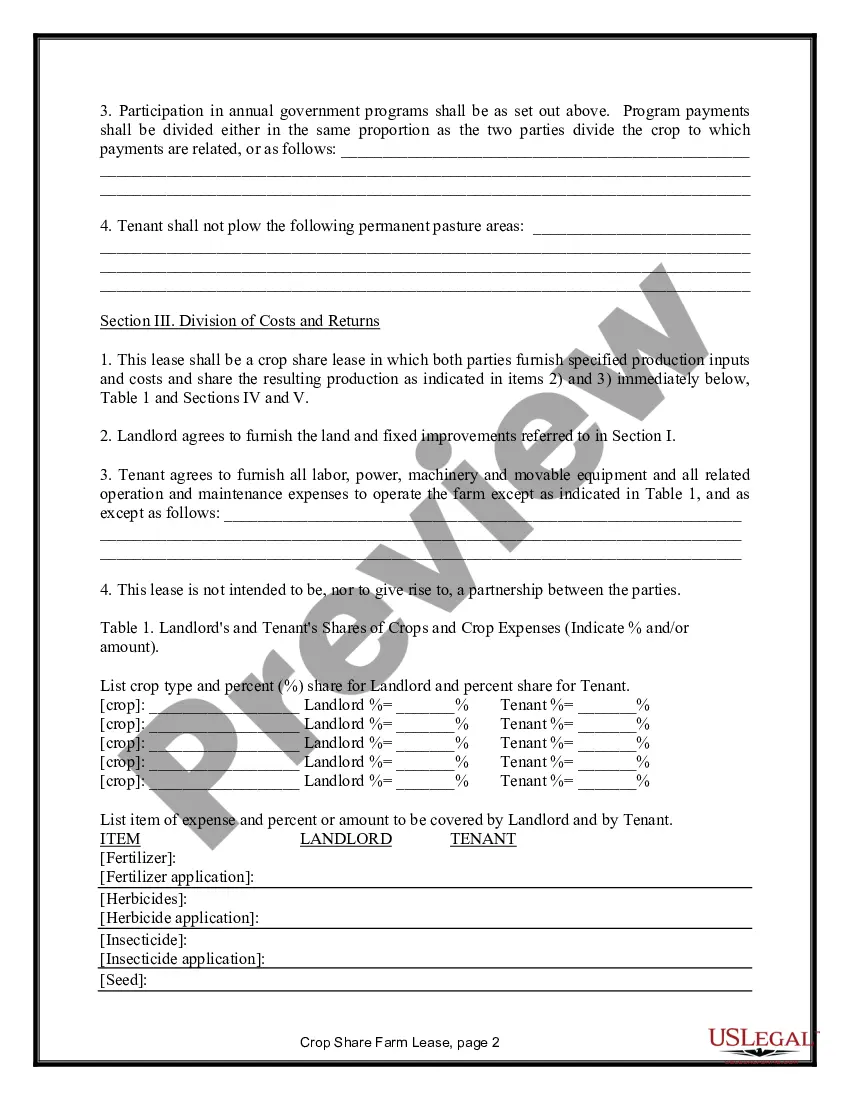

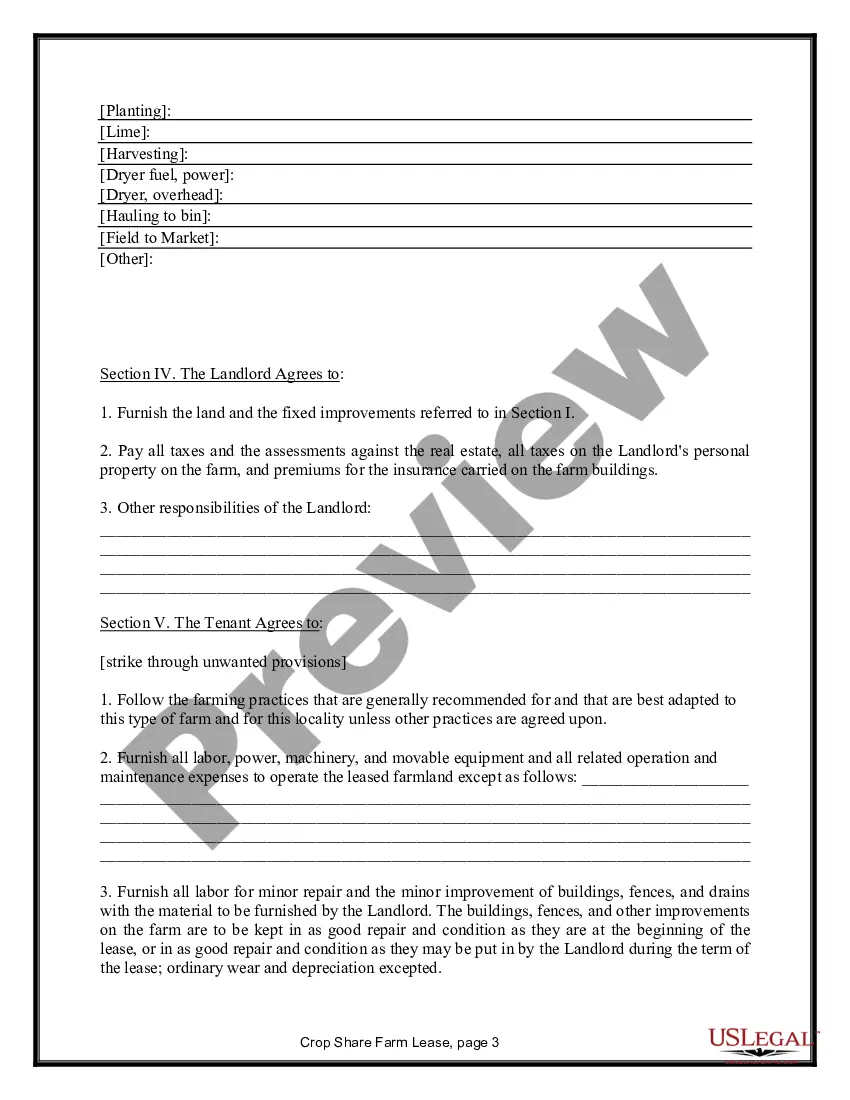

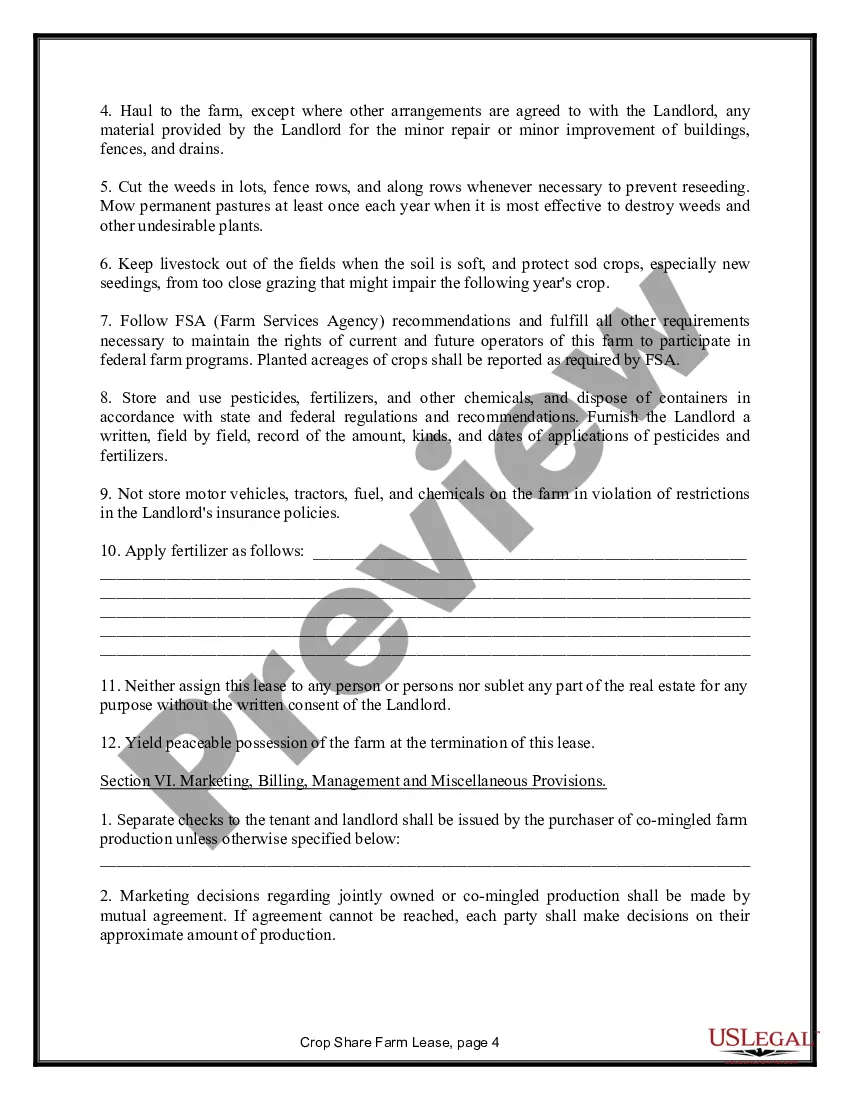

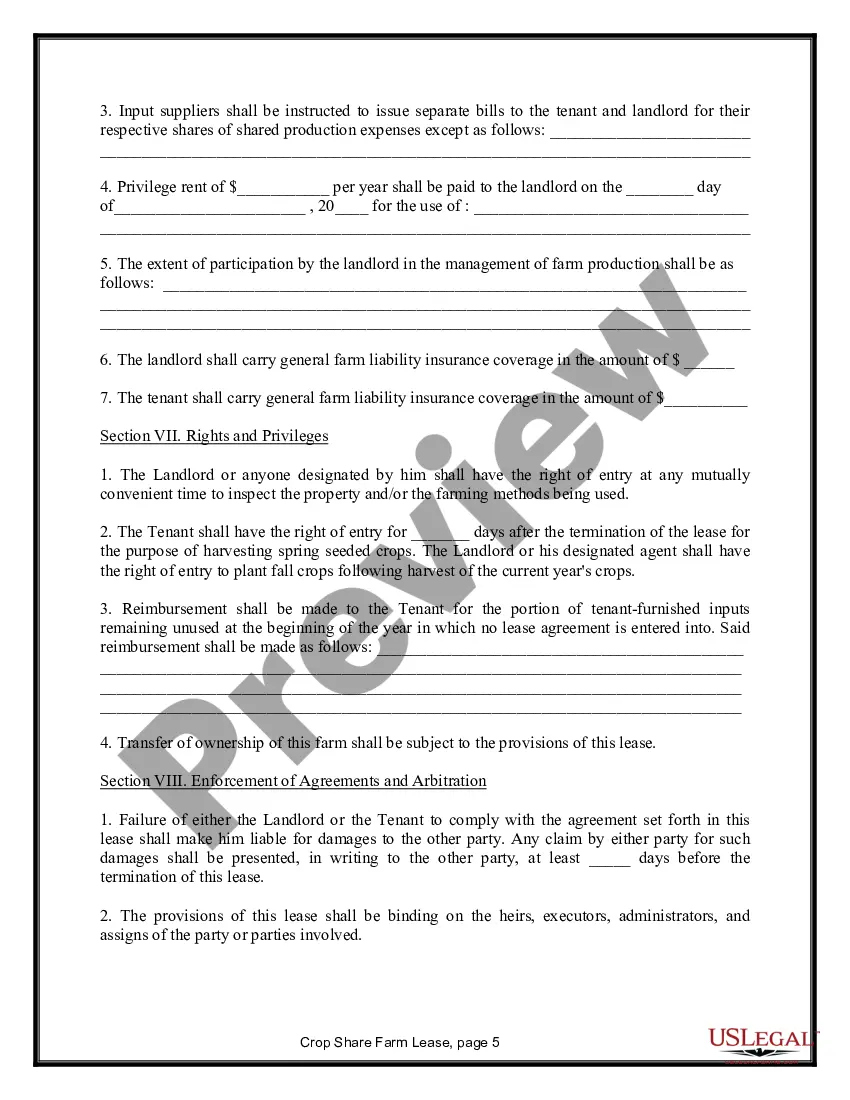

Texas Farm Lease or Rental — Crop Share is a legal agreement between a landowner and a farmer in Texas, where the farmer leases or rents the land for agricultural purposes, specifically for crop production. This type of agreement is beneficial for both parties involved, as it allows the landowner to utilize their land efficiently while providing the farmer with an opportunity to cultivate crops and share the resulting harvest. Keywords: Texas Farm Lease, Rental, Crop Share, landowner, farmer, agricultural purposes, cultivation, harvest. Different Types of Texas Farm Lease or Rental — Crop Share: 1. Fixed Cash Rent with Crop Share: This type of agreement involves the farmer paying a fixed cash rent to the landowner for leasing the land, along with sharing a certain percentage of the crop yield to compensate the landowner. 