The Texas Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan is a crucial document that outlines the specifics of a fixture filing associated with a commercial loan in the state of Texas. This exhibit serves to provide additional information and details related to the financing statement filed under the Uniform Commercial Code (UCC) in Texas. In this exhibit, certain keywords or elements must be included to ensure its relevance and compliance with the UCC requirements. These keywords may vary based on the specific type of commercial loan or the intricacies of the fixture filing being represented. However, some general relevant keywords and details typically covered in a Texas Exhibit to UCC-1 Financing Statement for a Fixture Filing are: 1. Identification: The exhibit should clearly identify the debtor and the secured party, including their legal names, addresses, and contact information. This helps establish the parties involved in the fixture filing. 2. Description of the Collateral: It is essential to include a detailed description of the collateral being financed or attached as a fixture, such as equipment, machinery, fixtures, inventory, or other tangible assets. This description may include make, model, serial numbers, or any specific details that accurately identify the collateral. It helps to specify that the collateral is intended to be a fixture, ensuring its attachment to the real estate. 3. Location: Specific information about the location of the real property where the fixture is attached should be provided. This includes the address, county, and any other necessary details to precisely indicate the exact location of the collateral. 4. Principal Amount and Terms: The principal amount of the commercial loan, along with any applicable interest rates, repayment terms, and payment schedules, should be included. This helps determine the value of the collateral and establishes the obligations between the debtor and the secured party. 5. Signatures and Dates: The exhibit should be signed and dated by both the debtor and the secured party to acknowledge the accuracy and legality of the information provided. This demonstrates the consent and agreement between the parties involved. Types of Texas Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan may include variations based on specific business types or industries. Some examples are: — Construction Fixture Filing: This type of exhibit may focus on fixtures attached to real property in the construction industry, such as construction equipment, scaffolding, or specialized machinery used in the construction process. — Manufacturing Fixture Filing: This exhibit could be applicable to the manufacturing sector, detailing fixtures attached to real estate, including specialized machinery, assembly lines, or production equipment. — Restaurant Fixture Filing: In the restaurant industry, this type of exhibit may cover fixtures such as kitchen equipment, refrigeration units, seating arrangements, or specialized cooking apparatus. It ensures the attachment of these assets to the property. Remember, the specific requirements and keywords in a Texas Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan may vary depending on the nature of the loan and the fixture being financed. It is recommended to consult a legal expert or an attorney well-versed in UCC regulations to ensure accuracy and compliance.

