Texas Depreciation Schedule

Description

How to fill out Depreciation Schedule?

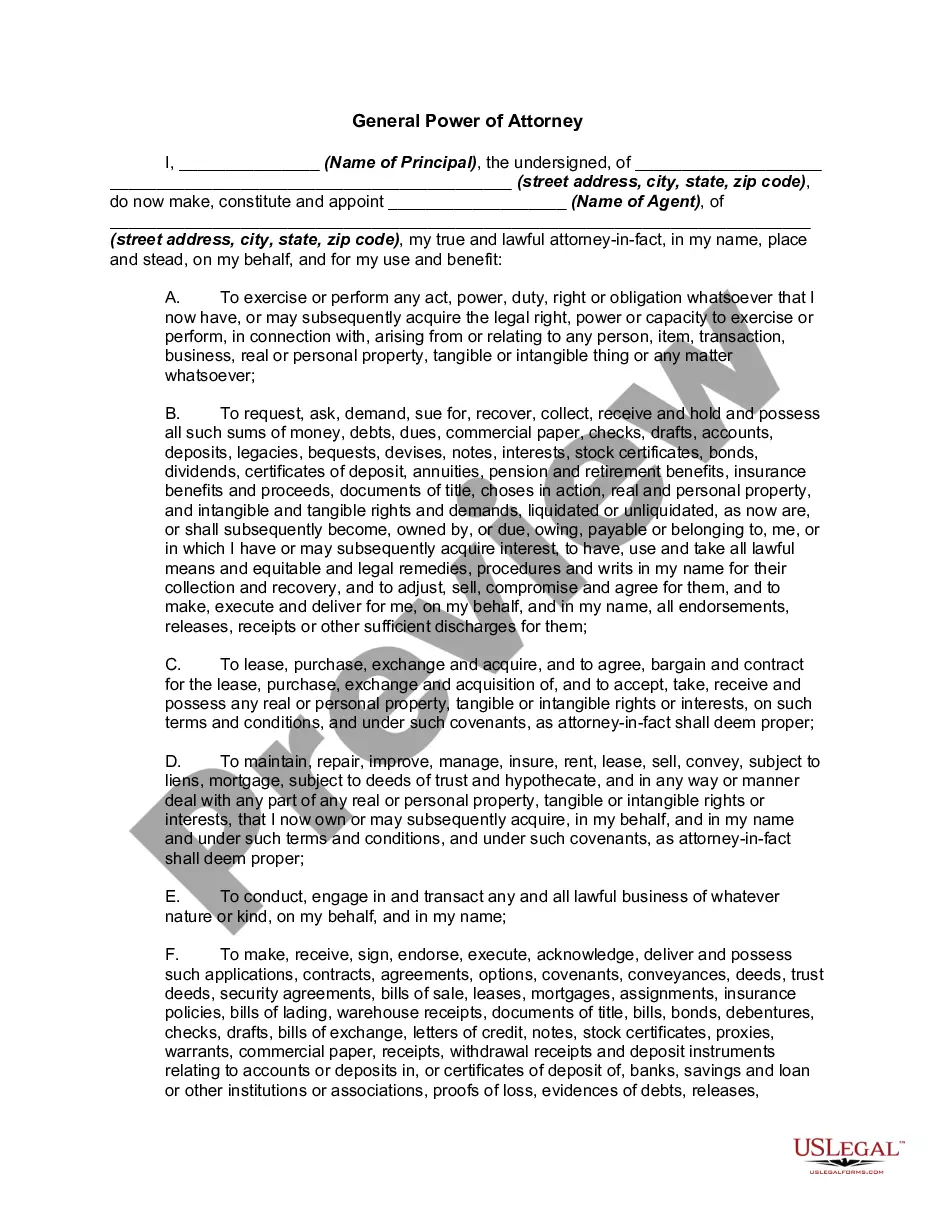

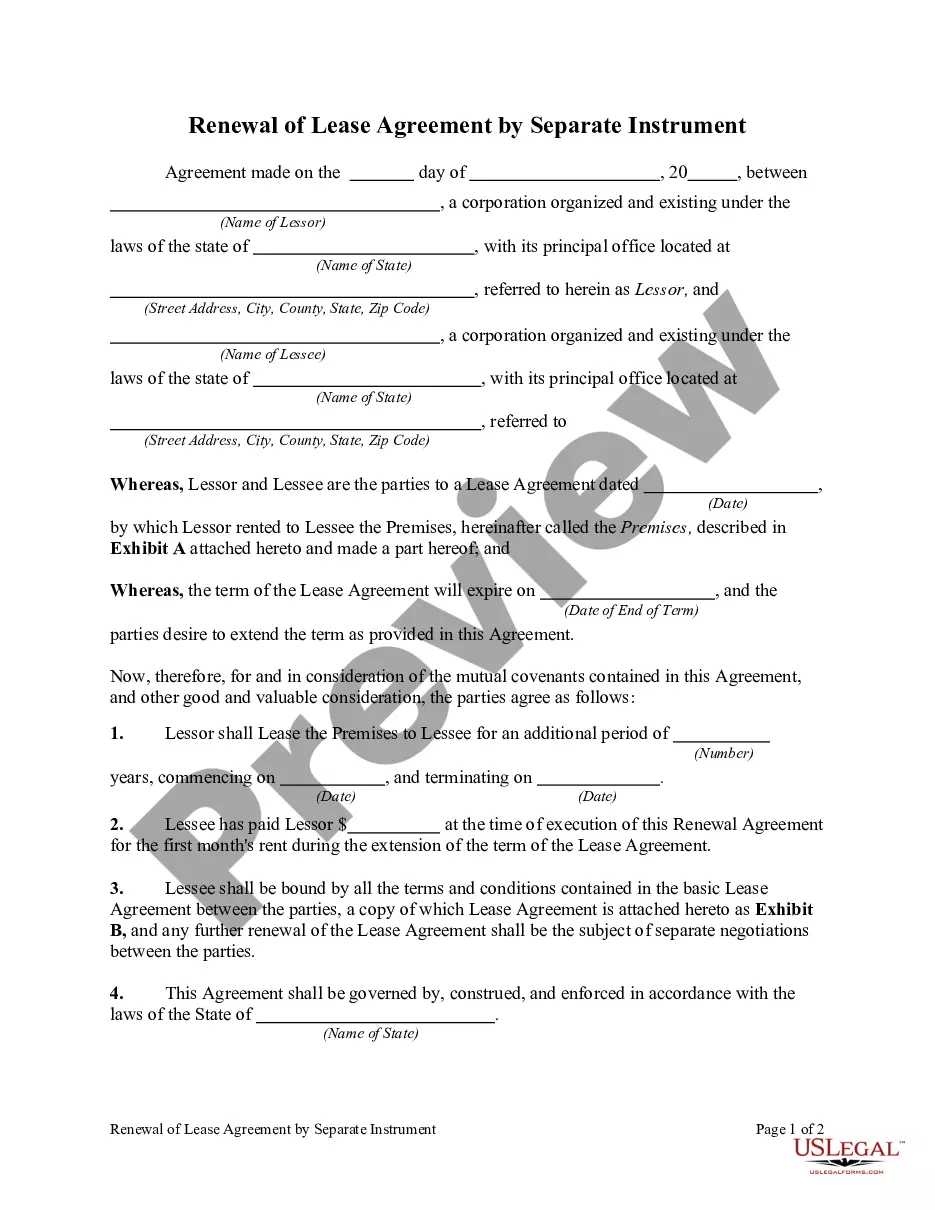

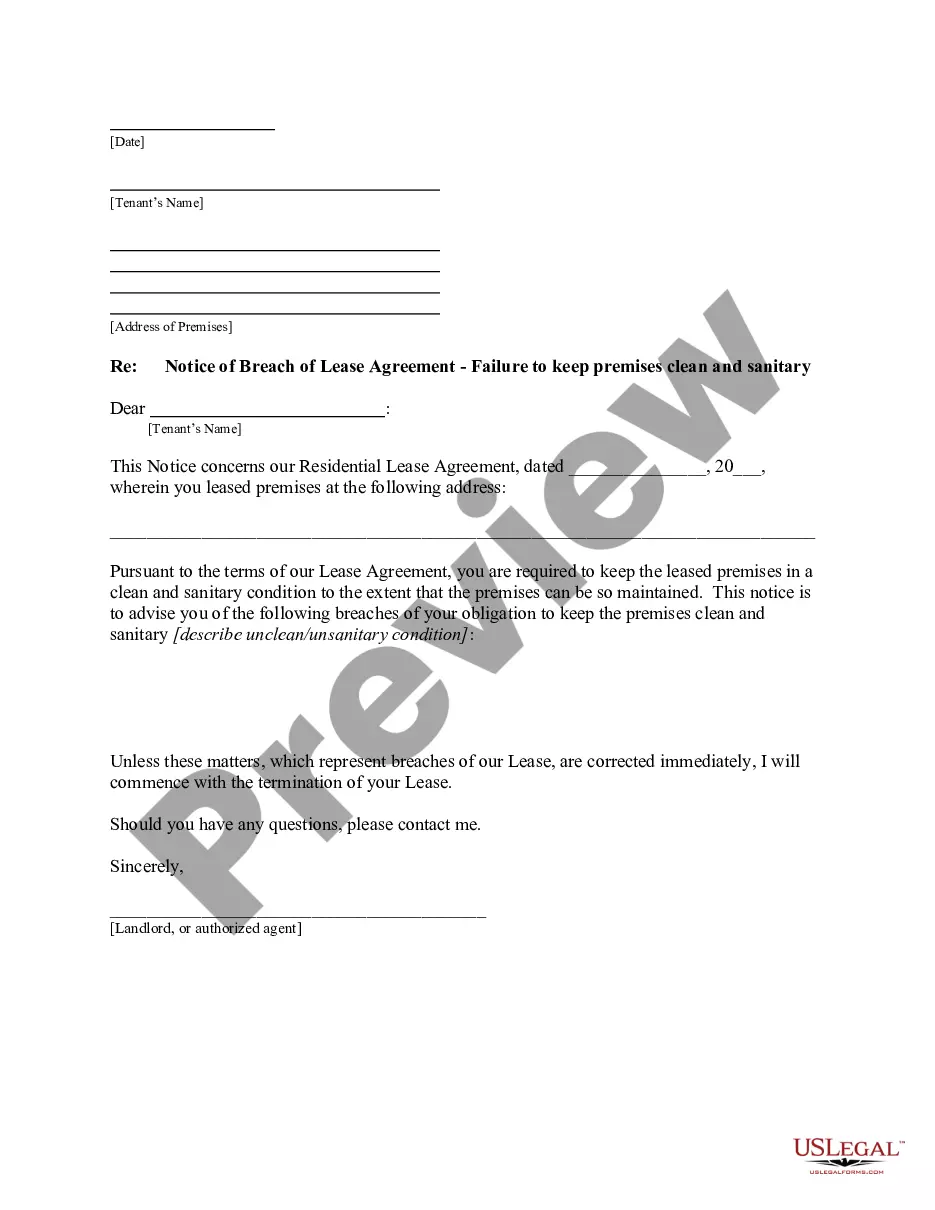

If you desire to finalize, obtain, or produce valid document templates, utilize US Legal Forms, the largest variety of valid forms, that are available online.

Employ the site’s user-friendly and accessible search to locate the documents you need.

A selection of templates for commercial and personal purposes are categorized by types and titles, or keywords and phrases.

Step 4. Once you have located the form you require, click on the Purchase now button. Choose the payment plan you prefer and input your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to discover the Texas Depreciation Schedule in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to obtain the Texas Depreciation Schedule.

- You may also access forms you previously stored in the My documents section of the account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review function to inspect the form's content. Remember to read the summary.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find alternative versions of the valid document template.

Form popularity

FAQ

