Title: Understanding the Texas Agreement to Sell Partnership Interest to Third Party Description: In Texas, an Agreement to Sell Partnership Interest to a Third Party refers to a legally binding contract that allows a partner in a partnership to sell or transfer their ownership interest to an external party, known as the third party. This detailed description will provide you with a comprehensive understanding of this type of agreement, its importance, and potential variations. Keywords: Texas agreement, Sell Partnership Interest, Third Party, legally binding contract, ownership interest, transfer, variations. Types of Texas Agreement to Sell Partnership Interest to Third Party: — Generic Agreement to Sell Partnership Interest: This type of agreement covers the sale or transfer of partnership interest in a general sense, without any specific set of guidelines or terms. — Agreement with Purchase Option: This agreement includes a clause that grants the purchaser an option to acquire the partnership interest at a later date or under specific conditions. It provides flexibility to both parties involved. — Agreement with Right of First Refusal: This agreement outlines a condition where the selling partner must offer their partnership interest to the other partners before selling it to a third party. This grants the partners the first opportunity to purchase the interest at the offered price. — Agreement with Non-Compete Clause: This agreement may include a non-compete clause which limits the selling partner's ability to engage in competing business activities for a certain period, ensuring the interests of the remaining partners. — Agreement with Consent Requirement: This agreement may require the consent or approval of other partners before the sale or transfer of the partnership interest can take place. It aims to protect the partnership's stability and avoid potential conflicts. Key Considerations in a Texas Agreement to Sell Partnership Interest to Third Party: 1. Identify the parties involved: Clearly state the names and addresses of all parties — the selling partner, the third-party purchaser, and the partnership itself. 2. Detailed description of partnership interest: Precisely define the percentage or amount of partnership interest being sold, including any particular rights and obligations associated with it. 3. Purchase price and payment terms: Specify the purchase price agreed upon, its payment schedule, and any other terms of payment, such as installments or lump-sum. 4. Representations and warranties: Enumerate any assurances made by the selling partner regarding the interest being sold, its legality, validity, and any potential claims or liabilities associated with it. 5. Closing and transfer procedures: Outline the steps and requirements that need to be fulfilled for the successful transfer of partnership interest, such as the execution of necessary documents, filing requirements, and timeline. 6. Governing law: Specify that the agreement will be interpreted and governed according to the laws of the state of Texas. Remember, this description provides a general overview of a Texas Agreement to Sell Partnership Interest to a Third Party, and it's recommended to consult with legal professionals to ensure compliance with the existing laws and to address any specific circumstances or variations applicable to your situation.

