Title: Texas Memorandum to Stop Direct Deposit: Exploring its Purpose and Variants Description: The Texas Memorandum to Stop Direct Deposit is a legal document that authorizes individuals to halt or terminate direct deposit payments from a specific source or organization. This comprehensive description will shed light on its purpose, providing relevant keywords and highlighting different types or variants of the memorandum. Keywords: Texas Memorandum, Stop Direct Deposit, Legal Document, Terminate Direct Deposit, Halt Payments, Variants 1. Purpose of Texas Memorandum to Stop Direct Deposit: The purpose of a Texas Memorandum to Stop Direct Deposit is to grant individuals the legal authority to halt or terminate direct deposit payments. This document ensures that payments are no longer made to an individual's account from a specific source, helping individuals exercise control over their finances and discontinue unwarranted or unwanted transactions. 2. Key Elements of the Memorandum: The key elements of a Texas Memorandum to Stop Direct Deposit typically include: — Identifying information: Such as the individual's name, contact details, and relevant account information. — Source/organization details: The name and address of the organization from which the individual wishes to terminate direct deposit payments. — Effective date: The specific date on which the direct deposit should cease. — Signatures: Signatures of the account holder and, in some cases, the employer or the organization involved. 3. Different Types of Texas Memorandum to Stop Direct Deposit: While the core purpose remains the same, there might be slight variations in the types of Texas Memorandum to Stop Direct Deposit based on the specific source or organization involved. Some common variants include: a. Texas Memorandum to Stop Direct Deposit from an Employer: This variant is applicable when an employee wishes to stop direct deposit payments from their current or former employer. b. Texas Memorandum to Stop Direct Deposit from a Government Agency: Specific to individuals receiving direct deposit payments from a government agency, this memorandum variant ensures the termination of such payments. c. Texas Memorandum to Stop Direct Deposit from a Financial Institution: In cases where an individual wants to cease direct deposit transactions from a specific financial institution, this variant proves useful. d. Texas Memorandum to Stop Direct Deposit from a Pension Provider: This variant applies to individuals who wish to halt direct deposit payments from their pension provider. 4. How to Obtain and File a Texas Memorandum to Stop Direct Deposit: To obtain a Texas Memorandum to Stop Direct Deposit, one can typically visit their employer's HR department, contact the responsible government agency, financial institution, or pension provider. It is crucial to follow the instructions provided by these entities to ensure timely filing and submission of the document. In conclusion, the Texas Memorandum to Stop Direct Deposit serves as a powerful legal tool allowing individuals in Texas to regain control over their financial affairs. By understanding its purpose and knowing the different types or variants, individuals can make informed decisions and take appropriate action to halt or terminate direct deposit payments from specific sources or organizations.

