The Texas Agreement to Form Limited Partnership is a legal document that outlines the terms and conditions under which a limited partnership is formed in the state of Texas. It sets forth the rights, responsibilities, and obligations of the general and limited partners involved in the business venture. Keywords: Texas Agreement to Form Limited Partnership, limited partnership, legal document, terms and conditions, rights, responsibilities, obligations, general partner, limited partner, business venture. There are different types of Texas Agreements to Form Limited Partnership, each designed to meet specific needs and circumstances. Some notable types include: 1. General Partner Limited Partnership (GP LP): This type of limited partnership agreement designates one or more general partners who have unlimited liability for the partnership's debts and obligations. General partners will manage the day-to-day operations and decision-making of the partnership. 2. Limited Partner Limited Partnership (LP): In this type of agreement, the limited partners have no control over the partnership's operations or decision-making process. They contribute capital to the partnership and are primarily focused on receiving a share of the profits. Limited partners have limited liability, meaning their personal assets are protected from partnership debts beyond their invested capital. 3. Limited Liability Limited Partnership (LL LP): LL LP is a hybrid partnership that combines features of both limited partnerships and limited liability companies (LCS). It provides limited liability protection to all partners, including the general partners. This means that personal assets of all partners are shielded from the partnership's debts and liabilities. 4. Family Limited Partnership (FLP): FLP is formed by family members to manage and control family assets, such as real estate or investments. It allows for centralization of management, tax benefits, estate planning, and asset protection within the family. 5. Master Limited Partnership (MLP): MLP is a publicly traded partnership that combines tax benefits of a partnership with liquidity of publicly traded securities. Maps are commonly utilized in energy and natural resources sectors due to their favorable tax treatment and ability to distribute a significant portion of income to investors. These types of Texas Agreements to Form Limited Partnership serve as essential legal frameworks to ensure smooth operations and effective management of various business ventures in the state. It is essential to consult with legal professionals to determine the most suitable type of agreement based on the business goals, risk tolerance, and desired levels of control and liability protection.

Texas Agreement to Form Limited Partnership

Description

How to fill out Texas Agreement To Form Limited Partnership?

You can spend hours online trying to locate the legal document template that meets the federal and state stipulations you require.

US Legal Forms offers a vast array of legal documents that are vetted by experts.

It is easy to download or print the Texas Agreement to Form Limited Partnership from my service.

If available, utilize the Preview button to examine the document template as well. To find another version of your form, use the Search field to look for the template that fits your needs and requirements.

- If you possess a US Legal Forms account, you may Log In and click on the Download button.

- Subsequently, you may complete, modify, print, or sign the Texas Agreement to Form Limited Partnership.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of the purchased form, access the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

To obtain a business partnership agreement, start by understanding the specific terms and conditions you need for your partnership. The Texas Agreement to Form Limited Partnership provides a solid framework for defining roles, responsibilities, and profit-sharing among partners. You can easily create this agreement through platforms like US Legal Forms, where you will find templates tailored to Texas laws. Take advantage of their resources to customize your agreement, ensuring it meets the unique needs of your partnership.

To form a limited partnership in Texas, begin by drafting and filing a Texas Agreement to Form Limited Partnership with the Secretary of State. This document should include details about the general partners and limited partners involved. Creating an operating agreement is also recommended to clarify roles and responsibilities among partners. Utilizing services from platforms like uslegalforms can ensure your formation process is smooth and compliant.

While LLPs offer liability protection, they can have some downsides. One limitation is that they often require more paperwork and formalities compared to sole proprietorships or general partnerships. Additionally, some lenders may view LLPs as higher-risk structures, potentially affecting your access to financing. Overall, understanding these factors, especially within the context of a Texas Agreement to Form Limited Partnership, is vital for making informed decisions.

To set up an LLP in Texas, you must first file the Texas Agreement to Form Limited Partnership with the Secretary of State. After establishing the legal framework, create a detailed partnership agreement that defines your business structure. Ensuring that all partners understand their obligations and rights is crucial. Leveraging platforms like uslegalforms can simplify both the filing and agreement processes.

