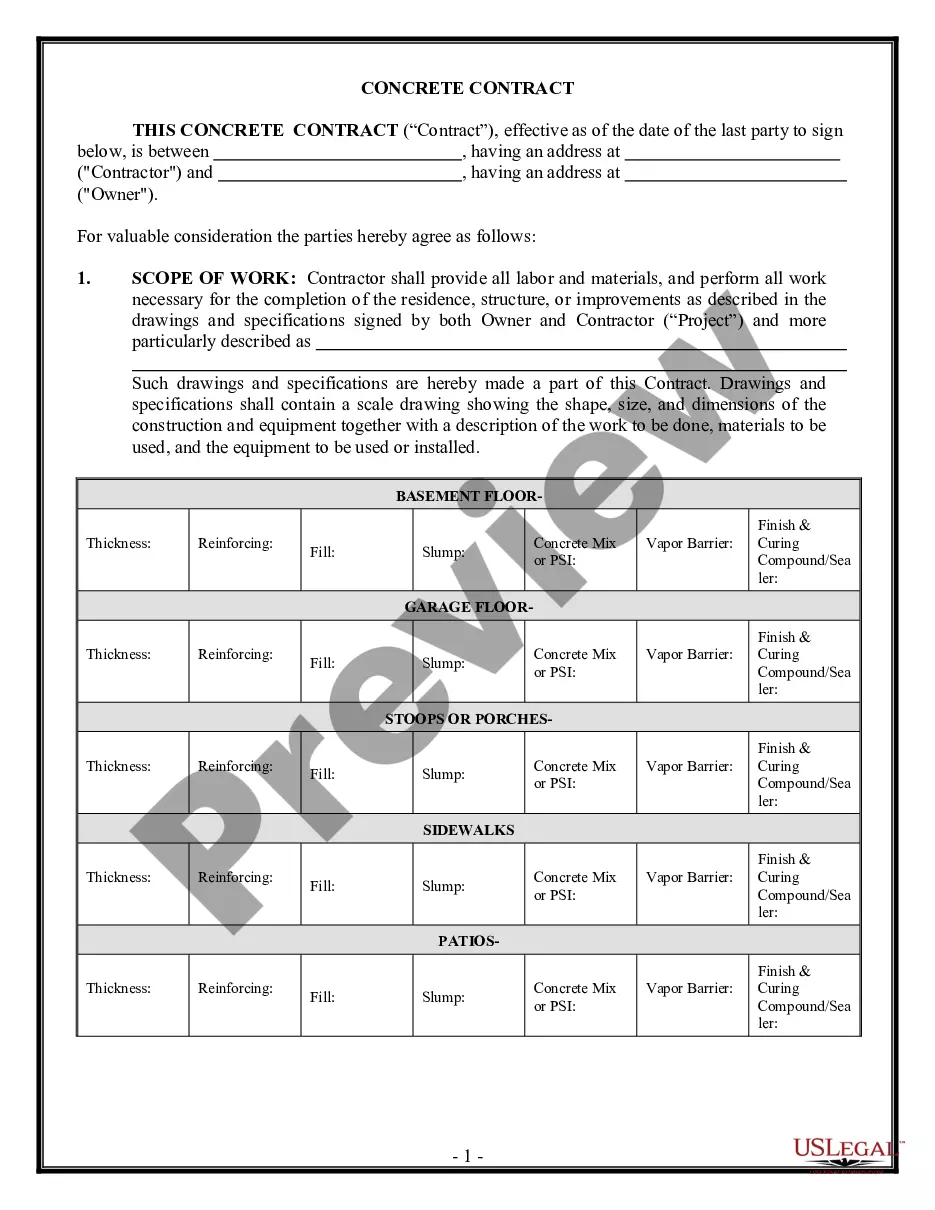

The Texas Sale of Unit by Co-operative Housing Corporation refers to the legal process of selling a unit within a co-operative housing corporation in the state of Texas. A co-operative housing corporation, also known as a housing co-op, is a type of housing arrangement where residents collectively own and manage the property. When it comes to the sale of a unit within a co-operative housing corporation in Texas, there are two common types: market-rate sales and limited-equity sales. 1. Market-Rate Sales: Market-rate sales occur when a unit is sold at market value, allowing the seller to obtain the fair market price for their property. It involves selling the unit to an external buyer who is not a current member or resident of the co-operative housing corporation. The market-rate sales offer more flexibility in terms of pricing and potential buyers since they are not limited to the co-operative's membership. 2. Limited-Equity Sales: Limited-equity sales, on the other hand, involve selling a unit at a price limited by the co-operative's policies. The selling price is typically set significantly below the market value to ensure affordability and maintain the co-operative's affordability goals. Limited-equity sales are typically restricted to members of the co-operative housing corporation, and there may be additional eligibility criteria to qualify for the purchase. In both types of sales, the co-operative housing corporation typically plays an important role in facilitating the transaction. They may have certain rules and regulations in place, which must be followed during the sale process. These rules might involve obligations such as providing notice to the co-operative of the intention to sell, obtaining necessary approvals from the board of directors or members, adhering to specific timelines, and ensuring compliance with any other requirements outlined in the cooperative's governing documents. It is crucial for both buyers and sellers to familiarize themselves with the specific sale procedures outlined by the co-operative housing corporation and comply with any legal regulations imposed by the state of Texas. Hiring a real estate attorney or consulting the co-operative's management is recommended to ensure a smooth and legally compliant sale transaction. In conclusion, the Texas Sale of Unit by Co-operative Housing Corporation encompasses the process of selling a unit within a housing co-op in Texas. The two common types of sales are market-rate sales, where the unit is sold at fair market value, and limited-equity sales, which involve selling the unit at a price below market value to maintain affordability. It is essential for all parties involved to understand the co-operative's rules, regulations, and any legal requirements to successfully navigate the sale process.

Texas Sale of Unit by Co-operative Housing Corporation

Description

How to fill out Texas Sale Of Unit By Co-operative Housing Corporation?

You are able to devote hrs on the Internet trying to find the legitimate record format that suits the federal and state needs you will need. US Legal Forms supplies a large number of legitimate kinds which can be reviewed by experts. It is simple to acquire or produce the Texas Sale of Unit by Co-operative Housing Corporation from your assistance.

If you already possess a US Legal Forms profile, you are able to log in and then click the Download switch. Afterward, you are able to comprehensive, change, produce, or signal the Texas Sale of Unit by Co-operative Housing Corporation. Every single legitimate record format you get is your own for a long time. To acquire yet another duplicate of any bought type, visit the My Forms tab and then click the related switch.

