Texas Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

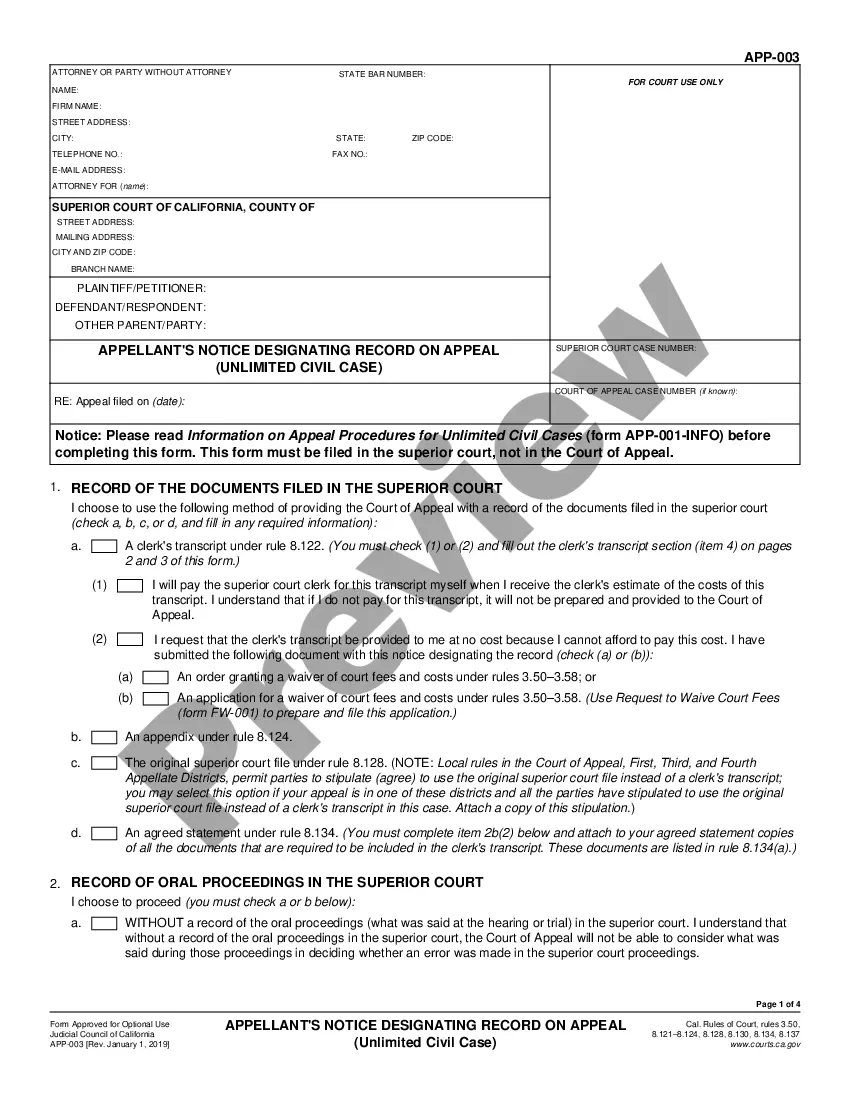

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

Are you currently in a position where you will need files for either organization or specific uses nearly every time? There are tons of legal file layouts accessible on the Internet, but finding kinds you can rely on isn`t straightforward. US Legal Forms provides a large number of kind layouts, such as the Texas Bill of Sale of Personal Property - Reservation of Life Estate in Seller, which are composed to fulfill federal and state requirements.

If you are previously familiar with US Legal Forms internet site and also have a free account, simply log in. Following that, you may acquire the Texas Bill of Sale of Personal Property - Reservation of Life Estate in Seller web template.

Unless you provide an profile and would like to begin to use US Legal Forms, adopt these measures:

- Get the kind you will need and make sure it is for the correct town/state.

- Take advantage of the Review option to examine the form.

- Browse the outline to ensure that you have chosen the appropriate kind.

- In case the kind isn`t what you are trying to find, utilize the Lookup area to get the kind that meets your requirements and requirements.

- Whenever you obtain the correct kind, just click Get now.

- Opt for the rates prepare you want, fill in the necessary information and facts to create your money, and buy an order utilizing your PayPal or charge card.

- Pick a hassle-free document file format and acquire your backup.

Discover all the file layouts you have purchased in the My Forms food selection. You can get a additional backup of Texas Bill of Sale of Personal Property - Reservation of Life Estate in Seller any time, if necessary. Just select the necessary kind to acquire or printing the file web template.

