Title: Understanding the Texas Irrevocable Pot Trust Agreement: Types and Comprehensive Overview Introduction: In estate planning, the Texas Irrevocable Pot Trust Agreement is a legal document that plays a crucial role to ensure the seamless transfer and management of assets. This article aims to provide a detailed description of the Texas Irrevocable Pot Trust Agreement, highlighting its key features, uses, benefits, and its various types that individuals may choose based on specific circumstances and goals. Keywords: Texas, Irrevocable Pot Trust Agreement, estate planning, assets, transfer, management, benefits, types. 1. What is a Texas Irrevocable Pot Trust Agreement? The Texas Irrevocable Pot Trust Agreement is a comprehensive legal document created to establish a trust that preserves and distributes assets to beneficiaries in a controlled manner. An irrevocable nature means that once the trust is established, it typically cannot be modified or revoked by the granter. 2. Key Features and Uses: — Asset Preservation: The primary goal of a Texas Irrevocable Pot Trust Agreement is to protect assets from creditors, lawsuits, or unnecessary taxes, ensuring their preservation for beneficiaries. — Controlled Distribution: This trust allows the granter to maintain control over the timing and conditions of asset distribution to beneficiaries, ensuring their responsible and proper management. — Estate Tax Planning: By placing assets within an irrevocable trust, the granter can potentially reduce the overall value of their estate, thereby minimizing estate taxes upon their passing. — Medicaid and Long-Term Care Planning: An Irrevocable Pot Trust can be an essential tool for individuals seeking to qualify for Medicaid or other government benefits without exhausting their assets. 3. Types of Texas Irrevocable Pot Trust Agreements: a) General Irrevocable Pot Trust Agreement: This type of trust offers maximum flexibility, allowing the granter to include a broad range of assets and beneficiaries. It provides absolute discretion over the distribution of assets among beneficiaries. b) Specific Purpose Pot Trust Agreement: Designed for a particular objective, such as educational expenses, healthcare, or charitable purposes. The assets within this trust are strictly designated for their intended purposes. c) Spendthrift Pot Trust Agreement: This trust includes additional clauses and provisions to protect beneficiaries from creditors' claims, ensuring that the assets remain intact and serve their intended purpose. d) Testamentary Pot Trust Agreement: Created within a will, this trust becomes effective upon the granter's death, allowing the assets to pass into a pot trust for distribution among beneficiaries. Conclusion: The Texas Irrevocable Pot Trust Agreement offers individuals a powerful tool for effective estate planning, asset protection, and controlled asset distribution. By understanding the different types available and seeking professional advice based on specific goals and circumstances, individuals can ensure the smooth succession and preservation of their assets for generations to come. Keywords: Texas, Irrevocable Pot Trust Agreement, estate planning, assets, preservation, controlled distribution, estate tax planning, Medicaid planning, types, general, specific purpose, spendthrift, testamentary.

