Texas Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a legal process that involves the dissolution of a business partnership, the sale of its assets, and the assumption of its liabilities by another entity. This type of liquidation provides an orderly and efficient exit strategy for partners who wish to wind up their partnership and distribute its assets. In Texas, there are three main types of liquidation of partnership with the sale of assets and assumption of liabilities: voluntary liquidation, involuntary liquidation, and statutory liquidation. Each type has its own specific circumstances and procedures. 1. Voluntary Liquidation: Voluntary liquidation occurs when partners mutually agree to dissolve the partnership and sell its assets. This process typically starts with a formal agreement among the partners to wind up the business. The partners will then appoint a liquidator, who is responsible for selling the partnership's assets in order to satisfy its liabilities. The remaining proceeds, if any, are distributed among the partners according to their respective ownership interests. 2. Involuntary Liquidation: Involuntary liquidation occurs when a partnership is forced to dissolve and liquidate its assets due to external factors such as bankruptcy, insolvency, or court order. In these cases, a receiver or trustee is appointed to oversee the liquidation process and ensure a fair distribution of assets and settlement of liabilities to creditors and partners. 3. Statutory Liquidation: In certain situations, Texas law allows for the statutory liquidation of partnerships. This typically occurs when a partnership fails to file its annual report and pay the required fees to the Secretary of State. The Secretary of State can issue a notice of administrative dissolution, leading to the statutory liquidation of the partnership's assets. The assets are then sold, and the proceeds are used to pay off any outstanding liabilities. Regardless of the type of liquidation, the sale of partnership assets and assumption of liabilities must comply with Texas state laws and regulations. This involves proper notice to creditors, filing of necessary legal documents, and adhering to specific timelines and procedures. In summary, Texas Liquidation of Partnership with Sale of Assets and Assumption of Liabilities offers partners an organized way to end their business partnership, liquidate assets, and settle obligations. Understanding the different types of liquidation can help partners navigate the process effectively and ensure a fair distribution of assets and liabilities.

