Texas Annuity as Consideration for Transfer of Securities is a financial arrangement that involves using an annuity as a form of payment or consideration for the transfer of securities. This method is common in Texas and provides individuals with an alternative option to traditional cash payments when acquiring or selling securities. An annuity is a contract between an individual and an insurance company, designed to provide a steady stream of income over a specific period or for life. In the context of transferring securities, an annuity can be used as a valuable asset that holds monetary value and can be exchanged for securities. The use of a Texas Annuity as Consideration for Transfer of Securities has several advantages. Firstly, it allows for flexibility in structuring deals, as both the buyer and seller can negotiate the terms and conditions of the annuity agreement. This option can be particularly useful when there is a need to address specific financial goals, tax implications, or liquidity concerns. Additionally, using an annuity as consideration eliminates the need for immediate cash payments, which can be advantageous if the buyer does not have sufficient funds readily available. This method can offer greater financial security by providing a reliable income source that can help cover the cost of acquiring securities over time. Several types of annuities can be used as consideration for the transfer of securities in Texas. These include fixed annuities, variable annuities, and indexed annuities. 1. Fixed annuities: These annuities guarantee a fixed rate of return over a specified period and provide a fixed income stream for the annuity holder. This type of annuity offers stability and predictable returns, making it an attractive option for those seeking security and consistent income. 2. Variable annuities: Unlike fixed annuities, variable annuities offer the potential for higher returns by allowing the annuity holder to invest in various securities such as stocks, bonds, and mutual funds. However, the returns are not guaranteed and depend on the performance of the chosen investments. Variable annuities are suitable for individuals who are willing to take on some investment risk for the possibility of greater returns. 3. Indexed annuities: These annuities provide a return based on the performance of a specified market index, such as the S&P 500. Indexed annuities offer a balance between fixed and variable annuities, as they provide the potential for higher returns linked to market performance, while also offering some degree of downside protection. This type of annuity may appeal to individuals who desire some market exposure but wish to avoid significant risks. In conclusion, Texas Annuity as Consideration for Transfer of Securities refers to using an annuity as a form of payment or consideration when acquiring or selling securities. This method offers flexibility, potential tax advantages, and a reliable income source for those involved in the securities transfer process. Different types of annuities, such as fixed, variable, and indexed annuities, can be utilized in this context, providing various benefits and features depending on the investor's objectives and risk appetite.

