Texas Determining Self-Employed Contractor Status is a process undertaken by the state of Texas to determine if an individual should be classified as a self-employed contractor for taxation and legal purposes. This classification is crucial, as it affects the rights, responsibilities, and obligations of both the individual and the entity engaging their services. To determine the self-employed contractor status, several factors are considered. These factors include the degree of control the individual has over their work and the work environment, the method of payment, the nature of the relationship between the individual and the entity, and the extent of the individual's investment in their own tools, equipment, and materials. The state of Texas recognizes various types of self-employed contractor statuses, each with its own specific criteria and implications. These include: 1. Independent Contractor: An independent contractor is an individual who works independently and provides services to clients or businesses. They maintain control over their work, determine their own working hours, and usually have multiple clients. Independent contractors are responsible for paying their own taxes, social security contributions, and other benefits, as they are not considered employees. 2. Sole Proprietor: A sole proprietorship is a type of self-employment where an individual operates their business as an individual entity. They have full control over their business and are personally liable for its debts and legal obligations. Sole proprietors report their business income and expenses on their personal tax returns. 3. Freelancer: A freelancer is a self-employed individual who offers their services to multiple clients. They typically work from project to project and may work in various fields such as writing, graphic design, or consulting. Freelancers enjoy independence but are responsible for managing their own contracts, negotiations, and business development. 4. Limited Liability Company (LLC) Owner: A limited liability company is a legal entity that combines elements of both corporations and partnerships. The owner(s) of an LLC are personally protected from the company's liabilities, and the company's profits and losses are reported on the owner's personal tax returns. It is essential for individuals and businesses in Texas to accurately determine the self-employed contractor status to comply with tax laws, labor regulations, and other legal requirements. Misclassification can lead to legal and financial consequences, such as fines, penalties, and potential disputes between the parties involved. In summary, Texas Determining Self-Employed Contractor Status is a critical process to properly classify individuals working as self-employed contractors. It involves assessing factors like control, payment methods, relationship dynamics, and investment. Recognizing different types of self-employed contractor statuses, including independent contractors, sole proprietors, freelancers, and LLC owners, is vital for businesses and individuals to ensure compliance with relevant laws and regulations.

