Texas Certificate of Amendment to Certificate of Trust of (Name of Trustor)

Description

How to fill out Certificate Of Amendment To Certificate Of Trust Of (Name Of Trustor)?

Choosing the best lawful record format can be quite a struggle. Naturally, there are a variety of themes accessible on the Internet, but how would you discover the lawful type you will need? Make use of the US Legal Forms internet site. The support provides thousands of themes, like the Texas Certificate of Amendment to Certificate of Trust of (Name of Trustor), that you can use for organization and private needs. Each of the types are examined by experts and meet state and federal needs.

Should you be presently listed, log in for your accounts and click the Down load button to have the Texas Certificate of Amendment to Certificate of Trust of (Name of Trustor). Use your accounts to search through the lawful types you have bought formerly. Proceed to the My Forms tab of the accounts and obtain one more version of your record you will need.

Should you be a brand new user of US Legal Forms, here are simple guidelines for you to follow:

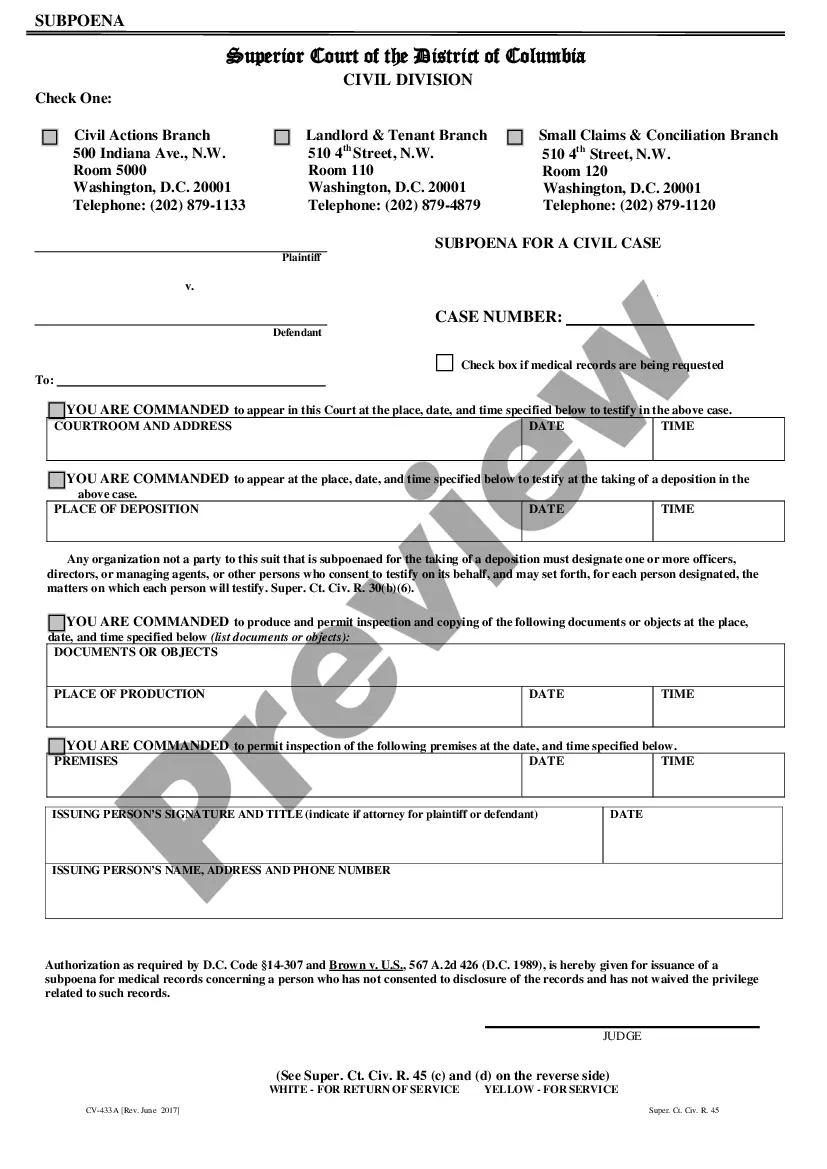

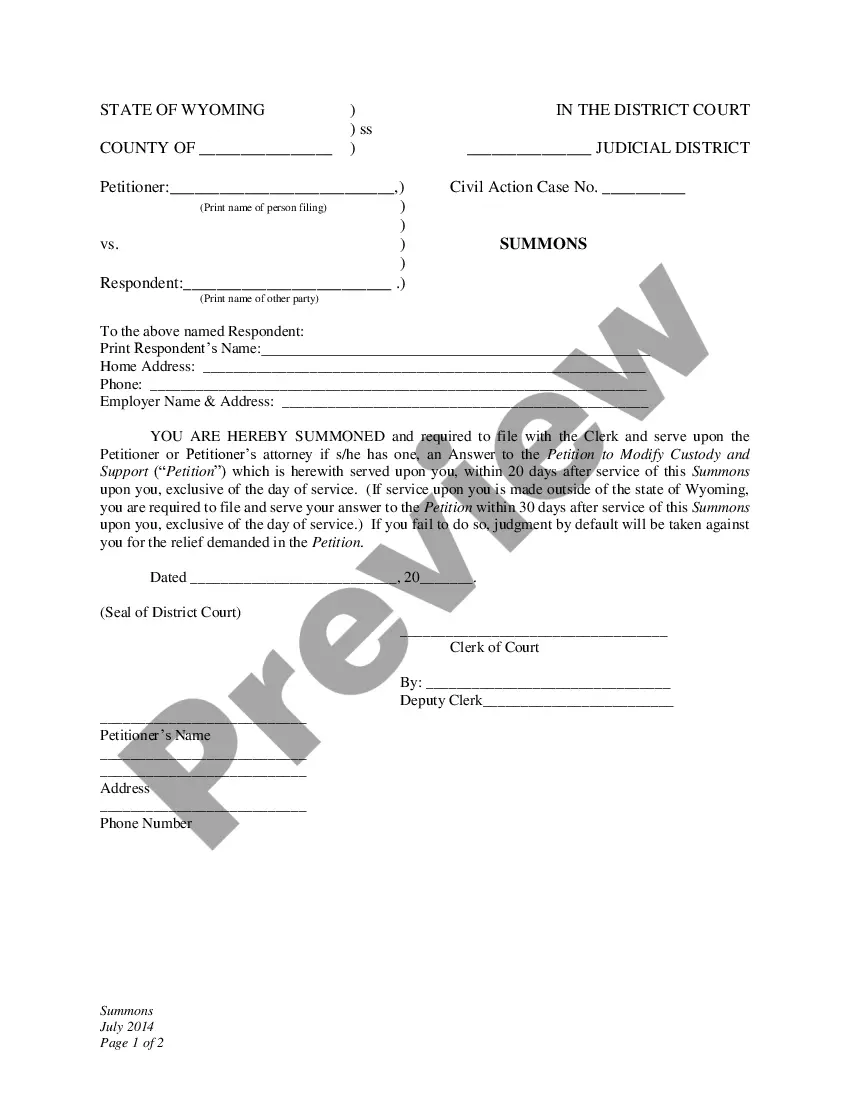

- Initial, ensure you have chosen the correct type for your personal town/county. You can examine the shape using the Review button and browse the shape information to ensure this is basically the best for you.

- In the event the type does not meet your requirements, use the Seach area to obtain the correct type.

- Once you are sure that the shape would work, go through the Acquire now button to have the type.

- Choose the costs strategy you desire and enter the required info. Make your accounts and purchase an order using your PayPal accounts or bank card.

- Select the file formatting and download the lawful record format for your system.

- Full, revise and produce and indication the acquired Texas Certificate of Amendment to Certificate of Trust of (Name of Trustor).

