The Texas Qualifying Event Notice Information for Employer to Plan Administrator is a crucial aspect of employee benefits management in Texas. When specific life events occur, employees may become eligible for certain changes or adjustments to their existing benefits plans. To ensure smooth operations, employers need to provide comprehensive information to the plan administrator regarding these qualifying events. The Texas Qualifying Event Notice Information for Employer to Plan Administrator should include the following key details: 1. Notification Purpose: Clearly state the purpose of the notice, which is to inform the plan administrator about the occurrence of a qualifying event. Emphasize the significance of notifying the plan administrator promptly to initiate necessary updates to the employee's benefits arrangement. 2. Employee Information: Provide complete details about the employee experiencing the qualifying event. Include their name, employee identification number, department, and contact information. This is essential for the plan administrator to identify and process the necessary changes accurately. 3. Qualifying Event Description: Clearly list and describe the specific life events that trigger eligibility for benefits adjustments. Common qualifying events include marriage, divorce, birth or adoption of a child, death of a spouse or dependent, termination of employment, or a change in work status resulting in loss or gain of coverage eligibility. 4. Supporting Documentation: Instruct the employee on the required documentation to substantiate the qualifying event. Specify which legal documents or certificates, such as marriage certificates, birth certificates, or death certificates, should be submitted to support the requested changes. Ensure that the plan administrator receives the necessary supporting documentation along with the notice. 5. Deadline for Submission: Establish a clear deadline for the employee to submit the qualifying event notice and supporting documentation to the plan administrator. Provide a specific date or a timeline within which the required information must be received to ensure timely processing of the necessary benefits adjustments. Different Types of Texas Qualifying Event Notice Information for Employer to Plan Administrator: 1. Texas Qualifying Event Notice for Marriage: This type of notice is specific to employees who are getting married or entering into a civil partnership. It includes the necessary details and documentation required to update the spouse's information and initiate coverage. 2. Texas Qualifying Event Notice for Divorce: This notice addresses the circumstances when an employee experiences a divorce or legal separation. It outlines the required steps to remove the former spouse from the employee's benefits plan. 3. Texas Qualifying Event Notice for Birth or Adoption: This notice is relevant when an employee becomes a parent through birth or adoption. It provides instructions on adding the new child as a dependent and requesting the necessary coverage adjustments. 4. Texas Qualifying Event Notice for Termination of Employment: This type of notice is applicable when an employee's employment is terminated. It guides the employer on notifying the plan administrator to terminate the employee's benefits coverage while offering information about any continuation options available. By following these guidelines and utilizing specific types of Texas Qualifying Event Notice Information for Employer to Plan Administrator, employers can effectively manage and administer employee benefits in the state of Texas.

