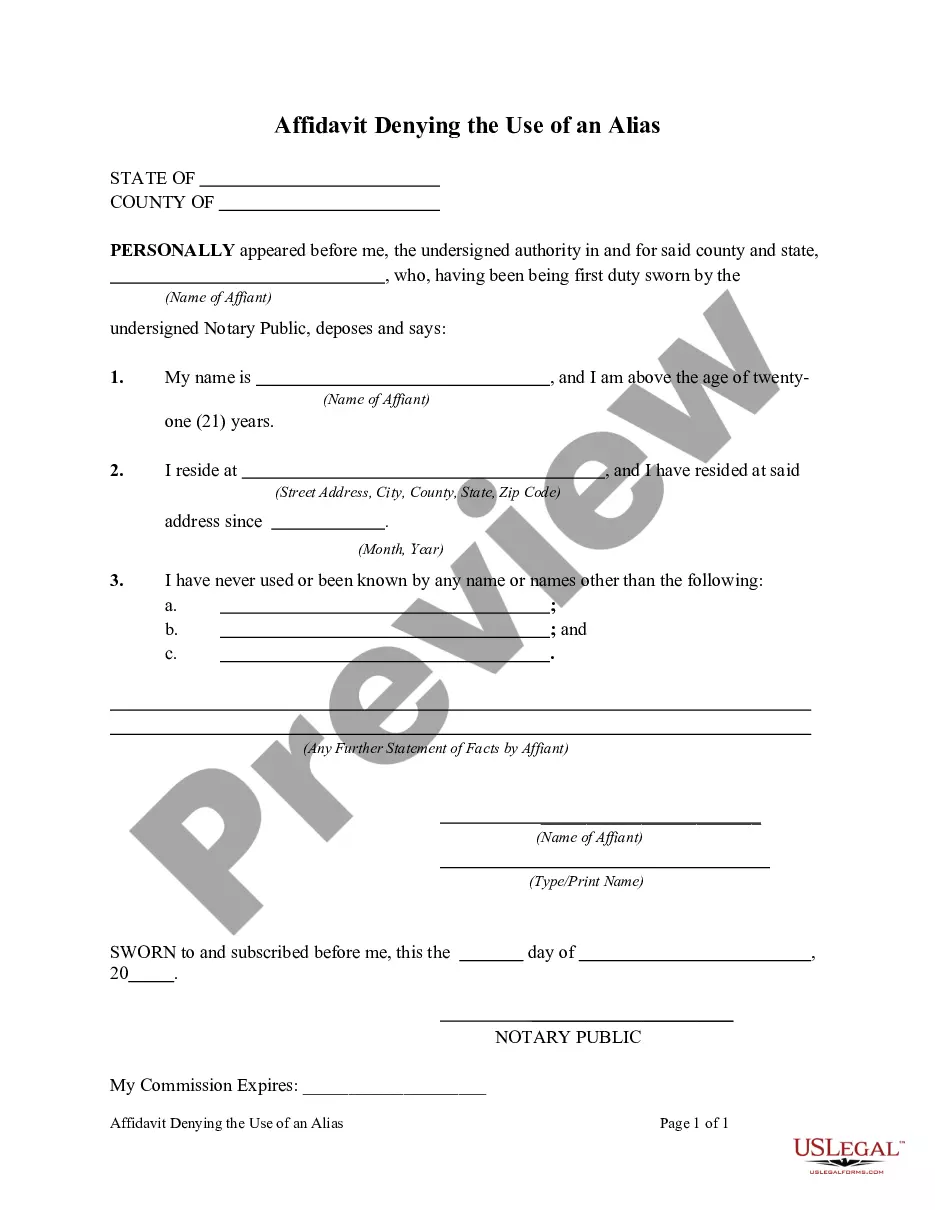

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for your proper city/land.

- Step 2. Utilize the Preview option to check out the form`s content material. Never forget about to see the information.

- Step 3. If you are not happy together with the kind, use the Lookup area at the top of the display screen to get other versions of the legitimate kind design.

- Step 4. Upon having found the form you need, select the Get now key. Opt for the costs program you choose and include your qualifications to sign up to have an accounts.

- Step 5. Method the financial transaction. You can utilize your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Select the format of the legitimate kind and download it on your gadget.

- Step 7. Full, modify and print out or indication the Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

Every legitimate record design you buy is the one you have for a long time. You have acces to each kind you downloaded with your acccount. Click on the My Forms section and choose a kind to print out or download once again.

Be competitive and download, and print out the Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation with US Legal Forms. There are millions of specialist and status-particular types you can utilize for the company or person requires.