Texas Self-Employed Independent Contractor Employment Agreement — Commission for New Business A Texas Self-Employed Independent Contractor Employment Agreement — Commission for New Business is a legally binding contract that outlines the terms and conditions for individuals who operate as self-employed independent contractors in Texas. This agreement is specifically designed for individuals who earn income through commissions for bringing in new business. In this agreement, there are several key elements that are crucial to ensure a clear understanding between the contractor and the hiring party. These elements include: 1. Identification of the Parties: The agreement should clearly identify the contractor and the hiring party, including their legal business names and addresses. 2. Purpose of the Agreement: The agreement should clearly state that the contractor's role is to generate new business for the hiring party in exchange for a commission, and that the hiring party does not exercise control over the contractor's methods or means of achieving this goal. 3. Commission Structure: The agreement should outline the commission structure, specifying the percentage or amount of commission that the contractor will receive for each new business obtained. It should also define how the commission will be calculated, whether it is based on a fixed percentage, a tiered scale, or any other agreed-upon method. 4. Performance Expectations: The agreement should detail the contractor's responsibilities and expectations in terms of generating new business. This may include identifying target markets, developing marketing strategies, attending networking events, or utilizing personal contacts to secure new clients or customers. 5. Payment Terms: The agreement should specify the frequency and method of commission payments. It should also outline any additional expenses or costs that would be deducted from the commission, such as marketing materials or travel expenses, if applicable. 6. Confidentiality and Non-Disclosure: The agreement should include provisions regarding the contractor's obligation to maintain the hiring party's confidential information, trade secrets, and client/customer lists. It may also include non-disclosure clauses to prevent the contractor from sharing sensitive information with competitors or other parties. 7. Termination Clause: The agreement should outline the conditions and procedures for terminating the agreement by either party. This may include a notice period, grounds for termination, and any applicable consequences or obligations upon termination. Different types of Texas Self-Employed Independent Contractor Employment Agreements based on commission for new business may include variations in commission structures, payment terms, or specific obligations and expectations of the contractor. These variations largely depend on the nature of the industry, the type of business, and the negotiation between the hiring party and the contractor. Overall, a Texas Self-Employed Independent Contractor Employment Agreement — Commission for New Business is a crucial document that protects the rights and interests of both the contractor and the hiring party. It provides clarity on the terms and conditions agreed upon, ensuring a fair and mutually beneficial relationship between the parties involved.