US Legal Forms is definitely the biggest catalogue of lawful types in which you will find various record themes. Make use of the service to download appropriately-created documents that follow express needs.

Form popularity

FAQ

The form may be mailed to P.O. Box 13697, Austin, Texas 78711-3697; faxed to (512) 463-5709; or delivered to the James Earl Rudder Office Building, 1019 Brazos, Austin, Texas 78701. If a document is transmitted by fax, credit card information must accompany the transmission (Form 807).

Keep in mind, if you have a Trust with a partner or spouse, you'll both need to sign the Trust Certification for it to be valid. Once it's signed and notarized, you may need to record it through your local county office, especially if the trust owns or plans to sell any real estate.

To amend your corporation in Texas, there is a $150 filing fee required. Expedited service is available for an additional $25.

An estate planning attorney must review the trust to ensure it can be amended. If the trust allows the surviving settlor to amend the trust, the authority to amend it may only be given to the surviving settlor. The mother may be permitted to amend the trust. However, it can't be anyone acting on her behalf.

As long as you are confident that your trust is validly formed in ance with state law, recording is not required nor necessary. However, for extra peace of mind, you may choose to record your Certificate of Trust with the county clerk's office in order to protect it from unauthorized changes or access.

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

Does a Trust Have to be Witnessed and Notarized? To be valid in Texas, a typewritten Will requires the presence of witnesses. However, there is no similar requirement that a Settlor signs a Trust agreement in the presence of witnesses for it to be valid.

Under the Texas Statutes, requirements for creating a trust include that the trustor is of sound mind, the trustee act in the best interest of the beneficiaries, and that some consideration, which means money or property, is included in the trust.