Texas Agreement to Sell Partnership Interest to Third Party

Description

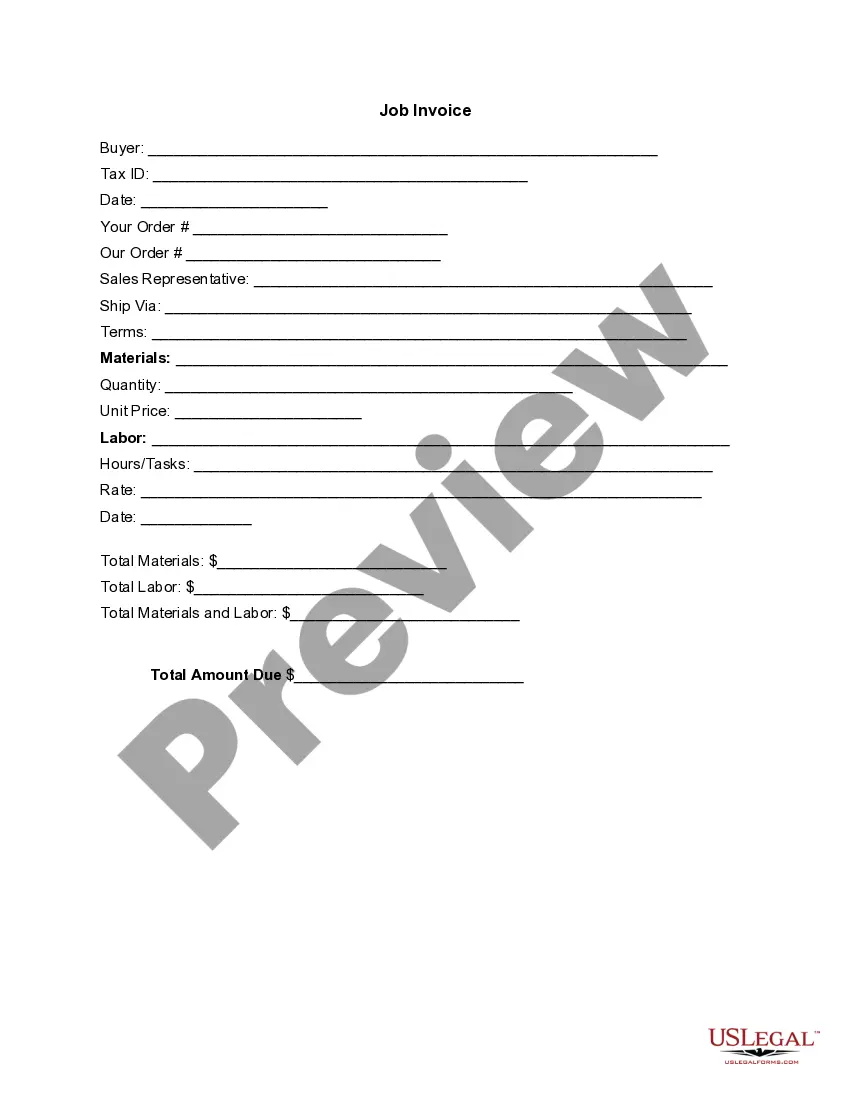

How to fill out Texas Agreement To Sell Partnership Interest To Third Party?

US Legal Forms - among the largest libraries of authorized varieties in the States - gives a wide range of authorized papers themes it is possible to obtain or print out. Utilizing the site, you may get a huge number of varieties for company and person reasons, categorized by groups, says, or keywords.You can find the latest models of varieties like the Texas Agreement to Sell Partnership Interest to Third Party within minutes.

If you already possess a membership, log in and obtain Texas Agreement to Sell Partnership Interest to Third Party from your US Legal Forms local library. The Obtain switch will show up on every kind you see. You have accessibility to all earlier saved varieties from the My Forms tab of your respective profile.

If you wish to use US Legal Forms the very first time, allow me to share easy guidelines to get you started off:

- Be sure you have chosen the proper kind for the city/region. Click the Preview switch to review the form`s articles. Read the kind outline to actually have chosen the right kind.

- When the kind does not satisfy your demands, utilize the Search area towards the top of the display to discover the one which does.

- When you are content with the shape, affirm your option by clicking on the Acquire now switch. Then, choose the costs plan you like and supply your qualifications to sign up to have an profile.

- Procedure the transaction. Make use of charge card or PayPal profile to accomplish the transaction.

- Find the file format and obtain the shape on your own system.

- Make adjustments. Fill up, edit and print out and indicator the saved Texas Agreement to Sell Partnership Interest to Third Party.

Every template you included in your bank account does not have an expiration time and is also your own property eternally. So, if you want to obtain or print out another backup, just proceed to the My Forms area and click on on the kind you want.

Get access to the Texas Agreement to Sell Partnership Interest to Third Party with US Legal Forms, by far the most substantial local library of authorized papers themes. Use a huge number of expert and status-certain themes that meet your company or person needs and demands.