Texas Memorandum to Stop Direct Deposit

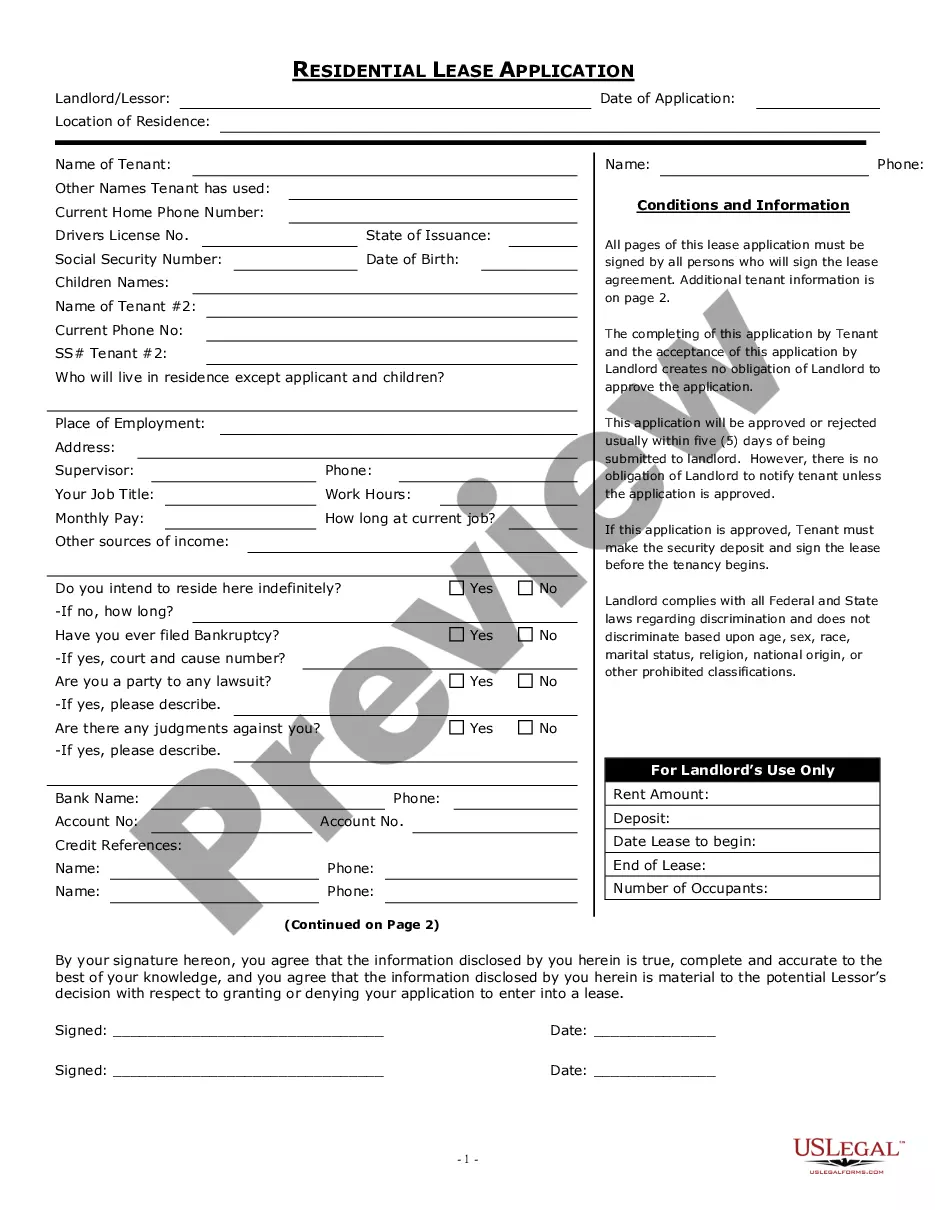

Description

How to fill out Texas Memorandum To Stop Direct Deposit?

US Legal Forms - one of many largest libraries of lawful forms in the USA - gives a wide array of lawful papers web templates it is possible to download or produce. Utilizing the web site, you may get a huge number of forms for organization and personal purposes, categorized by classes, suggests, or search phrases.You will discover the newest versions of forms just like the Texas Memorandum to Stop Direct Deposit in seconds.

If you currently have a subscription, log in and download Texas Memorandum to Stop Direct Deposit from the US Legal Forms library. The Down load switch can look on every single kind you perspective. You get access to all in the past delivered electronically forms within the My Forms tab of your own accounts.

In order to use US Legal Forms the very first time, listed here are basic directions to obtain began:

- Ensure you have selected the best kind for your metropolis/state. Select the Review switch to examine the form`s content. See the kind explanation to ensure that you have chosen the proper kind.

- In the event the kind does not suit your specifications, make use of the Search industry near the top of the display screen to find the the one that does.

- When you are satisfied with the form, verify your decision by clicking on the Purchase now switch. Then, choose the rates prepare you like and give your accreditations to sign up for an accounts.

- Process the financial transaction. Make use of your bank card or PayPal accounts to finish the financial transaction.

- Pick the format and download the form on the device.

- Make modifications. Fill out, change and produce and sign the delivered electronically Texas Memorandum to Stop Direct Deposit.

Each template you included with your bank account lacks an expiry particular date which is the one you have for a long time. So, if you wish to download or produce another version, just go to the My Forms segment and click about the kind you require.

Obtain access to the Texas Memorandum to Stop Direct Deposit with US Legal Forms, the most substantial library of lawful papers web templates. Use a huge number of skilled and condition-specific web templates that fulfill your organization or personal requires and specifications.

Form popularity

FAQ

State Law. In 2003, the Texas Payday Law was amended to include a provision for direct deposit. The amendment allows mandatory direct deposit for employees who keep appropriate bank accounts.

Direct Deposit Reversal If you have direct deposit, your employer can issue a reversal request to your bank, which then attempts to take the wages out of your account. The reversal must be for the full amount of the transaction that went into your account.

Cancellation by the Financial Institution: The financial institution receiving the direct deposits may cancel direct deposit. The institution must provide you and your payroll office 30 days written notice of the cancellation. The cancellation will not take effect until the Research Foundation processes it.

If direct deposit money is sent to a closed account, the funds may be returned to the original sender. While it might not go directly to you, it also will not be lost, and you need to get the sender your new account information.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days.

State Law. In 2003, the Texas Payday Law was amended to include a provision for direct deposit. The amendment allows mandatory direct deposit for employees who keep appropriate bank accounts.

Employee Requests Direct Deposit be Stopped Depending on the situation, they may instruct the employee to reopen their account or contact the bank for assistance. If they determine the payment should be stopped, the payroll office can complete the stop pending form.

If you determine that a direct deposit payment was made to an incorrect payee, for an incorrect amount or is a duplicate payment, you can submit a Direct Deposit Reversal Request form (74-191) (login required) to retrieve the erroneous direct deposit payment.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days. Assuming there is no applicable state law that overrides this guideline, an employer must follow it.

To stop the next scheduled payment, give your bank the stop payment order at least three business days before the payment is scheduled. You can give the order in person, over the phone or in writing. To stop future payments, you might have to send your bank the stop payment order in writing.