2. Flexible Cash Rent with Crop Share: In this arrangement, the cash rent paid by the farmer to the landowner varies depending on factors such as crop prices, yield potential, and market fluctuations. The crop share remains similar to fixed cash rent with crop share. 3. Negotiated Crop Share Lease: This type of lease involves the farmer and the landowner negotiating the terms and conditions of the crop share agreement, including the percentage of share. This type of lease allows for customization based on the specific needs and circumstances of both parties. 4. Crop Share with Expenses Split: Under this arrangement, both the farmer and the landowner share the expenses incurred during crop production, such as seed, fertilizer, and equipment costs, as well as share the crop yield based on a pre-determined percentage. 5. Custom Farming Agreement: This agreement is slightly different from the traditional crop share lease, as the landowner may hire a farmer to perform specific tasks related to crop production, such as planting, harvesting, and field maintenance, for a fixed fee or a share of the crop yield. 6. Sharing Equipment Lease: This lease involves the farmer and the landowner sharing equipment necessary for agricultural activities, such as tractors, combines, or irrigation systems. The farmer may pay for the equipment use in cash or a portion of the crop yield. Each type of Texas Farm Lease or Rental — Crop Share can be modified and customized based on the specific requirements and preferences of the landowner and the farmer. It is essential for both parties to clearly outline the terms, obligations, and expectations in a written agreement to avoid any misunderstandings or conflicts.

Texas Farm Lease or Rental - Crop Share

Description

How to fill out Texas Farm Lease Or Rental - Crop Share?

If you wish to full, down load, or printing legitimate record templates, use US Legal Forms, the largest selection of legitimate forms, which can be found on the Internet. Make use of the site`s simple and hassle-free search to find the documents you need. Different templates for enterprise and individual reasons are sorted by classes and states, or keywords. Use US Legal Forms to find the Texas Farm Lease or Rental - Crop Share in just a handful of mouse clicks.

If you are previously a US Legal Forms consumer, log in to the account and click on the Down load button to obtain the Texas Farm Lease or Rental - Crop Share. Also you can entry forms you previously delivered electronically within the My Forms tab of your respective account.

