The Texas Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment is a legal document that outlines the process of terminating a partnership in the state of Texas, providing guidelines for the distribution of assets and liabilities among the partners. This agreement serves as a written record of the partners' intentions and ensures a fair and orderly dissolution. Keywords: Texas, Agreement to Dissolve, Wind up Partnership, Settlement, Lump Sum Payment, partnership termination, assets, liabilities, partners, dissolution process, legal document, distribution. There are two primary types of Texas Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment: 1. Voluntary Dissolution and Wind up Partnership Agreement: This agreement is used when partners voluntarily decide to dissolve their partnership. It outlines the terms and conditions under which the dissolution will take place, including the distribution of assets, settlement of liabilities, and the lump sum payment from the partnership to the partners. 2. Judicial Dissolution and Wind up Partnership Agreement: In certain cases, a partnership may be dissolved by court order due to reasons such as breach of partnership agreement, incapacity of a partner, or partnership becoming illegal. This agreement covers the legal and procedural aspects of court-ordered dissolution, including the appointment of a receiver, valuation of assets, resolution of disputes, and the final lump sum payment to the partners. Regardless of the type of agreement, the Texas Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment generally includes the following key elements: 1. Identification of Partners: The agreement includes the names and contact details of all partners involved in the dissolution, establishing their authority to enter into this agreement. 2. Dissolution Date: The effective date of the partnership dissolution is specified in the agreement, marking the start of the wind-up process. 3. Asset Distribution: The agreement outlines how the partnership's assets will be distributed among the partners, ensuring fairness and compliance with relevant laws. 4. Liability Settlement: It specifies how the partnership's debts, obligations, and liabilities will be settled, ensuring that each partner's responsibility is clearly stated. 5. Lump Sum Payment: The agreement details the lump sum payment that partners will receive, taking into account factors such as capital contributions, profit share, and any outstanding debts. 6. Dissolution Process: The steps and procedures for winding up the partnership are provided, including the appointment of a liquidator or receiver if necessary. 7. Dispute Resolution: If disputes arise during the dissolution process, the agreement may include a mechanism for resolving them, such as arbitration or mediation. 8. Governing Law: The agreement specifies that it will be governed by the laws of the state of Texas, ensuring that all provisions align with the state's partnership laws. In summary, the Texas Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment is a crucial legal document that facilitates the fair and orderly dissolution of a partnership in Texas. It provides partners with a framework for distributing assets, settling liabilities, and receiving lump sum payments. Whether through voluntary or judicial dissolution, this agreement ensures that the partnership wind-up process is conducted in accordance with relevant laws and regulations.

Texas Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

How to fill out Texas Agreement To Dissolve And Wind Up Partnership With Settlement And Lump Sum Payment?

Are you presently in a place the place you need to have papers for either company or personal reasons virtually every day? There are plenty of legitimate record layouts available on the Internet, but discovering types you can rely is not effortless. US Legal Forms offers thousands of develop layouts, much like the Texas Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment, that are published to satisfy state and federal requirements.

Should you be presently acquainted with US Legal Forms website and possess a merchant account, just log in. Following that, you can obtain the Texas Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment template.

If you do not have an accounts and want to begin using US Legal Forms, follow these steps:

