Texas Stock Package refers to a comprehensive bundle of investment options that are tailored to suit the needs of individual investors who are primarily interested in investing in Texas-based companies. Texas, being the second-largest state in the United States with a vibrant economy, offers numerous opportunities for investors to capitalize on the growth potential of local businesses. The Texas Stock Package encompasses a range of investment instruments, including stocks, bonds, and mutual funds, focused specifically on companies that are headquartered or have a significant presence in Texas. This package aims to provide investors with exposure to the Texan economy and industries operating within the state, such as energy, technology, healthcare, financial services, manufacturing, and agriculture. Different types of Texas Stock Packages: 1. Texas Energy Stock Package: This package focuses on investing in Texas-based companies operating in the energy sector, including oil and gas exploration, production, and services. It caters to investors looking to benefit from Texas' rich energy resources and the state's prominence in the energy industry. 2. Texas Technology Stock Package: Specifically designed for those interested in technology companies based in Texas, this package provides exposure to firms involved in software development, hardware manufacturing, telecommunications, and innovation hubs like Austin's Silicon Hills. It allows investors to benefit from the thriving tech ecosystem in Texas. 3. Texas Healthcare Stock Package: This package targets investors seeking exposure to the healthcare industry in Texas. It includes investments in pharmaceutical companies, hospitals, healthcare services providers, and biotechnology firms based in Texas, taking advantage of the state's large and growing population's healthcare needs. 4. Texas Financial Services Stock Package: This package emphasizes investments in Texas-based banks, credit unions, insurance companies, and financial institutions. It caters to investors seeking exposure to the financial sector and the stability and competitiveness of Texas' vibrant financial market. 5. Texas Manufacturing Stock Package: This package focuses on Texas-based manufacturing companies across various industries, such as automotive, aerospace, electronics, and consumer goods. It offers investors the opportunity to participate in the state's manufacturing prowess and benefit from its skilled workforce and business-friendly environment. 6. Texas Agribusiness Stock Package: This package revolves around investments in agriculture-related companies based in Texas, including farming, ranching, food processing, and agricultural technology firms. It aims to capitalize on the state's vast agricultural resources, favorable climate, and strong demand for food and agricultural products. Investors interested in the Texas Stock Package have the flexibility to choose a specific package that aligns with their investment objectives, risk appetite, and sector preferences. By investing in various Texas-based companies through this package, investors can diversify their portfolios and potentially benefit from the state's robust and diverse economy.