Form popularity

FAQ

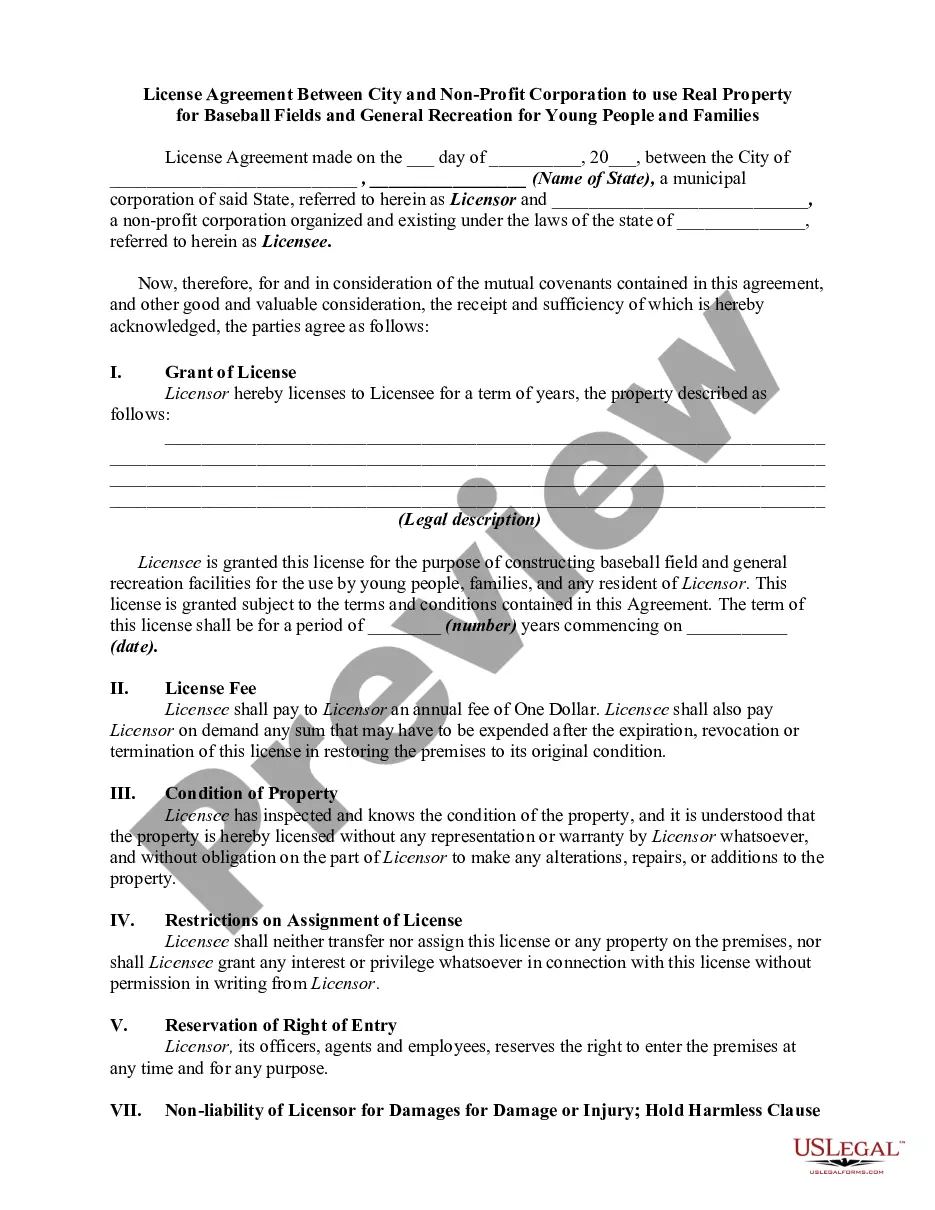

This means that a partner wishing to leave the partnership must first offer their interest to the other members in the company before offering it to an outside party. If all of the members refuse this offer, the partner is then allowed to transfer interest to anyone they choose.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).

Under the purchase scenario, one or more remaining partners may buy out the terminating partner's interest for fair market value (FMV) plus any relief of debt realized by the partner.

Partners in a firm are jointly and severally liable for any breach of trust committed by one partner, in which they were implicated. Persons other than partners may have authority to deal with third parties on behalf of the firm; however, such persons have no implied mandate.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

Which of the following is NOT a consequence of being a partner of a partnership? Partner's are not liable for each other's torts. Which of the following is incorrect concerning a joint venture? Joint venturers have more implied and apparent authority than do partners in a partnership.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

More info

Distance Contact Information Terms Privacy Policy.