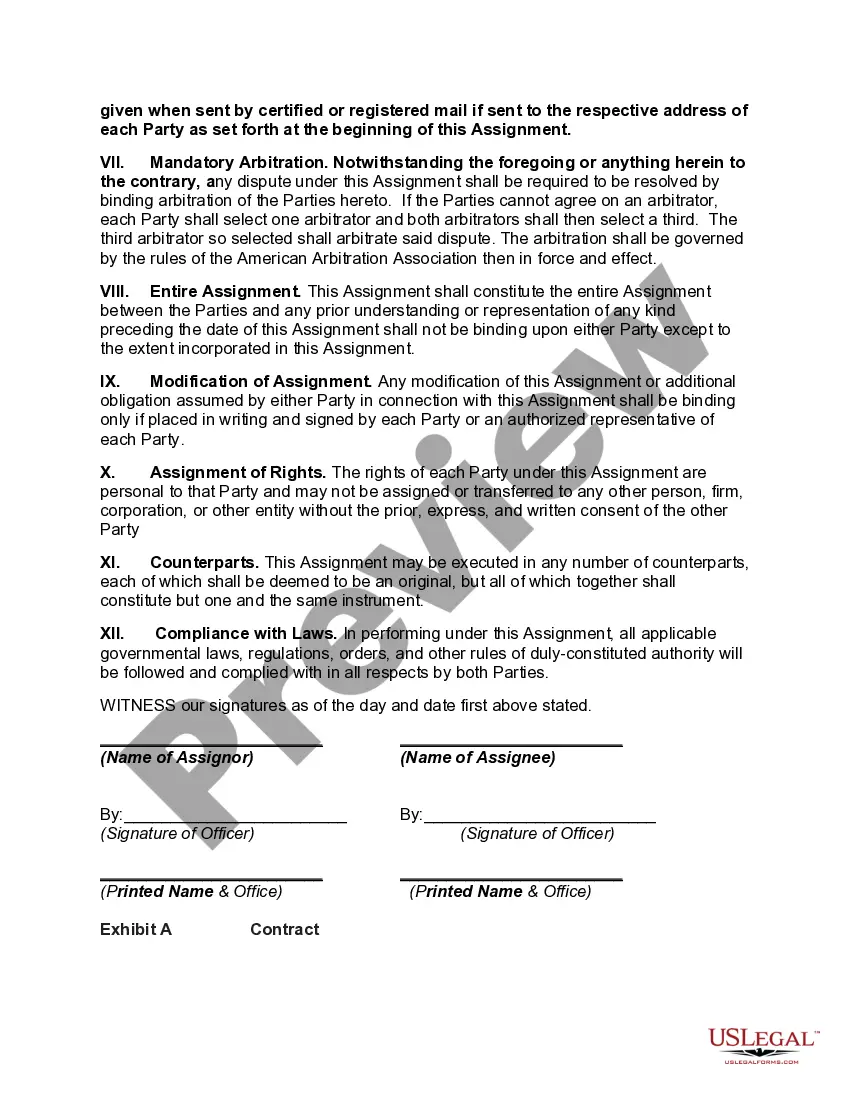

The Texas Assignment of Money Due or to Become Due under Contract refers to a legal document or process through which a party assigns their right to receive payments or money owed to them under a contract to another party. This means that the original beneficiary, known as the assignor, transfers their entitlement to receive future payments to a third party, known as the assignee. In Texas, this type of assignment is governed by the Texas Assignment of Contract Rights statute. It allows individuals or businesses to assign their rights to receive money under various types of contracts, including but not limited to employment agreements, lease agreements, loan agreements, and sales contracts. By entering into an assignment agreement, the assignor effectively transfers their right to collect the money owed to them under the contract to the assignee. This can be useful in situations where the assignor needs immediate funds, wants to delegate the responsibility of collecting payments, or wishes to transfer the contractual rights to a different party. There are a few variations of the Texas Assignment of Money Due or to Become Due under Contract, each catering to specific situations: 1. Absolute Assignment: This type of assignment involves a complete transfer of the assignor's rights, meaning the assignee assumes full responsibility for collecting the money owed and becomes the new beneficiary of the contract. 2. Conditional Assignment: In this case, the assignment is contingent upon specific conditions being met. The assignor's rights are transferred to the assignee, but the final transfer is subject to certain preconditions, often outlined in the assignment agreement. 3. Collateral Assignment: This type of assignment occurs when the assignor uses the money owed as collateral for a loan. The assignor pledges their rights to the assignee as security, ensuring that in the event of non-payment, the assignee has the right to collect the money directly. 4. Partial Assignment: Here, the assignor transfers only part of their rights to the assignee, enabling both parties to share the benefits and responsibilities of collecting the money owed under the contract. The Texas Assignment of Money Due or to Become Due under Contract is a valuable legal tool that allows individuals and businesses to manage their financial obligations more effectively. It provides flexibility, financial options, and the ability to transfer contractual rights as needed. However, it is crucial to seek legal advice and ensure that all parties involved fully understand the terms, conditions, and potential consequences of such an assignment.

