Texas Returned Items Report

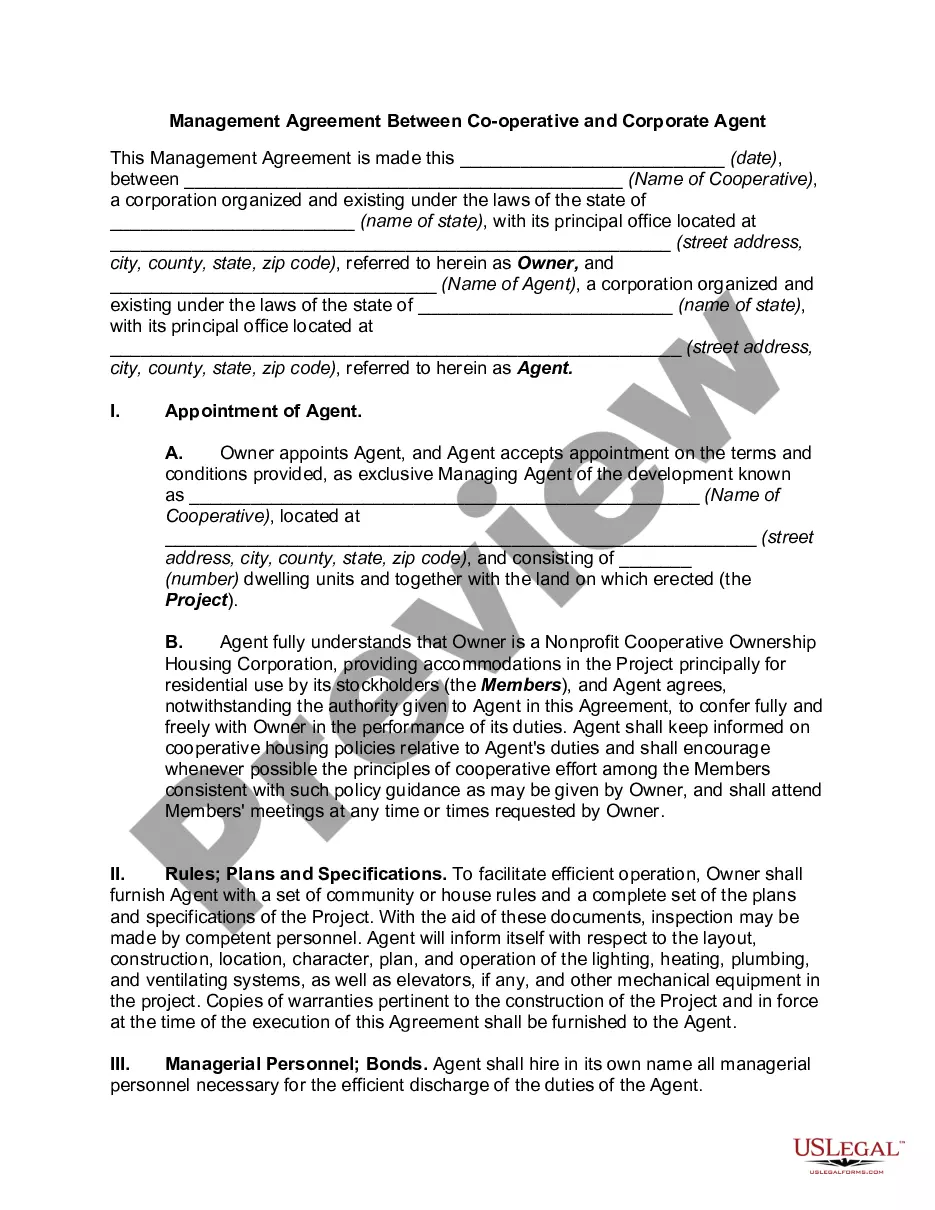

Description

How to fill out Returned Items Report?

Are you presently in a circumstance that necessitates documents for both professional or personal purposes nearly every day.

There are numerous authentic document templates available online, but finding ones you can rely on isn't easy.

US Legal Forms offers thousands of form templates, such as the Texas Returned Items Report, designed to meet federal and state regulations.

You can find all the document templates you have purchased in the My documents section.

You can acquire an additional copy of the Texas Returned Items Report at any time if needed. Just click the desired form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Once logged in, you can download the Texas Returned Items Report template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/state.

- Use the Review feature to examine the form.

- Check the description to confirm you have selected the right form.

- If the form isn't what you're looking for, use the Lookup field to find the document that meets your needs.

- Once you find the correct document, click Buy now.

- Choose the pricing option you want, fill in the necessary details to create your account, and complete the transaction using your PayPal or Visa/Mastercard.

- Select a convenient file format and download your copy.

Form popularity

FAQ

File online File online at the TxComptroller eSystems site. You can remit your payment through their online system. Click here for a step-by-step guide to filing your Texas sales tax returns. File by mail You can also download a Texas Sales and Use tax return here.

If you do not hold a Texas sales and use tax permit and you are the purchaser, you must first ask the seller for a refund of any tax paid in error. The seller can either grant the refund or give you Form 00-985, Assignment of Right to Refund (PDF), which allows you to file a refund claim directly with the Comptroller.

Sales tax refund can be described as if a registered person has overpaid sales tax because of error, he / she may request a refund of the overpaid amount from the relevant tax authorities within a year after the payment is made or after the decision or order causing the refund is announced from the end of the period

An exemption certificate must show:(1) the name and address of the purchaser;(2) a description of the item to be purchased;(3) the reason the purchase is exempt from tax;(4) the signature of the purchaser and the date; and.(5) the name and address of the seller.

If you bought something and paid sales tax for it, then you should receive that same sales tax back if you return the item. In general, this should happen regardless of location, and regardless of whether or not you bought the item online.

States want to ensure that the credit you take for refunds equals the amount of sales tax you charged your customer. If a sales tax rate went up 1% between the period where you filed sales tax and the period where you took a credit, you would be credited an extra 1% for each sale.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Unpaid sales or use tax is recoverable by the seller in the same manner as the original sales price of the taxable item itself, if unpaid, would be recoverable. The comptroller may proceed against either the seller or purchaser, or against both, until all applicable tax, penalty, and interest due has been paid.

The exemption certificate is properly completed and legible:name and address of the purchaser.description of the item to be purchased.the reason the purchase is exempt.signature of purchaser and date; and.name and address of the seller.

An exemption certificate must show:(1) the name and address of the purchaser;(2) a description of the item to be purchased;(3) the reason the purchase is exempt from tax;(4) the signature of the purchaser and the date; and.(5) the name and address of the seller.