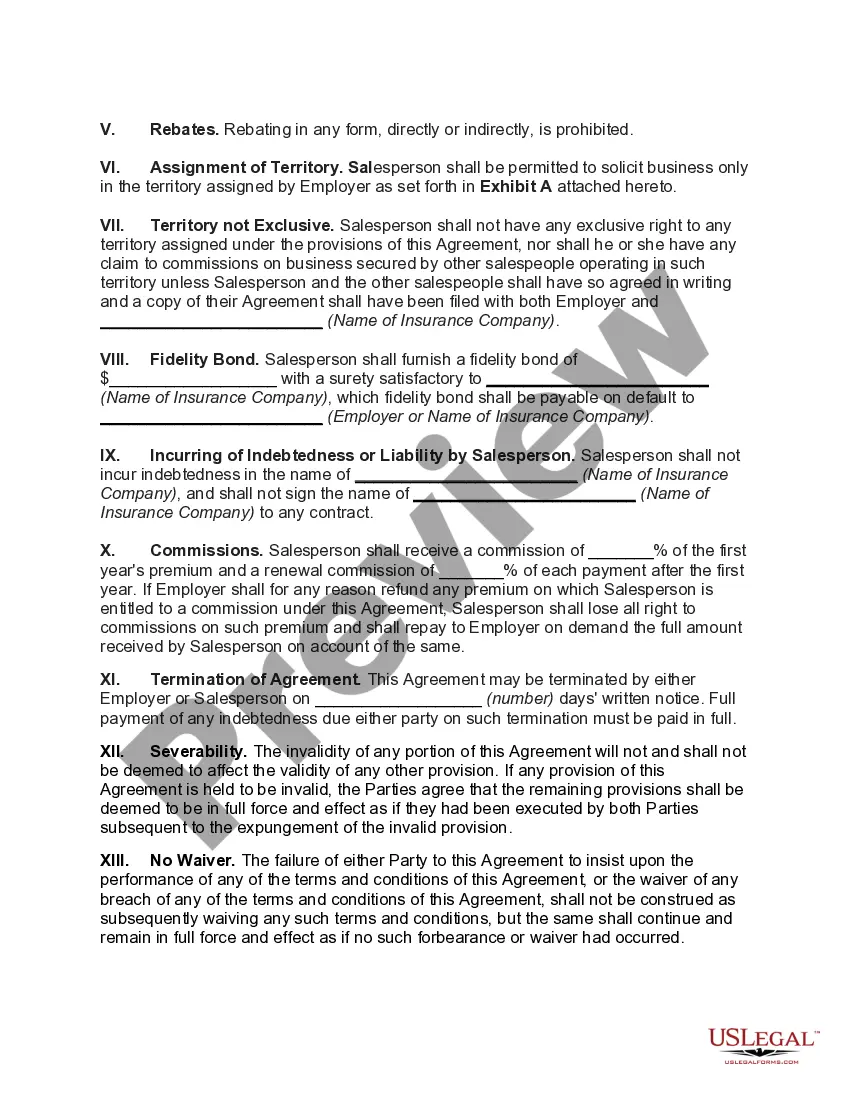

The Texas Employment Agreement between a General Agent as an Employer and a Salesperson for the Sale of Insurance is a legally binding document that outlines the terms and conditions of the employment relationship between a general agent and a salesperson in the insurance industry. This agreement defines the roles, responsibilities, and compensation structure specific to the salesperson's insurance sales activities. Keywords: Texas, employment agreement, general agent, employer, salesperson, insurance, sale, terms, conditions, employment relationship, roles, responsibilities, compensation structure Types of Texas Employment Agreements between General Agents as Employers and Salespersons for the Sale of Insurance: 1. Exclusive Agency Agreement: This type of agreement establishes an exclusive working relationship between the general agent and the salesperson, preventing the salesperson from representing or selling insurance products from other general agents or insurers within a designated territory. 2. Non-Exclusive Agency Agreement: In contrast to the exclusive agency agreement, the non-exclusive agency agreement allows the salesperson to represent multiple general agents or insurers simultaneously, without an exclusive commitment to one particular entity. 3. Commission-Only Agreement: This type of agreement outlines that the salesperson's primary compensation will be based solely on the commissions earned from insurance sales. The agreement may specify the commission rate or structure for different insurance products sold by the salesperson. 4. Base Salary plus Commission Agreement: Under this agreement, the salesperson receives a guaranteed base salary in addition to commission earnings. The base salary is paid regularly, providing stability, while commission payments are determined by the salesperson's performance in generating insurance sales. 5. Contract Duration Agreement: Some Texas employment agreements specify a predetermined contract duration, outlining the duration of employment between the general agent and salesperson. This could be a fixed term, such as one year, or an open-ended agreement with no specified end date. 6. Termination Clause Agreement: This agreement includes provisions for the termination of the employment relationship between the general agent and salesperson. It outlines the conditions under which either party may terminate the agreement, such as non-performance, violation of ethical standards, or breach of contractual obligations. 7. Non-Compete Agreement: A non-compete agreement restricts the salesperson from engaging in similar insurance-related business activities for a specified period after the termination of employment. This aims to protect the general agent's business interests and prevent the salesperson from directly competing against their former employer. These various types of Texas Employment Agreements between General Agents as Employers and Salespersons for the Sale of Insurance provide flexibility in establishing a mutual understanding of the employment relationship, compensation structure, and business expectations between the parties involved.

Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance

Description

How to fill out Texas Employment Agreement Between General Agent As Employer And Salesperson - Sale Of Insurance?

You can invest time online trying to locate the appropriate document template that satisfies both state and federal requirements you require.

US Legal Forms offers thousands of valid forms that have been examined by experts.

You can easily download or print the Texas Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance from their service.

If available, utilize the Review button to view the document template at the same time.

- If you have an existing US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can fill out, modify, print, or sign the Texas Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance.

- Each legitimate document template you download is yours permanently.

- To get another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Check the form description to confirm you have chosen the right template.

Form popularity

FAQ

Creating your own agreement starts with clearly identifying what you wish to achieve. Use simple language to outline the responsibilities and rights of each party involved. If you aim for a legally binding agreement, such as a Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, templates from UsLegalForms can provide a solid foundation and necessary legal framework.

To write a simple contract agreement, begin by identifying the parties involved and the purpose of the contract. Clearly outline the terms, including obligations, payment methods, and deliverables. For a Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, ensure the contract complies with relevant laws, and consider using templates from trusted platforms like UsLegalForms for guidance.

Writing a simple employment contract involves clear communication of the terms of employment. Start by stating the parties involved, job title, and responsibilities. Clearly define compensation, work hours, and any benefits, ensuring it aligns with Texas laws for a Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance. Always keep the language straightforward and avoid legal jargon.

To determine if someone is an employee or an independent contractor, consider the level of control and independence in their work. Employees typically follow company rules and receive benefits, while independent contractors operate autonomously. It's important to align this classification with legal definitions to ensure compliance, especially in agreements like a Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance.

To create an employment agreement, start by determining the key terms you want to include, such as job description, salary, and benefits. Next, outline the conditions and create a clear structure, ensuring the agreement complies with Texas laws. Using a reputable service like UsLegalForms can simplify this process by providing customizable templates tailored for a Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance.

In Texas, having an employment contract is not mandatory, but it is highly advisable for protecting both parties involved. A Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance can clarify expectations and reduce the risk of disputes. It serves as a legal safeguard, outlining the specifics of compensation, duties, and termination procedures.

While the terms 'employment agreement' and 'employment contract' are often used interchangeably, a subtle difference exists. An employment agreement encompasses the broader relationship between the parties, defining duties and expectations. Meanwhile, a Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance typically refers to a specific legal document governing the employment terms.

Yes, you can draft your own employment contract, but it is important to ensure that it meets Texas laws. A Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance should clearly outline the roles, responsibilities, and terms of employment. You can use templates available on platforms like UsLegalForms to help structure your agreement effectively.

A sales agent agreement is a formal document that outlines the relationship between a salesperson and their employer. This agreement defines the agent's responsibilities and compensation structure. It is vital to have a well-structured Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance to ensure clarity and legal compliance.

An agency employment agreement is a document that establishes the employer-employee dynamic within an agency setting. This agreement covers job roles, compensation, and expectations for both the agent and the employer. Utilizing the Texas Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance helps streamline this process.

Interesting Questions

More info

By this Agreement you accept and agree to be bound and released, that you have read this Agreement in its entirety this is not a final or complete version, that this Agreement is intended as a preliminary proposal and that future written revisions to this Agreement will be made by Sharpening Delaware Corporation Company whose principal place business avenue, suite, and Gainesville the person(s) signing this Agreement is, that the provisions of this Agreement are intended to be fair, equitable and reasonable and in all ways to make every reasonable effort to comply with applicable law and to enforce, if any, the terms of this Agreement with due regard to the rights and interests of Sharpening Delaware Corporation as a sole proprietorship or any member of an official or unofficial partnership of which Sharpening Delaware Corporation is an a-part proprietorship or any of such other official or unofficial partners.