Trust your tax software or a tax professional to help you complete a tax depreciation schedule. MACRS usually follows the straight line or double declining method. IRS Publication 946 determines each asset's useful life and explains all the depreciation and amortization rules and regulations.

A depreciation schedule is a report that outlines all available tax depreciation deductions for a residential investment property or commercial building. Most properties, new and old, have depreciation available. depreciation can be claimed in your tax return each financial year to help you save thousands.

What does a depreciation schedule include?A breakdown of all building allowance costs.A breakdown of all plant and equipment costs.The rates at which you can claim different items and the effective lifespan estimate of each item.A breakdown of how much you can claim per annum based on the financial year end.

That way the quantity surveyor will see your property in the true state of what you have purchased. And if the tenant hasn't moved in yet, that's a bonus, as it will avoid disruption. The good news is you only need to have the depreciation schedule prepared ONCE not every year as some people think. 4.

How do I get a depreciation schedule? In order to create a depreciation schedule, you'll need to schedule a site inspection with a qualified quantity surveyor if your investment property was built after 1985 and/or the costs of construction are unknown. It's an ATO requirement.

What does a depreciation schedule include?A breakdown of all building allowance costs.A breakdown of all plant and equipment costs.The rates at which you can claim different items and the effective lifespan estimate of each item.A breakdown of how much you can claim per annum based on the financial year end.

To calculate the annual amount of depreciation on a property, you divide the cost basis by the property's useful life. In our example, let's use our existing cost basis of $206,000 and divide by the GDS life span of 27.5 years. It works out to being able to deduct $7,490.91 per year or 3.6% of the loan amount.

If you own a rental property that is eligible for depreciation, you should get a tax depreciation schedule, or at least a depreciation estimate, to help with your decision. This will allow you to claim depreciation deductions each financial year when lodging your tax return, so you pay less tax.

Divide the expected units to be produced for each year by the total expected units over the asset's life, then multiply the result by the difference of price and salvage value to find the depreciation for each year.

Usually, the information that a depreciation schedule includes is a description of the asset, the date of purchase, how much it costs, how long the firm estimates to use the asset (life), and the value of the asset when the firm decides to replace it (salvage value).