Texas Determining Self-Employed Contractor Status

Description

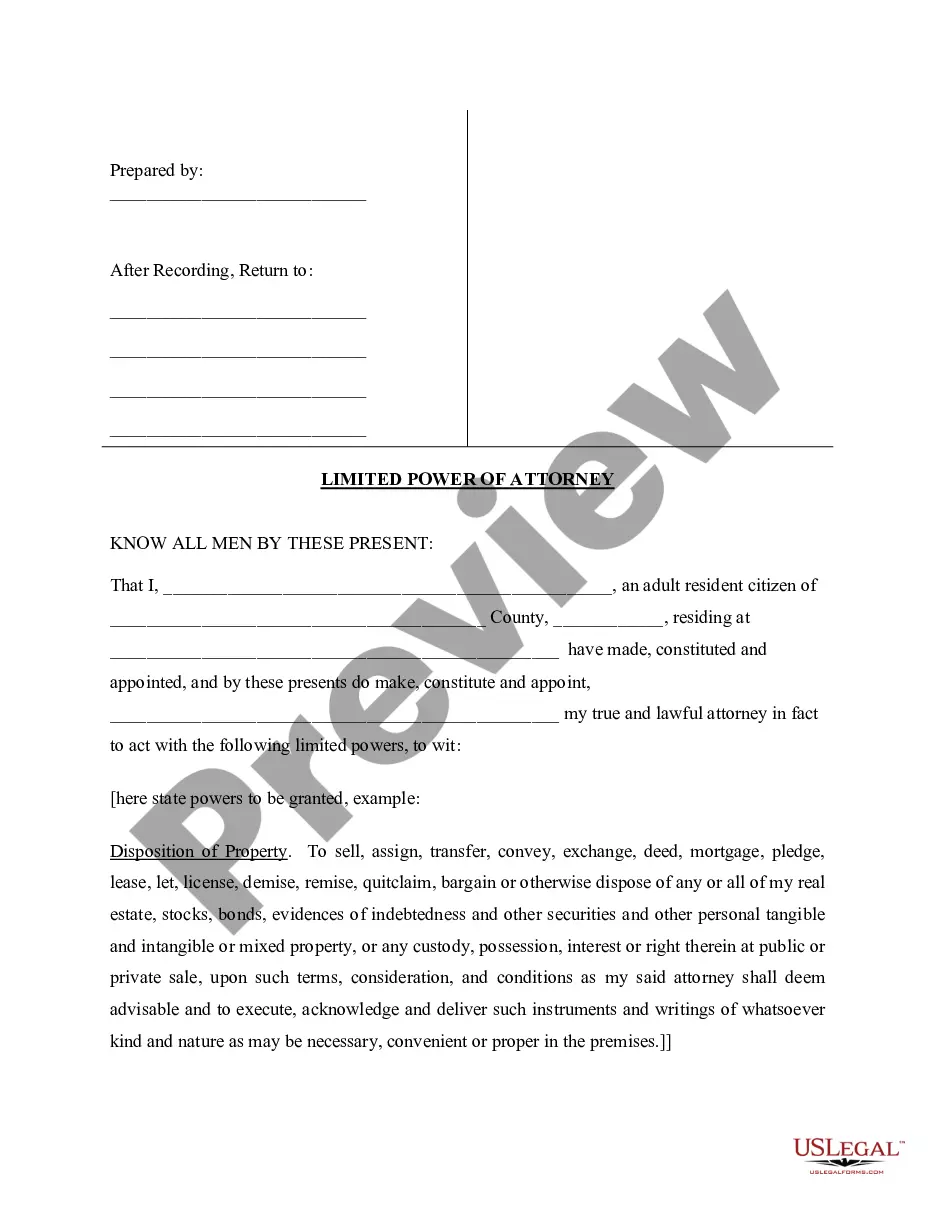

How to fill out Texas Determining Self-Employed Contractor Status?

Discovering the right lawful papers template could be a have a problem. Of course, there are a lot of layouts available on the net, but how can you obtain the lawful form you need? Make use of the US Legal Forms site. The assistance offers a large number of layouts, such as the Texas Determining Self-Employed Contractor Status, which can be used for enterprise and personal requires. All the forms are checked by professionals and satisfy state and federal specifications.

In case you are previously listed, log in to the profile and then click the Down load option to get the Texas Determining Self-Employed Contractor Status. Make use of profile to check through the lawful forms you have bought previously. Check out the My Forms tab of your profile and get one more copy in the papers you need.

In case you are a brand new customer of US Legal Forms, here are simple instructions so that you can comply with:

- Initially, ensure you have selected the right form for the city/state. It is possible to examine the shape utilizing the Preview option and read the shape information to ensure it will be the best for you.

- In the event the form will not satisfy your requirements, take advantage of the Seach area to obtain the appropriate form.

- Once you are sure that the shape would work, select the Get now option to get the form.

- Pick the costs plan you want and type in the needed information and facts. Build your profile and pay for the order making use of your PayPal profile or charge card.

- Choose the data file format and acquire the lawful papers template to the product.

- Full, modify and printing and signal the acquired Texas Determining Self-Employed Contractor Status.

US Legal Forms is the greatest catalogue of lawful forms that you can find numerous papers layouts. Make use of the company to acquire appropriately-manufactured papers that comply with condition specifications.

Form popularity

FAQ

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

An independent contractor is self-employed, bears responsibility for his or her own taxes and expenses, and is not subject to an employer's direction and control. The distinction depends upon much more than what the parties call themselves.

How to demonstrate that you are an independent worker on your resumeMention that time when you had to work on a project on your own.Talk about projects that required extra accountability.Describe times when you had to manage several projects all at once.More items...

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

The basic test for determining whether a worker is an independent contractor or an employee is whether the principal has the right to control the manner and means by which the work is performed.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.