Texas Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

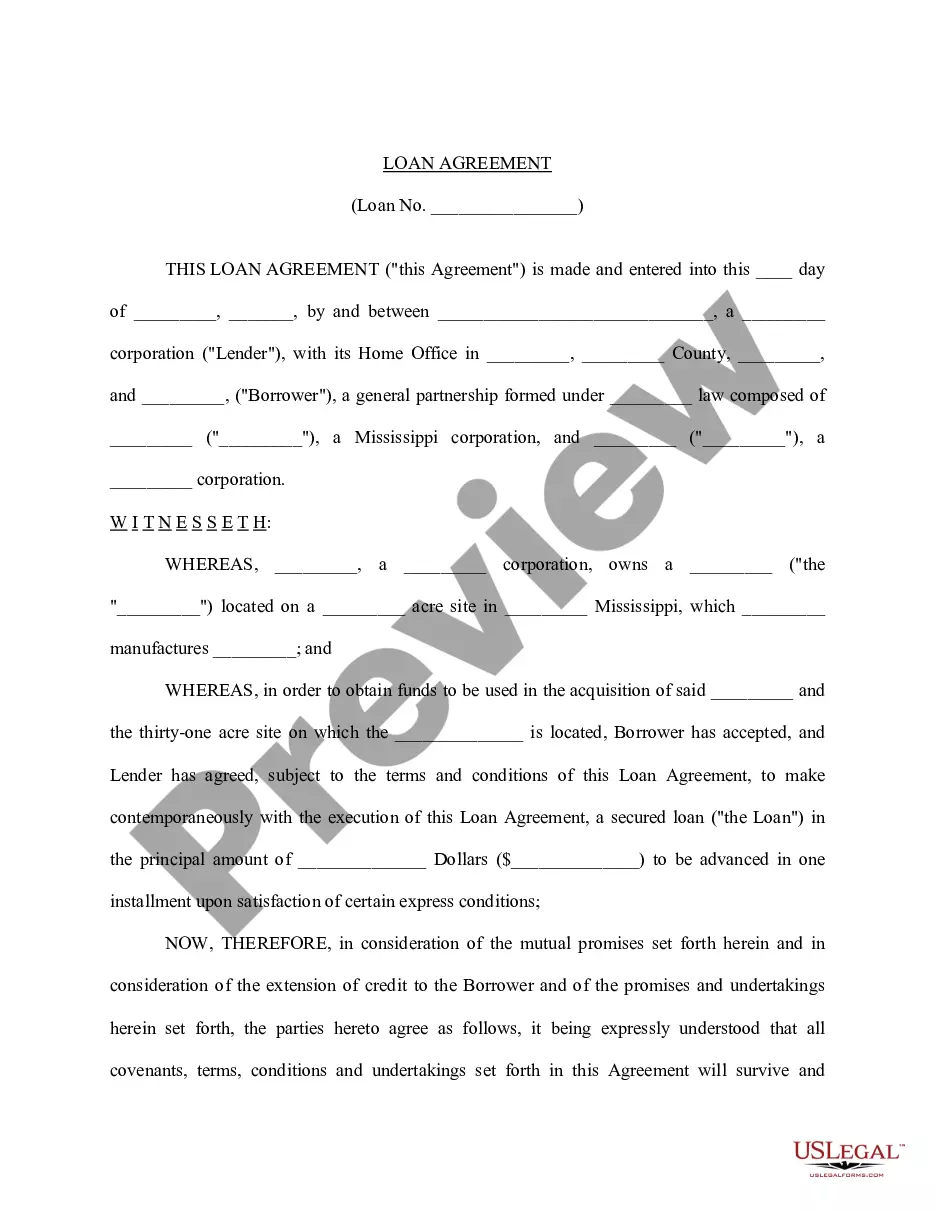

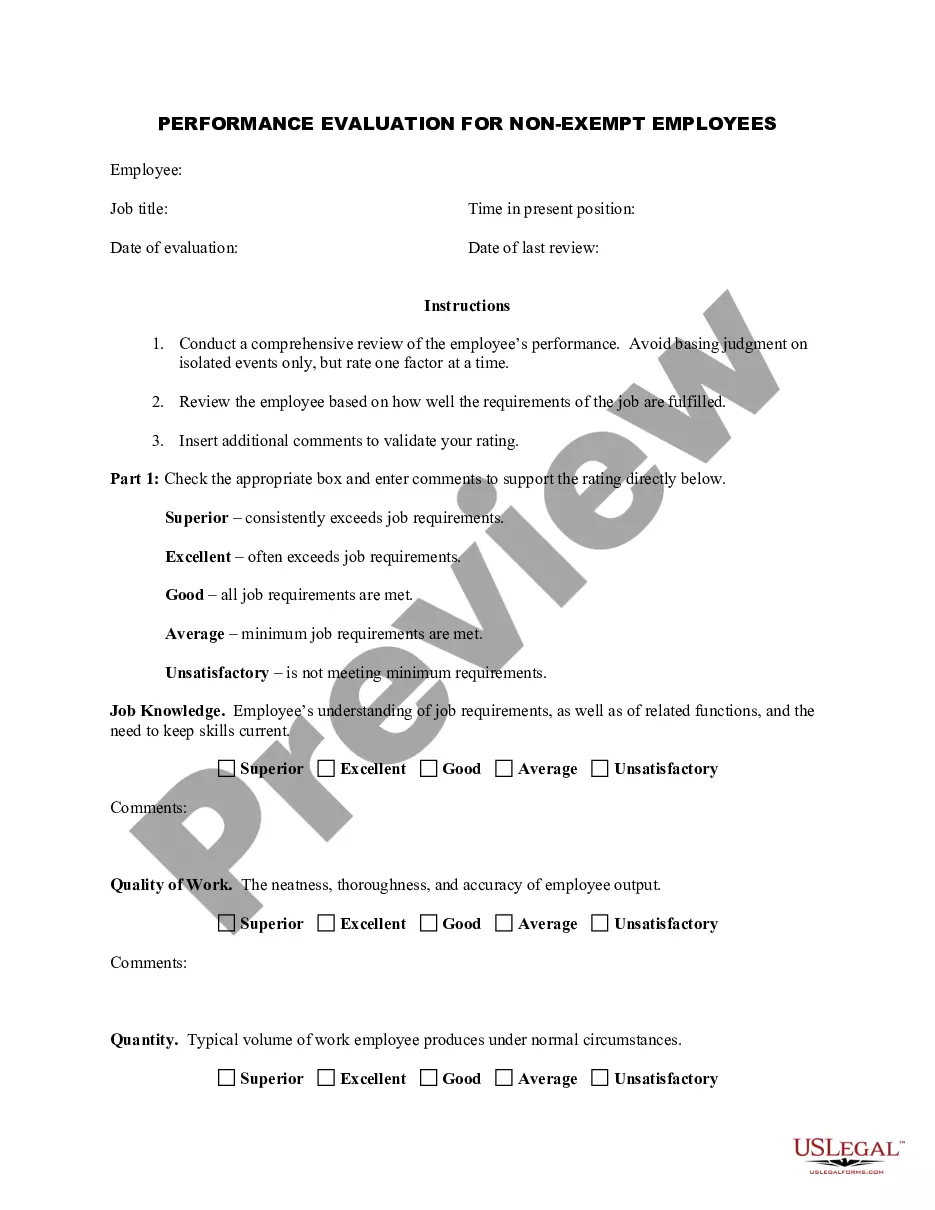

How to fill out Texas Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

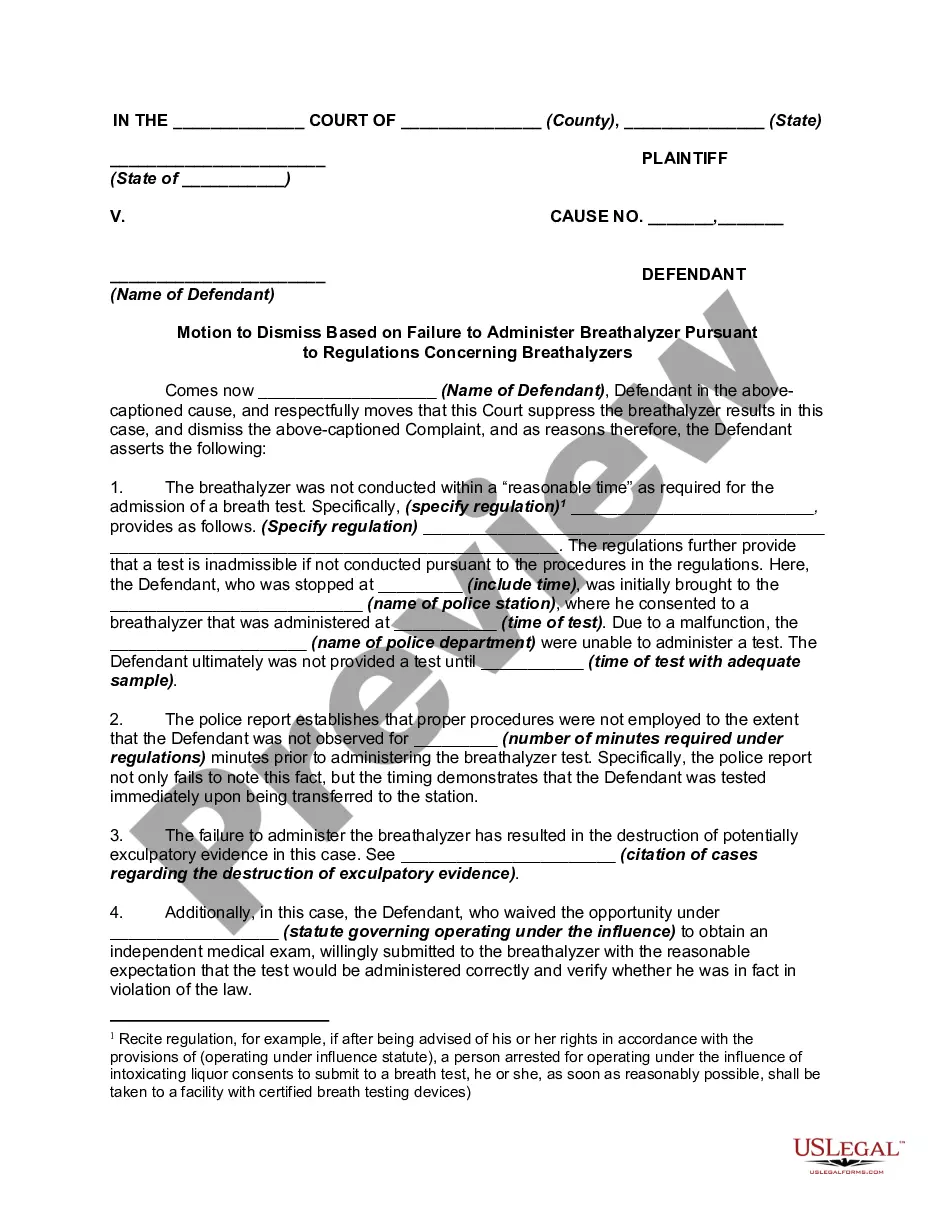

It is possible to devote hours online trying to find the authorized file design that meets the state and federal needs you will need. US Legal Forms provides a huge number of authorized varieties which can be examined by experts. It is possible to obtain or print out the Texas Liquidation of Partnership with Sale of Assets and Assumption of Liabilities from the service.

If you have a US Legal Forms account, you are able to log in and click the Download key. After that, you are able to complete, revise, print out, or signal the Texas Liquidation of Partnership with Sale of Assets and Assumption of Liabilities. Every authorized file design you buy is the one you have eternally. To have yet another backup of the purchased form, visit the My Forms tab and click the related key.

If you use the US Legal Forms web site for the first time, adhere to the simple directions beneath:

