A Texas Self-Employed Independent Contractor Employment Agreement is a legally binding contract between a self-employed individual (contractor) and a client or company (employer) that outlines the terms and conditions of their working relationship. This agreement is specifically designed for individuals working as independent contractors in the state of Texas. Work, Services, and Materials: The agreement defines the scope of work, services, and materials to be provided by the contractor. It outlines the nature of the work or project, the expected deliverables, and the timeframe within which the contractor is required to complete the work. Key Terms and Conditions: The agreement includes essential terms and conditions such as payment arrangements, including the contractor's compensation structure, rates, and any agreed-upon payment milestones or schedules. It may also specify whether the contractor is responsible for covering their own expenses related to the project or if the client will reimburse them for any pre-approved costs. Intellectual Property: Intellectual property rights are typically addressed in the agreement. It clarifies whether the contractor retains ownership of any intellectual property they create while performing the work or whether those rights are assigned to the client or company. Confidentiality and Non-Disclosure: To protect sensitive information, the agreement may include provisions outlining the contractor's responsibility to maintain confidentiality and prohibit them from sharing any proprietary or confidential information they are privy to during the course of their work. Indemnification: An indemnification clause may be included to protect the client or company from any claims or liabilities that may arise from the contractor's work. This clause ensures that the contractor takes responsibility for any damages, losses, or legal actions arising out of their actions or omissions. Termination: The agreement should outline the conditions under which either party may terminate the agreement, including any notice periods required. It may also specify if termination is allowed for cause or without cause and the consequences of termination, such as payment for work completed or reimbursement of certain expenses. Different Types of Texas Self-Employed Independent Contractor Employment Agreements: 1. General Contractor Agreement: This is a broad agreement used for various types of projects or services provided by an independent contractor in Texas. 2. Consulting Services Agreement: This agreement is specific to consultants providing professional advice or expertise to clients. 3. Construction Contractor Agreement: Tailored specifically for contractors engaged in construction-related projects within the state of Texas, this agreement may include additional provisions regarding safety standards, insurance requirements, and compliance with local building codes and regulations. 4. Creative Services Agreement: This type of agreement is used when the contractor offers creative services such as graphic design, content writing, photography, or video production. 5. IT Services Agreement: Suitable for independent contractors working in information technology or software development fields, this agreement sets out the specifics of the services to be provided and any associated intellectual property rights. In summary, a Texas Self-Employed Independent Contractor Employment Agreement for work, services, and/or materials is a comprehensive legal document that governs the working relationship between an independent contractor and their client or company. It covers areas ranging from payment terms to intellectual property rights, confidentiality, termination, and more. Different types of agreements exist, each tailored to specific industries or service offerings.

Texas Self-Employed Independent Contractor Employment Agreement - work, services and / or materials