Texas Irrevocable Pot Trust Agreement

Description

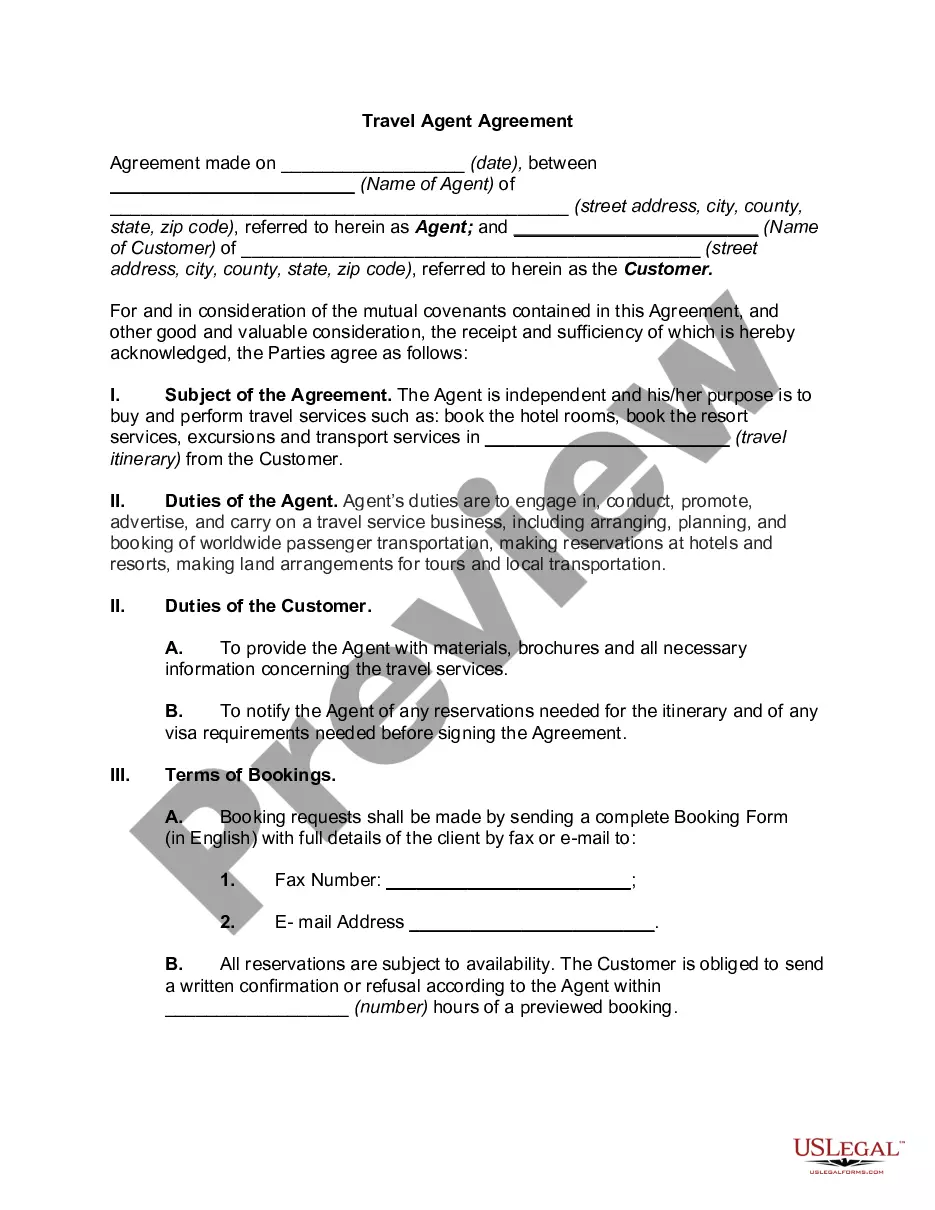

How to fill out Texas Irrevocable Pot Trust Agreement?

Finding the right legitimate record web template could be a have difficulties. Of course, there are tons of web templates available on the Internet, but how do you find the legitimate kind you require? Take advantage of the US Legal Forms web site. The assistance offers a huge number of web templates, for example the Texas Irrevocable Pot Trust Agreement, that you can use for business and private requires. Each of the kinds are checked by professionals and satisfy federal and state needs.

If you are currently listed, log in in your accounts and click on the Down load switch to find the Texas Irrevocable Pot Trust Agreement. Make use of accounts to look from the legitimate kinds you may have ordered formerly. Proceed to the My Forms tab of your respective accounts and acquire one more version of your record you require.

If you are a new customer of US Legal Forms, here are basic instructions for you to comply with:

- Very first, make sure you have chosen the right kind for your personal city/county. It is possible to look over the form utilizing the Preview switch and study the form outline to make certain this is the best for you.

- In the event the kind will not satisfy your needs, utilize the Seach field to obtain the appropriate kind.

- Once you are positive that the form is proper, go through the Purchase now switch to find the kind.

- Choose the prices strategy you need and enter in the necessary information and facts. Design your accounts and buy the order making use of your PayPal accounts or credit card.

- Select the file formatting and download the legitimate record web template in your product.

- Full, modify and printing and indication the attained Texas Irrevocable Pot Trust Agreement.

US Legal Forms will be the largest library of legitimate kinds that you can discover a variety of record web templates. Take advantage of the company to download skillfully-produced papers that comply with status needs.