- Initially, be sure that you have selected the correct file design for your region/city of your choice. Look at the form description to make sure you have picked out the appropriate form. If accessible, use the Review key to appear with the file design at the same time.

- If you wish to get yet another version from the form, use the Lookup discipline to get the design that fits your needs and needs.

- When you have identified the design you would like, simply click Purchase now to move forward.

- Find the pricing plan you would like, type in your credentials, and register for an account on US Legal Forms.

- Total the transaction. You should use your credit card or PayPal account to cover the authorized form.

- Find the structure from the file and obtain it to the system.

- Make adjustments to the file if necessary. It is possible to complete, revise and signal and print out Texas Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

Download and print out a huge number of file templates utilizing the US Legal Forms Internet site, that offers the biggest collection of authorized varieties. Use professional and state-specific templates to tackle your small business or specific needs.

Form popularity

FAQ

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.

What Role Does Basis Play In A Partnership Liquidation? basis equal to the amount of money on hand plus the level at which any business-related assets will be contributed, ie, what they will cost.

The basis of property (other than money) distributed by a partnership to a partner in liquidation of the partner's interest shall be an amount equal to the adjusted basis of such partner's interest in the partnership reduced by any money distributed in the same transaction.

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

Cases. A dividend may be referred to as liquidating dividend when a company: Goes out of business and the net assets of the company (after all liabilities have been paid) are distributed to shareholders, or. Sells a portion of its business for cash and the proceeds are distributed to shareholders.

Section 331 contains rules governing the extent to which gain or loss is recognized to a shareholder receiving a distribution in complete or partial liquidation of a corporation.