Texas Pot Testamentary Trust

Description

How to fill out Pot Testamentary Trust?

Are you presently in a circumstance where you require documents for either organization or particular uses almost every day.

There are numerous authorized document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, including the Texas Pot Testamentary Trust, designed to meet state and federal regulations.

Once you find the correct form, click Buy now.

Select the pricing plan you want, fill out the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- If you're already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Texas Pot Testamentary Trust template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and confirm it is for the correct region/area.

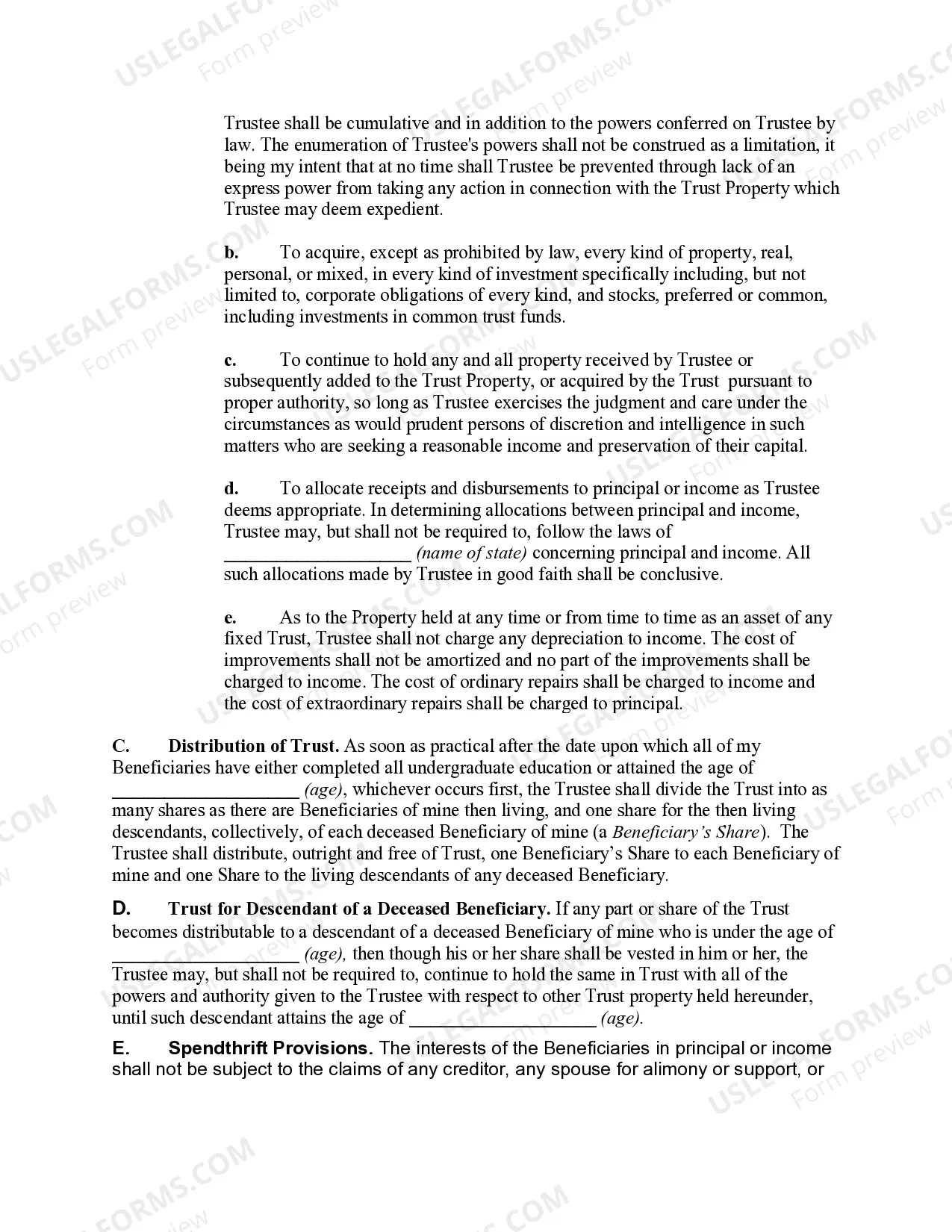

- Use the Preview button to examine the form.

- Review the details to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

If we're dealing with a testamentary trust to be established under a person's Will, then that trust doesn't come into existence until that person has passed away. Their executor and trustees are responsible for pooling all assets, paying all debts and then transferring the assets according to the terms of the Will.

Since the income earned within a testamentary trust is taxed on a separate tax return at graduated tax rates, an income- splitting opportunity arises for your beneficiaries. For example, let's assume an adult child is in the top marginal tax bracket of approximately 46% (top marginal tax rate varies by province).

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.

To create a testamentary trust, the settlor first must select the trustee and the beneficiary and specify the assets that are to be placed in trust. The settlor also has the ability to specify when and how to disburse the trust to the beneficiary. The last will and testament should detail all of this information.

The adult pays the top marginal tax rate on their non-inheritance income. the beneficiaries of the testamentary trust include three. the low income rebate applies to the distributions to minors and. the inheritance earns income of $60,000 per annum.

A Testamentary Trust is a trust established under the provisions of a person's Last Will and Testament. Unlike trusts created during the lifetime of the Grantor, a testamentary trust does not become effective until the Grantor has died and his Will has been through probate.

The main benefits of testamentary trusts are their ability to protect assets and to reduce tax paid by beneficiaries from income earned from the inheritance.