Texas Qualifying Event Notice Information for Employer to Plan Administrator

Description

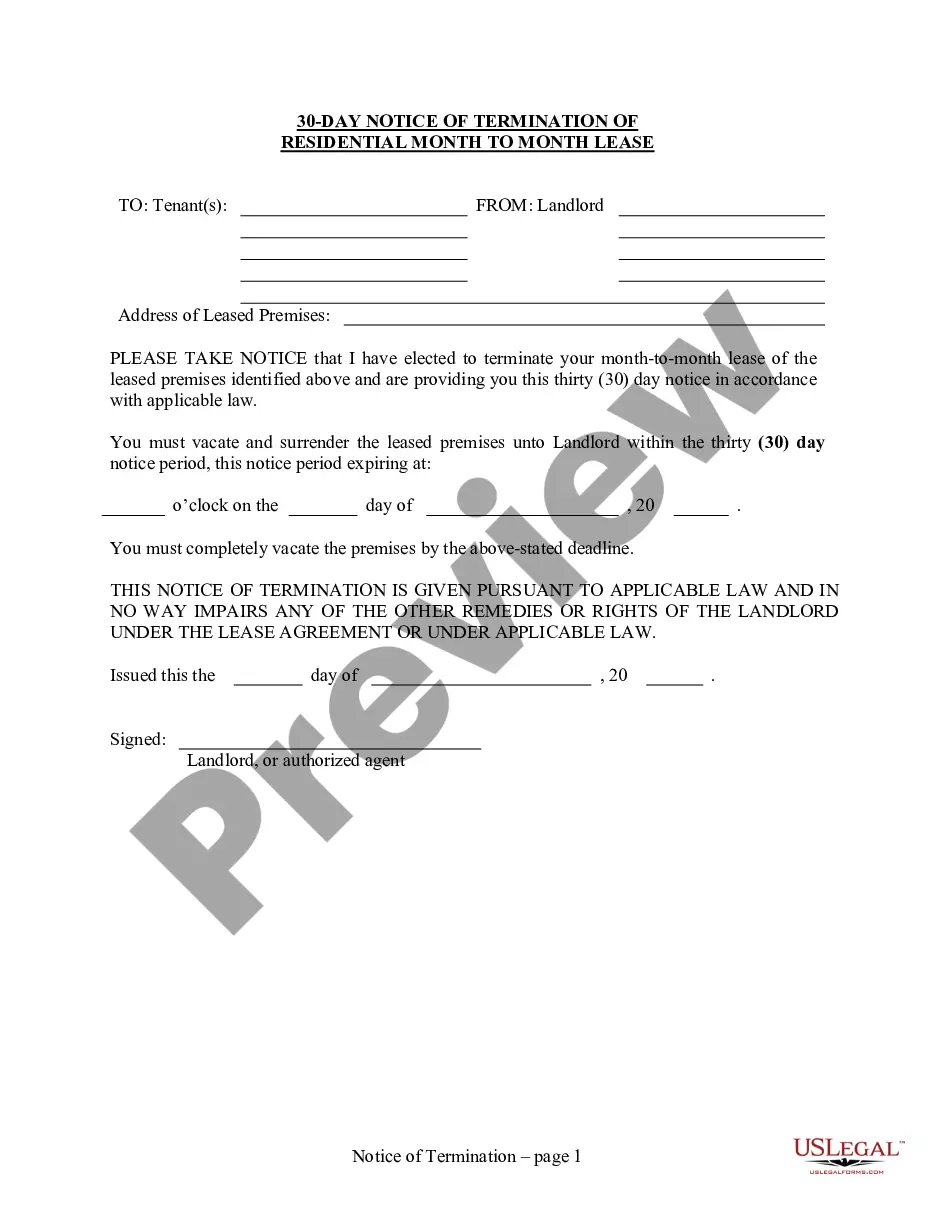

How to fill out Texas Qualifying Event Notice Information For Employer To Plan Administrator?

If you need to full, down load, or print authorized papers web templates, use US Legal Forms, the most important selection of authorized forms, that can be found on-line. Take advantage of the site`s easy and handy research to get the files you need. A variety of web templates for business and person reasons are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to get the Texas Qualifying Event Notice Information for Employer to Plan Administrator within a couple of mouse clicks.

In case you are previously a US Legal Forms customer, log in for your accounts and click on the Download button to have the Texas Qualifying Event Notice Information for Employer to Plan Administrator. You may also accessibility forms you in the past saved inside the My Forms tab of the accounts.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that appropriate area/land.

- Step 2. Make use of the Review choice to examine the form`s information. Do not overlook to read through the information.

- Step 3. In case you are unhappy together with the form, utilize the Look for field at the top of the display to find other versions in the authorized form template.

- Step 4. Once you have discovered the shape you need, select the Get now button. Select the prices strategy you favor and include your accreditations to register for an accounts.

- Step 5. Procedure the financial transaction. You can utilize your bank card or PayPal accounts to accomplish the financial transaction.

- Step 6. Select the format in the authorized form and down load it on your system.

- Step 7. Full, edit and print or sign the Texas Qualifying Event Notice Information for Employer to Plan Administrator.

Each authorized papers template you purchase is your own permanently. You might have acces to each and every form you saved inside your acccount. Go through the My Forms area and choose a form to print or down load once again.

Be competitive and down load, and print the Texas Qualifying Event Notice Information for Employer to Plan Administrator with US Legal Forms. There are many specialist and condition-distinct forms you may use for the business or person demands.