Texas Resolution of Meeting of LLC Members to Dissolve the Company

Description

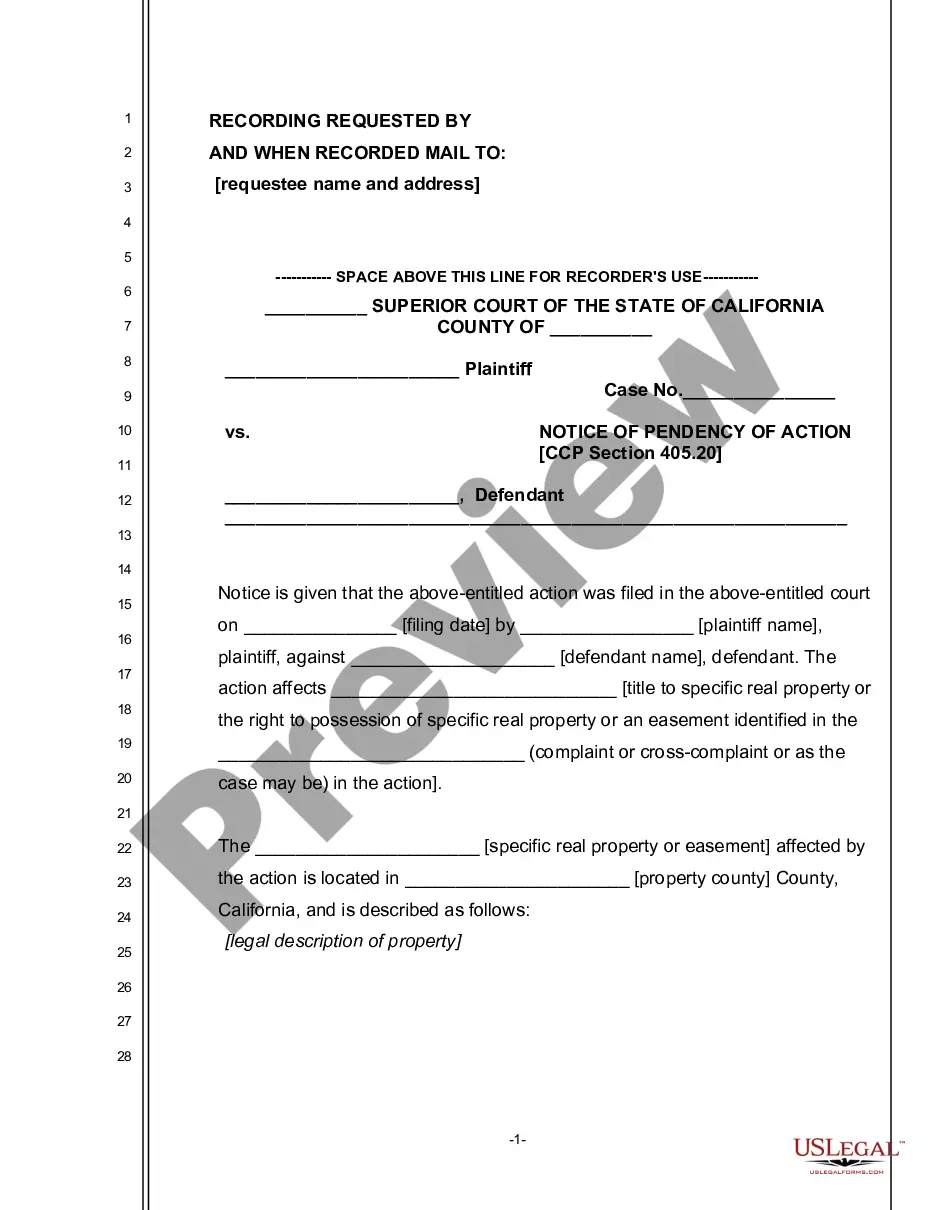

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

Choosing the best legal record design can be quite a have a problem. Naturally, there are a variety of themes available on the net, but how will you discover the legal form you need? Utilize the US Legal Forms site. The support delivers a huge number of themes, including the Texas Resolution of Meeting of LLC Members to Dissolve the Company, which you can use for enterprise and personal demands. Each of the kinds are checked out by specialists and meet up with federal and state requirements.

If you are currently signed up, log in to the accounts and click on the Obtain button to get the Texas Resolution of Meeting of LLC Members to Dissolve the Company. Use your accounts to search throughout the legal kinds you may have acquired formerly. Visit the My Forms tab of your accounts and obtain yet another copy in the record you need.

If you are a new end user of US Legal Forms, listed here are straightforward guidelines that you can comply with:

- First, be sure you have selected the proper form to your city/region. You are able to check out the form utilizing the Preview button and look at the form outline to make sure it is the best for you.

- When the form will not meet up with your requirements, make use of the Seach industry to get the appropriate form.

- Once you are certain that the form is proper, select the Buy now button to get the form.

- Pick the prices plan you want and type in the necessary info. Design your accounts and pay money for your order utilizing your PayPal accounts or credit card.

- Opt for the file format and down load the legal record design to the product.

- Comprehensive, change and print out and sign the acquired Texas Resolution of Meeting of LLC Members to Dissolve the Company.

US Legal Forms will be the most significant catalogue of legal kinds in which you can discover numerous record themes. Utilize the company to down load appropriately-created paperwork that comply with status requirements.

Form popularity

FAQ

Closing an LLC is not as simple as locking the door and walking away. There are several steps you must take to protect yourself from liability and withdraw remaining assets from the company. by Brette Sember, J.D. Making the decision to close a business can be stressful.

It will take 4-6 weeks for the CPA to process your request. Once you receive your certificate of account status, you will need to attach it to your certificate of termination.

Expelling a member and redeeming their membership interest (buying them out) are two distinct acts. Typically, expelled members are no longer permitted to vote, access company books and records, or otherwise influence the operations of the company. They are, however, still equity holders in the company.

How you remove an LLC member from your company will depend on the internal procedures of the company.Review the Operating Agreement. First, review the LLC operating agreement.Review Any Additional Written Agreements, Such as a Buyout Agreement.Complete the Membership Change.Inform the State of Texas.

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee. The form can be filed online. If you'd like to save yourself some time, you can hire us to dissolve your LLC for you.

Pursuant to section 152.802 of the Texas Business Organizations Code (BOC), the registration of a limited liability partnership may be voluntarily withdrawn by filing a withdrawal notice with the secretary of state.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

The Secretary of State charges a $40 filing fee for dissolving an LLC. If submitting via the website, you can pay online when you submit the forms. Checks should be payable to the secretary of state, and if you're paying by credit card via fax, make sure you also attach Form 807.

How you remove an LLC member from your company will depend on the internal procedures of the company.Review the Operating Agreement. First, review the LLC operating agreement.Review Any Additional Written Agreements, Such as a Buyout Agreement.Complete the Membership Change.Inform the State of Texas.

A shareholder resolution to dissolve corporation agreement is an authorization used when shareholders, during a formal meeting, agree to dissolve the corporation.