Texas Stock Package

Description

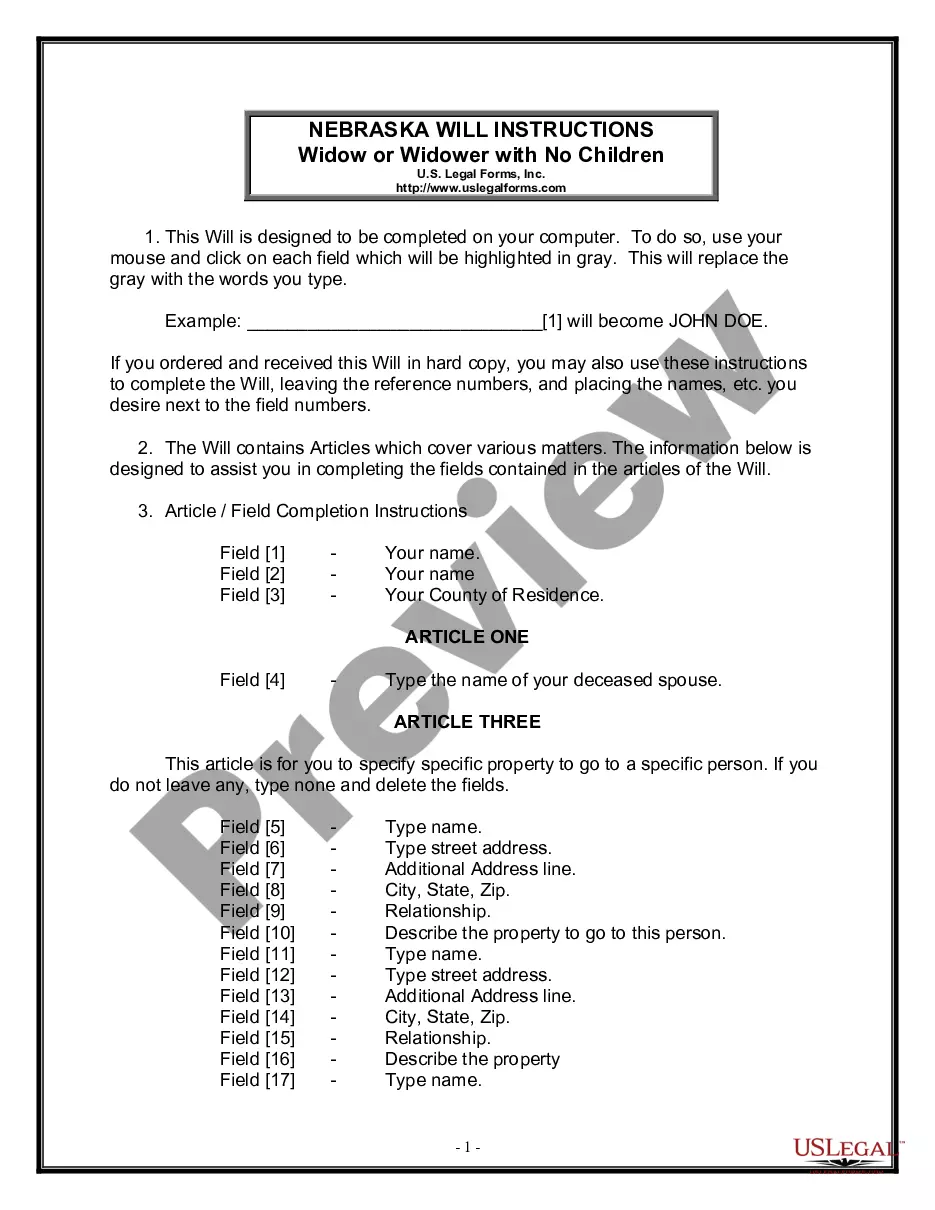

How to fill out Texas Stock Package?

Are you currently within a placement that you need to have paperwork for possibly business or personal uses nearly every working day? There are a variety of authorized papers templates available online, but discovering types you can depend on is not effortless. US Legal Forms delivers 1000s of kind templates, much like the Texas Stock Package, that are created to satisfy state and federal requirements.

If you are already knowledgeable about US Legal Forms web site and also have a merchant account, simply log in. After that, you may download the Texas Stock Package template.

Should you not provide an bank account and want to start using US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is for that right city/county.

- Use the Preview button to examine the shape.

- Look at the information to actually have selected the appropriate kind.

- If the kind is not what you`re looking for, use the Look for industry to get the kind that meets your needs and requirements.

- When you discover the right kind, click Purchase now.

- Opt for the prices program you want, fill in the desired info to generate your money, and purchase the order with your PayPal or Visa or Mastercard.

- Select a handy file format and download your version.

Locate all the papers templates you possess bought in the My Forms menu. You can get a additional version of Texas Stock Package anytime, if necessary. Just click on the needed kind to download or produce the papers template.

Use US Legal Forms, by far the most comprehensive assortment of authorized varieties, in order to save time and steer clear of faults. The services delivers expertly produced authorized papers templates which you can use for an array of uses. Make a merchant account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

At the time of your departure, you are generally allowed to exercise the vested portion of your stock option awards, and you will forfeit the unvested portion. If you are planning on leaving your job, you should review the details of your vesting schedule.

When an employer gives you equity as part of your compensation package, they're offering you partial ownership of the company. However, your stock usually has to vest first, meaning that you typically need to work for the company for a period of time if you want to become an owner.

TI shares traded at over $82 per share, and its market capitalization was valued at over $88.0 billion in October 2018.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Employee stock options can be a lucrative part of an individual's overall compensation package, although not every company offers them. Workers can buy shares at a pre-determined price at a future date, regardless of the price of the stock when the options are exercised.

If you are buying stock from an option, you buy it at the option price, regardless of what the current price of the stock is. So if you are an employee with an option to buy 12,000 shares of stock at $1 a share, you will need to pay $12,000. At that point, you would own the shares outright.

Texas Instruments has 5.35% upside potential, based on the analysts' average price target. Is TXN a Buy, Sell or Hold? Texas Instruments has a conensus rating of Hold which is based on 6 buy ratings, 11 hold ratings and 3 sell ratings.

Texas Instruments Inc (NASDAQ:TXN) The 25 analysts offering 12-month price forecasts for Texas Instruments Inc have a median target of 160.00, with a high estimate of 210.00 and a low estimate of 120.00. The median estimate represents a +3.07% increase from the last price of 155.23.

TI stock was first traded on October 1, 1953, on the New York Stock Exchange. How do I buy TI stock? TI stock can be purchased through a stockbroker, bank, credit union or other financial institution or online service that provides brokerage services.