Texas Payroll Deduction Authorization Form

Description

How to fill out Payroll Deduction Authorization Form?

If you wish to finalize, acquire, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal documents, which can be accessed online.

Take advantage of the website's straightforward and easy-to-use search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords and phrases.

Every legal document template you purchase is yours permanently. You can access every document you've saved in your account. Click on the My documents section and choose a document to print or download again.

Be proactive and download and print the Texas Payroll Deduction Authorization Form with US Legal Forms. There are numerous professional and state-specific documents available for your business or personal needs.

- Utilize US Legal Forms to find the Texas Payroll Deduction Authorization Form in just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and click the Download button to obtain the Texas Payroll Deduction Authorization Form.

- You can also access forms you previously saved within the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

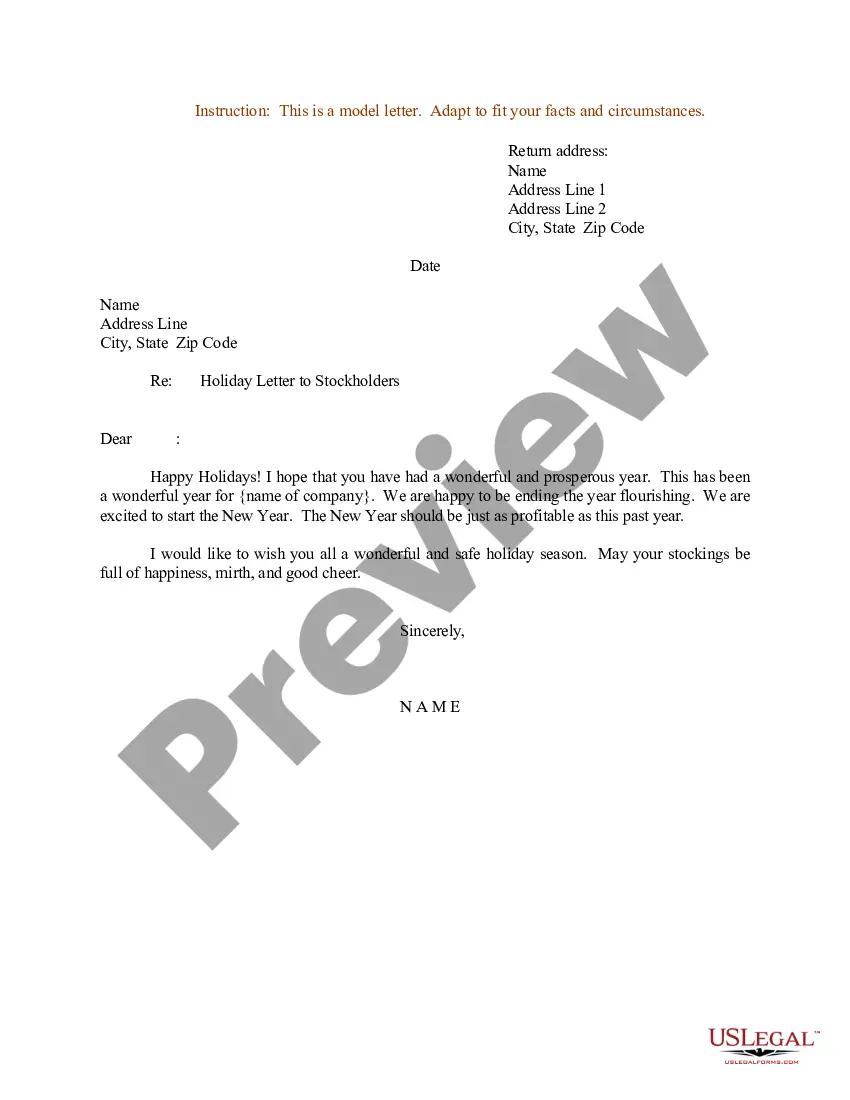

- Step 2. Use the Review option to examine the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Texas Payroll Deduction Authorization Form.

Form popularity

FAQ

Authorization is a formal agreement that allows someone to take a specific action on your behalf. In the context of the Texas Payroll Deduction Authorization Form, it enables employers to deduct amounts from your paycheck for items like benefits or loans. This ensures that both the employer and employee have clear permissions, making payroll management smoother.

Payroll authorization refers to the process by which an employee grants permission to an employer to deduct certain amounts from their paycheck. Using the Texas Payroll Deduction Authorization Form, employees can specify what deductions are allowed. This process ensures transparency and compliance with Texas labor laws, making it easier for both parties.

Authorized Deduction means those items set forth in each Application, or other authorization, that a Settlement Products Client authorizes the Originator, or a servicer on behalf of the Originator, to deduct from its Deposit Account.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

In general, an employer is not permitted to deduct from an employee's wages unless the deduction is authorized by law, such as with court-ordered child support or state or federal taxes. However, if an employee agrees in writing to have wages deducted for a lawful purpose, then deductions are permitted.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

If an employer makes an unlawful deduction from an employee's paycheck to recover a wage overpayment, the aggrieved employee can file a wage claim with the DLSE or file a lawsuit. A finding against an employer could expose the employer to penalties and the employee's attorney's fees.

Mandatory Payroll Tax DeductionsSocial Security & Medicare taxes also known as FICA taxes. State income tax withholding. Local tax withholdings such as city or county taxes, state disability or unemployment insurance.

The law on wage deductionsTaking money from wages without consent or contractual provision can result in a claim for unlawful deduction of wages, even if the individual has been employed for less than two years.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.