Texas Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan

Description

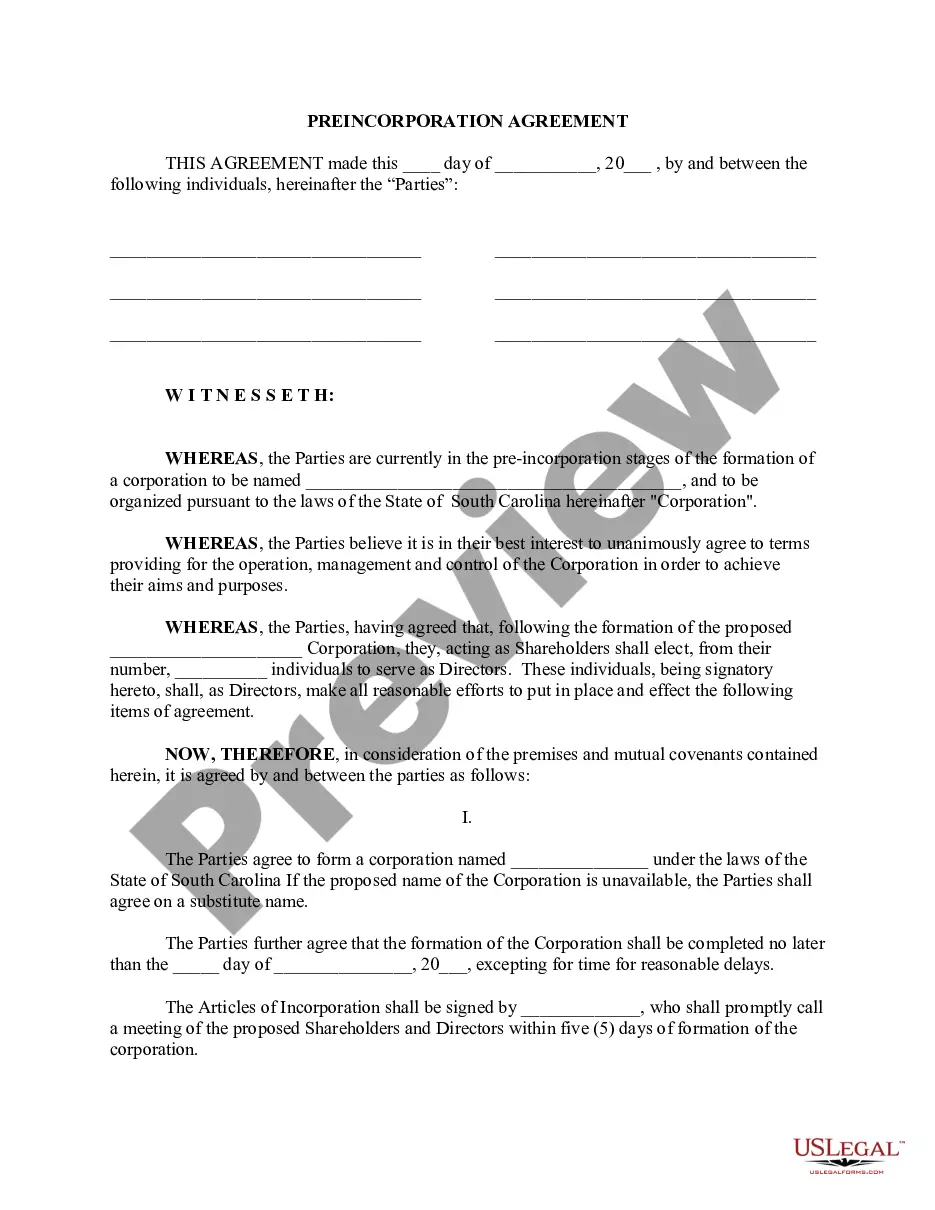

How to fill out Texas Exhibit To UCC-1 Financing Statement Regarding A Fixture Filing For A Commercial Loan?

If you need to total, obtain, or print out lawful file web templates, use US Legal Forms, the largest collection of lawful kinds, which can be found on-line. Use the site`s simple and handy lookup to obtain the documents you need. Various web templates for company and specific purposes are sorted by categories and suggests, or keywords. Use US Legal Forms to obtain the Texas Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan in a couple of clicks.

When you are previously a US Legal Forms customer, log in for your bank account and click on the Download switch to find the Texas Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan. You can even access kinds you previously delivered electronically in the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have chosen the form for your proper city/nation.

- Step 2. Utilize the Review solution to look over the form`s content material. Don`t overlook to see the information.

- Step 3. When you are not happy together with the kind, use the Look for area near the top of the display screen to get other variations from the lawful kind template.

- Step 4. Once you have discovered the form you need, select the Get now switch. Choose the costs prepare you like and include your accreditations to sign up on an bank account.

- Step 5. Procedure the transaction. You may use your credit card or PayPal bank account to finish the transaction.

- Step 6. Choose the structure from the lawful kind and obtain it on your own system.

- Step 7. Complete, edit and print out or sign the Texas Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan.

Each and every lawful file template you buy is yours forever. You might have acces to every single kind you delivered electronically inside your acccount. Go through the My Forms portion and select a kind to print out or obtain again.

Remain competitive and obtain, and print out the Texas Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan with US Legal Forms. There are millions of specialist and status-certain kinds you may use for the company or specific requires.