If you work with US Legal Forms initially, follow the instructions listed below:

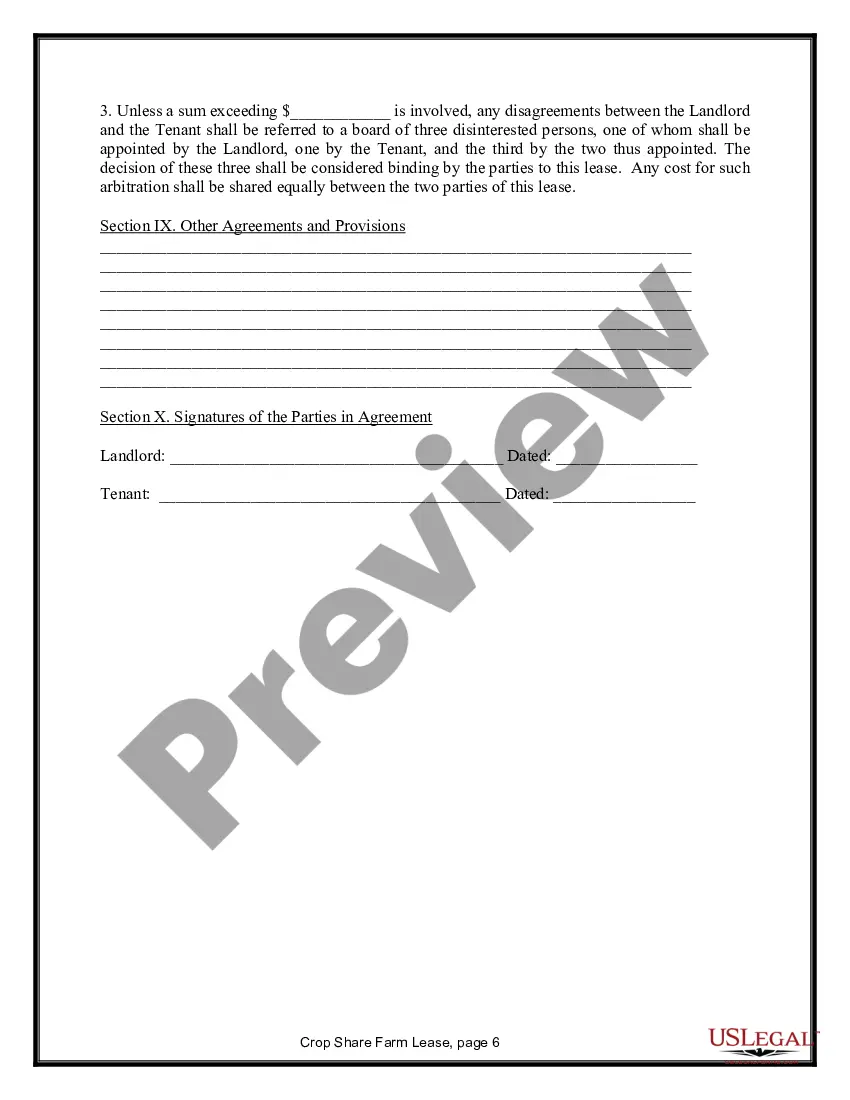

- Step 1. Ensure you have selected the form for your proper area/land.

- Step 2. Take advantage of the Review method to check out the form`s content material. Never forget to learn the information.

- Step 3. If you are not happy with all the type, utilize the Look for area at the top of the screen to get other types in the legitimate type template.

- Step 4. Upon having discovered the form you need, select the Acquire now button. Choose the pricing program you prefer and add your accreditations to register to have an account.

- Step 5. Procedure the financial transaction. You can utilize your credit card or PayPal account to perform the financial transaction.

- Step 6. Choose the format in the legitimate type and down load it on the system.

- Step 7. Complete, modify and printing or indicator the Texas Farm Lease or Rental - Crop Share.

Each and every legitimate record template you acquire is yours forever. You may have acces to every single type you delivered electronically within your acccount. Go through the My Forms section and pick a type to printing or down load again.

Remain competitive and down load, and printing the Texas Farm Lease or Rental - Crop Share with US Legal Forms. There are thousands of expert and condition-particular forms you can utilize for the enterprise or individual requirements.