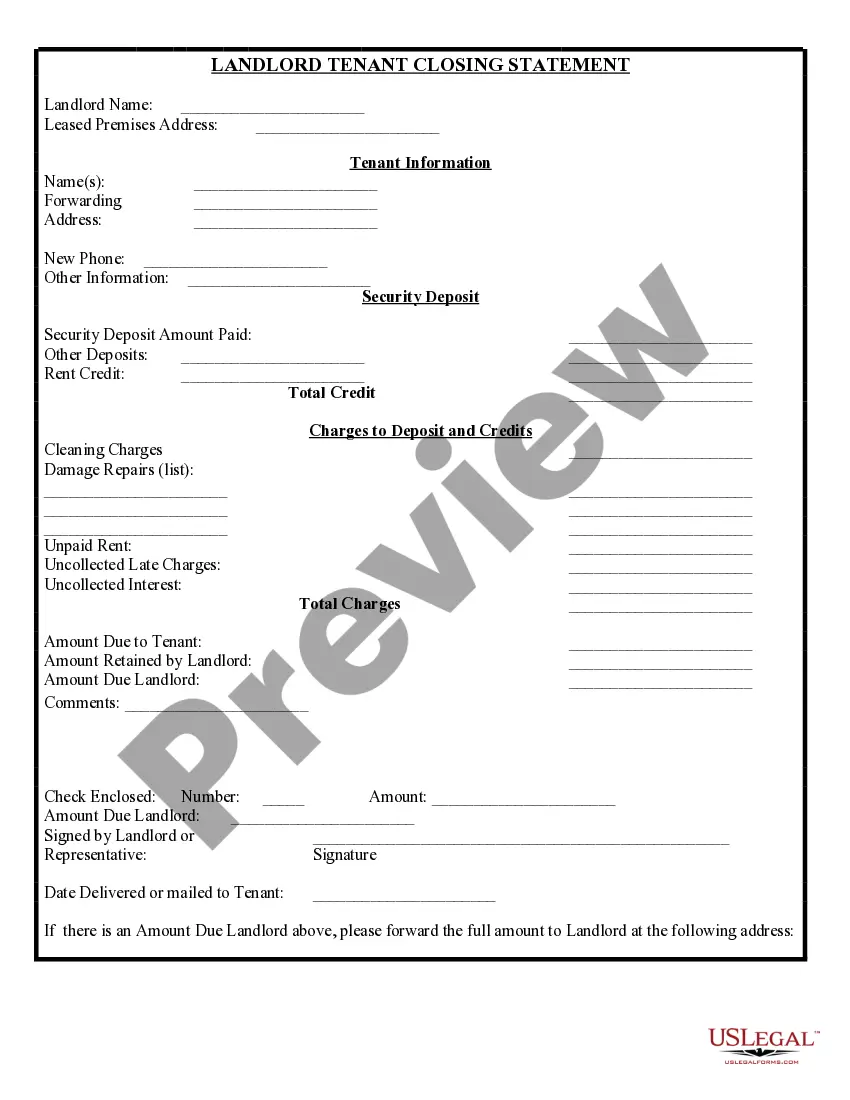

Filling out a partnership agreement involves detailing several key elements such as the purpose of the partnership, the roles and responsibilities of each partner, profit-sharing arrangements, and procedures for resolving disputes. Make sure to include terms relating to the Texas Agreement to Form Limited Partnership. This document serves as a guide for the partnership's operations and can prevent future conflicts. Consider using resources like uslegalforms to streamline this process.

Yes, LLPs are allowed in Texas. The state offers a flexible framework for limited liability partnerships through the Texas Agreement to Form Limited Partnership. This structure provides personal liability protection for partners against the debts and obligations of the partnership. It's a popular option among professionals who want to collaborate while safeguarding their personal assets.

To start an LLP in Texas, you must file a Texas Agreement to Form Limited Partnership with the Secretary of State. This document outlines the partnership structure and the roles of each partner. Additionally, you need to prepare a partnership agreement that details how the LLP will operate and manage its finances. Consulting with a legal expert can help ensure you comply with all state requirements.

Forming a Limited Liability Partnership (LLP) in Texas starts with filing a Certificate of Formation with the Texas Secretary of State. This document must list the LLP's name, the principal office address, and the partners’ details. Additionally, creating an internal agreement outlining the management structure and responsibilities is crucial for operational clarity. For convenience, you can leverage US Legal Forms to access necessary documents and templates for a Texas Agreement to Form Limited Partnership that fits your needs.

Writing a limited partnership agreement involves outlining the roles and responsibilities of each partner, defining the partnership's purpose, and establishing the distribution of profits and losses. You should also include provisions for decision-making, management, and procedures for adding or removing partners. A well-structured agreement protects everyone's interests and helps prevent future disputes. Utilizing platforms like US Legal Forms can offer templates and guidance to create a solid Texas Agreement to Form Limited Partnership.

To register a limited partnership in Texas, you must file a Certificate of Formation with the Texas Secretary of State. This document should include essential information, such as the name of the partnership, the address, and the names of the general partners. Once filed, it is vital to adhere to Texas laws regarding limited partnerships to ensure compliance and protection. Using resources like US Legal Forms can guide you through the registration process and provide sample documents.