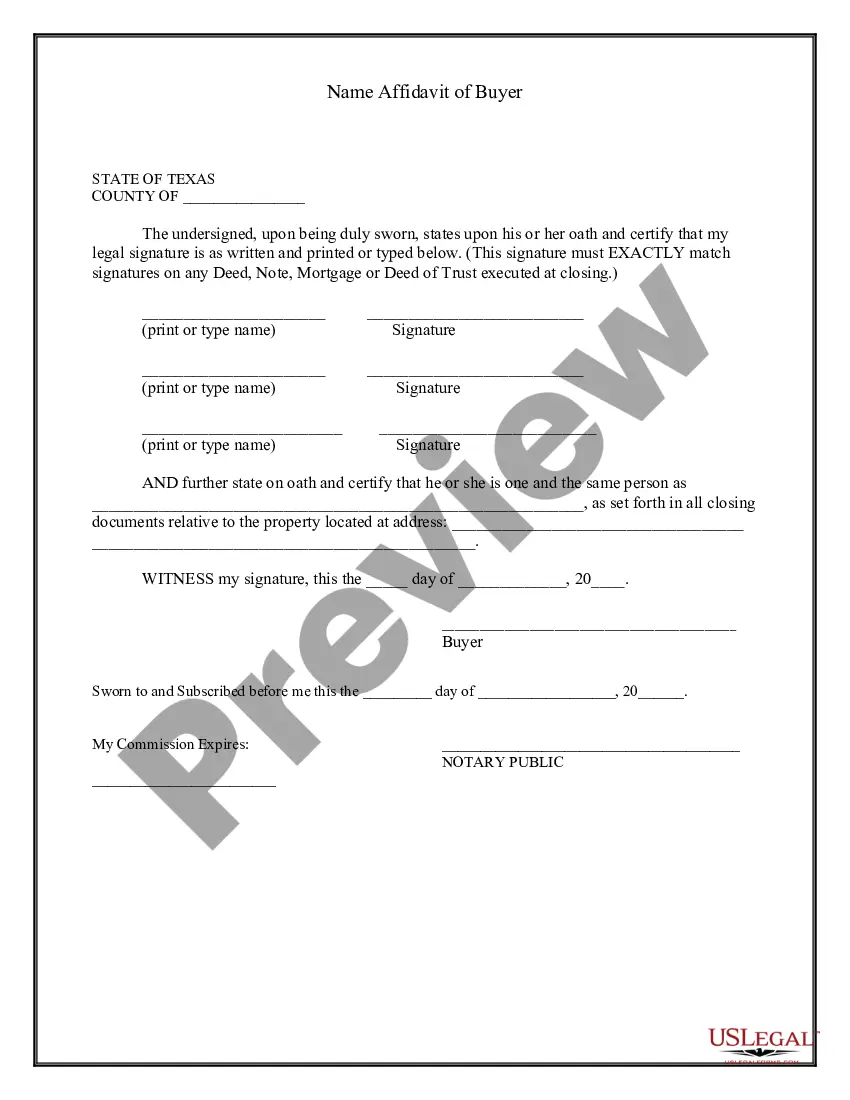

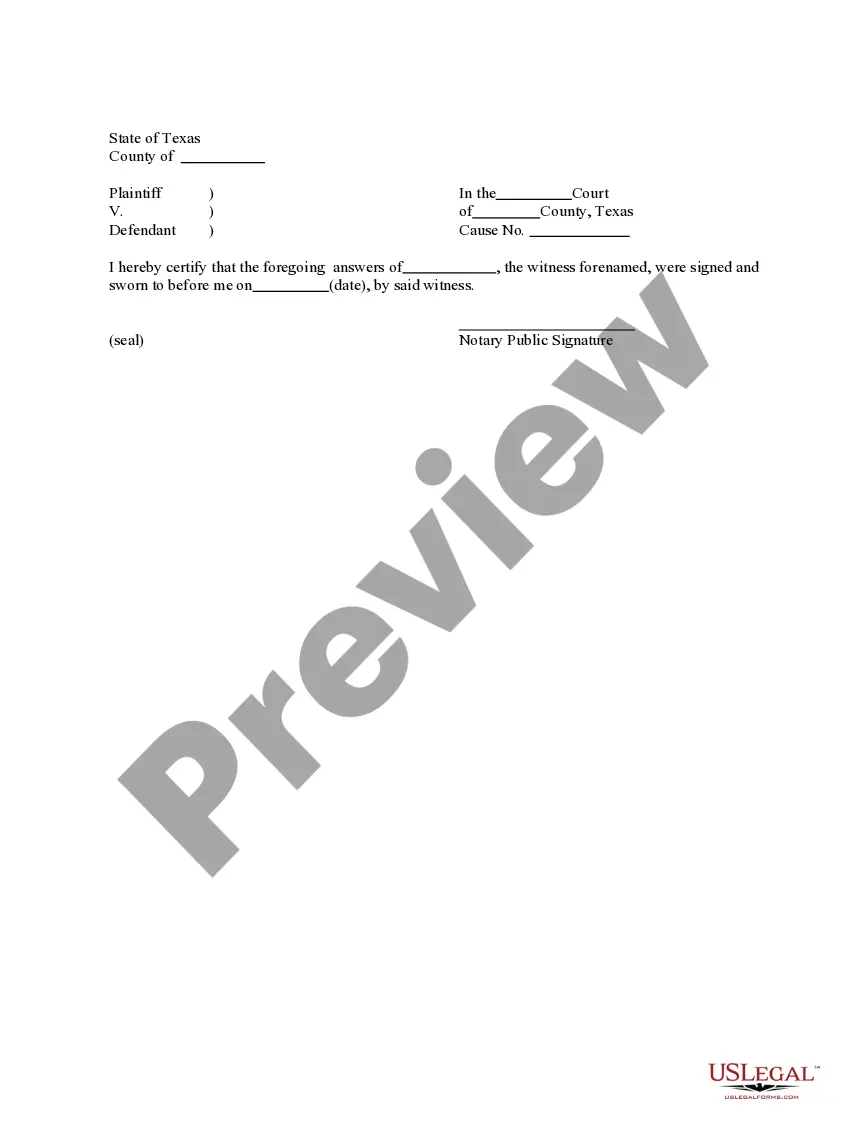

- Find the develop you will need and ensure it is for your proper city/region.

- Utilize the Review button to analyze the form.

- See the information to ensure that you have selected the proper develop.

- In the event the develop is not what you are trying to find, make use of the Look for discipline to get the develop that meets your requirements and requirements.

- Whenever you get the proper develop, click on Get now.

- Choose the rates program you need, fill in the required details to make your money, and pay money for your order utilizing your PayPal or charge card.

- Choose a hassle-free data file structure and obtain your version.

Find all of the record layouts you may have purchased in the My Forms menus. You may get a additional version of Texas Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment anytime, if required. Just go through the necessary develop to obtain or printing the record template.

Use US Legal Forms, probably the most extensive collection of legitimate forms, to save time as well as avoid blunders. The assistance offers appropriately produced legitimate record layouts that you can use for a range of reasons. Create a merchant account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

Therefore, you should consider consulting with a local business attorney before ending your partnership.Review Your Partnership Agreement.Take a Vote or Action to Dissolve.Pay Debts and Distribute Assets (Wind Up)No State Filing Required.Notify Creditors, Customers, Clients, and Suppliers.Final Tax Issues.More items...

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

Just keep in mind these five key steps when dissolving a partnership:Review your partnership agreement.Discuss with other partners.File dissolution papers.Notify others.Settle and close out all accounts.

Generally, however, the liquidators of a partnership pay non-partner creditors first, followed by partners who are also creditors of the partnership. If any assets remain after satisfying these obligations, then partners who have contributed capital to the partnership are entitled to their capital contributions.

Debt to parties, account of capital of each partner, advances given by partners, residue to be divided amongst partners in profit sharing ratio.

The distribution of payments of the Company in the process of winding-up shall be made in the following order: (i) All known debts and liabilities of the Company, excluding debts and liabilities to Members who are creditors of the Company; (ii) All known debts and liabilities of the Company owed to Members who are

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.