2011 Texas Annuity Training Course Answers

Description

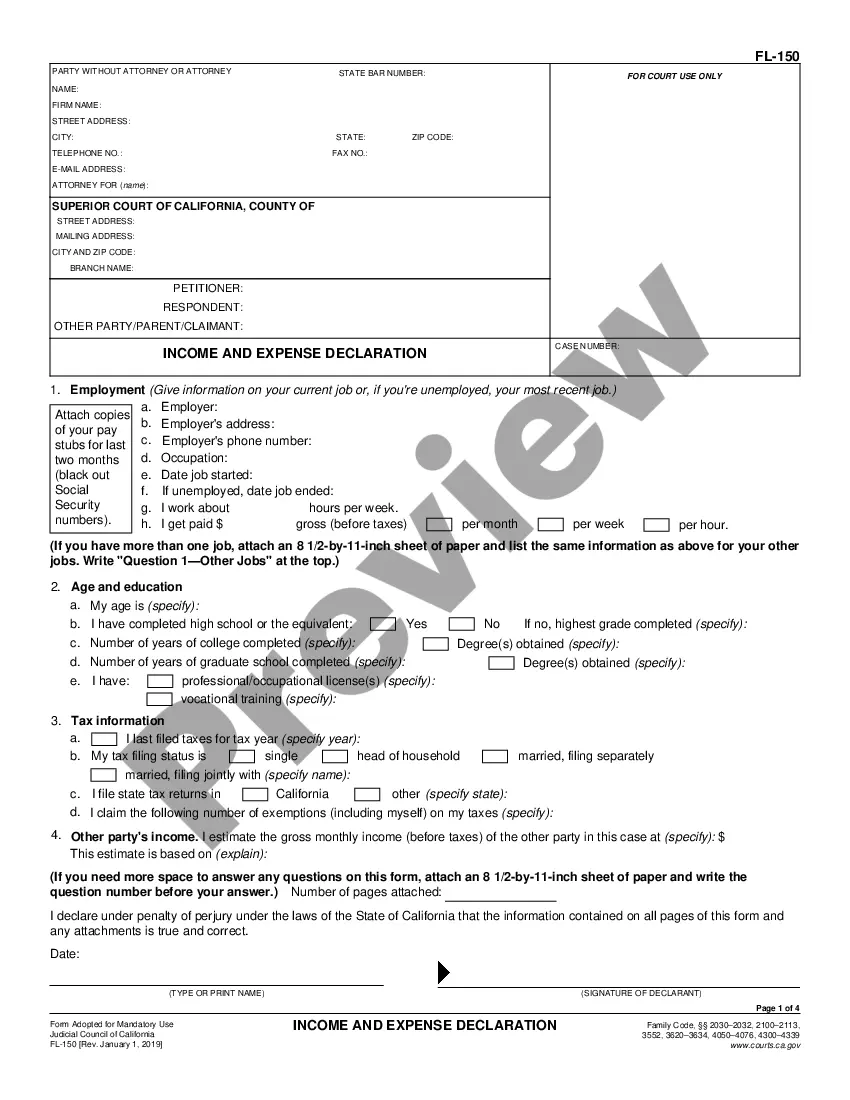

How to fill out Texas Annuity As Consideration For Transfer Of Securities?

If you wish to comprehensive, down load, or print out legitimate file web templates, use US Legal Forms, the largest selection of legitimate kinds, which can be found on the web. Take advantage of the site`s basic and practical research to find the paperwork you need. A variety of web templates for company and person purposes are categorized by groups and says, or search phrases. Use US Legal Forms to find the Texas Annuity as Consideration for Transfer of Securities in a couple of mouse clicks.

If you are previously a US Legal Forms client, log in to the account and then click the Down load switch to have the Texas Annuity as Consideration for Transfer of Securities. You can also access kinds you previously downloaded within the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form to the proper town/country.

- Step 2. Make use of the Preview choice to check out the form`s information. Never forget about to learn the outline.

- Step 3. If you are not happy using the form, utilize the Research field near the top of the display screen to find other versions from the legitimate form web template.

- Step 4. After you have discovered the form you need, click on the Purchase now switch. Choose the prices program you prefer and include your qualifications to sign up for the account.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal account to perform the transaction.

- Step 6. Find the structure from the legitimate form and down load it on your own device.

- Step 7. Complete, modify and print out or indication the Texas Annuity as Consideration for Transfer of Securities.

Every legitimate file web template you purchase is yours permanently. You might have acces to each form you downloaded inside your acccount. Click on the My Forms segment and choose a form to print out or down load once again.

Be competitive and down load, and print out the Texas Annuity as Consideration for Transfer of Securities with US Legal Forms. There are millions of expert and state-certain kinds you can utilize to your company or person demands.

Form popularity

FAQ

Florida and Texas Have Strong Annuity Creditor Protections Exemption of cash surrender value of life insurance policies and annuity contracts from legal process.

As mentioned in the previous paragraph, fixed annuities are safe from lawsuits by creditors or anyone else. Each state has different rules regarding this last benefit and federal rules apply if your annuity is a 401k or IRA investment.

Annuity early withdrawal penalties Annuity withdrawals made before you reach age 59½ are typically subject to a 10% early withdrawal penalty tax. For early withdrawals from a qualified annuity, the entire distribution amount may be subject to the penalty.

Only assets specifically invested in an annuity are protected. Owning an annuity will not protect other non-cash assets, such as real estate.

Insurance agents are often paid well to get people to buy annuities, so there is potential for fraud even with a trusted agent and trusted insurer. Victims of annuities fraud could face substantial losses due to false promises or an inability to access money when they need it.

You don't have to pay taxes on your earnings, or contributions if your annuity is an individual retirement account (IRA), until you withdraw the earnings. Immediate annuities allow you to create an income stream.

An annuity consideration or premium is the money an individual pays to an insurance company to fund an annuity or receive a stream of annuity payments. An annuity consideration may be made as a lump sum or as a series of payments, often referred to as contributions.

Income annuities provide guaranteed lifetime income, either now or in the future, while other types of annuities help defer taxes or provide protection from stock market losses.

Do you pay taxes on annuities? You do not owe income taxes on your annuity until you withdraw money or begin receiving payments. Upon a withdrawal, the money will be taxed as income if you purchased the annuity with pre-tax funds. If you purchased the annuity with post-tax funds, you would only pay tax on the earnings.

Annuity is a contract in between the insurance company (i.e., the party granting the annuity) and the annuitant (receiver of annuity) whereby in consideration of the payment of a purchase price by the annuitant, the other party (i.e., the insurance company) undertakes to make a yearly or annual payment to the annuitant