Texas Demand for Payment of Account by Business to Debtor

Description

How to fill out Demand For Payment Of Account By Business To Debtor?

Finding the appropriate legal document format can be challenging.

Certainly, numerous templates are accessible online, but how can you find the legal template you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Texas Demand for Payment of Account by Business to Debtor, which you can use for business and personal requests. All the forms are vetted by professionals and comply with state and federal regulations.

Once you are confident the form is suitable, click the Get now button to obtain the form. Choose the pricing plan you wish and provide the required information. Create your account and process the transaction using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the downloaded Texas Demand for Payment of Account by Business to Debtor. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Use the service to download professionally crafted papers that adhere to state regulations.

- If you're already registered, Log In to your account and click the Download button to obtain the Texas Demand for Payment of Account by Business to Debtor.

- Use your account to search through the legal forms you have previously purchased.

- Navigate to the My documents tab in your account and download another copy of the document you need.

- If you're a new user of US Legal Forms, here are simple steps for you to follow.

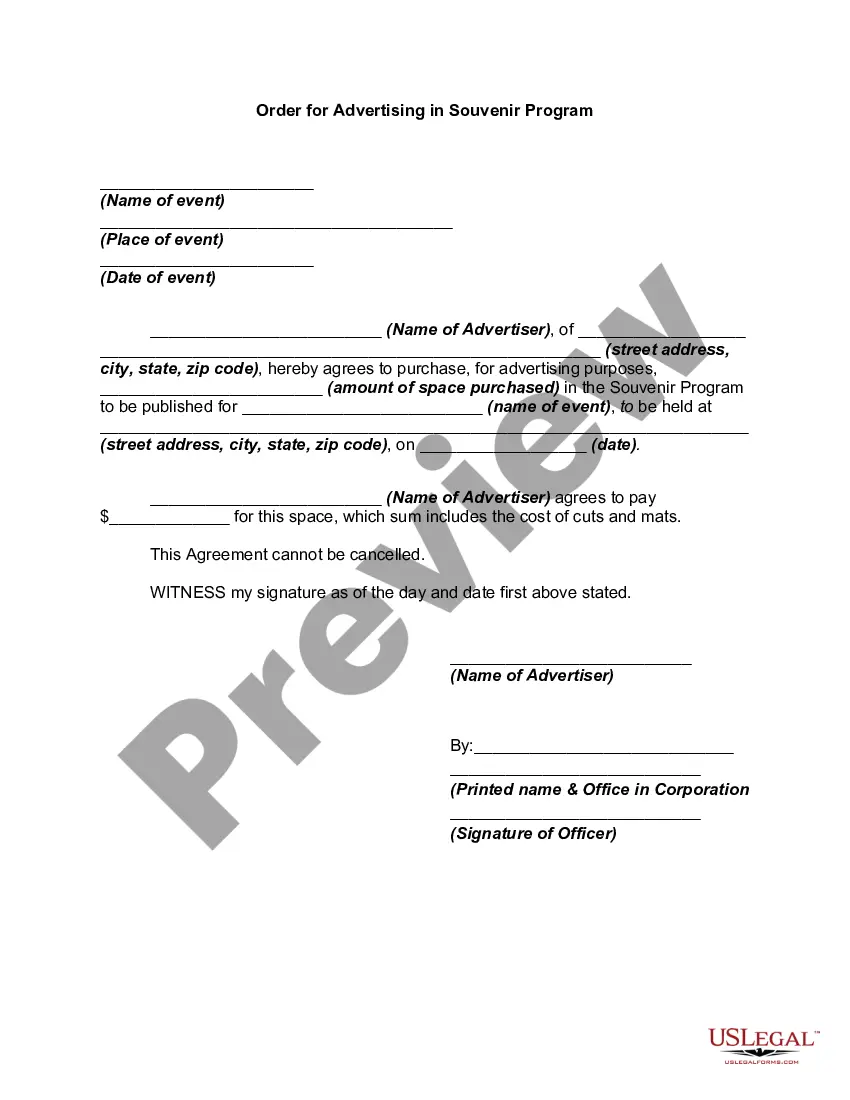

- First, ensure you've selected the correct form for your city/area. You can view the form using the Preview button and review the form details to confirm it's the right one for you.

- If the form doesn't meet your needs, use the Search field to find the appropriate form.

Form popularity

FAQ

In Texas, certain assets are exempt from seizure during a judgment. This includes your homestead, personal items like clothing and furniture, and retirement accounts in most cases. Under the Texas Demand for Payment of Account by Business to Debtor, you want to ensure that your essential assets remain protected. Engaging with an attorney can offer clarity on what you should safeguard.

Frequently Asked Questions (FAQ)Type your letter.Concisely review the main facts.Be polite.Write with your goal in mind.Ask for exactly what you want.Set a deadline.End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand.Make and keep copies.More items...

While your wages cannot be garnished in Texas, a creditor can place a levy on your bank account. Once your paycheck is placed into your bank account, it is no longer considered wages and can be seized. This means that creditors can still take money from your checking or savings account, or other financial institution.

These three tips can help businesses avoid a garnishment situation:Establish a Separate Entity. Sole proprietors that might be at risk for bank account garnishment on their personal debts should consider establishing an LLC to protect their business assets.File for Bankruptcy.Make Payment Arrangements.

While not required by Texas laws, sending a breach of contract demand letter is one of the most useful tactics to getting: The other party to fulfill their end of the deal. Paid for the obligations you have performed under the contract.

Once you have a judgment against you, creditors can garnish your bank account in Texas. They do this with a Writ of Garnishment. They cannot garnish your wages but once you deposit your paycheck into the bank they can freeze your account with a valid judgment.

In many states, some IRS-designated trust accounts may be exempt from creditor garnishment. This includes individual retirement accounts (IRAs), pension accounts and annuity accounts. Assets (including bank accounts) held in what's known as an irrevocable living trust cannot be accessed by creditors.

In Texas, when a creditor has a judgment against you (even for credit cards or medical bills), the creditor has a right to garnish your bank account. To garnish a bank account, the court files a writ of garnishment or notice of garnishment.

Creditors cannot just take money in your bank account. But a creditor could obtain a bank account levy by going to court and getting a judgment against you, then asking the court to levy your account to collect if you don't pay that judgment.

Writ of Garnishment in TexasOnce you have a judgment against you, creditors can garnish your bank account in Texas. They do this with a Writ of Garnishment. They cannot garnish your wages but once you deposit your paycheck into the bank they can freeze your account with a valid judgment.