Description

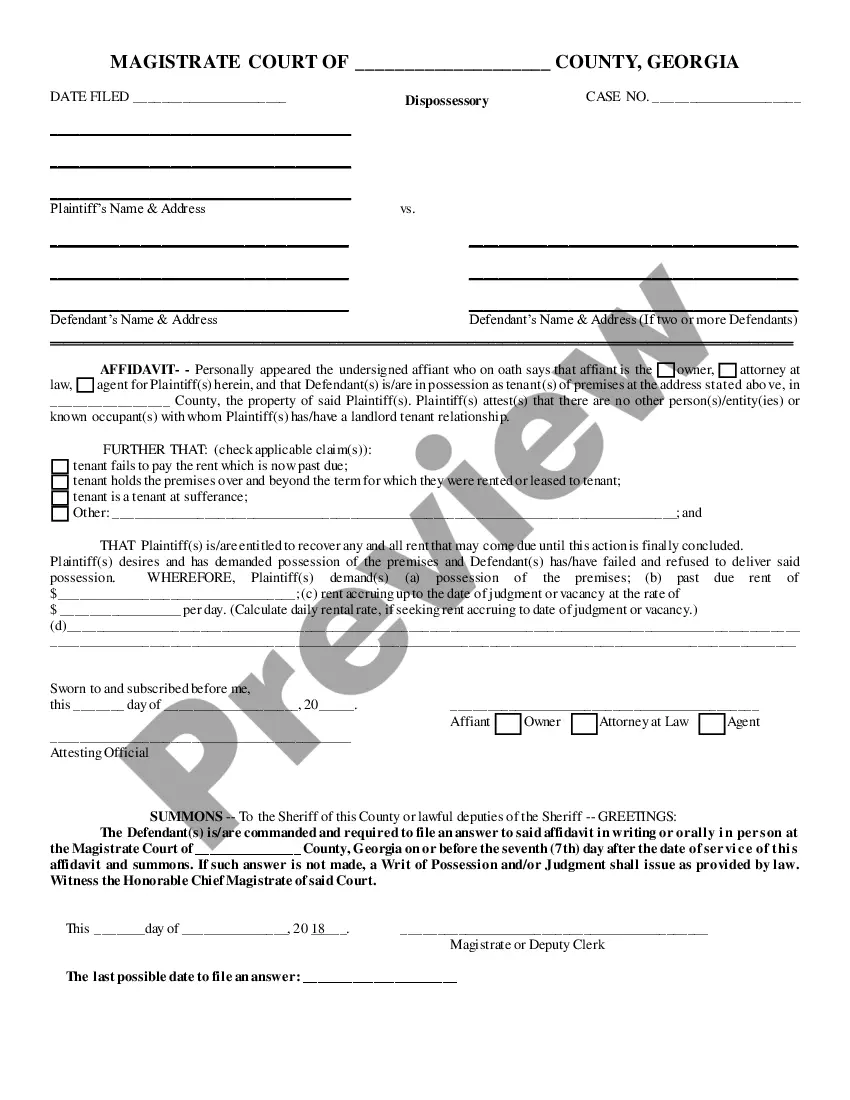

How to fill out Texas Self-Employed Independent Contractor Employment Agreement - Work, Services And / Or Materials?

US Legal Forms - one of many greatest libraries of legal varieties in the USA - provides a variety of legal papers web templates it is possible to download or print. Making use of the internet site, you may get a large number of varieties for enterprise and specific purposes, categorized by classes, states, or keywords.You can find the newest versions of varieties such as the Texas Self-Employed Independent Contractor Employment Agreement - work, services and / or materials in seconds.

If you currently have a registration, log in and download Texas Self-Employed Independent Contractor Employment Agreement - work, services and / or materials from the US Legal Forms catalogue. The Download key can look on each and every form you perspective. You have access to all earlier saved varieties in the My Forms tab of your account.

If you want to use US Legal Forms initially, allow me to share basic guidelines to help you get started off:

- Ensure you have chosen the correct form for your personal metropolis/state. Select the Review key to examine the form`s information. Read the form description to ensure that you have chosen the appropriate form.

- In case the form does not match your specifications, make use of the Look for area at the top of the screen to get the one that does.

- Should you be content with the shape, verify your option by clicking the Acquire now key. Then, opt for the costs plan you want and give your qualifications to sign up on an account.

- Process the financial transaction. Make use of your charge card or PayPal account to accomplish the financial transaction.

- Pick the format and download the shape on your own product.

- Make modifications. Fill up, edit and print and indication the saved Texas Self-Employed Independent Contractor Employment Agreement - work, services and / or materials.

Each format you included with your money does not have an expiration date and it is the one you have for a long time. So, if you wish to download or print another duplicate, just visit the My Forms area and click in the form you want.

Get access to the Texas Self-Employed Independent Contractor Employment Agreement - work, services and / or materials with US Legal Forms, by far the most comprehensive catalogue of legal papers web templates. Use a large number of professional and condition-distinct web templates that meet your small business or specific needs and specifications.