Should you use the US Legal Forms internet site the very first time, keep to the straightforward directions under:

- Very first, be sure that you have selected the right record format for that area/area that you pick. Read the type description to ensure you have picked out the correct type. If offered, take advantage of the Preview switch to check with the record format too.

- If you would like get yet another variation of your type, take advantage of the Lookup area to discover the format that meets your requirements and needs.

- Once you have located the format you would like, simply click Get now to carry on.

- Find the costs prepare you would like, type your credentials, and register for a merchant account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal profile to purchase the legitimate type.

- Find the structure of your record and acquire it for your product.

- Make changes for your record if necessary. You are able to comprehensive, change and signal and produce Texas Sale of Unit by Co-operative Housing Corporation.

Download and produce a large number of record layouts utilizing the US Legal Forms web site, that provides the greatest collection of legitimate kinds. Use skilled and status-certain layouts to deal with your business or individual demands.

Form popularity

FAQ

ConsMost co-ops require a 10 to 20 percent down payment.The rules for renting your co-op are often quite restrictive.Because there are a limited amount of lenders who do co-op loans, your loan options are restricted.Typically it is harder to rent your co-op with the restrictions that most co-ops have.

op owner has an interest or share in the entire building and a contract or lease that allows the owner to occupy a unit. While a condo owner owns a unit, a coop owner does not own the unit. Coops are collectively owned and managed by their residents, who own shares in a nonprofit corporation.

When you pay off the cooperative loan, the bank will return the original stock and lease to you and will also forward a UCC-3 Termination Statement that must be filed in order to terminate the bank's security interest in your cooperative shares.

The main advantage of buying a co-op is that they are more affordable and cheaper to buy than a condo. This is one reason this type of housing is popular in cities with a high cost of living. What's more is that you typically get better square footage for your money.

Co-ops must abide by the laws that govern fair housing, but they can be more restrictive than other housing options when it comes to ownership requirements. Because there is no landlord, and there are no tenants, the rules for purchasing shares in the partnership are set by the partners.

The disadvantages of a cooperative society have been defined below:Limited Resources:Incapable Management:Lack of Motivation:Rigid Business Practices:Limited Consideration:High Interest Rate:Lack of Secrecy:Undue Government Intervention:More items...

Other Steps to Take After Paying Off Your MortgageCancel automatic payments.Get your escrow refund.Contact your tax collector.Contact your insurance company.Set aside your own money for taxes and insurance.Keep all important homeownership documents.Hang on to your title insurance.

ConsMost co-ops require a 10 to 20 percent down payment.The rules for renting your co-op are often quite restrictive.Because there are a limited amount of lenders who do co-op loans, your loan options are restricted.Typically it is harder to rent your co-op with the restrictions that most co-ops have.

Appreciation. Market rate co-ops tend to not rise in value as rapidly as condos. Low-income co-ops (which have lower purchase prices and income restrictions) also appreciate at a limited rate.