Texas Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

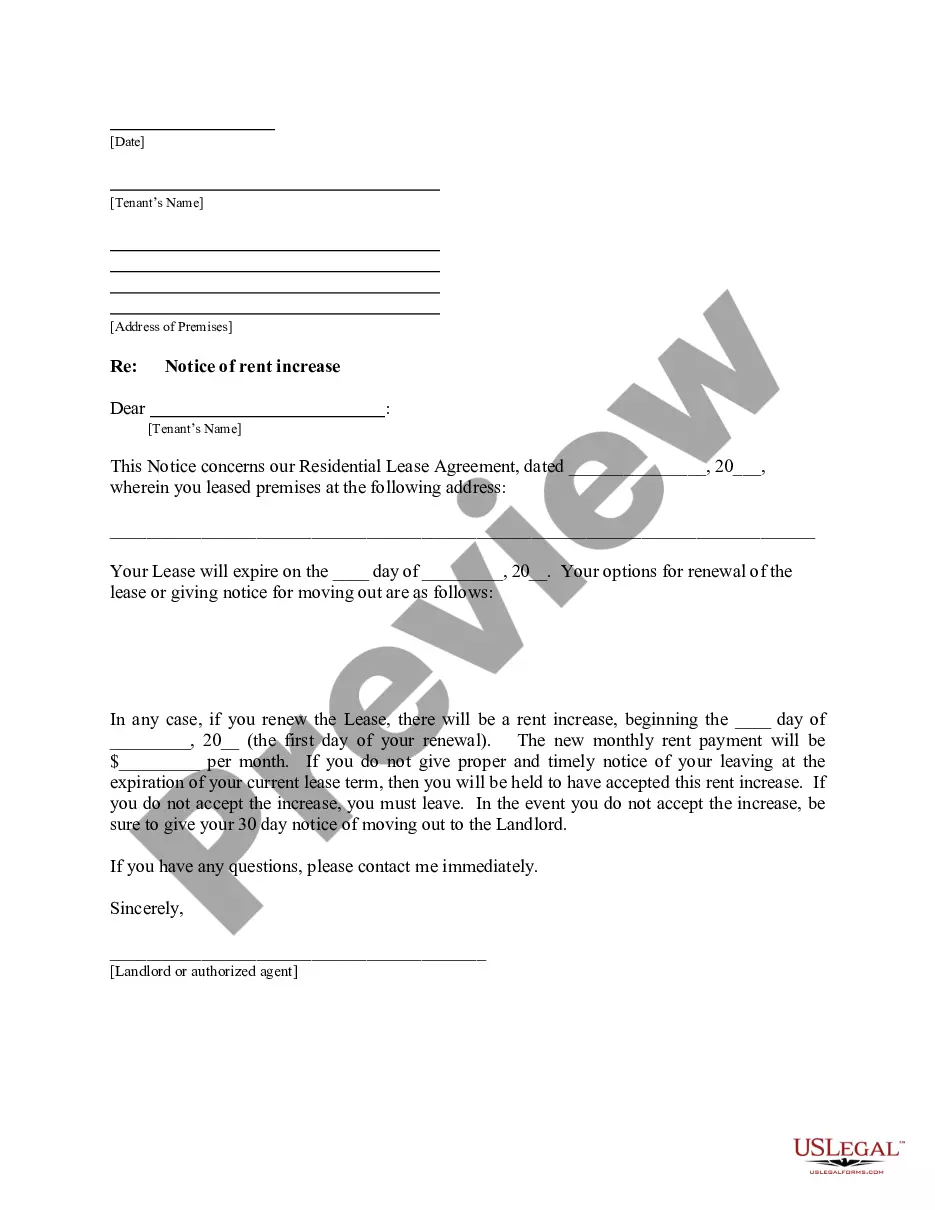

How to fill out Texas Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

If you need to complete, download, or print out lawful papers web templates, use US Legal Forms, the biggest selection of lawful forms, that can be found online. Take advantage of the site`s simple and easy practical research to get the files you require. Different web templates for organization and specific uses are sorted by types and says, or keywords and phrases. Use US Legal Forms to get the Texas Self-Employed Independent Contractor Employment Agreement - commission for new business in just a couple of mouse clicks.

When you are presently a US Legal Forms customer, log in to your profile and click the Download switch to obtain the Texas Self-Employed Independent Contractor Employment Agreement - commission for new business. You may also entry forms you previously delivered electronically inside the My Forms tab of the profile.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for the right metropolis/region.

- Step 2. Utilize the Preview choice to look over the form`s content material. Don`t forget about to read the information.

- Step 3. When you are unhappy with the kind, take advantage of the Search discipline on top of the display screen to locate other versions from the lawful kind design.

- Step 4. When you have discovered the form you require, click the Purchase now switch. Opt for the costs plan you prefer and add your accreditations to register to have an profile.

- Step 5. Process the deal. You may use your charge card or PayPal profile to finish the deal.

- Step 6. Find the format from the lawful kind and download it on the gadget.

- Step 7. Total, revise and print out or sign the Texas Self-Employed Independent Contractor Employment Agreement - commission for new business.

Each and every lawful papers design you buy is your own property permanently. You may have acces to each and every kind you delivered electronically with your acccount. Click on the My Forms section and choose a kind to print out or download once more.

Be competitive and download, and print out the Texas Self-Employed Independent Contractor Employment Agreement - commission for new business with US Legal Forms. There are many professional and state-specific forms you may use for your organization or specific requires.

Form popularity

FAQ

If you are an independent contractor, a gig worker, or are self-employed in Texas, and you are out of work due to COVID-19, you may qualify for unemployment benefits through Pandemic Unemployment Assistance (PUA).

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.

Whether you're an employee or an independent contractor depends on the conditions of your employment, not your job title or work schedule. The law says you're an employee unless your employer can show otherwise. Your employer might have misclassified you as an independent contractor when you're actually an employee.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.