Use US Legal Forms, by far the most considerable collection of legal kinds, to save efforts and stay away from blunders. The services provides appropriately manufactured legal file layouts which you can use for a selection of uses. Make a free account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

If assets have to be sold to produce funds to pay Joan's debts, the Executors must agree which assets are to be sold. They cannot make unilateral decisions and act on them just because they think it is the sensible thing to do; or because some of the beneficiaries are pressurising them to do it.

An executor can sell the property alone if it is in the deceased's sole name. Selling a deceased's property owned in their sole name will require probate. Only an executor can sell a property in probate.

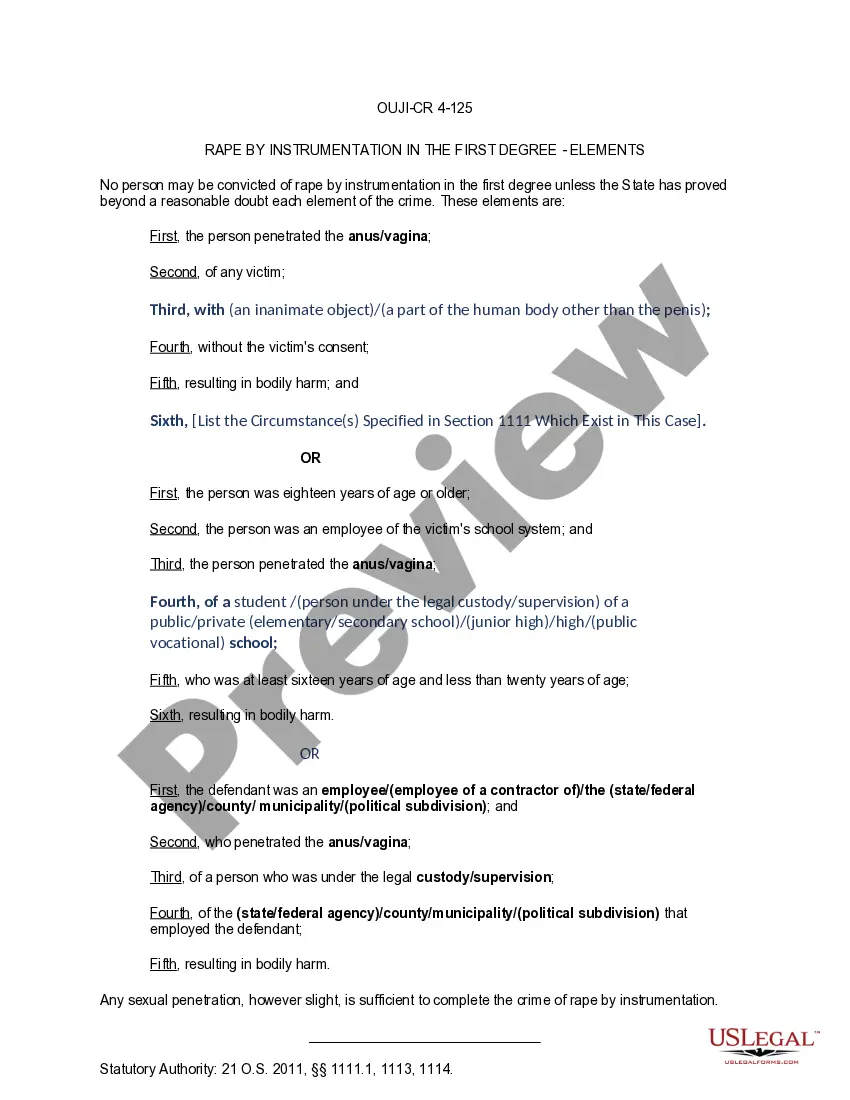

Filters. Latin/French. For the life of another, term often used in bequeathing a right (but not title) in property.

Pur autre vie (per o-truh vee) is a French legal phrase which means for another's life. This phrase is durational in meaning as it is another's life, not that of the possessor, that is used to measure the amount of time someone has a right to possess real property.

In property law of countries with a common law background, including the United States and some Canadian provinces, pur autre vie (Law French for "for another's life") is a duration of a proprietary freehold interest in the form of a variant of a life estate.

The right of alienation: A life tenant has the right to sell, lease, mortgage, or otherwise alienate the life estate in the property.

Appointment of an independent executor; The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

Measuring life means the period over which a jackpot or second-level annuitized prize is paid out. For each winning ticket, the measuring life shall be the natural life of the individual determined by the commission to be a valid prize winner.

Now, people can convey clear title to their property by completing a transfer on death deed form, signing it in front of a notary, and filing it in the deed records office in the county where the property is located before they die at a cost of less than fifty dollars.