Texas Assignment of Money Due or to Become Due under Contract

Description

How to fill out Assignment Of Money Due Or To Become Due Under Contract?

It is possible to spend several hours on the web looking for the authorized document format that fits the state and federal needs you need. US Legal Forms supplies a large number of authorized varieties that happen to be analyzed by professionals. It is possible to down load or produce the Texas Assignment of Money Due or to Become Due under Contract from our service.

If you already have a US Legal Forms account, you can log in and click the Down load option. Afterward, you can comprehensive, revise, produce, or signal the Texas Assignment of Money Due or to Become Due under Contract. Every single authorized document format you get is your own property permanently. To have another copy of any obtained develop, visit the My Forms tab and click the related option.

Should you use the US Legal Forms site the very first time, adhere to the basic recommendations listed below:

- First, make sure that you have chosen the best document format for your county/metropolis of your choosing. See the develop outline to ensure you have selected the proper develop. If accessible, use the Review option to look through the document format too.

- In order to get another edition of your develop, use the Research area to discover the format that meets your requirements and needs.

- Upon having located the format you would like, click on Get now to continue.

- Select the rates strategy you would like, type your qualifications, and register for your account on US Legal Forms.

- Comprehensive the deal. You may use your credit card or PayPal account to fund the authorized develop.

- Select the format of your document and down load it to the gadget.

- Make changes to the document if needed. It is possible to comprehensive, revise and signal and produce Texas Assignment of Money Due or to Become Due under Contract.

Down load and produce a large number of document web templates utilizing the US Legal Forms site, that offers the largest selection of authorized varieties. Use skilled and state-particular web templates to tackle your organization or personal needs.

Form popularity

FAQ

Obligations cannot be transferred to a third party except by novation. An assignment may be either a legal assignment or an equitable assignment. For more information on assigning rights under a contract, see Practice note, Contracts: assignment.

In order for an assignment of contract to occur, the original contract must be eligible. Some contracts may be written to disallow assignment or may require consent from one or both/all parties for assignment to occur. In addition, an assignment does not always remove full liability from the assignor.

An assignment of contract occurs when one party to an existing contract (the "assignor") hands off the contract's obligations and benefits to another party (the "assignee"). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights.

An assignable contract has a provision allowing the holder to give away the obligations and rights of the contract to another party or person before the contract's expiration date. The assignee would be entitled to take delivery of the underlying asset and receive all of the benefits of that contract before its expiry.

As required by our Legal Terms, attorneys must disclose if any AI is used in answering your question. Yes, you may assign it, although absent Seller's written consent you won't be released from your duties stated in the Contract.

That no assignment clause says that neither party can transfer or assign this agreement without the written consent of the other party. If you look at the assignment clause, that generally makes sense, because you may not want to be in a contract with a new person that you didn't initially know about.

(a) A contract assignment must be made as part of an ownership change, a change in tax status, or a transfer from one legal entity to another through a legal process. No assignment is effective until approved, in writing, by the Texas Department of Human Services (DHS).

A statutory right to cancel a contract or return a purchase because you change your mind is not the norm in Texas. State law grants a right to cancel ? also called a ?right of rescission? or a ?cooling off? period ? in only a few specific instances.